Global Markets Recap

U.S. Markets:

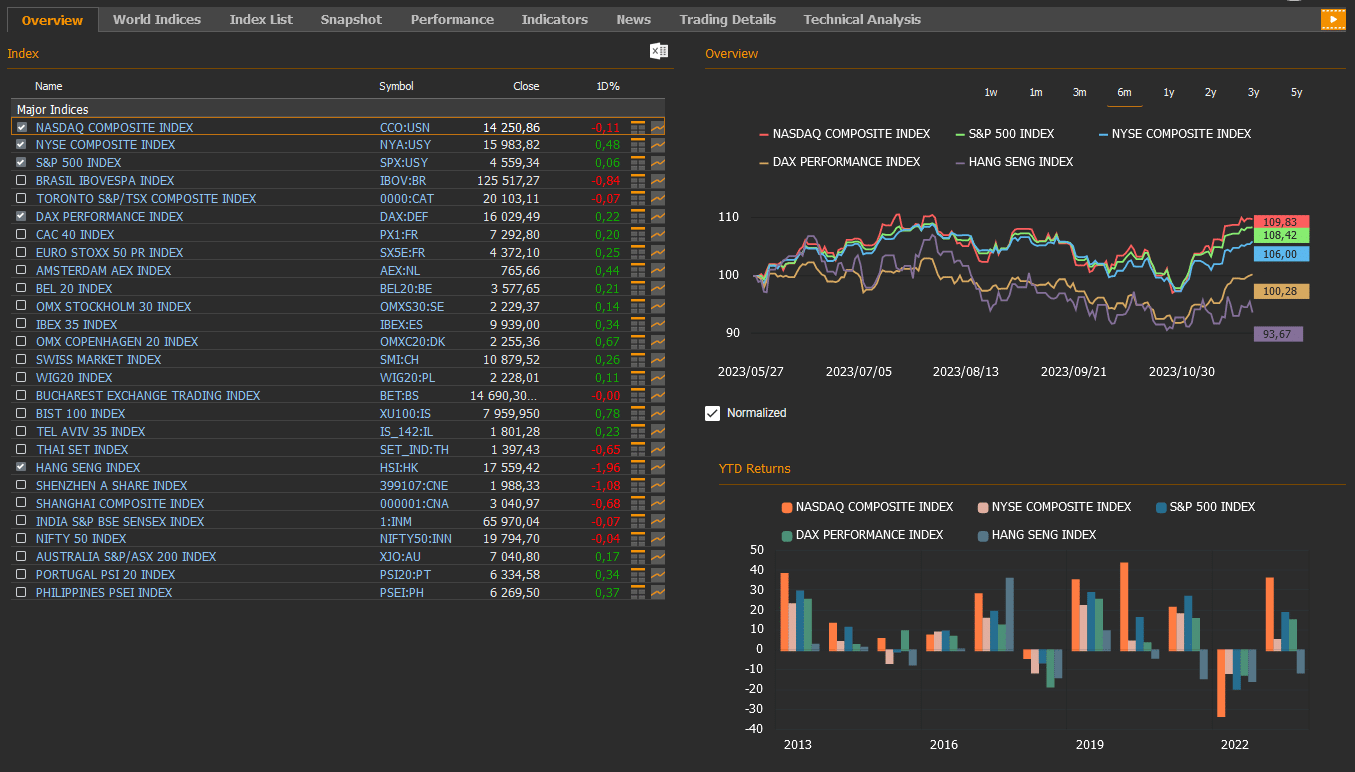

- On Friday, on a daily basis, the Nasdaq index closed the day with a 0.11% decline, while the S&P 500 index recorded a 0.06% increase, the NYSE Composite index was up 0,48% and the Dow Jones index closed with a 0.33% rise.

- The Dollar index ended the week with a 0.4% decrease, closing at 103.4.

- The barrel price of Brent crude oil remained flat at $80.6 last week.

- US. Treasury yields showed a widespread increase at the start of Friday’s trading session post-Thanksgiving. The 10-year U.S. Treasury yield saw a gain of over 5 basis points, settling at 4.47% by the end of the week. The 2-year U.S. Treasury yield, particularly responsive to Federal Reserve policy rates, rose by 6 basis points to reach 4.95%.

European Markets:

- European stocks climbed Friday, as the Stoxx Europe 600 indexSXXP, closed up 0.33% to 459.98. The German DAX index increased 0.22% to 16,029.49, the French CAC 40 index increased 0.20% to 7,292.80 and the FTSE 100 index UKX was flat.

