Global Markets Recap

U.S. Markets:

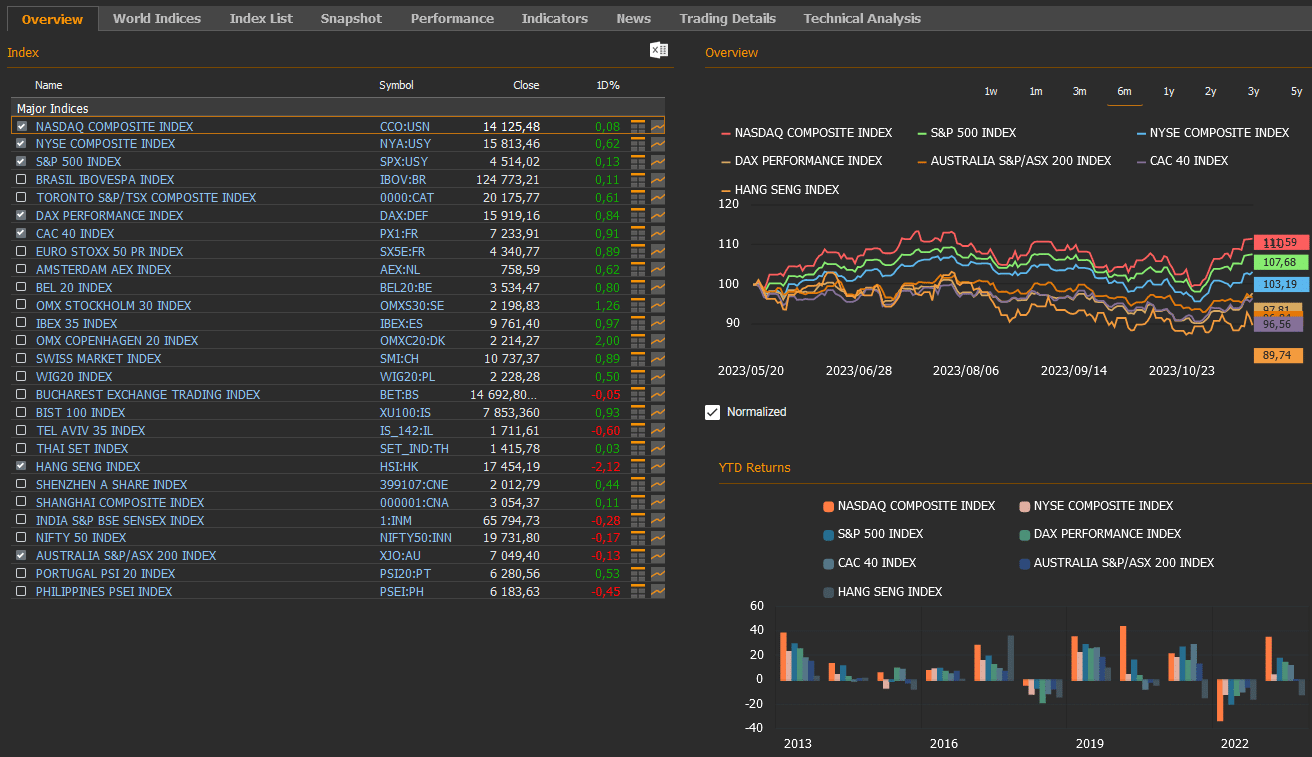

- On Friday, expectations among market players that the Fed had reached the peak in interest rates influenced Wall Street indices in the US, closing the day with gains. On a daily basis, the Nasdaq Composite index rose by 0.08% to 14,125.48, the S&P 500 index by 0.13% to 4,514.02, and the Dow Jones index by 0.01% to 34,947.28.

- The Dollar index closed the week at 103.9, marking a 1.8% decline, driven by increased expectations that the Fed had reached the peak in interest rates.

- The price per barrel of Brent Crude Oil, concluded the past week at 80.61 USD per barrel, experiencing a 4% rise The price per barrel of West Texas Intermediate Crude also jumped 4% to settle at 76.62 USD.

- he 2-year U.S. Treasury yield, sensitive to Fed policy rates, closed the week at 4.89%, down by 17 basis points. 10-year U.S. Treasury yield completed the last week at 4.44%, reflecting a 22 basis points decrease.

European Markets:

- European stocks climbed Friday, as the Stoxx Europe 600 indexSXXP, closed up 1.01% to 455.82.The German DAX index increased 0.84% to 15,919.16, the French CAC 40 index increased 0.91% to 7,233.91 and the FTSE 100 index UKX increased 1.26% to 7,504.25.

