Global Markets Recap

U.S. Markets:

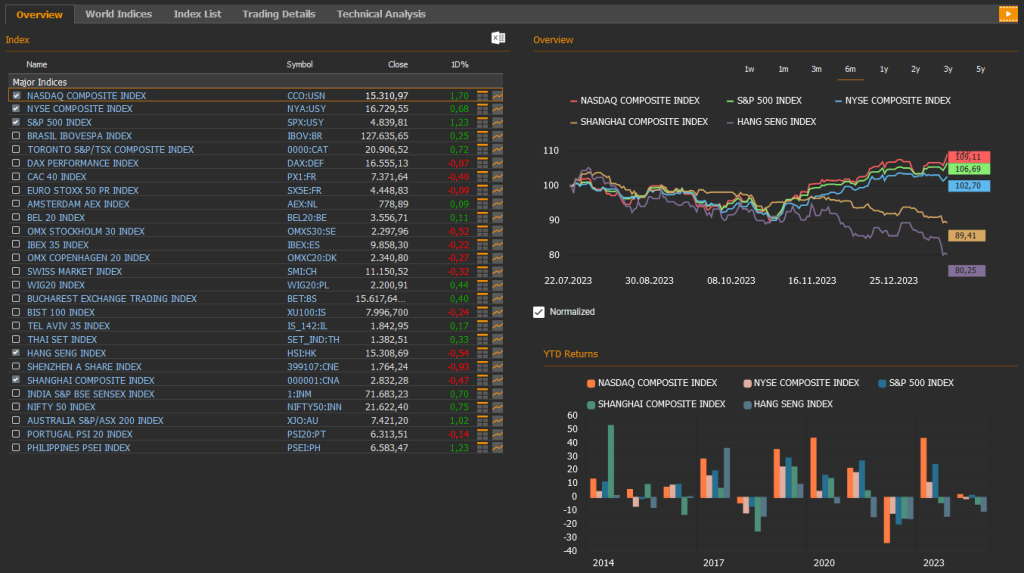

- On Friday, major U.S. stock indices experienced gains, and the S&P 500 index SPY:USY achieved its initial record closing in over two years. Technology shares on the New York Stock Exchange hit new highs, with the Nasdaq index CCO:USN rising by 1.70%, the NYSE composite index NYA:USY by 0.68%, the S&P 500 index SPY:USY by 1.23%, while the Dow Jones Industrial Average index DJI by 1.05%.

- The Dollar index DXY, a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 103.3 marking a 0.9% increase.

- The Brent crude oil closed the previous week at USD 78.56 per barrel, reflecting a 0.3% rise.

- The price of gold closed last week with a 1% decline, settling at USD 2,030 per ounce.

- The 10-year U.S. Treasury yield completed the week with a 18 basis points gain , settling at 4.12%. The 2-year U.S. Treasury yield, particularly responsive to Federal Reserve policy rates, fell to 4.15% from 4.38% down by 24 basis points.

European Markets:

- European stocks closed the Friday session with losses, as the Stoxx Europe 600 index SXXP, falling 0.26% to 469.24. The German DAX index was flat at 16,55.13, the French CAC 40 indexfell 0.40% to 7,371.64 and the FTSE 100 index UKX was flat at 7,461.93.

Asian Markets:

- Stocks in the Asia-Pacific region mostly rose Friday, Jan 19. Hong Kong stocks weakened with the Hang Seng index down 0.54% to 15,308.69, while the Nikkei 225 index added 1.4% to 35,963.27. China’s Shanghai Composite index declined 0.5% to 2,832.28.

- S&P/ASX 200 Benchmark index in Australian stock market rose 1,02% to 7,421.20.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Overview of Key Economic Indicators in the US Last Week

The preliminary data for the University of Michigan Consumer Confidence Index for January surpassed expectations, rising from 69.7 to 78.8, the highest level since July 2021. The recovery in consumer confidence was driven by increased expectations of slowing inflation and strengthened income expectations. Notably, the sub-indices for current conditions and expectations both saw positive movements.