Asian Markets:

- On Monday, Nov. 27, Asia-Pacific stocks decreased, with shares in Hong Kong declining for the second day.

- Last Friday, November 24, stocks in the Asia-Pacific region were varied. The Hang Seng index down 1.96% to 17,559.42, while the Nikkei 225 index increased 0.5% to 33,625.53. The Shanghai Composite index declined 0.68% to 3,040.97.

- The S&P/ASX 200 Benchmark index in Australian stock market increased 0.17% to 7,040.80.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

US Market Outlook and Economic Events

- Fed’s November Meeting Minutes: Inflation Concerns and Policy Caution

The minutes of the Federal Reserve’s FOMC meeting in November were released last week. The minutes highlighted that inflation continued to stay high, and inflation risks were closely monitored. Members emphasized the need to consider cumulative tightening in monetary policy, taking into account the delayed effects of monetary policy.

Key points from the released minutes include unanimous agreement among members that the Fed is proceeding cautiously, making policy decisions based on the entirety of future data in each meeting.

Additionally, the minutes emphasized that higher interest rates were beginning to constrain households and businesses. Members also commented on the significant tightening of financial conditions in recent months due to the rise in long-term interest rates, stating that the Fed’s policy should remain restrictive until inflation is clearly sustainably reduced.

Some members in the minutes reported that an increasing number of businesses were being affected by high interest rates, leading to the deferral or reduction of investment plans due to elevated borrowing costs.

- Housing Market Challenges

The existing home sales for October declined by a monthly rate of 4.1%, exceeding expectations and extending its decline for the fifth consecutive month, reaching the lowest level since August 2010.

Rising mortgage interest rates after the Fed’s interest rate hikes and the low housing supply negatively impacted housing demand.

- October Durable Goods Orders: Significant Decline Raises Concerns

The preliminary durable goods orders data recorded a 5.4% decline in October after a 4% increase in September, surpassing expectations of a 3.2% decrease.

This decline marked the second-largest drop since April 2020. Notably, a substantial decrease in orders for non-defense aircraft and parts (49.6% decrease) contributed to the decline in durable goods orders.

Excluding defense aircraft, non-defense capital goods orders, a key indicator of business investment, continued to decline for the second consecutive month with a 0.1% drop in October, indicating weakness in investment.

- Labor Market Resilience and Consumer Confidence Boost in November

From the U.S. employment market data, the weekly initial jobless claims for the week ending November 18 decreased from 233,000 to 209,000, surpassing expectations and reaching the lowest level in the past five weeks. The data also remained below historical averages, indicating a tight labor market.

The final November Michigan University Consumer Confidence Index was revised upward from 60.4 to 61.3 in November.

Looking into details, the current conditions sub-index was revised upward from 65.7 to 68.3 in November, while the expectations sub-index was slightly revised downward from 56.9 to 56.8.

Consumers’ short-term inflation expectations for the next 12 months were revised slightly upward from 4.4% to 4.5%, reaching the highest level since April, while long-term inflation expectations remained at 3.2%, maintaining the highest levels since March 2011.

- Mixed Signals in November: Manufacturing Contracts, Services Show Growth

November’s preliminary S&P Global Manufacturing and Services PMI data, providing signals about the latest outlook for economic activity, were released last week.

The manufacturing PMI in November fell to 49.4 from the growth threshold of 50, indicating a return to contraction in the manufacturing sector. On the other hand, the services PMI in November increased from 50.6 to 50.8, suggesting a slight acceleration in growth in the services sector.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Upcoming US Economic Indicators

- Powell’s Speech and Economic Activity Signals

The focus will be on Friday’s speech by Fed Chairman Powell for potential new signals regarding the Bank’s monetary policy.

On Friday, November’s final S&P Global Manufacturing Sector PMI data and the ISM Manufacturing Purchasing Managers’ Index will provide signals about the latest outlook for economic activity. According to preliminary data, the manufacturing PMI in November fell to 49.4 from the growth threshold of 50, indicating a return to contraction in the manufacturing sector.

- Revised Q3 GDP Growth and Inflation Data

Turning to Wednesday, the revised data for the annualized quarterly GDP growth for the Q3 of 2023 will be followed. After a slight slowdown in the annualized quarterly growth rate from 2.2% in the Q1 to 2.1% in the Q2, it surged to 4.9% in the Q3, surpassing expectations and indicating the strongest growth since the Q4 of 2021.