Asian Markets:

- Last Friday, November 17, stocks in the Asia-Pacific region mostly climbed. The Hang Seng index down 2.1% to 17,454.19, while the Nikkei 225 index increased 0.5% to 33,585.20. The Shanghai Composite index increased 0.1% to 3,054.37.

- The S&P/ASX 200 Benchmark index in Australian stock market dropped 0.13% to 7,049.40.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

US Market Outlook and Economic Events

- Fed Members’ Perspectives

Fed governor Christopher Waller drew attention to the increase in bond yields since July, describing it as a financial earthquake. However, he refrained from commenting on its impact on policy interest rates.

Fed governor Michelle Bowman mentioned that it is still early to evaluate the effects of the increase in bond yields on tightening financial conditions, inflation, and the economy. Emphasizing the volatility of yields, Bowman stated that they could support further interest rate hikes if inflation stalls or falls below the target.

- U.S. Inflation and Other Economic Data

Last week, alongside inflation data, Mortgage Bankers Association (MBA) data on housing market loan applications and interest rate trends were published. In addition, retail sales, producer prices, and data on petroleum and petroleum product stocks were closely monitored.

The absence of changes in consumer prices in October resulted in an annual inflation rate of 3.2%. This figure slightly undershot previous expectations, as market analysts anticipated a 3.3% annual inflation, considering the September rate was at 3.7%.

In October, the cost of shelter continued to go up, rising by 0.3%, although at a slower pace compared to the 0.6% increase in September.

The overall energy index experienced a 2.5% decrease, mainly due to the notable decline in gasoline prices, which offset any gains in other energy component indexes.

The headline food index showed a 0.3% increase, slightly higher than the 0.2% growth observed in September.

Inflation data indicates a need for new assessments of economic expectations and suggests ongoing market fluctuations. Markets anticipate the Fed to begin interest rate cuts in May.

- Producer Price Index (PPI) Trends

Following the Consumer Price Index (CPI), the Producer Price Index (PPI) decelerated. In October, PPI experienced its sharpest decline since April 2020, decreasing by 0.5% monthly and retreating from 2.2% to 1.3% annually (Expectation: 1.9%).

Excluding food and energy prices, Core PPI remained stable monthly (Expectation: 0.3%) but decreased from 2.7% to 2.4% annually.

- Retail Sales Overview

Retail sales declined by 0.1% in October compared to the previous month, falling below expectations. Various sectors recorded declines, with miscellaneous store retailers (-1.7%) and furniture stores (-2.0%) leading. However, health and personal care stores (1.1%), food & beverage stores (0.6%), and online trade (0.2%) partially offset these declines.

On a yearly basis, retail trade growth slowed from an upwardly revised 4.1% in September to 2.5% in October.

- Industrial Production Challenges

Industrial production fell below expectations in October, contracting by 0.6% monthly (Expectation: -0.3%) and experiencing a 0.7% annual decline.

This marks the most significant monthly drop in industrial production in four months. The automotive and manufacturing sector’s industrial production decreased by 10%.

The capacity utilization rate decreased by 0.6% monthly to 78.9 in October (Expectation: 79.4), remaining below the 50 year historical average of 0.8%.

- Housing and Unemployment

Mortgage applications increased by 2.8% in the week ending November 10th, following a 2.5% rebound the previous week. The rise, attributed to lower inflation expectations and a pullback in U.S. Treasury yields, pushed mortgage demand to a five-week high.

Applications to purchase a home increased by 3%, while those to refinance a home advanced by 2%. The average interest rate on a 30-year fixed-rate mortgage remained unchanged at 7.61%.

Weekly jobless claims for the week ending November 11 exceeded expectations, rising to 231,000, a weekly increase of 13,000 (Expectation: 220,000). Continued jobless claims rose by 18,000 to 1,865,000 (Expectation: 1,847,000).

The Philadelphia Fed Manufacturing index increased by 3.1 points in November to -5.9 (Expectation: -9), marking the 16th consecutive month of negative readings.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Upcoming US Economic Indicators

- Focus on Fed Minutes and Key Economic Indicators

In the U.S., the markets await the release of the Federal Reserve’s November FOMC meeting minutes on Tuesday. The Fed maintained the federal funds rate range at 5.25%-5.50% in the last meeting, aligning with expectations and marking two consecutive unchanged meetings, a unanimous decision.

The decision statement highlighted persistent high inflation and emphasized monitoring inflation risks. Members acknowledged cumulative tightening, considering delayed effects, and assessed financial conditions, noting potential impacts on economic activity, employment, and inflation.

