Emerging markets, on the other hand, represent many opportunities with much more rewarding outcomes. Yet, it’s the question of how to choose the most rewarding investment opportunities.

Circumstances in emerging markets are very similar in this regard. Risks are higher but can be calculated with accurate and reliable source of data. This happens to be the speciality of EquityRT.

All the information you need in one place. Add EquityRT to your toolkit for quality investment research.

With the Right Data Source, Risks Can Be Evaded

Specifically focused on emerging markets, EquityRT provides a vast amount of data on countries in the MENA region along with Turkey, South Africa, Poland, Romania and Russia. Collecting data is a matter of reach and coverage so it is important to be able to collect data about all the companies in these markets if a full-scale picture is to be presented. EquityRT can do this and not only that, it has a foothold in these countries.

Data is universal and, in an era when data can be shared and delivered almost instantly, one may think that having a physical presence in a country is not vital when it comes to collecting financial data. But on the contrary, it is still important to know the dynamics of emerging markets and access to the most reliable financial data.

What makes EquityRT platform unique is that it combines in-depth coverage of emerging market stocks with global stock markets and intelligent analytics. For example;

- Analysts get the full picture on Turkish markets thanks to full range of data and information on BIST100 companies.

- With Screener, they can easily break down and find companies with Price-To-Book Ratio below 1 in the MENA region.

