The world continues to fight against the economic and social disruption caused by the COVID-19 pandemic and a sustained recovery significantly depends on the course of the virus and a rapid vaccine rollout. Things are not different for the world’s largest economy, the United States.

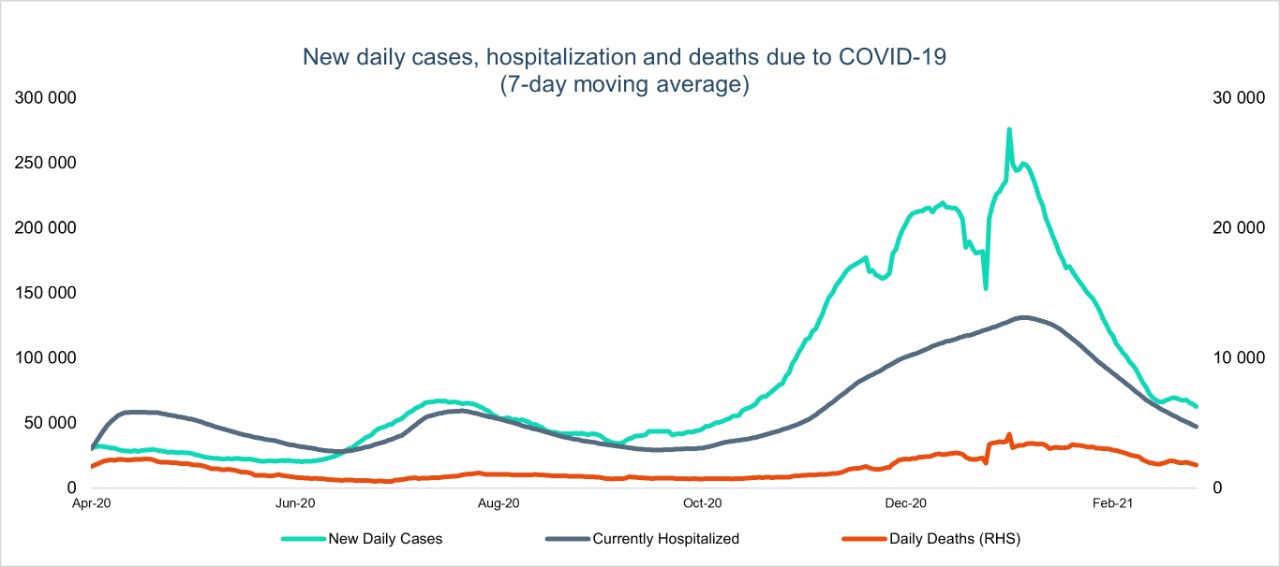

The first case of the coronavirus was confirmed in January 2020 in Washington state and since then more than 29.5 million coronavirus cases have been reported. The number of cases and deaths from COVID-19 climbed to all-time highs at the beginning of this year with a peak at the number of people hospitalized around 132,500 but over the past few weeks, there are signs that the number of cases has been declining or stabilizing.

As of March 04, 2021, the 7-day average of daily diagnosis was around 65,500 people. The number of people hospitalized was around 47,000 and the daily new deaths due to COVID-19 were around 1,760.

All the information you need in one place. Add EquityRT to your toolkit for quality investment research.

The strong fiscal stimulus in the United States backed with the fastest vaccination rollout could boost the growth by over 3% in 2021

The global economic prospects have greatly improved in recent months. The wide distribution and uptake of available vaccines are expected to control the spread of the virus and offer hope for a return to a semblance of normal conditions later this year across the United States and around the globe.