Fed Chairman Powell, post-decision, noted that inflation remains above the target, committing to keeping rates steady until sustainable progress is observed. He emphasized a cautious approach, evaluating further tightening based on economic data.

- Durable Goods Orders Recovery

Additionally, on Wednesday, the preliminary data for October durable goods orders will be closely watched. After a two-month decline, durable goods orders showed a significant recovery in September, rising by 4.6%, the strongest increase since July 2020. Notably, a substantial increase in orders for non-defense aircraft and parts (92.5% increase) influenced the overall rise in durable goods orders.

- Labor Market Insights and Consumer Confidence Update

Wednesday will feature the weekly initial jobless claims data, providing insights into the labor market. The recent release showed a slight increase from 218,000 to 231,000, reaching the highest level in about two years, indicating a tight labor market.

On the same day, the final version of the University of Michigan Consumer Confidence Index for November will be released. Preliminary data showed a 3.4-point decline to 60.4, falling below expectations and marking the lowest level in the past six months.

- Housing Market Dynamics

In addition, Wednesday will reveal data on existing home sales for October, offering insights into the housing market. September’s existing home sales saw a 2% monthly decline, extending the drop for the fourth consecutive month to the lowest level since October 2010. Rising mortgage interest rates and low housing inventory have negatively impacted housing demand in the U.S., especially after the Fed’s interest rate hikes.

- Economic Activity Signal

Closing the week on Friday, attention will turn to the S&P Global Manufacturing and Services PMI data for November, providing a crucial signal about the current economic activity.

October’s manufacturing PMI reached 50, indicating an exit from the contraction zone and a stabilization in manufacturing activities.

The service PMI for October rose to 50.6, signifying an acceleration in the growth of the service sector. Preliminary data for November is expected to show a slight contraction in manufacturing and a mild slowdown in service sector growth.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

Industrial production and foreign trade figures have been released for the Euro Area. Consumer and producer inflation data from the United Kingdom has been published.

- Euro Area Industrial Contraction

Industrial production contracted more than expected in September, declining by 1.1%. The annual decrease was 6.9%, influenced by a drop in durable and non-durable goods production.

- Trade Surplus and GDP Contraction

The Euro Area posted a trade surplus of EUR 10 billion in September of 2023, decreasing considerably from a EUR 29.8 billion gap on a yearly basis, largely due to the stabilization in prices of natural gas and other major resource imports into the region.

The Euro Area contracted by 0.1% in the third quarter, in line with expectations. The GDP shrank 0.1% on a quarter-on-quarter basis in the three months to September 2023, marking the first contraction since 2020, influenced by the COVID-19 pandemic.

Among the bloc’s major economies, Germany’s GDP shrank by -0.1%, Italy stalled, while France (0.1%) and Spain (0.3%) experienced modest growth.

The European Commission has lowered its economic growth expectations for the Euro Area this year from 0.8% to 0.6%, citing high inflation, tightening monetary policy, and a contraction in demand. The forecast for 2024 has also been revised down from 1.3% to 1.2%.

- The ZEW Indicator

The ZEW Investor Confidence Index for the Euro Area rose from 2.3 to 13.8 in November (Expectation: 6.1). This marked the highest reading since February this year, with 48% of surveyed analysts predicting stability in economic activity, 32.9% forecasting improvement, and 19.1% anticipating a decline.

The ZEW Indicator of Economic Sentiment for Germany also rose by another 10.9 points to reach 9.8 in November 2023, surpassing market expectations of 5. This suggests that Europe’s largest economy has reached a turning point amid heightened economic expectations and significantly more optimistic outlooks for the German industrial sector.

- German Current Account

Germany’s current account showed a surplus of EUR 28.1 billion in September, contributing to a total surplus of EUR 198.5 billion for the first three quarters of the year.

- UK Consumer Prices

In the United Kingdom, consumer prices remained unchanged in October 2023, following a 0.5% increase in the previous month, missing market expectations of a 0.1% rise.

The core inflation rate, excluding energy, food, alcohol, and tobacco prices, rose by 0.3% in October, slightly below the forecast of 0.4%.

The annual inflation rate dropped to 4.6% in October 2023, down from 6.7% in both September and August, falling short of market expectations of 4.8%. This is the lowest rate since October 2021, partly due to the recent reduction in energy prices.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

- ECB Meeting Minutes and Monetary Policy Signals

In Europe, the focus is on the release of the minutes from the European Central Bank’s (ECB) November meeting on Thursday.

In its October meeting, the ECB kept interest rates steady in line with expectations, emphasizing a data-based approach to determining the appropriate level and duration of constraints. The ECB noted that interest rates are considered to be at a level that will contribute significantly to lowering inflation to 2% when kept sufficiently long.

