Global Markets Recap

U.S. Markets:

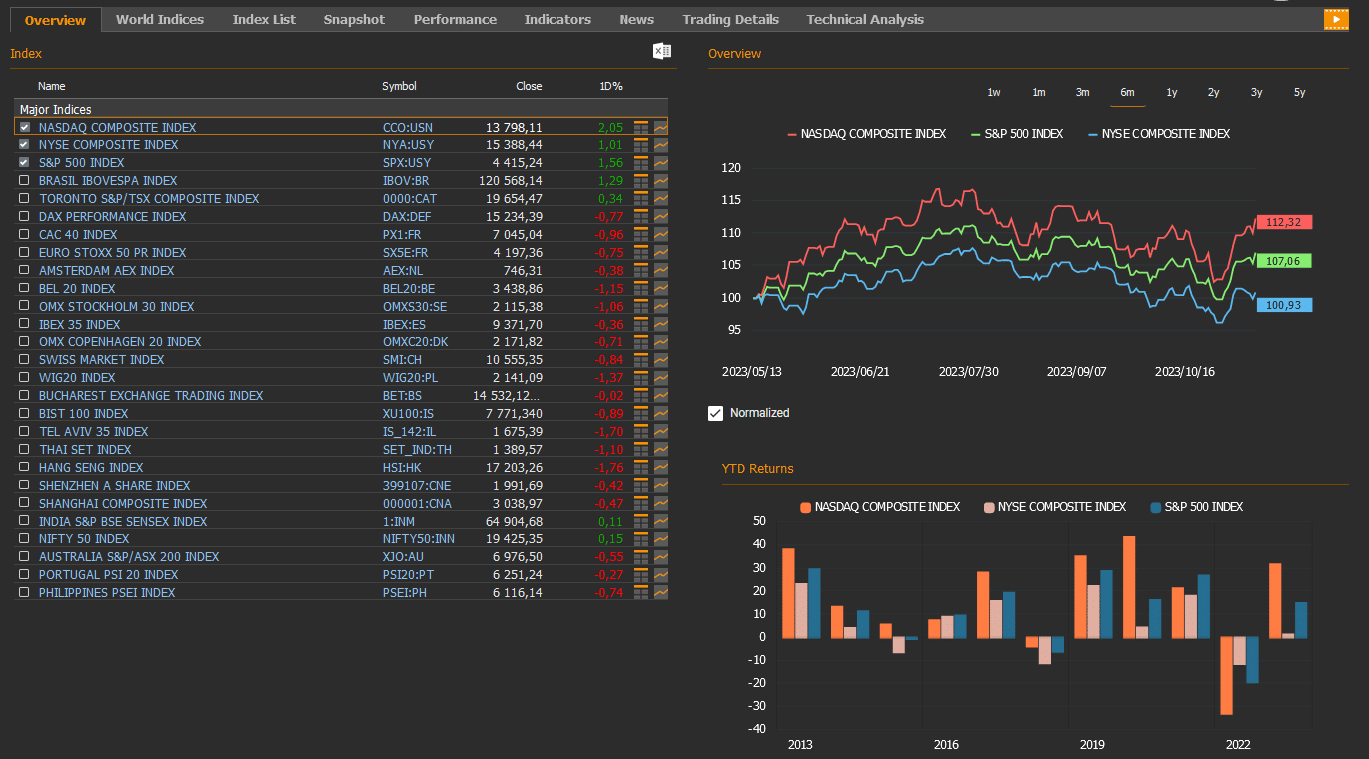

- Wall Street managed to close the week with strong gains. Federal Reserve Chairman Jerome Powell’s hawkish comments on interest rates had weakened risk appetite on Thursday. The S&P 500 index achieved its highest closing since September 19. All sectors in the index concluded a positive session, led by the technology sector. The S&P 500 index closed last Friday with a 1.56% gain at 4.415,24. The Dow Jones Industrial Average index rose 1.2% to 34,283.10, and Nasdaq Composite index climbed 2.0% to 13.798,11.

- In the FX markets, the Dollar index closed flat and negative, experiencing a 0.05% decrease on a daily basis and closing at 105.86.

- Oil futures finished higher on Friday, but posted a third straight weekly loss. The price per barrel of Brent Crude Oil, last week, closed at 81.43 USD, marking a 1.77% increase. The price per barrel of West Texas Intermediate Crude rose 1.9% to settle at 77.17 USD.

