Global Markets Recap

U.S. Markets:

- Following the weak employment data released in the United States on Friday, the expectation that the Fed may have reached its peak in interest rates keeps the risk appetite high.

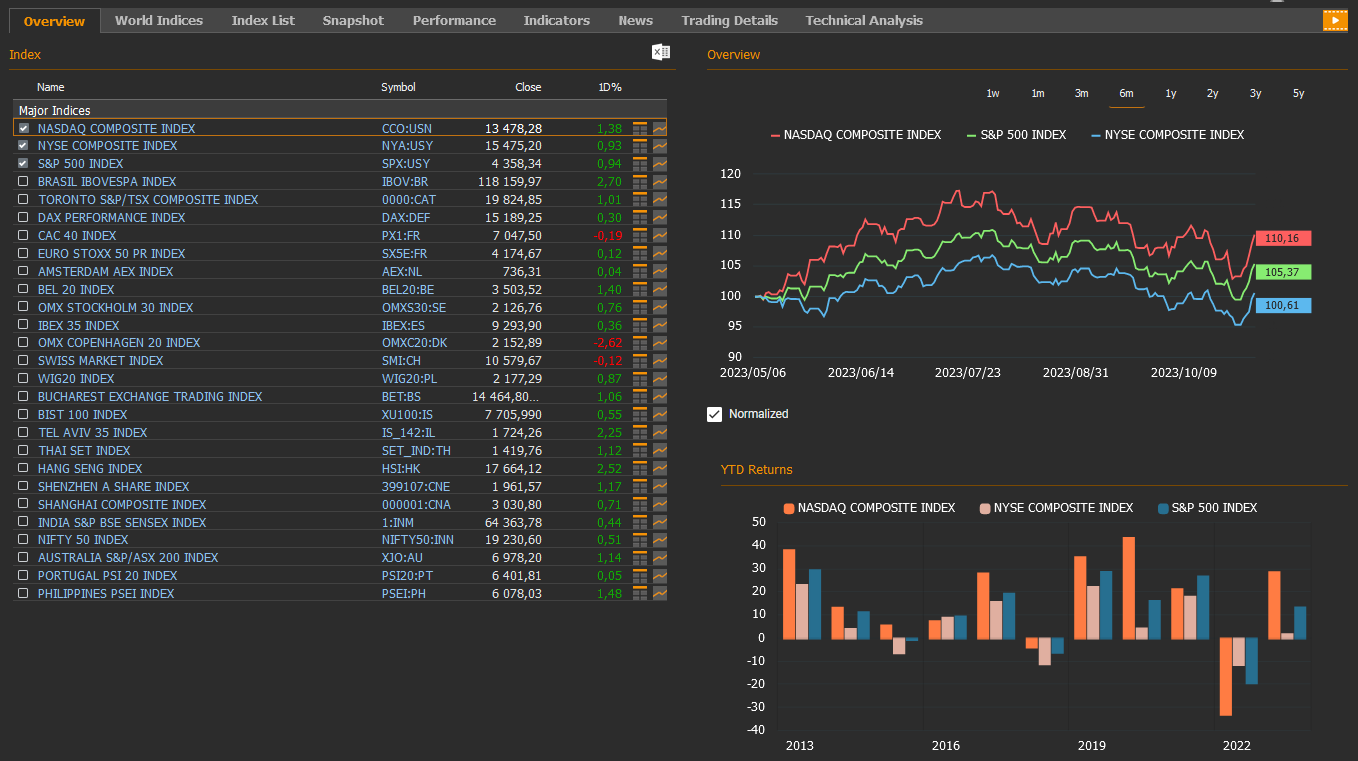

- The S&P 500, which closed last Friday with a 0.94% gain, exhibited its best weekly performance of the year with a 5.9% increase. The influence of reduced yields extended to various assets, including stocks, where major indexes recorded their most significant weekly advances of the year. These gains ranged from 5.07% for the Dow Jones Industrial Average to 6.61% for the Nasdaq Composite. It was the best week since November 2022 for both the S&P 500 and the Nasdaq Composite indices

- The Dollar index ended the previous week with 1% decrease on a daily basis, closing at a level of 105. In addition to the sharp decline in the index, Gold futures settled 0.3% higher at 1,999.2 USD on the last trading day of the last week, influenced by the downward movement in U.S. 2 and 10-year Treasury yields.