Speeches by ECB President Lagarde on Thursday and Friday will be closely monitored for possible new signals regarding the central bank’s monetary policy.

- Germany’s Producer Price Index (PPI)

Germany’s Producer Price Index (PPI) for October was observed on Monday.

In October, producer prices experienced a year-on-year decline of 11%, following a record drop of 14.7% in September, in line with expectations. This marks the fourth consecutive month of falling producer prices, primarily attributed to a base effect from the previous year. The energy sector made the most significant downward contribution, with prices falling by 27.9%.

- Euro Area Consumer Confidence and Flash PMI Data

On Wednesday, the Euro Area Consumer Confidence preliminary data for November will be released.

The October data indicated a level of -17.9, maintaining its lowest levels since March, with consumers signaling a deterioration in their future financial situations and the general economic conditions in their countries. Consumers mentioned that rising borrowing costs following the ECB’s interest rate hikes negatively impacted consumer confidence.

On Thursday, the November HCOB Manufacturing and Services Flash PMI data for the Euro Area will provide information on the current economic outlook.

In October, manufacturing PMIs in the region continued to contract below the 50 growth threshold due to the tightening of financial conditions and weakening demand following the ECB’s interest rate hikes.

Services PMIs moved from expansion to contraction in Germany in October, while other regions continued in contraction.

Preliminary data suggests that manufacturing and services PMIs are expected to remain in contraction in November.

- German Business Climate and GDP Growth

On Friday, Germany’s IFO Business Climate Index for November, reflecting the assessments of firms in manufacturing, construction, wholesale, and retail trade, will be released.

In October, the index rose from 85.8 to 86.9, exceeding expectations. The current conditions index increased to 89.2, and the expectations index rose to 84.7, indicating a limited decrease in firms’ pessimism about the coming months. A slight increase in the index is expected in November.

Additionally, on Friday, final data on Germany’s Gross Domestic Product (GDP) growth for the Q3 of 2023 will be released. In the Q2 of 2023, the German economy recorded limited growth of 0.1%, followed by a slight contraction of 0.1% in the Q3 of 2023. On an annual basis, the German economy showed a 0.3% contraction in the Q3 of 2023 after stagnant growth of 0% in the Q2 of 2023.

- Swedish Central Bank Interest Rate Decision

On Thursday, the decision of the Swedish Central Bank on interest rates will be followed.

In its September meeting, the bank raised the policy interest rate by 25 basis points to 4%, maintaining the highest levels since 2008. The market expectation for this week’s meeting is that the bank will raise the policy rate by 25 basis points to 4.25%.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Asia for the Week

- Surpassing Expectations in Industrial Production and Retail Sales

In China, industrial production increased by 4.6% on a yearly basis, exceeding expectations set at 4.4%. Additionally, retail sales showed a year-on-year growth of 7.6%, surpassing the market’s anticipation of 5.5%. However, there was a cooling off in investments.

Foreign direct investment (FDI) into China declined by 9.4% year-on-year, totaling CNY 987.01 billion in the first ten months of 2023, equivalent to USD 136.40 billion.

FDI in the service sector decreased by 15.9% to CNY 672.10 billion, while in the manufacturing sector, it increased by 1.9% to CNY 283.44 billion. Notably, investment in high-tech manufacturing rose by 9.5%, with the medical equipment and instrument manufacturing industry experiencing a growth rate of 34.6%, and the electronic and communication equipment manufacturing industry growing by 14.8%.

- Decline in China’s New Home Prices in October

China’s new home prices dropped by 0.1% year-on-year in October 2023, marking the fourth consecutive month of decline.

- Steady Lending Rates Amid Economic Mixed Signals

The People’s Bank of China (PBoC) maintained lending rates at the November fixing, with the one-year loan prime rate (LPR) unchanged at a record low of 3.45% and the five-year rate, a reference for mortgages, held at 4.2% for the fifth straight month. This decision followed the central bank’s decision to hold medium-term interbank rates steady, given mixed economic activity in October and deepening headwinds from the property sector despite stimulus measures.

- Japan’s Economic Contraction in Q3 2023: Faster Than Expected Decline

Japan’s economy contracted by 0.5% quarter-on-quarter in Q3 of 2023, worse than market forecasts of a 0.1% decline. This followed a 1.1% growth in Q2, marking the first GDP contraction since Q4 of 2022.

On an annualized basis, the Japanese economy contracted by 2.1% during the Q3 of 2023, reflecting uncertainties stemming from elevated inflation and a cloudy global economic outlook.