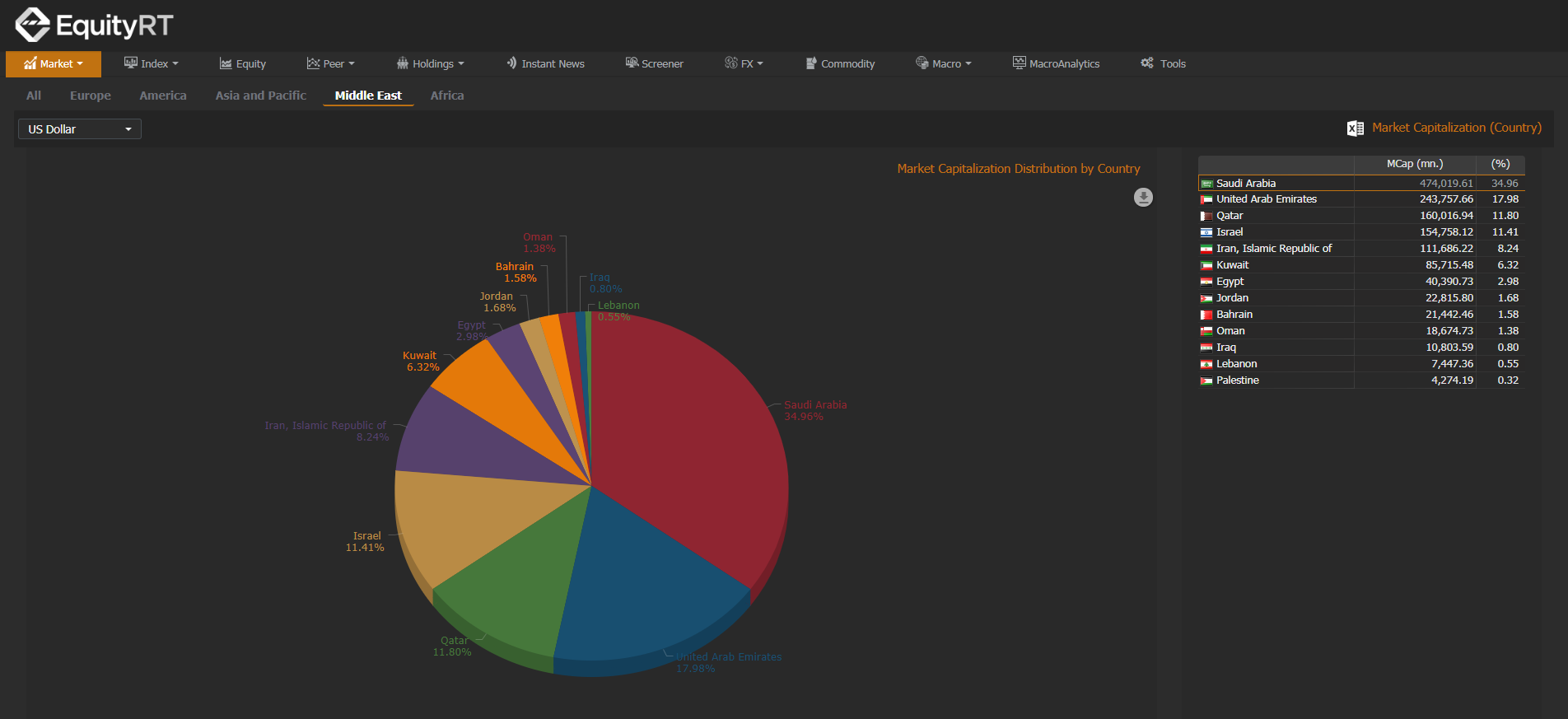

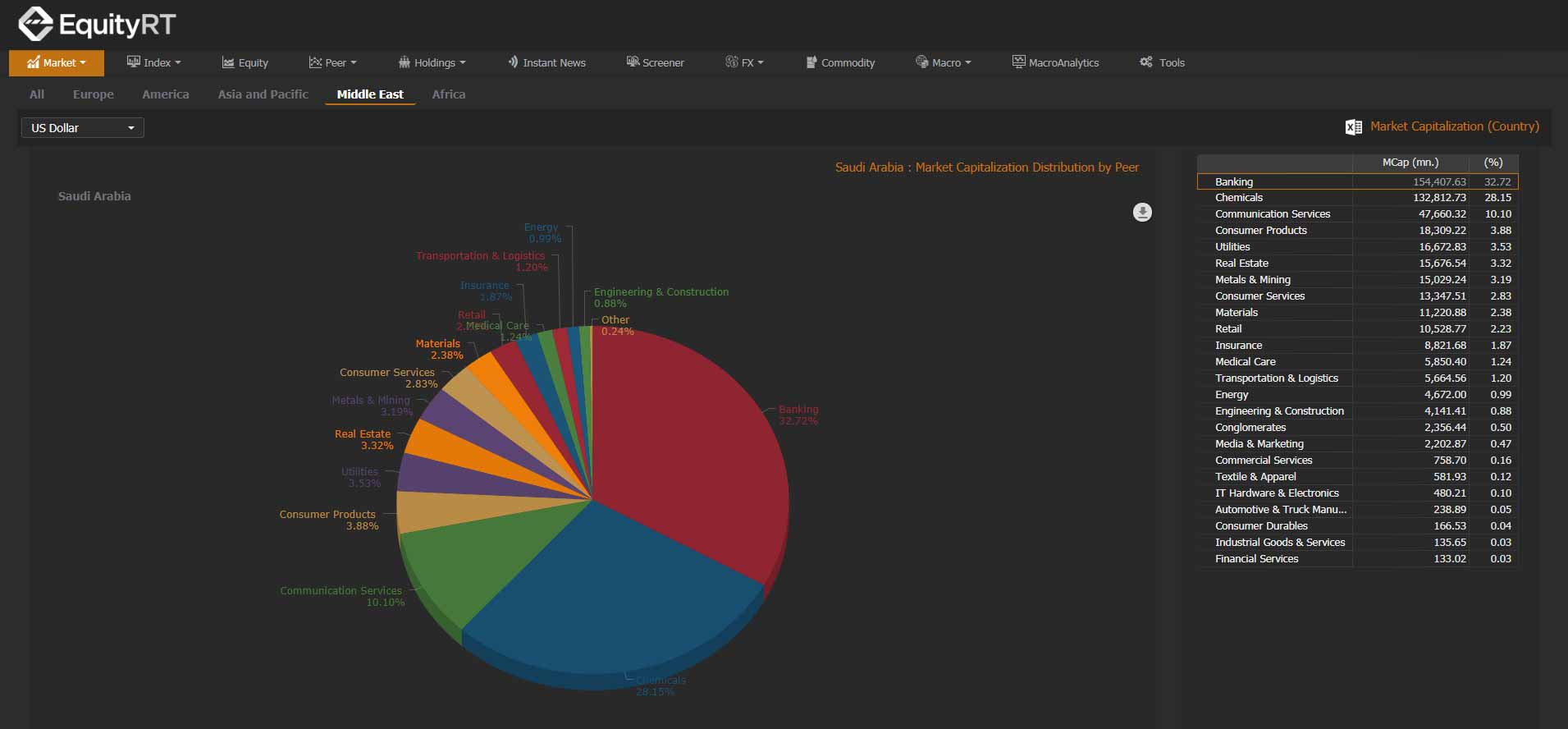

- With Market Capitalization distribution, they can take a general picture on country basis and further deepen the analysis with a few clicks on the country and peer sections.