- The price per barrel of Brent crude oil, last week, closed at 84.9 USD, marking a 2.3% decrease.

- Treasury yields, which retreated since the Fed’s decision to keep interest rates unchanged, continued their momentum on the last trading day of the week.

- The 10-year U.S. Treasury yield dropped by 9 basis points abruptly on Friday following the U.S. employment data ending the day at 4.58%. The yield The 2-year U.S. Treasury yield, sensitive to Fed policy rates, dropped by 13 basis point on Friday at 4.84%, reflecting expectations of a peak in interest rates.

European Markets:

- European stocks finished higher Friday, with the Stoxx Europe 600 indexSXXP, rising 0.17% to 444.24. The German DAX increased 0.3% to 15,189.25, the French CAC 40 index declined 0.19% to 7,047.50 and the FTSE 100 index UKX fell 0.39% to 7,417.73.

- The yield on the 10-year UK Treasury bond yield dropped 9.39 basis points to 4.30%, and the yield on the German 10-year bond declined 7.5 basis points to 2.64%.

Asian Markets:

- Asia-Pacific stocks mostly climbed Friday. The Hang Seng index increased 2.5% to 17,664.12, while the Nikkei 225 index rose 1.10% to 31.949,89. The Shanghai Composite index added 0.71% to 3,030.80.

- The S&P/ASX 200 Benchmark index in Australian stock market gained 0.21% to 6,826.90.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

US Market Outlook and Economic Events

This week is weak in terms of economic data and corporate earnings. Investors are awaiting corporate updates from Walt Disney, Wynn, Occidental Petroleum, and D.R Horton.

- Manufacturing Sector Indicators in the U.S.

The October S&P Global manufacturing sector’s final PMI data and ISM manufacturing industry index in the United States, signaling the latest view of economic activity, were closely monitored. Accordingly, in October, the manufacturing PMI, in line with preliminary data, reached 50, indicating that the manufacturing sector emerged from the contraction zone and manufacturing sector activities became stable. Thus, it reached the highest level in the last six months.

On the other hand, the ISM manufacturing industry index for October in the United States dropped from 49 to 46.7, falling below expectations (49), indicating a slowdown in the manufacturing industry. However, due to weak demand and accelerated declines in new orders, it extended its contraction trend for the thirteenth month.

- Consumer Confidence and Inflation Expectations

In October, the Conference Board’s consumer confidence index in the United States fell from 104.3 to 102.6 but exceeded expectations (100.5). This index reflects consumers’ assessments of current labor market conditions and short-term economic outlook.

Consumers’ concerns about various economic factors, including rising prices, especially for food and gasoline, were highlighted. Additionally, there was a noticeable increase in consumer concerns about geopolitical tensions in the Middle East. Furthermore, consumers’ average inflation expectations for the next 12 months increased from 5.7% to 5.9%.

- U.S. Labor Market Data

Key data points from the U.S. labor market, including JOLTS job openings and ADP private sector employment data, are being closely monitored.

The JOLTS job openings for September exceeded expectations by rising from 9.50 million to 9.55 million, reaching the highest level in the last four months, despite slight expectations of a decrease. This indicated that the labor market remained robust despite the Federal Reserve’s monetary tightening measures.

On the other hand, the ADP private sector employment increase for October, which rose from 89,000 to 113,000, fell below expectations (150,000).

Monthly employment increases continued to exceed the range of 70,000 to 100,000 needed to keep pace with the growing working-age population, demonstrating the labor market’s resilience to Federal Reserve tightening measures.

The weekly initial jobless claims for the week ending October 28 increased slightly from 212,000 to 217,000, reaching the highest level in the last two months, while continuing the trend at low levels and indicating a tight labor market.

- Housing Market Data and Durable Goods Orders

In the U.S. housing market, data for September showed a slowdown in the monthly growth rate in construction spending, attributed to rising mortgage rates.