- Housing and Labor Market Data

December housing starts in the U.S. experienced a modest 4.3% monthly decline, while building permits increased by 1.9%, beating expectations.

In the labor market, weekly initial jobless claims for the week ending January 13th dropped to 187,000, the lowest since September 2022, indicating continued tightness in the labor market.

- Manufacturing and Retail Sales

In December, U.S. industrial production showed a slight 0.1% monthly increase, with manufacturing up 0.1% and mining up 0.9%.

The capacity utilization rate, despite expectations of a slight decrease in December, was recorded at 78.6%, similar to the previous month.

The Empire State Manufacturing Index for January signaling the direction of manufacturing activity, declined from -14.5 to -43.7 in January, extending the firms’ decline in new orders and shipments. The index had reached record low levels in April 2020 at -78.2 and May 2020 at -48.5.

On the retail front, December retail sales saw a robust 0.6% increase, exceeding expectations, confirming a strong finish to the holiday season. Excluding automobile, gasoline, building materials, and food sales, core retail sales recorded the strongest increase since July, rising by 0.8% in December following a 0.5% increase in November, indicating robust growth in domestic demand.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

U.S. Economic Data Highlights for the Week

- S&P Global Manufacturing and Services PMI

When looking at the U.S. economic calendar this week, all eyes are on the release of the January S&P Global Manufacturing and Services PMI data on Wednesday.

In December, the Manufacturing PMI dropped from 49.4 to 47.9, indicating an increased contraction in the manufacturing sector for the second consecutive month. In contrast, the Services PMI increased from 50.8 to 51.4, signaling a slight acceleration in the growth of the service sector, maintaining its highest levels in the past five months.

- Advance GDP Growth Data

Thursday will bring the annualized quarterly advance GDP growth data for Q4 2023. After a mild slowdown in Q2 and a downward revision in the Q3, the U.S. economy continued to demonstrate robust growth, albeit at a slightly slower pace.

Expectations for Q4 suggest a further slowdown, with the annualized growth rate anticipated to decline from 4.9% to 1.8%.

- Personal Consumption Expenditures (PCE) Price Index

Also on Thursday, the preliminary data for the annualized quarterly PCE Price Index, a key inflation indicator closely monitored by the Federal Reserve, will be released. Q3 data showed a slight downward revision in both the headline PCE Price Index (from 2.8% to 2.6%) and the core PCE Price Index (from 2.3% to 2%).

Q4 is expected to continue this trend, with a slowdown to 2.2% for the headline PCE Price Index and a stable 2% for the core PCE Price Index.

- Durable Goods Orders

Thursday will also feature the advance durable goods orders data for December, providing insights into the health of the manufacturing sector. Following a significant rebound in November with a 5.4% increase, particularly driven by a surge in orders for non-defense aircraft and parts, the expectation for December is a more modest 1.1% increase.

- Weekly Jobless Claims

On the same day, the weekly data on initial jobless claims will be released, offering a snapshot of the labor market. The previous week saw a decline to 187,000 claims, the lowest since September 2022, indicating ongoing tightness in the labor market.

- Housing Market Data

In the housing market, Thursday will unveil data on December new home sales, followed by pending home sales for December on Friday.

- Corporate Earnings Season Continues

The week will also see earnings reports from major companies, including American Express, Johnson & Johnson, Procter & Gamble, Intel Corp, IBM, Netflix, Tesla, AT&T, Blackstone, 3M, General Electric, Verizon, Intuitive Surgical, Visa, and ServiceNow.

- Focus on Canada and Mexico

Beyond the U.S., attention will turn to the Bank of Canada’s interest rate decision, expected to remain unchanged as inflation remains elevated. Additionally, Canada’s housing prices and Mexico’s foreign trade and unemployment figures will be under scrutiny.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

- November Manufacturing Output

In the Eurozone, industrial production for November continued its decline for the third consecutive month, posting a monthly decrease of 0.3%, in line with expectations. On a yearly basis, the contraction rate increased from 6.6% in October to 6.8% in November, marking nine consecutive months of contraction. Looking into the details, durable consumer goods production contracted by 2%, capital goods production by 0.8%, and intermediate goods production by 0.6%. However, nondurable consumer goods production increased by 1.2%, and energy production saw a 0.9% rise.