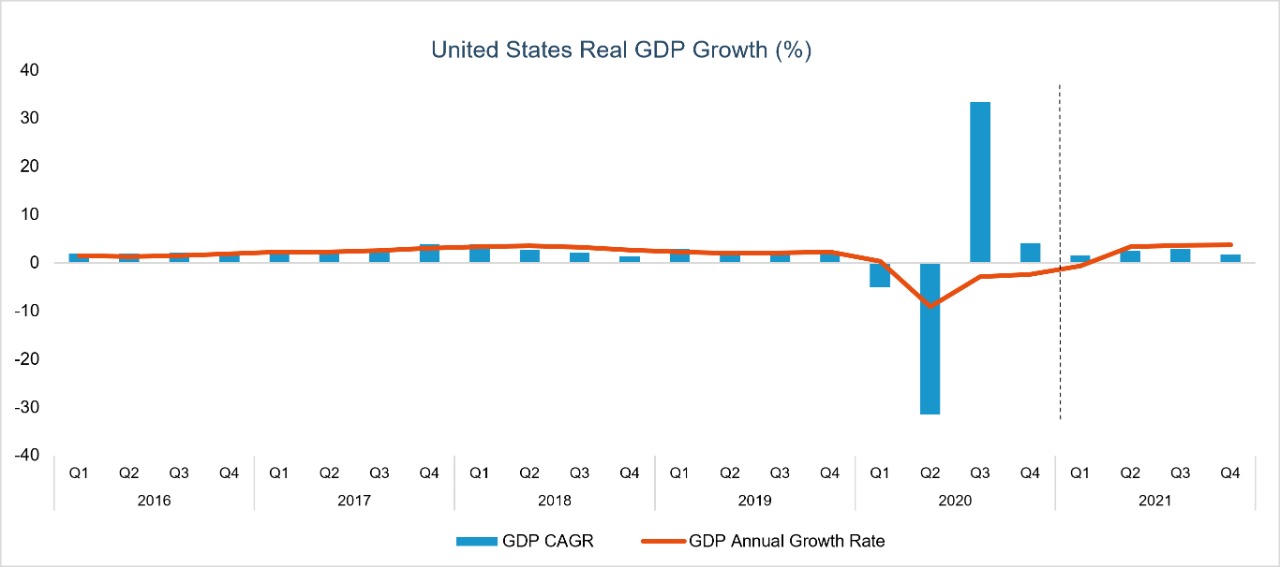

The first half of 2020 has seen an unparalleled economic challenge. The COVID-19 crisis has seriously damaged the U.S. economy. The country first suffered from the lock-down of China’s manufacturing sector then the shut-down of local businesses. The GDP contracted sharply, and the jobless rates dramatically hiked. Massive monetary and fiscal policies have protected the households and businesses.