Examining the details of Q3 growth, the significantly higher growth rate of consumer spending, which constitutes a large part of the country’s economy, rising from 0.8% to 4% in line with expectations, was decisive.

In addition, private inventory investments, net exports, federal and local government spending, and residential fixed investments increased, while the decline in non-residential fixed investments limited the growth.

Also on Wednesday, the revised data for the Q3 Personal Consumption Expenditures (PCE) price indexes (including core) will be released as a key inflation indicator closely followed by the Fed.

According to preliminary data, the annualized quarterly PCE price index rose from 2.5% in the Q2 to 2.9% in the Q3, while the core PCE price index slowed from 3.7% in the Q2 to 2.4%, reaching the lowest level since the Q4 of 2020.

On Thursday, the PCE deflator (including core) data for October along with personal income and spending data for October, will be followed.

While the monthly inflation rate of the PCE deflator is expected to slow from 0.4% to 0.1% in October, the annual rate is expected to decline from 3.4% to 3.1%.

The increase in the core PCE deflator is expected to slow from 0.3% to 0.2% on a monthly basis and from 3.7% to 3.5% on an annual basis.

In October, it is expected that personal income will slow from 0.3% to 0.2% on a monthly basis, and personal spending will decrease from 0.7% to 0.2%.

- Job Market Watch: Weekly Initial Jobless Claims Update

On Thursday, data on weekly initial jobless claims from the job market will be followed.

The last reported weekly initial jobless claims were recorded at 209,000, surpassing expectations and reaching the lowest level in the past five weeks, remaining below historical averages and indicating continued tightness in the labor market.

- Future Economic Indicators

This week, from housing market data, October new home sales, September S&P/Case-Shiller 20-City Home Price Index, October pending home sales, and October construction spending will be followed.

In addition, on Wednesday, the Beige Book report, compiled from economic data from 12 Federal Reserve districts, will be released. The report will be closely monitored for current assessments of the U.S. economy and expectations for the future.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

- ECB October Meeting Minutes

In its October meeting, the ECB, in line with expectations, kept interest rates stable, putting a halt to interest rate hikes. The released minutes underscored members’ consensus on maintaining stable interest rates in October, while signaling a cautious stance towards the economy and leaving room for potential interest rate hikes if needed, reflecting concerns about prolonged higher interest rates to support inflation targets.

- Optimistic Outlook: Eurozone Consumer Confidence on the Rise in November

The consumer confidence data for November in the Eurozone, while rising from -17.8 to -16.9, reached its highest level in the past three months. Particularly, in the survey, consumers were observed to be optimistic that interest rates would not increase further, and there would be a continued slowdown in inflation.

- November Manufacturing PMIs in Europe: Mixed Signals Amidst Contraction and Expansion

In November, manufacturing PMIs in the Eurozone continued their contraction below the 50 growth threshold, especially after the tightening of financial conditions and the impact of weakening demand following ECB interest rate hikes.

Accordingly, while manufacturing PMIs in Germany increased from 40.8 to 42.3 in November, from 43.1 to 43.8 in the Eurozone, and from 44.8 to 46.7 in the UK, indicating a slight slowing of contraction in the manufacturing sector, in contrast, it decreased from 42.8 to 42.6 in France, indicating a slight increase in the contraction rate in the manufacturing sector.

- Inflation Trends: October Data Reveals Deceleration in Germany and Eurozone

In Germany, headline HICP remained flat on a monthly basis in October, while it decreased from 4.5% to 3.8% on an annual basis. Also, on an annual basis, core HICP decreased from 4.6% to 4.3% in October, reaching the lowest level since August 2022.

While the monthly growth rate of headline HICP in the Eurozone in October slowed down from 0.3% to 0.1%, on an annual basis, it decreased from 4.3% to 2.9%, reaching the lowest level since July 2021. Core HICP, in October, had a monthly growth rate of 0.2%, similar to the previous month, while on an annual basis, it decreased from 4.5% to 4.2%, reaching the lowest level since July of last year.

In Germany, the Producer Price Index (PPI) showed a monthly decline of 0.2% in September, followed by a 0.1% decline in October. Thus, it continued its decline for the past two months. On an annual basis, the rate of decline in October decreased from 14.7% to 11%, extending its decline for the fourth month. Especially, the significant declines in the PPI on an annual basis are influenced by the base effect due to energy prices last year.