- December Final Consumer Price Index (CPI)

The headline CPI increased by 0.2% on a monthly basis, following a 0.6% decline in November. On a yearly basis, it rose from 2.4% to 2.9%, marking the first increase in inflation since April. The increase in the headline CPI was predominantly influenced by energy price fluctuations. The core CPI, after a 0.6% monthly decrease in November, was upwardly revised from a 0.4% to a 0.5% increase in December. On a yearly basis, it decreased from 3.6% to 3.4%, reaching its lowest level since March 2022.

- German Economic Indicators and ZEW Indices (January)

In Germany, January ZEW current conditions index slightly declined from -77.1 to -77.3, indicating continued weakness in the current economic situation. However, the ZEW expectations index increased from 12.8 to 15.2, extending its positive trend for the third consecutive month. This surge in expectations was driven by participants anticipating a moderate recovery in economic activity and expectations of a rate cut by the ECB in the first half of the year.

- German Economic Performance in 2023

In 2023, the German economy contracted 0.3%, reversing the 1.8% growth in 2022. This contraction was influenced by persistent high inflation and increasing interest rates, affecting both domestic and international demand.

The industrial sector, particularly energy production, saw a significant 2% decline. Manufacturing output, driven by the automotive industry and vehicle construction, fell by 0.4%. The service sector experienced a slowdown, especially in information & communication, business, and public services.

On the demand side, there were declines in private consumption (-0.8%), investment (-0.3%), and government spending (-1.7%). However, net external demand had a positive impact due to larger reductions in imports compared to exports.

- Inflation Figures for the UK

In the UK, the Consumer Price Index (CPI) for December showed a 0.4% increase on a monthly basis, rebounding from a 0.2% decline in November, surpassing expectations. On a yearly basis, it rose from 3.9% to 4%, marking the first increase in the annual inflation rate in the last ten months.

The core CPI, after a 0.3% monthly decrease in November, increased by 0.6% in December. On a yearly basis, it remained steady at 5.1%, maintaining its lowest level since January 2022.

- Producer Price Index (PPI) for Germany – December

Germany’s Producer Price Index (PPI) for December showed a 1.2% monthly decrease, following a 0.5% decline in November, exceeding expectations (0.4% decrease). On a yearly basis, the rate of decline increased from 7.9% in November to 8.6% in December, marking the sixth consecutive month of decline. The significant drops in the yearly PPI were primarily influenced by the base effect of energy prices compared to the previous year.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

- ECB Interest Rate Decision and President Lagarde’s Speech

On Thursday, the focus in European markets will be on the ECB’s interest rate decision and the speech by ECB President Lagarde.

In December of last year, the ECB kept interest rates steady, pausing rate hikes in the last two meetings while announcing a faster reduction in its balance sheet. The key refinancing rate remained at 4.50%, the marginal lending rate at 4.75%, and the deposit facility rate at 4.00%. It was stated that future decisions of the bank would ensure that policy interest rates are set at sufficiently restrictive levels as long as necessary. A data-dependent approach would continue to be followed to determine the appropriate level and duration of the restrictive stance.

It is expected that the ECB will keep interest rates unchanged in this week’s and March’s meetings.

- HCOB Manufacturing and Services PMI Data – January

On Wednesday, preliminary PMI data for manufacturing and services sectors for January from HCOB will provide insights into the current economic outlook in Europe.

In December, manufacturing PMIs in the region continued their contraction below the 50 growth threshold due to tightening financial conditions and weakened demand following ECB rate hikes.

Manufacturing PMIs increased from 42.6 to 43.3 in Germany and from 44.2 to 44.4 in the Eurozone, indicating a slight slowdown in the contraction pace. However, in France, PMI decreased from 42.9 to 42.1, and in the UK, it decreased from 47.2 to 46.2, signaling a slight acceleration in the contraction pace.

