Global Markets Recap

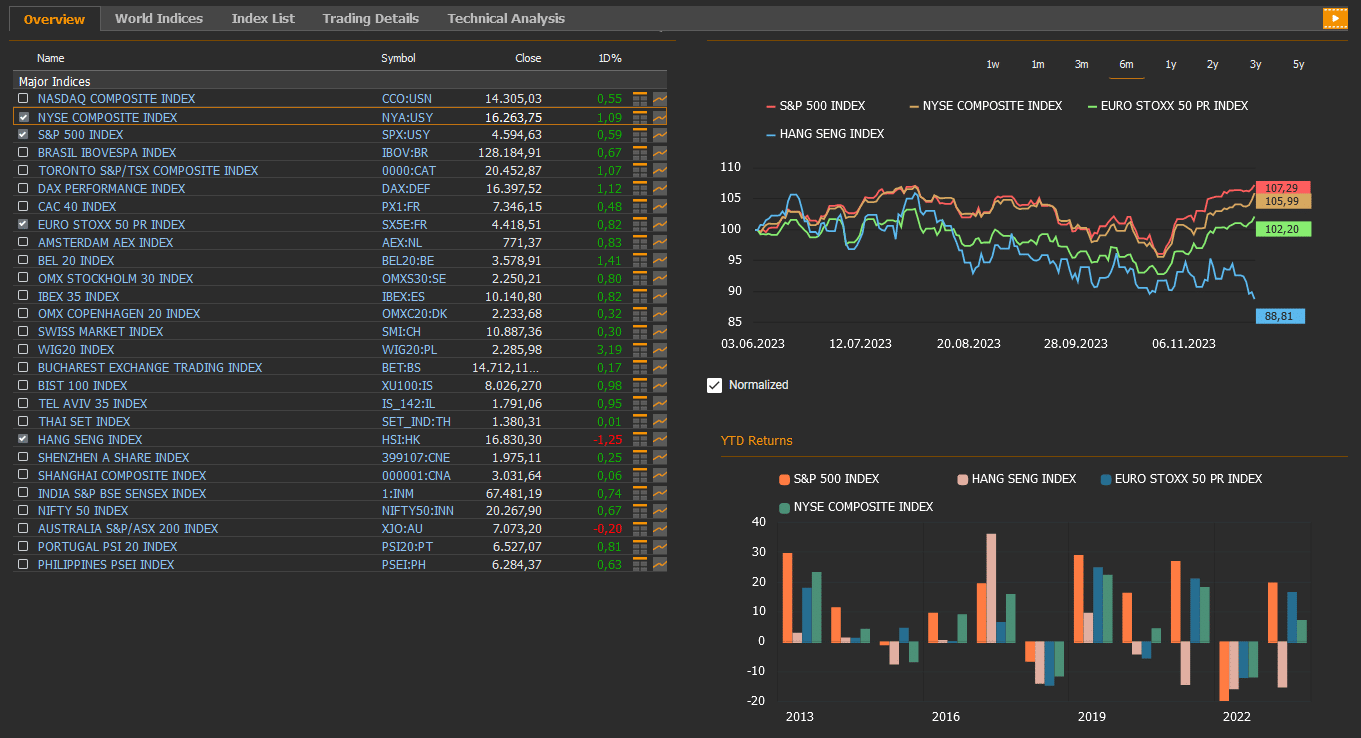

- Last Friday, following Federal Reserve Chairman Powell’s speech, the Wall Street closed the day with gains, driven by increasing expectations that the Fed’s interest rate hike process is coming to an end, and next year, interest rate cuts will begin. On a daily basis, the Nasdaq composite index rose by 0.55%, the NYSE composite index was up 1.09%, the S&P 500 index index increased by 0.59%, and the Dow Jones index by 0.82%.

- The Dollar index closed last week at 103.2, marking a 0.1% decrease.

- The barrel price of Brent crude oil closed at $78.9, reflecting a 2% decline due to expectations that supply cuts following the OPEC+ Group meeting would not balance the market.

- The price of an ounce of gold closed last week at $2,071, rising by 3.6%, influenced by expectations that the Fed’s interest rate hike process is coming to an end, and next year, interest rate cuts will begin.

- The 10-year U.S. Treasury yield completed last week at 4.20%, experiencing a 27 basis point decrease. The 2-year U.S. Treasury yield, particularly responsive to Federal Reserve policy rates, closed the week at 4.54%, with a 41 basis point decrease.

European Markets:

- European stocks rose Friday, as the Stoxx Europe 600 index SXXP, closed up 0.99% to 466.20. The German DAX index increased 1.12% to 16,397.52, the French CAC 40 index increased 0.48% to 7,346.15 and the FTSE 100 index UKX gained 1.01% to 7,529.35.