- Treasury yields closed with mixed results on Friday, marking the third consecutive week of decline for the 30-year rate. This followed a market recovery from a challenging auction of the longest-dated maturity. The 2-year U.S. Treasury yield, sensitive to Fed policy rates, rose by 3.8 basis points to 5.060% from Thursday’s level of 5.022%, extending its climb to the highest level since October 31. Conversely, 10-year U.S. Treasury yield saw a marginal decrease to 4.627% from Thursday’s 4.629%, with a weekly rise of 7 basis points. The yield on the 30-year Treasury note experienced a drop of 3.2 basis points to 4.733% when factoring in new issue levels.

European Markets:

- European stocks dropped Friday, as the Stoxx Europe 600 indexSXXP, closed down 1.00% to 443.31.The German DAX index dropped 0.77% to 15,234.39, the French CAC 40 index weakened 0.96% to 7,045.04 and the FTSE 100 index UKX fell 1.28% to 7,360.55.

- The yield on the 10-year UK Treasury bond yield dropped 5.76 basis points to 4.34%, and the yield on the German 10-year bond declined 6.770 basis points to 2.71%.

Asian Markets:

- On Friday, November 10, stocks in the Asia-Pacific region experienced a decline, marking the fourth consecutive day of losses for the Hong Kong market. The Hang Seng index down 1.8% to 17,203.26, while the Nikkei 225 index dropped 0.2% to 32,568.11. The Shanghai Composite index fell 0.5% to 3,038.97.

- The S&P/ASX 200 Benchmark index in Australian stock market dropped 0.5% to 6,976.50.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

US Market Outlook and Economic Events

The earnings season will continue, featuring reports from Home Depot, Cisco, TJX, Walmart, and Applied Materials.

- Inflation Assessment by Federal Officials

Despite positive signals of easing price pressures, Minneapolis Fed President Neel Kashkari stated that it is too early to declare victory against inflation. Kashkari remarked, ‘To say we’ve finished and resolved the issue, we need more data and to see how the economy evolves.’ Although Kashkari noted favorable inflation data in the last three months, he emphasized that it is not yet sufficient for a successful outcome and more data is needed to control inflation.

Richmond Fed President Thomas Barkin, a hawkish member of the Fed, acknowledged real progress in inflation but pointed out that it still remains at very high levels. He mentioned that the economy needs to slow down to bring inflation down to the 2% target. Similarly, Atlanta Fed President Raphael Bostic shared a comparable view, stating that monetary policy is restrictive enough, but ensuring inflation reaches the 2% target will keep the policy restrictive until confirmed.

- Jobless Claims and Trade Balance

The weekly initial jobless claims for the week ending November 4 were announced, revealing a slight decrease from 220,000 to 217,000. Despite this mild drop, the claims continued to trend at low levels, remaining below historical averages and indicating a tight labor market. Additionally, it was observed that the previously reported 217,000 claims for the week ending October 28 were revised to 220,000.

Trade balance data for September was released in the U.S. On a monthly basis, exports rose by 2.2%, reaching $261.1 billion, the highest value since August 2022. The increase in exports was particularly driven by industrial commodities, mainly the rise in crude oil and fuel exports, and an increase in food, seed, and beverage exports.

Monthly imports, on the other hand, increased by 2.7% to 322.7 billion USD in September. Strong employment and low unemployment rates continued to drive consumption, especially in imported consumer goods, cell phones, small household appliances, and passenger vehicles.

As a result, the monthly trade deficit increased from 58.7 billion USD to 61.5 billion USD in September, influenced by the monthly increase in imports exceeding the increase in exports.

In the last trading day of the week, marked by generally weak economic data, attention was turned to the University of Michigan’s consumer sentiment survey. Consumer confidence in the U.S. dropped for the fourth consecutive time, and household inflation expectations rose again. The persistent increase in inflation expectations poses a potential short-term concern for Fed members.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Upcoming US Economic Indicators

In the upcoming week, all eyes in the U.S. will be on the eagerly anticipated inflation rate data, shining a spotlight on retail sales and speeches by Fed officials. Furthermore, focus will extend to producer prices, industrial production, export and import prices, as well as building permits and housing starts.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

- European Central Bank Officials’ Statements

Francois Villeroy de Galhau’s Caution: European Central Bank (ECB) Governing Council member Francois Villeroy de Galhau expressed their intention to reach the 2% inflation target by 2025. However, he noted that the ECB would not raise interest rates unless faced with more significant challenges and currently has no plans for a near-future rate cut.

Robert Holzmann’s Preparedness for Rate Hikes: ECB member Robert Holzmann emphasized the need for the ECB to be ready for a potential interest rate hike if necessary. Holzmann cautioned against prematurely declaring victory over inflation, indicating that the ECB should remain vigilant and prepared to raise interest rates when needed.

