Global Markets Recap

U.S. Markets:

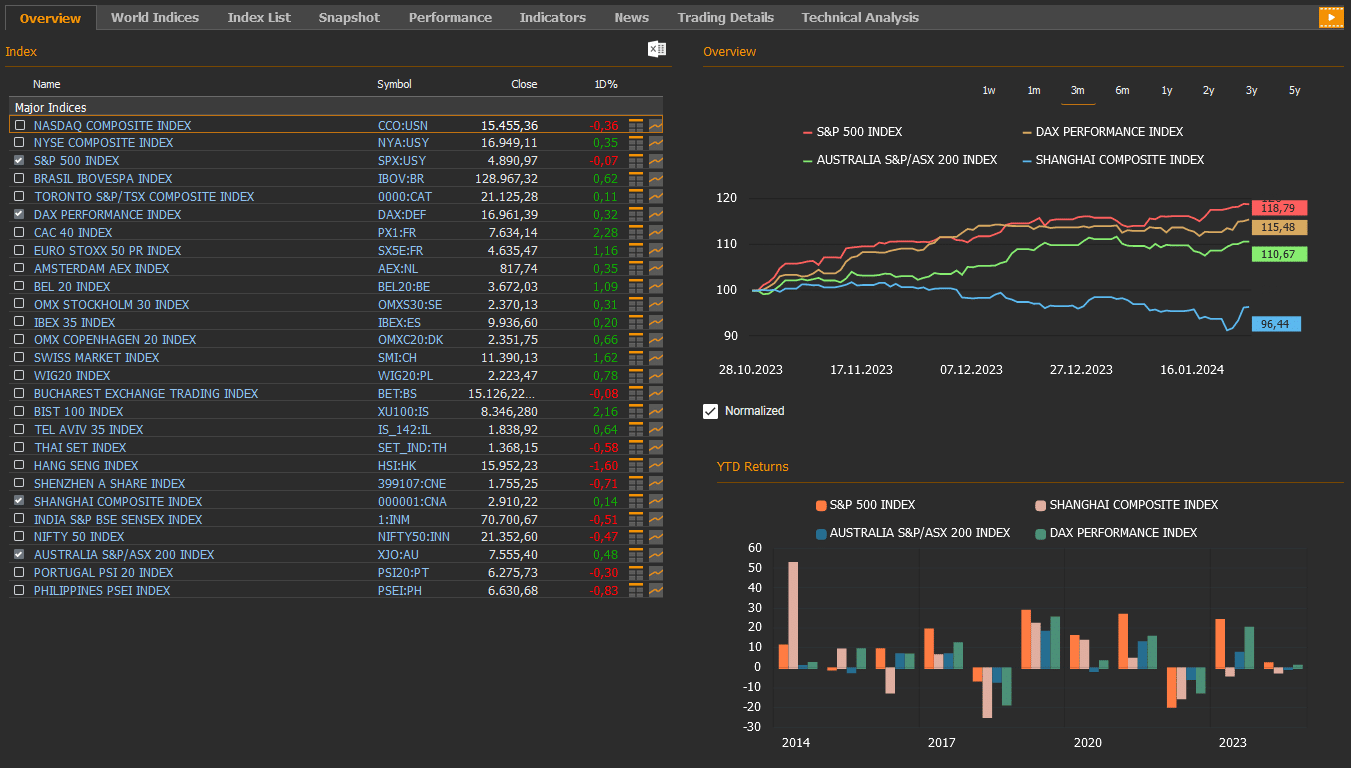

- On Friday, the Wall Street concluded with mixed results, influenced by declines in the technology sectors that weighed on the overall market.Top of Form The S&P 500 index SPY:USY slipped 0.1% to 4,890.97, the Nasdaq index CCO:USN down 0.4% to 15,455.36, the NYSE composite index NYA:USY up 0.4% to 16,949.11, while the Dow Jones Industrial Average index DJI rose 0.2% to 38,109.43.

- The Dollar index DXY, a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 103.4 marking a 0.1% increase.

- The Brent crude oil closed the previous week at USD 82.9 per barrel, reflecting a 1.2% rise.

- The price of gold closed last week with a 1% decline, settling at USD 2,018 per ounce.

- The 10-year U.S. Treasury yield completed the week with a 1 basis points gain, settling at 4.14%. The 2-year U.S. Treasury yield, particularly responsive to Federal Reserve policy rates, finished 4.36% up by 4 basis points.

European Markets:

- European stocks rose Friday, as the Stoxx Europe 600 index SXXP, finished up 1.1% to 483.44. The German DAX index rose 0.3% 16,961.13, the French CAC 40 indexgained 2.3% to 7,634.14.

