Global Markets Recap

U.S. Markets:

Friday’s US job market data, stronger than expected, fueled expectations that the Fed might delay interest rate cuts and reduce the anticipated cut amount. Despite this, tech giants like Meta Platforms and Amazon, with solid financials, boosted Wall Street indices by over 1%.Top of Form

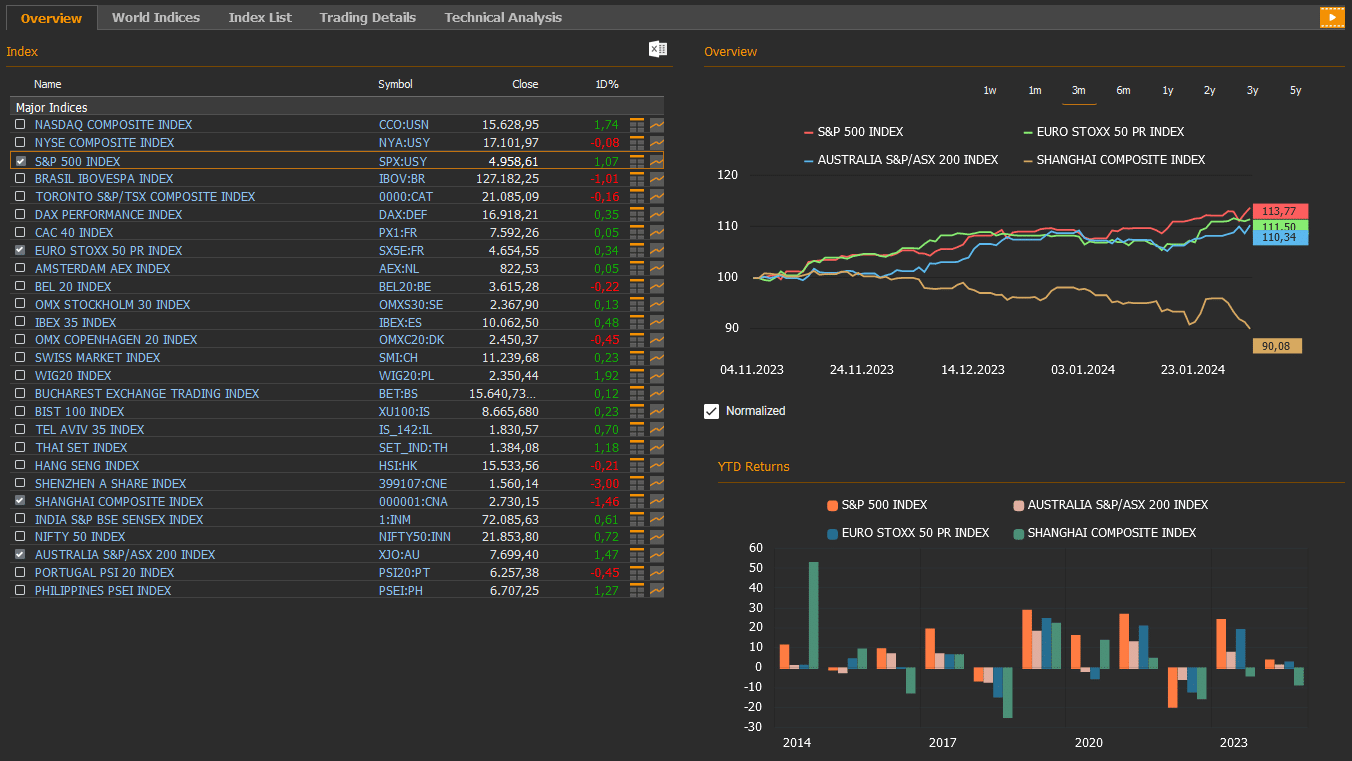

- The S&P 500 index SPY:USY added 1.1% to close at 4,958.61, the Nasdaq composite index CCO:USN rose 1.7% to 15,628.95, the NYSE composite index NYA:USY down 0.1% to 17,101.97, while the Dow Jones Industrial Average index DJI rose 0.4% to 38,654.42.

- The Dollar index DXY, a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 104 marking a 0.5% increase.

- The Brent crude oil closed the previous week at USD 77.3 per barrel, reflecting a 6.8% drop.

- The price of gold closed last week with a 1.1% rise, settling at USD 2,039 per ounce.

- The 10-year U.S. Treasury yield completed the week with a 13 basis points drop, settling at 4.02%. The 2-year U.S. Treasury yield, particularly responsive to Federal Reserve policy rates, finished 4.36% up by 1 basis points.

European Markets:

- European stocks were mildly positive Friday, as the Stoxx Europe 600 index SXXP, finished up 0.01% to 483.93. The German DAX index rose 0.35% 16,918.21, the French CAC 40 indexwas flat at 7,592.26.