Asian Markets:

- Stocks in the Asia-Pacific region mostly grew Friday, Dec. 1. The Hang Seng index down 1.25% to 16,830.30, while the Nikkei 225 index declined 0.17% to 33,431.51. China’s Shanghai Composite index gained 0.06% to 3,031.64.

- The S&P/ASX 200 Benchmark index in Australian stock market weakened 0.2% to 7,073.20.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

US Market Outlook and Economic Events

- Federal Reserve’s Stance on Inflation and Economic Signals

Federal Reserve Chairman Powell stated that it is too early to declare victory on inflation and emphasized that despite recent positive signals regarding inflation, monetary policy will remain restrictive until inflation firmly returns to the 2% target.

Additionally, Powell mentioned that it is premature to make predictions about reaching a sufficiently restrictive stance or the timing of interest rate cuts, expressing readiness for further tightening if necessary. He acknowledged the unusually uncertain economic outlook, emphasizing that the Fed is proceeding cautiously and making decisions on a meeting-by-meeting basis.

- Economic Activity Overview

On the U.S. front, signals indicating the latest economic activity for November were monitored through the final S&P Global Manufacturing Purchasing Managers’ Index (PMI) data and the ISM Manufacturing Purchasing Managers’ Index. According to this, the manufacturing PMI for November decreased from 50, indicating growth, to 49.4, suggesting a return to contraction in the manufacturing sector, consistent with the leading data.

The ISM Manufacturing Purchasing Managers’ Index for November also remained at 46.7, indicating a sustained contraction in manufacturing, extending its trend in the contraction zone for the fourteenth consecutive month.

- PCE Deflator and Employment Market Data

October data for the PCE deflator, which the Fed closely monitors, along with personal income and spending data for October, were released:

- The monthly inflation rate of the PCE deflator in October slowed from 0.4% to 0, exceeding expectations (0.1%), marking the lowest level since July 2022. On a yearly basis, it decreased from 3.4% to 3%, reaching the lowest level since March 2021. Expectations were for a decrease to 3.1%.

- The increase in the core PCE deflator slowed from 0.3% to 0.2% on a monthly basis in October, in line with expectations. On a yearly basis, it decreased from 3.7% to 3.5%, marking the lowest level since April 2021.

- The monthly growth rate of personal income in October slowed from 0.4% to 0.2%, in line with expectations, while the monthly growth rate of personal spending also decreased from 0.7% to 0.2%, consistent with expectations.

From the employment market data in the U.S., weekly initial jobless claims for the week ending November 25th, while slightly increasing from 211,000 to 218,000, remained at historically low levels, signaling a tight labor market.

- Housing Market and Consumer Confidence

In terms of housing market data, the October pending home sales, indicating the number of homes for which a sale contract has been signed but the transfer of title has not yet occurred, confirmed the slowdown in the housing market by declining by 1.5% on a monthly basis.

New home sales for October, affected by persistently high mortgage rates, experienced a higher-than-expected decline of 5.6% on a monthly basis, indicating a weakening in housing demand.

Another housing market indicator is the S&P/Case-Shiller 20 City Home Price Index. In September, the monthly growth rate slowed from 0.8% to 0.7%, marking the lowest level in the past three months, while the annual growth rate increased from 2.1% to 3.9%.

The Conference Board Consumer Confidence Index for November increased from 99.1 to 102, despite expectations of a continued decline, recording an increase after three months of decline.

Looking at the details, the current conditions index, reflecting consumers’ evaluations of current job and labor market conditions in November, slightly decreased from 138.6 to 138.2, while the expectations index, reflecting short-term assessments for the future, increased from 72.7 to 77.8. Thus, the expectations index continued its trend below 80 for the third consecutive month, historically indicating an impending recession. The survey also revealed that approximately two-thirds of consumers believed a recession is likely to occur in the next 12 months.

- Beige Book Report and GDP Growth

According to the Beige Book Report published by the Fed, economic activity in the country has slowed since October, and demand for the workforce continues to decline.

The annualized quarterly GDP growth rate for the third quarter of this year was revised upward from 4.9% to 5.2%, indicating the strongest growth since the end of 2021. Examining the details of the revised growth data for the Q3, the upward revision was driven by upward revisions in non-residential fixed investments and local government spending, despite a downward revision in the growth rate of consumption expenditures, which represents a significant portion of the country’s economy (from 4% to 3.6%).