The final data for durable goods orders in the United States for September and factory orders were also released. Durable goods orders, after declining by 5.6% in July and 0.1% in August on a monthly basis, were slightly revised downward from a 4.7% increase to 4.6% in September, marking a significant recovery after two months of decline, making it the strongest increase since July 2020.

Factory orders, which had a 2.1% monthly decline in July followed by a 1% increase in August, saw strong recovery in September with a 2.8% increase, surpassing expectations (2.3% increase). This marked the highest monthly increase since January 2021.

- Federal Reserve’s Monetary Policy

The Federal Reserve, in its recent meeting, decided to keep the federal funds rate range at 5.25%-5.50%, highlighting various key points:

- Inflation remains elevated, and inflation risks are closely monitored.

- The Federal Reserve is committed to considering cumulative tightening in monetary policy.

- Tightened financial and credit conditions are expected to impact economic activity, employment, and inflation.

- The evaluation of financial conditions has been expanded in the statement.

- The pace of balance sheet reduction will continue as previously announced.

- Federal Reserve Chairman’s Statements

After the Federal Reserve’s interest rate decision, Chairman Powell shared important insights:

- The central bank aims to keep interest rates at current levels until they are confident that inflation is approaching the target.

- Powell emphasized their commitment to maintaining a sufficiently restrictive policy stance.

- He noted that they have not yet achieved the policy stance to bring inflation back to 2% and more tightening may be necessary.

- The full effects of monetary tightening are yet to be felt, and a rate cut is not on the agenda at the moment.

- The focus is currently on whether monetary policy is sufficiently restrictive, and future decisions will be data-driven.

- Powell also stated that the idea that it would be difficult to raise interest rates after a pause is not accurate.

The Chairman is closely monitoring geopolitical developments for their potential impact on the economy.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Upcoming US Economic Indicators

In the United States, the week ahead will feature addresses from various Federal Reserve officials, the publication of the Michigan Consumer Sentiment index, and foreign trade statistics.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

- Eurozone Inflation Data

In October, the headline CPI’s monthly growth rate slowed down from 0.3% to 0.1%, falling below expectations of a 0.3% increase. Year-on-year, it dropped from 4.3% to 2.9%, marking the lowest level since July 2021.

The core CPI in the Eurozone for October also saw a decrease, with a monthly growth rate of 0.2%, down from 0.3%, and a year-on-year decrease from 4.5% to 4.2%. The year-on-year core CPI reached a record level of 5.7% in March 2022.

- German Inflation Data

The preliminary Consumer Price Index data for October in Germany was also released. The headline CPI remained flat in October after increasing by 0.3% in June, July, August, and September. Year-on-year, it decreased from 4.5% to 3.8%, the lowest level since August 2021.

Core CPI in Germany showed similar trends for October. It had a monthly growth rate of 0.2%, the same as the previous month, and a year-on-year decrease from 4.6% to 4.3%, marking the lowest level since August 2022.

- German GDP Growth in Q3

Preliminary data reveals Germany’s third-quarter GDP growth at 0.1% on a quarterly basis, below the expected 0.2% contraction, with a year-on-year decline of 0.3%. This contraction was influenced by rising interest rates and the impact of high inflation, particularly affecting consumer spending.

- GDP Growth Data for Italy, France, and the Eurozone

Preliminary GDP growth data for the third quarter of this year was also released for Italy, France, and the Eurozone:

Italy’s economy showed stagnant growth of 0% in the third quarter, following a 0.4% contraction in the second quarter. Year-on-year growth slowed down from 0.3% to 0%.

France’s economy experienced limited growth of 0.1% in the third quarter after a 0.6% growth in the previous quarter. Year-on-year growth decreased from 1.1% to 0.7%.

The Eurozone’s economy contracted by 0.1% in the third quarter, following a 0.2% growth in the second quarter. Year-on-year growth slowed down from 0.5% to 0.1%.

These results indicate that despite a short-term improvement in the second quarter, economic growth in the Eurozone is facing significant challenges in the third quarter.

- Manufacturing Sector PMI

The final Purchasing Managers’ Index (PMI) data for the manufacturing sector in the Eurozone was released.

Manufacturing PMIs remained below the 50 growth threshold, indicating a continuation of contraction in the manufacturing sector due to the tightening financial conditions after the ECB’s interest rate hikes and weakening demand.