- Euro Area Economic Indicators

The Euro Area’s Consumer Expectations Survey for September revealed an increase in the 12-month average inflation expectation from 3.5% to 4%, while the three-year inflation expectation remained unchanged at 2.5%. Economic growth expectations for the next 12 months showed a decline, signaling weakness, and unemployment expectations increased from 11.1% to an average of 11.4% in September.

The Euro Area retail sales data for September indicated a 0.3% monthly decline, marking the third consecutive month of decrease. The yearly contraction continued, reaching 2.9%, signaling a persistent downturn in domestic demand. The impact of tightened financial conditions due to ECB’s potential rate hikes is expected to keep retail sales under pressure.

In Germany, the final Consumer Price Index (CPI) data for October showed a flat monthly trend after a 0.3% increase in September. The yearly CPI decreased from 4.5% to 3.8%, reaching the lowest level since August 2021.

Core CPI, on a yearly basis, decreased from 4.6% to 4.3%, hitting the lowest level since August 2022.

Germany’s industrial production for September revealed a higher-than-expected 1.4% monthly decline, signaling weakening production due to factors such as high energy prices, global interest rate levels, and a slowdown in the Chinese economy. This decline marked the fourth consecutive month of production decrease.

- Euro Area Producer Price Index (PPI) and German Trade Balance

In the Euro Area, the Producer Price Index (PPI) for September increased by 0.5% monthly, following a revised 0.7% rise in August. The yearly rate decreased from 11.5% to 12.4%, reflecting a decline in energy and intermediate goods costs.

Germany’s trade balance data for September indicated a monthly decline in exports by 0.3%, reaching $261.1 billion, the highest value since August 2022. The increase in exports was particularly driven by industrial commodities, mainly the rise in crude oil and fuel exports, and an increase in food, seed, and beverage exports. Monthly imports, on the other hand, increased by 2.7% to $322.7 billion in September.

The monthly trade deficit increased from $58.7 billion to $61.5 billion, influenced by the monthly increase in imports exceeding the increase in exports

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

In the upcoming week, market participants will closely monitor key economic indicators and events within the Euro Area. Tuesday will feature the release of the second estimates of quarterly and yearly growth rates, alongside the influential ZEW Economic Index for Germany, complemented by speeches from ECB officials.

Wednesday will bring attention to the inflation rates for France and Italy, along with wholesale price changes in Germany. The midweek focus on economic data will provide insights into the economic conditions of major Eurozone economies.

The conclusion of the week on Friday will see a keen interest in the Euro Area’s inflation rate, coupled with a noteworthy address from ECB President Lagarde.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Asia for the Week

- Chinese Inflation Dynamics

In China, the Consumer Price Index (CPI) for September showed a 0.1% decline following a 0.2% increase in August, falling below expectations and marking the end of a three-month upward trend. On a yearly basis, the CPI decreased from 2% to 0%, contrary to the expected 0.1% decline.

September’s core CPI, excluding food and energy prices, recorded a yearly level of 0.6%, reaching the lowest level in the past four months. The annual consumer price inflation in China was observed to significantly undershoot the government’s target of 3% for the year.

The Producer Price Index (PPI) in China remained unchanged in October after a 0.4% increase in September. On a yearly basis, the decline rate increased slightly from 2.5% to 2.6%, marking the thirteenth consecutive month of decline due to weakening demand. The impact of weakening demand suggested signs of deflation in an economy struggling to revive, with both consumer and producer prices experiencing decreases.

- Deflationary Concerns and Government Measures

Weakening demand and decreasing consumer and producer prices in China signaled challenges in economic revitalization, bordering on deflation. However, government measures aimed at boosting consumption and strengthening post-pandemic recovery showed a positive impact. Since March, producer deflation has gradually decreased, with expectations pointing towards a 2.7% decline on a yearly basis.

The Chinese government’s various measures to increase consumption and enhance post-pandemic recovery played a crucial role in stabilizing the economy. Despite the struggle to overcome deflationary pressures, the impact of these policies has been evident since March, contributing to the reduction in producer deflation and aligning with the expected 2.7% yearly decline.

These economic indicators reflect China’s ongoing efforts to navigate challenges, with government strategies playing a vital role in shaping the economic landscape.

- A Week Ahead Overview of Key Indicators and Real Estate Trends

In the upcoming week, market observers will closely monitor crucial economic indicators scheduled for release. On Wednesday, attention will be focused on industrial production, retail sales, and fixed asset investment figures, providing key insights into China’s economic performance.

Thursday’s agenda includes the release of house price index data for October, offering a comprehensive view of the real estate market.

Notably, the average new home prices in China’s 70 major cities reported a persistent decline of 0.1% year-on-year in September 2023, marking the third consecutive month of subdued demand amidst ongoing efforts by Beijing to address a prolonged property downturn.