- November Sees Modest Rise in German’s Business Climate, Reflecting Improved Economic Sentiment

The IFO Business Climate Index for Germany increased from 86.9 to 87.3 in November, recording a slight increase below expectations. Thus, it continued its rise for the second month and reached its highest level in the last four months.

Looking at the details, the current conditions index increased from 89.2 to 89.4, reaching the highest level since July, while the expectations index increased from 84.8 to 85.2, reaching the highest level since May. This indicated that companies continued to reduce their pessimism about the coming months to some extent.

- German Q3 2023 GDP: A Closer Look at Stagnation and Contraction Amid Economic Challenges

The final data for GDP growth for the Q3 of 2023 was announced in Germany. After a quarterly contraction of 0.4% at the end of last year, the German economy remained stagnant with 0% growth in the Q1 of 2023, despite easing concerns about the energy crisis, as tightened financial conditions suppressed consumer spending and decreased public spending. However, in the Q2 of 2023, after limited growth of 0.1% on a quarterly basis, it recorded a limited contraction of 0.1% in the Q3, in line with preliminary data.

On an annual basis, the German economy, after growing by 0.1% in the Q2, contracted by 0.4% in the Q3. Especially in the contraction in the Q3, it was observed that the decisive factor was the contraction of private consumer spending due to increased interest rates and high inflation levels.

- Swedish Central Bank Holds Steady

The Central Bank of Sweden kept the policy interest rate at 4%, stating that inflation had decreased and inflationary pressures had eased. Expectations were towards an increase of 25 basis points to 4.25%. However, the Bank indicated that the policy interest rate could be further increased at the beginning of next year if inflation expectations worsened.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

Looking at the data calendar for this week, the focus of the markets in Europe will be on the speeches of ECB President Lagarde on Monday, Thursday, and Friday.

On Friday, final HCOB manufacturing PMI data for November, providing information on the recent economic outlook in Europe, will be tracked.

In addition, inflation data that will guide the ECB ‘s monetary policy will be followed on Wednesday with preliminary HICP data for November in Germany and on Thursday with preliminary HICP data for November in the Eurozone.

According to preliminary data in November, a monthly decrease of 0.1% is expected in headline HICP in Germany, and on an annual basis, a decrease from 3.8% to 3.5% is expected. Headline HICP in the Eurozone is expected to decrease by 0.2% on a monthly basis, and on an annual basis, it is expected to slow down from 2.9% to 2.7%. The core HICP is expected to decrease from 4.2% to 3.9%.

Final consumer confidence data for November in the Eurozone and GfK consumer confidence data for December in Germany will be followed on Wednesday and Thursday, respectively.

Preliminary Consumer confidence data for November in the Eurozone increased from -17.9 to -16.9, reaching its highest level in the last three months. It was observed in the survey that consumers were especially optimistic about the expectation that interest rates would not increase further and that inflation would continue to slow down.

GfK consumer confidence data for November in Germany decreased from -26.7 to -28.1, recording a decrease above expectations, and thus continued its trend at the lowest levels since April.

Take the guesswork out of investing: Backtest your strategies with ease!

Economic Indicators in Asia for the Week

- Key Economic Signals from China

In the coming week, attention turns to crucial economic indicators in China, with the official manufacturing and non-manufacturing PMI data for November offering insights into the nation’s economic trajectory.

Thursday’s release of official manufacturing PMI data and Friday’s Caixin Manufacturing PMI will provide signals about the activities of small and medium-sized enterprises.

In October, China’s official manufacturing PMI dropped from 50.2 to 49.5, signaling a contraction in the manufacturing sector. The official non-manufacturing PMI, reflecting the performance of the service and construction sectors, declined from 51.7 to 50.6 in October, indicating a slowdown in non-manufacturing growth. Caixin’s manufacturing PMI for the same month in China fell from 50.6 to 46.5, indicating a return to contraction after two months of growth.

These data underscore the fragility of China’s economic recovery, suggesting a potential need for further government support measures.

- Central Bank Decisions in Focus

Market watchers will monitor the interest rate decisions of the Reserve Bank of New Zealand on Wednesday and the Bank of Korea on Thursday.

The Reserve Bank of New Zealand is expected to maintain its policy interest rate at 5.50%, while the Bank of Korea is anticipated to keep its policy interest rate at 3.50%.