Asian Markets:

- Stocks in the Asia-Pacific region mostly increased Friday, Feb 02. Hong Kong stocks weakened with the Hang Seng index down 0.2% to 15,533.56, while the Nikkei 225 index gained 0.4% to 36,158.02. China’s Shanghai Composite index declined 1.5% to 2,730.15.

- S&P/ASX 200 Benchmark index in Australian stock market rose 1.48% to 7,699.40.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Overview of Key Economic Indicators in the US Last Week

- U. S. Labor Market Indicators

Non-farm payrolls for January unexpectedly rose from 333,000 to 353,000, reaching the highest level in the past year. The data for the previous month was upwardly revised from 216,000 to 333,000 against the expectation of a slowdown to 180,000.

The January non-farm payroll increase marked the strongest in the past year, signaling the labor market’s continued tightness. The revision of last year’s data for non-farm payrolls highlighted an average monthly upward revision of 27,000 in the second half of the year.

The unemployment rate remained at 3.7% in January, its lowest since July, contrary to expectations of a slight increase to 3.8%.

In January, the number of unemployed decreased by 144,000 to 6.12 million, while the number of employed decreased by 31,000 to 161.2 million. The labor force participation rate remained at 62.5%.

Average hourly earnings, indicating wage growth concerning inflation, increased from 0.4% to 0.6% monthly in January, exceeding the expected slowdown to 0.3%. The annual growth rate rose from 4.3% to 4.5%, the highest in the last four months.

- ADP Private Sector Employment

The January ADP private sector employment increase dropped from an expected 158,000 on a monthly basis to a lower-than-expected 107,000. This marks the lowest level in the past four months, contrary to the anticipated decrease to 145,000. Additionally, it was noted that the data for the previous month was slightly revised downward from 164,000 to 158,000.

- U. S. Durable Goods Orders and Factory Orders

Durable goods orders remained flat in December after a 5.4% increase in November. Non-defense capital goods orders excluding aircraft saw a downward revision from 0.3% to 0.2% after a 0.9% increase in November, signaling recovery in investments in the last two months.

Factory orders continued their upward trend with a 0.2% increase in December after a 2.6% increase in November.

- University of Michigan’s Consumer Confidence

The final data for the University of Michigan’s Consumer Confidence Index in January was slightly revised upward from 78.8 to 79, maintaining its highest levels since July 2021.

Increased expectations of slowing inflation and strengthened income expectations were decisive in the positive revision.

- Housing Market Data

Construction spending increased by 0.9% in December, surpassing expectations.

In 2023, the construction value reached $1,978.7 billion, marking a 7% increase from the $1,848.7 billion spent in 2022.

The S&P/Case-Shiller 20-City Composite Home Price Index showed a slower monthly increase at 0.2%, exceeding expectations. The index experienced its first decline since January 2023, bringing it back to levels last observed during the summer months.

- Federal Reserve’s Interest Rate Decision

The Federal Reserve kept the federal funds rate in the range of 5.25%-5.50%, aligning with expectations and signaling openness to future rate cuts without immediate action. Fed Chairman Powell expressed belief in starting rate cuts this year if the economy progresses as expected but emphasized the importance of achieving sustainable 2% inflation before initiating cuts, indicating no rate cut expectations in March.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

U.S. Economic Data Highlights for the Week

The final PMI data for the S&P Global services sector and the ISM non-manufacturing index for January will be monitored on Monday.

According to preliminary data, the service PMI data in January rose from 51.4 to 52.9, indicating an acceleration in growth beyond expectations, driven by improved demand conditions, reaching the highest level in the past seven months.

In contrast, the ISM non-manufacturing index for December declined from 52.7 to 50.6, exceeding expectations, signaling a slowdown in growth in non-manufacturing sectors and reaching the lowest level in the past seven months.

On Wednesday, trade balance data for December will be released.

In November, the monthly trade deficit decreased from $64.5 billion to $63.2 billion, reaching the lowest level in the last three months. While monthly imports fell by 1.9% to $316.9 billion, exports also decreased by 1.9% to $253.7 billion, hitting the lowest level since July. It is expected that in December, the monthly trade deficit will continue to narrow, reaching $62.2 billion.

On Thursday, data on weekly initial jobless claims will be released. Despite expectations of a slight decrease, the recently announced weekly initial jobless claims increased from 215,000 to 224,000, reaching the highest level since mid-November. However, these levels remain below historical averages, indicating a continued tight labor market.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

- Eurozone Manufacturing PMI and Inflation Data

Last week, the final January HCOB manufacturing PMI data provided insights into the recent economic outlook across Europe. The manufacturing PMIs for January in the region continued their contraction below the 50 growth threshold, influenced by the tightening financial conditions and weakened demand following the ECB’s interest rate hikes.