In October, manufacturing PMIs were revised slightly upwards in Germany, from 40.7 to 40.8, in France, from 42.6 to 42.8, and in the Eurozone, from 43 to 43.1, suggesting a modest slowdown in the rate of contraction in the manufacturing sector.

- Eurozone Consumer Confidence

In the Eurozone, the final consumer confidence index for October confirmed the preliminary data by remaining at -17.9, marking the lowest level since March.

Consumers indicated concerns about their future financial situations and the general economic conditions in their countries, both of which are perceived to be worsening. Rising borrowing costs due to the ECB’s interest rate hikes were mentioned as a factor negatively affecting consumer confidence.

- Bank of England and Norges Bank Interest Rate Decisions

The Bank of England (BoE) decided to keep its policy rate at 5.25%, matching expectations. The central bank stated that it anticipates a need for a restrictive monetary policy for an extended period. Notably, some hawkish members expressed the need for an additional 25 basis points rate hike due to persistent upward price pressures.

In Norway, the Norges Bank also decided to keep its policy rate at 4.25%, in line with expectations. They hinted at a likely rate hike in December due to persistently high core inflation.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

On Monday, the HCOB PMI data for the service sector in the European region is published. Additionally, Germany, France, and Italy released their respective composite PMI and service sector PMI data.

- Euro Area Services PMI Hits 2021-Low

The final HCOB Euro Area Services PMI for October 2023 remained at 47.8, confirming a three-month decline in services sector activity. This marks the most significant contraction since February 2021. Notably, demand conditions worsened, with new business volumes declining at the fastest rate since January 2021.

- German Private Sector Contracts

Germany’s final composite PMI for October 2023 was 45.9, indicating the fourth consecutive month of contraction. New orders, employment, and backlogs of work declined, with subdued business expectations. Input cost inflation retreated, and output charge inflation was the weakest since February 2021.

- Italy Services Sector Contracts Quickly

Italy’s services PMI fell to 47.7 in October 2023, marking the fastest contraction in a year. Foreign orders dropped due to geopolitical tensions, leading to decreased job creation. Output charges rose at the slowest pace in two years, and input costs increased. Optimism remained below average.

- French Private Sector Contracts Further

France’s composite PMI for October 2023 was revised to 44.6, down from the flash estimate of 45.3. It marked the fifth consecutive month of contraction, attributed to sluggish demand and financing conditions. Employment increased, led by the services sector, while operating costs saw a notable increase. Prices for goods and services rose moderately.

- Key Data Releases for the Week

Upcoming data releases of the week include Germany’s industrial production and the Euro Area producer price index on Tuesday. Wednesday will feature Germany’s inflation rate and Euro Area retail sales data, while on Friday, ECB President Lagarde is scheduled to deliver a speech.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Asia for the Week

- Chinese Economic Indicators and BOJ’s Policy Announcement

In China, the official manufacturing Purchasing Managers’ Index (PMI) for October fell from 50.2 to 49.5, indicating a return to contraction in the manufacturing sector. The official non-manufacturing PMI, which also provides insights into the performance of the service and construction sectors, dropped from 51.7 to 50.6 in October, signaling a slowdown in non-manufacturing growth. However, it remained in the growth zone for the tenth consecutive month.

These figures suggest that economic stabilization in China has become fragile, highlighting the need for further supportive measures by the government.

The Caixin manufacturing sector PMI, which provides signals about the activities of small and medium-sized enterprises in China, declined from 50.6 to 46.5 in October, indicating a return to contraction in the manufacturing sector after a two-month interval.

The Caixin services sector PMI increased from 50.2 to 50.4, suggesting a slight acceleration in the growth of the service sector.

In China, the focus will be on October’s trade figures and inflation data to gain more insights into the effects of government economic stimulus, especially after PMI data indicated unexpected contractions.

The Bank of Japan (BOJ) maintained its policy interest rate at -0.10% and announced a more flexible approach to yield curve control, allowing long-term interest rates to rise to higher levels. BOJ stated that a more flexible approach would be adopted in controlling the 10-year government bond yield, with a reference point of around 1%.