Asian Markets:

- Stocks in the Asia-Pacific region mostly increased Friday, Jan 26. Hong Kong stocks weakened with the Hang Seng index down 1.6% to 15,952.23, while the Nikkei 225 index declined 1.3% to 35,751.07. China’s Shanghai Composite index added 0.1% to 2,910.22.

- S&P/ASX 200 Benchmark index in Australian stock market rose 0.48% to 7,555.40.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Overview of Key Economic Indicators in the US Last Week

- U.S. GDP Growth Rate

Last week, the preliminary data for the annualized quarterly GDP growth for Q4 2023 year was released. After a slight slowdown from 2.2% in Q1 to 2.1% in Q2, the US economy’s growth rate surged to 4.9% in Q3. Although there was a moderation to 3.3% in Q4, it exceeded expectations of a 2% rise.

A notable influence is observed in the deceleration of consumer spending, declining from 3.1% to 2.8%. Despite this, it is noteworthy that the performance exceeded expectations of a 2.5% rise. The slowdown in private inventory investments, government spending, and residential investments played a role in the overall deceleration witnessed in Q4.

- Durable Goods Orders in December

The advance data on durable goods orders for December was also monitored. Following a 5.5% increase in November, durable goods orders remained unchanged in December, surpassing the anticipated 1.1% increase. Notably, there was a significant increase of 5.2% in communication equipment orders, while defense aircraft and parts orders experienced the steepest decline at 2.9%. Non-defense capital goods orders excluding aircraft showed signs of recovery with a 0.3% increase, indicating a positive trend in investment.

The Personal Consumption Expenditure (PCE) deflator for December showed a 0.2% monthly increase, aligning with expectations. Core PCE inflation edged higher from 0.1% to 0.2% on a monthly basis, while annual core inflation slowed to 2.9%.

Pending home sales, rebounded by 8.3% in December, surpassing expectations. This strong monthly increase marked the most robust growth since June 2020.

On annual basis, pending home sales saw a 1.31 percent growth in December 2023. This marks the initial rise since May 2021.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

U.S. Economic Data Highlights for the Week

Wednesday’s spotlight will be on the Federal Reserve’s interest rate decision, accompanied by Chairman Powell’s address. The Fed, maintaining the interest rate at 5.25-5.50% in the previous month, has not altered its interest rate policy for three consecutive meetings.

On Thursday, attention turns to the release of key manufacturing indicators: The S&P Global Manufacturing PMI and ISM Manufacturing Index for January.

In January, the Manufacturing PMI unexpectedly rose from 47.9 to 50.3, indicating a return to growth territory after two months of contraction below the 50 thresholds since October 2022.

ISM Manufacturing New Orders dropped to 47.1 in December from 46.7 better than forecasts of 47.1.

On Tuesday, the Conference Board will release the consumer confidence index for January, and on Friday, the final index data from the University of Michigan will be out.

In December, the Conference Board’s consumer confidence index exceeded expectations, rising from 101 to 110.7, marking the most significant increase since the beginning of 2021. Short-term inflation expectations of consumers decreased to 2.9%, the lowest since December 2020. The index is expected to continue its upward trend, reaching 115 in January.

Tuesday will witness the release of the S&P/Case-Shiller 20 City Home Price Index for November, and Thursday will bring the construction spending data for December.

In October, the annual growth rate of the S&P/Case-Shiller 20 City Home Price Index rose from 6.2% to 6.3%. It is anticipated that the index’s annual increase rate will remain unchanged in November.

- U.S. Employment Market

The job openings data for December, ADP private sector employment data for January on Wednesday, weekly initial jobless claims on Thursday, and non-farm payrolls, unemployment rate, and average hourly earnings for January on Friday will be closely monitored.

The December JOLTS job openings data continued its downward trend, reaching 8.79 million, the lowest since March 2021. It is expected that the JOLTS job openings data for December will remain at the level of 8.75 million.

In December, ADP private sector employment increased from 101,000 to 164,000 on a monthly basis, exceeding expectations. The data for January is expected to show a slowdown to 135,000.

The most recent weekly initial jobless claims reached 214,000, above expectations but still at historically low levels, indicating a tight labor market.

In December, nonfarm payrolls increased from 173,000 to 216,000, the highest in the last three months, while the unemployment rate remained at 3.7%.

For January, a slight increase in the unemployment rate to 3.8% is expected, along with a slowdown in the monthly increase rate of average hourly earnings from 0.4% to 0.3%, and a year-on-year increase of 4.1%.

- U. S. Factory Orders

On Friday, the factory orders for December will be released. In November, factory orders climbed 2.6% on a monthly basis, recovering from a downwardly revised 3.4% fall in October, and better than market forecasts of a 2.1% increase. It is the biggest gain since January 2021.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

- European Central Bank (ECB) Interest Rate Decision

On the European front, the ECB decided to keep interest rates unchanged, aligning with expectations. The ECB emphasized the importance of maintaining interest rates at current levels for an extended period to contribute significantly to controlling consumer prices. The central bank confirmed that the Pandemic Emergency Purchase Program (PEPP) would continue until the end of 2024.