The preliminary Consumer Price Index (CPI) data for January in the Eurozone exhibited a monthly decrease of 0.4%, aligning with expectations after a 0.2% increase in December. On an annual basis, it slightly dropped from 2.9% to 2.8%.

Core CPI, excluding volatile items, experienced a monthly decline of 0.9%, resulting in the lowest levels since March 2022.

- Eurozone and Germany Economic Performance

The Eurozone narrowly avoided recession as it experienced slight growth of 0.1% in Q4 2023, following a mild contraction in Q3.

Meanwhile, the German economy contracted by 0.3% in Q4, consistent with expectations after flat growth in the preceding quarter. The revision of Q3 growth from a 0.1% contraction to a flat 0% allowed the German economy to avoid entering a recession.

The final consumer confidence data for January in the Eurozone declined from -15.1 to -16.1, maintaining a negative trajectory despite being the highest level since February 2022.

- Central Bank Decisions – BoE and Riksbank

The Bank of England (BoE) kept its policy rate unchanged at 5.25%, maintaining the highest borrowing cost levels in the last 15 years. Additionally, the BoE hinted at potential interest rate cuts by reducing inflation projections and abandoning verbal guidance on future rate increases.

The Swedish Riksbank retained its policy rate at 4%, emphasizing that previous rate hikes had alleviated concerns about high inflation.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

The final HCOB services PMI data for January in the Eurozone was released on Monday. The services PMI fell to 48.4, indicating the sixth consecutive contraction in services activity in the currency bloc.

Germany’s trade surplus increased to EUR 22.2 billion in December 2023, surpassing market forecasts and reaching the highest level since November 2017.

The Eurozone’s producer prices plummeted by 10.6% on a yearly basis in December 2023, marking the largest decline in three months.

On Tuesday, retail sales data for December in the Eurozone will be monitored. Retail sales in the region showed a weakening trend, with a 0.3% decline in November following a 0.4% increase in October. On a yearly basis, the decline rate increased from 0.8% to 1.1%. It is expected that retail sales will continue their monthly decline by 1% in December, maintaining a yearly decrease rate of 1.1%.

Regarding the trajectory of production in Germany, factory orders for December will be followed on Tuesday, and industrial production data for December will be monitored on Wednesday. Germany’s factory orders are expected to remain flat in December, while industrial production is anticipated to decline by 0.2%, continuing its sixth consecutive monthly decrease.

Germany’s final Consumer Price Index (CPI) data for January will be released on Friday, providing insights into inflation trends .

The preliminary data showed a lower-than-expected monthly increase of 0.1% and a year-on-year decline from 3.7% to 2.9%. Core CPI in Germany also decreased from 3.5% to 3.4%, marking the lowest level since June 2022.

Take the guesswork out of investing: Backtest your strategies with ease!

Economic Indicators in Asia for the Week

- China’s PMI Signals

The official NBS manufacturing PMI in January slightly increased from 49 to 49.2, indicating a mild slowdown in the contraction pace in the manufacturing sector. However, the manufacturing sector in China has been in contraction for the fourth consecutive month due to deflationary risks, weak demand, and challenges in the real estate sector.

January readings are typically influenced by the Lunar New Year celebration, scheduled for February 10 this year.

On the other hand, the official NBS non-manufacturing PMI, reflecting the performance of the service and construction sectors, rose from 50.4 to 50.7 in January. This suggests a slight acceleration in growth in the non-manufacturing sectors, marking the strongest increase since September of the previous year. Nevertheless, the non-manufacturing sector has maintained growth for the thirteenth consecutive month.

- China’s Inflation Data

On Thursday, China’s Consumer Price Index (CPI) and Producer Price Index (PPI) data for January will be released.

In December, monthly CPI in China showed a 0.1% increase after a 0.5% decrease in November, indicating a rebound after two months of decline. On a yearly basis, the decline rate decreased from 0.5% to 0.3%, signaling a reduction in deflationary pressures. However, PPI continued to decline for the fifteenth consecutive month, slowing from 3% to 2.7% in December.

For January, a slight increase in the year-on-year CPI decline rate to 0.5% and a mild deceleration in the PPI decline rate to 2.6% are expected in China.

- Australian Central Bank Meeting

The meeting of the Reserve Bank of Australia (RBA) is scheduled for tomorrow. Following last month’s assessment of the economy, where the RBA decided to keep the policy interest rate at 4.35% in line with market expectations, the central bank is expected to maintain the policy rate at the upcoming meeting.

Additional economic indicators to monitor include the fourth-quarter growth rate in Indonesia, the interest rate decisions in India and Thailand, and the leading economic index for Japan.