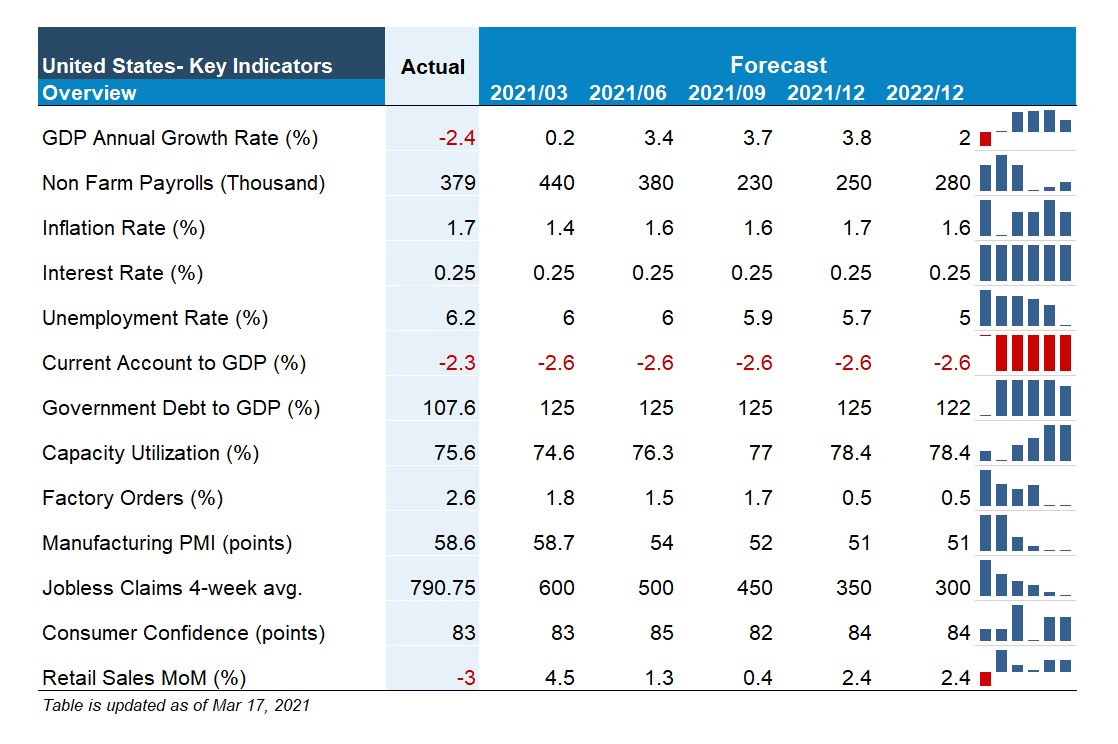

Slow GDP growth is expected in the first half of 2021 due to largely reimposed local restrictions but as an increasing number of people receive vaccines, the restrictions should start to ease, and the rebound of postponed consumer spending on services could lead to a higher rate of growth in the second part of the year.

In its latest interim outlook, the OECD expects the global economy to expand by 5.6% in 2021 and regain lost ground since the start of the pandemic by mid-2021. According to the organization, the American economy will see the most improved performance among its peers by growing 6.5% this year. This means to double the 3.3% the OECD had pencilled in three months ago.

The US inflation growth should not come at the risk of overheating

Delivery of federal aid packages could be pushing up economic growth forecasts to higher levels, but some economists have already started to worry that flooding the country with cash would likely ignite inflation. The current annual inflation rate for the United States is 1.7% over the last 12 months. This is the highest rate since February 2020. Even so, the inflation still remains below pre-COVID levels and Federal Open Market Committee’s long-term objective (2%).

The Federal Reserve reiterates that there is no broad sign of inflation and they will maintain an accommodative stance of monetary policy until the employment situation has improved and the inflation is securely above 2%. The long-term US treasury yields have been rising since August 2020 to more than 1.5% in March, possibly as a result of improved prospects for economic recovery and a higher expected inflation rate.

The $1.9 trillion aid package will increase the total demand, pushing the price levels up but the large labor supply available for work should prevent wages from rising. Currently, unemployment remains quite high compared to 2019 and the labor market continues to reflect the impact of the pandemic. The US economy is largely driven by the service sector and the cost of the workforce is the main driver of inflation over the medium to longer term.

According to the monthly report released by the US Bureau of Labour Statistics, the number of unemployed citizens is 10 million and the unemployment rate at the moment is 6.2%, the lowest rate since last April when the unemployment had jumped to a record high of 14.8 %.

Surely, the labor market crisis is much improved from nearly a year ago. In February 2021, the economy succeeded to create 379,000 jobs and most of the job gains occurred in restaurants and other services businesses as falling new infections and additional relief package boosted hiring.

Thanks to wide vaccination supported by record levels of fiscal stimulus, there is great hope that the U.S economy will not only recover from the pandemic but also will spring back rapidly. The risks associated with the size of Joe Biden’s plan remain difficult to predict, and the US will test how much it can stimulate the economy and how fast labor market can recover without overheating. The risk of doing too little outweighs the risk of doing not enough in the face of an unprecedented health crisis.

Source: National sources, Trading economics forecasts and WHO data via EquityRT, covidtracking.com

by Ozge Gurses I Macro Research at EquityRT

17/03/2021

Need access to global macro indicators to keep a pulse on the global economies? Please contact us at info@equityrt.com