- When it comes to company fundamentals, extensive coverage is leveraged by the financial transparency as EquityRT delivers financials as they are presented and just after they are published.

- A wide range of consensus estimates and analyst recommendations on emerging markets for analysts to make sound investment decisions.

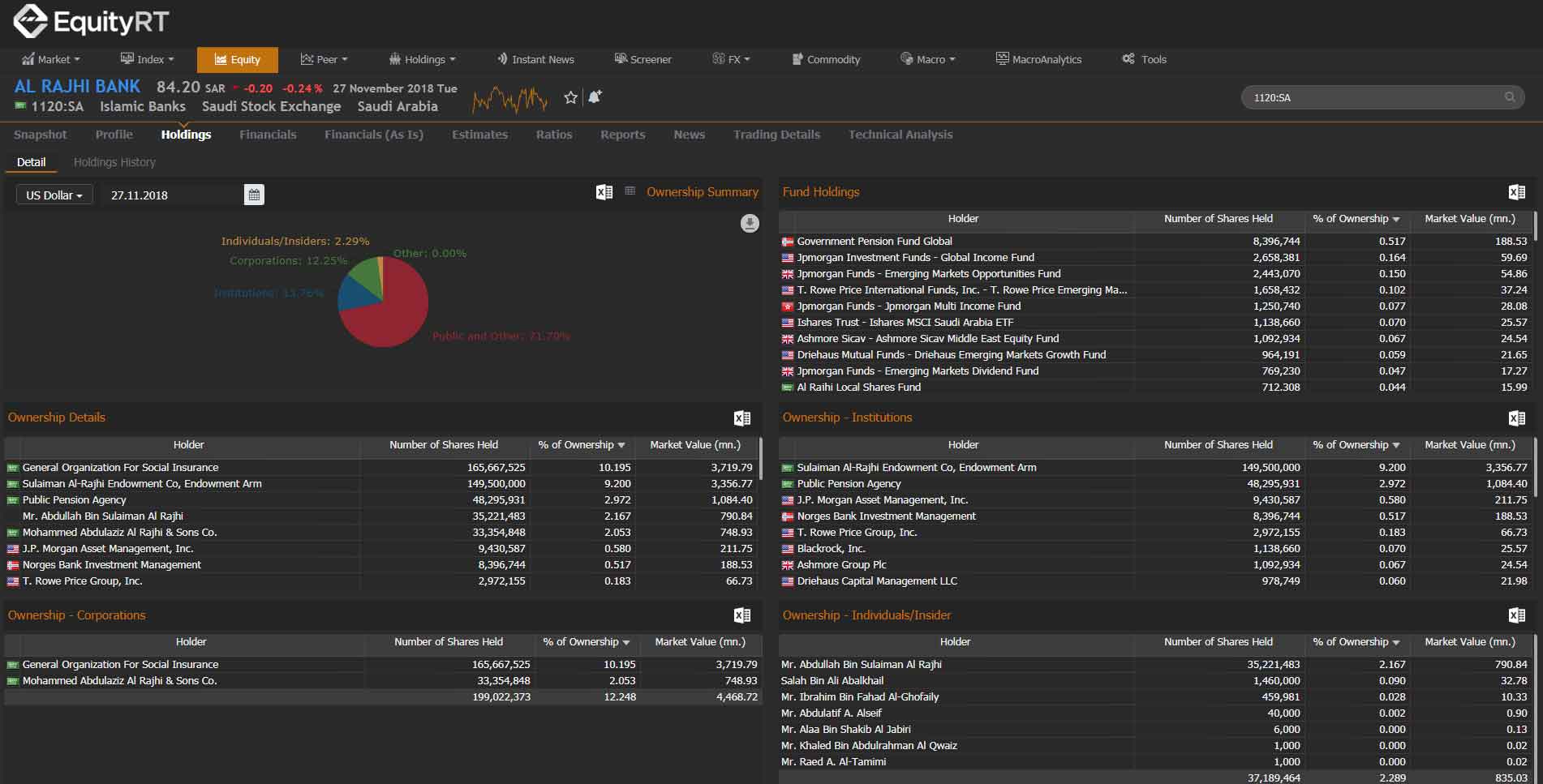

- Last but not least, with a little twist on the shareholders and holdings data, it’s easy to spot who invests in the emerging markets, in which stocks and which sectors!

In conclusion; yes, the stakes are higher in emerging markets, but they can be evaded by a reliable source of information and data. EquityRT is a specialized platform in being that source.