- OECD Global Economic Outlook

The Organization for Economic Co-operation and Development (OECD) released its Global Economic Outlook Report. The OECD mentioned that global economic growth will slightly lose momentum next year but emphasized a reduced risk of a sharp downturn despite high debt levels and uncertainty about interest rates.

The global economic growth forecast for 2023 was slightly revised downward from 3% to 2.9%, maintained at 2.7% for 2024, and projected at 3% for 2025.

The OECD anticipates a deceleration in U.S. growth, projecting a decrease from 2.4% this year to 1.5% next year. This marks a revision from its September estimates, which had predicted U.S. growth at 2.2% in 2023 and 1.3% in 2024.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Upcoming US Economic Indicators

- Factory Orders Rebound and Strong September Performance

Looking at this week’s economic calendar, Monday will see the October factory orders data.

Factory orders, after a 2.1% decline in July, rebounded by 1% in August, partially offsetting the previous month’s decrease. In September, factory orders showed a strong recovery, exceeding expectations with a 2.8% increase. This monthly increase in September was the highest since January 2021.

- Key Economic Signals via PMIs

The November S&P Global Services Sector final PMI data and ISM Non-Manufacturing Index, which will provide signals about the latest economic activity, will be monitored.

According to the preliminary data, the November services PMI increased from 50.6 to 50.8, indicating a slight acceleration in growth in the service sector. In October, the ISM Non-Manufacturing Index decreased from 53.6 to 51.8, signaling a slowdown in non-manufacturing sectors.

- Labor Market Insights

Labor market data that guides the Fed’s monetary policy will be closely watched.

Tuesday will feature the Job Openings and Labor Turnover Survey (JOLTS) data for October. Wednesday will bring the ADP private sector employment data for November. Thursday will include weekly initial jobless claims data, and Friday will provide the non-farm payrolls, unemployment rate, and average hourly earnings data for November.

The JOLTS data for September surpassed expectations, rising from 9.50 million to 9.55 million, marking the highest level in the past four months. The ADP private sector employment increase for October rose from 89,000 to 113,000 but fell below expectations (150,000). Despite a gradual easing of the labor market in recent months, employment gains have continued to exceed the necessary monthly range of 70,000 to 100,000 to accommodate the growing working-age population.

Last week’s initial jobless claims, while slightly increasing from 211,000 to 218,000, remained at historically low levels, indicating a tight labor market. In October, non-farm payroll increase fell from 297,000 to 150,000, surpassing expectations (180,000) for a decline, marking the lowest level in the past four months. The unemployment rate rose from 3.8% to 3.9%, the highest level since January, with expectations for it to remain at 3.8%. While the number of unemployed increased by 146,000 to 6.51 million in October, the number of employed decreased by 348,000 to 161.2 million.

Looking at average hourly earnings, the monthly growth rate slowed from 0.3% to 0.2% in October, below expectations (0.3%). The yearly growth rate also decreased from 4.3% to 4.1%, maintaining its lowest level since June 2021. These data indicated a partial slowdown in inflationary pressures arising from wages.

- Trade Balance and Consumer Sentiment

On Wednesday, October trade balance data will be followed. In September, the monthly trade deficit increased from $58.7 billion to $61.5 billion due to a greater increase in imports than exports. While monthly imports reached their highest level in the past seven months at $322.7 billion with a 2.7% increase, exports also rose to their highest level since August 2022, increasing by 2.2% to $261.1 billion.

Finally, on Friday, the preliminary University of Michigan Consumer Sentiment Index for December will be monitored.

In November, the index decreased from 63.8 to 61.3. Looking at the details, the current conditions sub-index decreased from 70.6 to 68.3 in November, while the expectations sub-index fell from 59.3 to 56.8.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

- Contracting Manufacturing PMIs

November HCOB manufacturing sector final PMI data, providing information on the recent economic outlook in Europe, was closely monitored.

Accordingly, in November, manufacturing PMIs across the region continued their contraction below the 50 growth threshold, driven by the tightening of financial conditions and weakening demand following the ECB’s interest rate hikes.

Manufacturing PMIs in November increased from 42.3 to 42.6 in Germany, from 42.6 to 42.9 in France, from 43.8 to 44.2 in the Eurozone, and from 46.7 to 47.2 in the UK, indicating a slight slowdown in the contraction pace in the manufacturing sector.

- Inflation Trends and ECB Monetary Policy

Inflation data, a key determinant of the ECB’s monetary policy, was tracked with the preliminary November CPI data for the Eurozone.

After a 0.1% monthly increase in headline CPI in October, it unexpectedly dropped by 0.5% in November, marking the sharpest monthly decline since January 2020. Expectations were for a 0.2% decrease. The yearly rate also decreased from 2.9% to 2.4%, maintaining its lowest level since July 2021, with expectations for a decrease to 2.7%.

