Global Markets Recap

U.S. Markets:

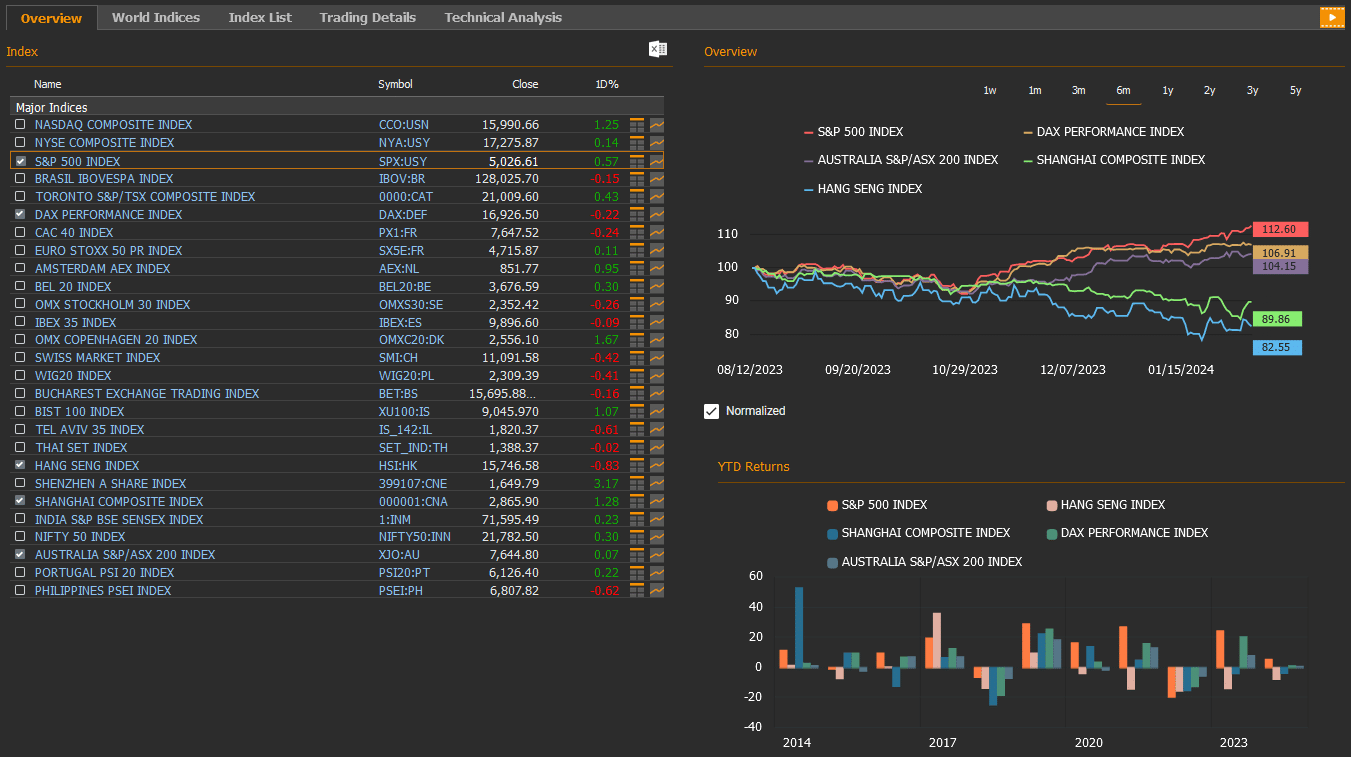

- On Friday, the S&P 500 index SPY:USY added 0.57% to close at 5,026.61, the Nasdaq composite index CCO:USN rose 0.14% to 17,275.87, the NYSE composite index NYA:USY up 1.25% to 15,990.66, while the Dow Jones Industrial Average index DJI dropped 0.14% to 38,671.69.

- The Dollar index DXY, a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 104.2 marking a weekly 0.2% rise.

- The Brent crude oil closed the previous week at USD 82.2 per barrel, reflecting a weekly 6.3% rise.

- The price of gold closed last week with a 0.8% drop, settling at USD 2,024,16 per ounce.

- The 10-year U.S. Treasury yield completed the week with a 16 basis points increase, settling at 4.17%. The 2-year U.S. Treasury yield, particularly responsive to Federal Reserve policy rates, finished 4.49% up by 12 basis points.

European Markets:

- European stocks were flat Friday, as the Stoxx Europe 600 index SXXP, finished down 0.1% to 484.83. The German DAX index fell 0.22% 16,926.50, the French CAC 40 indexdropped 0.24% to 7,647.52.