Service PMIs, on the other hand, indicated a slight increase in contraction pace in Germany (from 49.6 to 49.3) and a slight slowdown in the Eurozone (from 48.7 to 48.8), while in France, it increased from 45.4 to 45.7. In the UK, the service sector showed mild acceleration, increasing from 50.9 to 53.4.

- Consumer Confidence and Business Sentiment Data

On Tuesday, preliminary consumer confidence data for January in the Eurozone and GfK consumer confidence data for February in Germany will be released.

In December, Eurozone consumer confidence slightly rebounded from -16.9 to -15, reaching the highest level since February 2022 but maintaining a negative trajectory. It is expected to continue its recovery in January, reaching -14.3.

In Germany, GfK consumer climate indicator for January increased slightly from -27.6 to -25.1, showing a partial recovery from the lowest levels in the last two months but still remaining in the negative territory.

The index is expected to rise further to -24.3 in February.

Additionally, on Thursday, the IFO business climate index for January will be released, reflecting evaluations of firms in manufacturing, construction, wholesale, and retail sectors regarding the current and next 6-month period in the German economy. In December, the index declined from 87.2 to 86.4, the lowest level in the last three months, indicating increased pessimism among firms about the coming months. However, a slight increase to 86.7 is expected in January.

- Norges Bank Meeting – Thursday

On Thursday, the Norges Bank’s meeting will be closely watched. Last month, despite expectations of keeping the policy rate unchanged, the bank raised it by 25 basis points to 4.50% and signaled that it would remain at this level for some time.

It is expected that the bank will keep the policy rate unchanged in this week’s meeting.

Take the guesswork out of investing: Backtest your strategies with ease!

Economic Indicators in Asia for the Week

- China’s Q4 GDP Growth and Annual Economic Performance

The GDP growth data for the fourth quarter of last year in China was monitored. The quarterly growth rate of the Chinese economy slowed from 1.5% to 1% on a quarter-on-quarter basis, falling below expectations (1.1%). On an annual basis, the growth rate increased from 4.9% to 5.2%, but it was below expectations (5.3%).

The government refrained from a major stimulus package to control mounting debts, opting for a limited CNY 1 trillion bond issuance in October for infrastructure spending. The People’s Bank of China injected liquidity to support the economy, but economists see limited room for further monetary easing.

- December Economic Indicators for China

On a yearly basis, industrial production growth increased from 6.6% to 6.8%, exceeding expectations (6.6% growth). However, the growth rate of retail sales slowed from 10.1% to 7.4%, falling below expectations (8% growth). The growth rate of fixed asset investment slightly exceeded expectations, reaching 3% compared to the expected 2.9%.

- People’s Bank of China (PBoC) Policy Moves

On Monday, the People’s Bank of China’s decision to keep benchmark interest rates unchanged contributed to a decline in risk appetite in the country’s stock markets.

Growing concerns about economic activity in China strengthened as the PBoC decided to maintain interest rates. Investors are now focused on the potential decisions the Chinese government may take to stimulate the economy.

- Other Economic Updates in the Region

The annual inflation rate in Hong Kong declined to 2.4% in December 2023 from 2.6% in the previous month, aligning with market forecasts of 2.5%.

Taiwanese export orders experienced a significant 16% year-on-year decline, reaching USD 43.81 billion in December 2023. This figure was much worse than the expected 0.25% fall, reversing the 1% gain observed in the previous month. The decrease was broad-based across all product groups, with notable declines in transport equipment (-30.7%), information & communication products (-25.3%), and other products (-17.3%).

On Tuesday, the Bank of Japan’s meeting will be closely watched. In the previous meeting last month, the BOJ maintained the policy rate at -0.10%, continuing its ultra-loose monetary policy. While the BOJ is expected to keep the policy rate unchanged in the upcoming meeting, any potential new signals regarding the future of negative interest rate policies will be closely monitored.