Core CPI in the Eurozone, after showing a 0.2% monthly increase in October, recorded a 0.6% decrease in November, and the yearly rate decreased from 4.2% to 3.6%, reaching its lowest level since April of last year. Expectations were for a decrease to 3.9%. Core CPI reached a record level of 5.7% in March.

- Consumer Confidence and Economic Sentiment

The final consumer confidence data for November in the Eurozone was followed, recording a level of -16.9, the highest in the last three months, consistent with the preliminary data.

The GfK consumer confidence data for December in Germany, rising slightly from -28.3 to -27.8, showed a partial recovery from the lowest levels since April but continued its weak trend in the negative zone. Looking at details, the consumer buying propensity index slightly recovered from -16.3 to -15, while the index for income expectations decreased from -15.3 to -16.7, and the index for economic situation expectations remained flat at -2.3 with a slight increase.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

- ECB President’s Speech Signals

Looking at this week’s economic calendar in Europe, Monday will focus on a speech by ECB President Lagarde. Lagarde’s speech will be monitored for possible new signals regarding the Bank’s monetary policy.

- Economic Snapshots on Monday and Tuesday

In October 2023, Germany’s trade surplus rose to EUR 17.8 billion, surpassing expectations of EUR 17.1 billion and marking the highest surplus since June. This increase resulted from a sharper decline in imports (1.2% to EUR 108.6 billion) than in exports (2.7% drop to EU countries. Germany’s trade dynamics reflected a robust surplus amid varied international trade patterns.

In December, the Eurozone Sentix Investor Confidence Index demonstrated an improvement, increasing to -16.8 from November’s -18.6, surpassing the market consensus of a -14.4 reading. Additionally, the Expectations Index in the Eurozone showed positive movement, rising to -9.8 from the previous month’s -10.0.

Tuesday will bring the final HCOB services sector PMI data for November, providing insights into the recent economic outlook in Europe.

According to preliminary data, service PMIs continued their contraction in November, except in the UK. In Germany, it increased from 48.2 to 48.7, in France from 45.2 to 45.3, and in the Eurozone from 47.8 to 48.2, indicating a slight slowing in the contraction pace in the service sector. In contrast, it increased from 49.5 to 50.5 in the UK, indicating a transition from contraction to growth in the service sector.

On Tuesday, the PPI data for December in the Eurozone will be released. An increase of 0.2% is expected in the monthly PPI in October, with a slowdown in the annual rate from 12.4% to 9.5%.

- Manufacturing, Retail Dynamics, and Economic Growth

On Wednesday, retail sales data for October in the Eurozone will be followed. After a 0.3% monthly decline in retail sales in September, a mild recovery of 0.1% is expected in October, while the annual rate is expected to slow down from 2.9% to 1.2%.

On the other hand, Wednesday will bring the factory orders data for October in Germany, and Thursday will provide the industrial production data for October in Germany.

On Thursday, the final GDP growth data for the Q3 of 2023 in the Eurozone will also be announced. The Eurozone economy contracted by 0.1% in the Q3 after growing by 0.2% on a quarterly basis in the Q2, and the annual growth rate slowed from 0.5% to 0.1%.

- Friday’s Focus: Inflation Indicators

The inflation data that will guide the ECB’s monetary policy will be followed, with the release of the final CPI data for November in Germany.

According to preliminary data, headline CPI in Germany decreased by 0.4% in November after being flat in October, exceeding expectations for a 0.1% decrease. The yearly rate also decreased from 3.8% to 3.2%, reaching its lowest level since June 2021, with expectations for a decrease to 3.5%. Additionally, the yearly rate for core CPI decreased from 4.3% to 3.8%, maintaining its lowest level since August 2022.

Take the guesswork out of investing: Backtest your strategies with ease!

Economic Indicators in Asia for the Week

-

In Asia, the Caixin services sector PMI data for November, providing signals about the activities of small and medium-sized enterprises in China, will be followed on Tuesday.The Caixin Services PMI increased slightly from 50.2 to 50.4 in October after reaching its lowest level in nine months in September, indicating growth in the service sector for the tenth consecutive month.

Additionally, Thursday will bring the September trade data for China.

On Friday, final GDP growth data for the Q3 of 2023 of Japan’s economy will be monitored.

Furthermore, on Tuesday, the meeting of the Reserve Bank of Australia will be followed.

The Bank had raised its policy interest rate by 25 basis points to 4.35% last month due to the rise in inflation expectations. The Bank is expected to keep the policy interest rate unchanged at this week’s meeting.