ECB President Lagarde highlighted the impact of tight financial conditions on reducing demand, and asserted that the current interest rate levels would help achieve their targets.

- IFO Business Climate Index in Germany

Despite expectations of a slight increase, the index declined to 85.2 from 86.3, hitting its lowest level since October 2022. The current conditions index dropped to 87, the lowest since July 2020, indicating heightened pessimism about the upcoming months.

- Germany’s Consumer Confidence

In Germany, the GfK consumer climate indicator for February, recorded its lowest level in the past 11 months, unexpectedly dropping from -25.4 to -29.7 despite expectations of a slight recovery. The purchasing inclination index decreased from -8.8 to -14.8, income expectations dropped from -6.9 to -20, and economic situation expectations declined from -0.4 to -6.6.

The propensity to save jumped from 7.3 to 14, reaching its highest level since August 2008.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

- Eurozone GDP Growth and Consumer Confidence

In the Eurozone, preliminary GDP growth data for Q4 2023 will be released on Tuesday for both Germany and the Euro Area.

The German economy experienced stagnant quarterly growth of 0% in Q1 2023 due to tightening financial conditions alongside high inflation and ECB interest rate hikes. In Q3 2023, the German economy contracted by 0.1%, reversing the 0.1% growth in Q2.

On an annual basis, GDP declined by 0.4%, contrasting with the 0.1% growth in the preceding period.

A contraction of 0.3% is expected in the German economy for Q4, indicating a potential recession.

A similar contraction of 0.1% is anticipated for the Eurozone in Q4. In Q3 2023, the Eurozone economy contracted by 0.1%, reversing a downwardly revised 0.1% growth in the previous quarter. The decline, the first since Q4 2022, was mainly attributed to a negative 0.3 percentage point contribution from inventory changes.

Additionally, the final consumer confidence data for January will be released on Tuesday in the Eurozone, following the preliminary data that showed a slight decline from -15.1 to -16.1, maintaining a weak trend in the negative territory.

- Inflation and PMI Data

Wednesday will bring inflation data from Germany, followed by Eurozone inflation data on Thursday.

In December, Germany’s preliminary headline inflation (HICP) showed a 0.1% increase on a monthly basis after a 0.4% decrease in November. Annually, it rose from 3.2% in November to 3.7% in December, driven by a base effect related to the government covering part of households’ monthly heating expenses (so-called December Emergency Aid).

Core inflation in December decreased from 3.8% to 3.5%.

Preliminary data for January suggests a 0.2% monthly increase in headline inflation and a decline in year-on-year inflation from 3.7% to 3.3%.

In the Eurozone, headline inflation decreased by 0.6% in November and increased by 0.2% in December, reaching 2.9% year-on-year.

Core inflation, after a 0.6% decrease in November, increased by 0.5% in December, with an annual decline from 3.6% to 3.4%. Preliminary data for January suggests a 0.3% monthly decrease in headline inflation and an annual decline from 2.9% to 2.8%.

On Thursday, final HCOB manufacturing PMI data for January will provide insights into the economic outlook in Europe. Preliminary data for January indicated a continued contraction in the manufacturing sector due to tightening financial conditions and weakening demand following ECB interest rate hikes.

German Manufacturing PMI increased from 43.3 to 45.4, the highest in 11 months and above forecasts of 43.7. France Manufacturing PMI rose from 42.1 to 43.2 (highest since September 2023), while 44.4 to 46.6 in the Eurozone (the highest in 10 months and above forecasts of 44.8), and 46.2 to 47.3 in the United Kingdom (the highest in 9 months and above forecasts of 46.7), suggesting a slight easing in the pace of contraction.

- BOE’s Meeting

The Bank of England’s meeting on Thursday will be closely monitored, following its decision to keep the policy interest rate at 5.25% in the previous month.

The Bank of Sweden’s meeting on Thursday is also anticipated, with expectations that it will maintain the policy interest rate at 4%.

Take the guesswork out of investing: Backtest your strategies with ease!

Economic Indicators in Asia for the Week

- China’s PMI and GDP Data

China’s official manufacturing and non-manufacturing PMI data for January will be released on Wednesday, providing signals about the country’s economic trajectory.

Additionally, Caixin’s manufacturing PMI data, reflecting the activities of small and medium-sized enterprises, will be disclosed on Thursday.

In December, China’s official manufacturing PMI declined from 49.4 to 49, indicating an acceleration of contraction in the manufacturing sector. However, Caixin’s manufacturing PMI increased from 50.7 to 50.8, suggesting a mild acceleration of growth.

Other economic indicators to follow will be Japan’s and South Korea’s industrial production indices in December and CPI readings for Hong Kong, Taiwan and Australia.