Asian Markets:

- Stocks in the Asia-Pacific region decreased Friday, Feb 09. Hong Kong stocks weakened with the Hang Seng index down 0.8% to 15,746.58, while the Nikkei 225 index gained 0.1% to 36,897.42. China’s Shanghai Composite index rose 1.3% to 2,865.90.

- In Asia, due to the Lunar New Year, the Chinese stock market remained closed, along with markets in Hong Kong, Singapore, Taiwan, and South Korea.

- The S&P/ASX 200 Benchmark index in Australian stock market rose 0.07% to 7,644.80

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Overview of Key Economic Indicators in the US Last Week

Let’s take a look at the macroeconomic indicators and developments tracked in the US last week:

The January S&P Global Services PMI data, signaling the recent outlook of economic activity, was revised downward from 52.9 to 52.5, indicating a slight slowdown in service sector growth but maintaining its highest level in the past seven months.

The January ISM Non-Manufacturing Index rose from 50.5 to 53.4, exceeding expectations and pointing to an acceleration in growth in non-manufacturing sectors, reaching the highest level in the last four months.

The monthly trade deficit in December increased slightly from $61.9 billion to $62.2 billion, in line with expectations. In December, monthly imports increased by 1.3% to $320.4 billion, while exports also increased by 1.5% to $258.2 billion.

Data from the labor market for the week ending February 3 showed weekly initial jobless claims decreasing from 227,000 to 218,000, surpassing expectations and marking the lowest level in the last three weeks, continuing to remain below historical averages and indicating a tight labor market.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

U.S. Economic Data Highlights for the Week

This week in the United States, all eyes are on the January Consumer Price Index (CPI) data coming out tomorrow and the Producer Price Index (PPI) data scheduled for Friday.

- Key Indicators Impacting Monetary Policy

In December, the headline CPI showed a monthly increase of 0.2%, consistent with the previous month. The year-over-year rate rose from 3.1% to 3.4%, reaching its highest level in the last three months.

The core CPI, which excludes food and energy prices, experienced a monthly increase in line with expectations, at 0.3%, similar to the previous month. This resulted in a reduction in the year-over-year rate from 4% to 3.9%, marking the lowest level in the past two and a half years.

For January, it is anticipated that the headline CPI will demonstrate a 0.2% monthly increase, reducing the year-over-year rate from 3.4% to 3%. The core CPI is expected to exhibit a monthly increase of 0.3%, lowering the year-over-year rate from 3.9% to 3.8%.

The headline PPI showed a 0.1% monthly decline in November, followed by a similar decrease in December, continuing its uninterrupted decline for the third consecutive month. Contrary to expectations of a 0.1% monthly increase, the year-over-year rate increased from 0.8% to 1%, contrasting expectations of a rise to 1.3%.

The core PPI, excluding food and energy products, demonstrated a flat performance on a monthly basis in December, maintaining this trend for the past three months.

- Industrial Production and Capacity Utilization

Thursday will witness the release of January industrial production and capacity utilization data, offering insights into the production trend.

Industrial production, after a stagnant trend on a monthly basis in November, saw a slight increase of 0.1% in December, despite expectations of no growth. Production from the manufacturing sector, constituting 78% of overall output, increased by 0.1%, surpassing market expectations for a stagnant figure.

Capacity utilization experienced a slight decrease from 78.7% to 78.6% in December, maintaining levels close to the two-year lows. It now stands 1.1 percentage points below its long-term average.

For January, industrial production is expected to continue its ascent with a 0.3% monthly increase, while capacity utilization is anticipated to rise slightly from 78.6% to 78.8%.

- New York Fed Empire State Index

On Thursday, the New York Fed Empire State Manufacturing Index for February will provide signals regarding the direction of the manufacturing industry.

In January, despite expectations of a mild recovery, the index fell from -14.5 to -43.7 due to sharp declines in new orders and shipments, reaching the lowest level since May 2020. This trend of contraction is expected to persist, with the index projected to recover to -15 in February.

- Retail Sales and Labor Market Updates

Thursday will also see the release of January retail sales data, offering signals about the trend of domestic demand. Retail sales showed a 0.3% month-over-month increase in November, followed by a higher-than-expected 0.6% increase in December, reaching the highest level in the last three months. However, expectations suggest a slight decline of 0.1% month-over-month in retail sales for January.

Additionally, on Thursday, the weekly initial jobless claims data will be monitored for insights from the labor market. The most recent weekly initial jobless claims, decreasing from 227,000 to 218,000 and surpassing expectations, marked the lowest level in the last three weeks. These levels remain below historical averages, continuing to indicate a tight labor market.

- University of Michigan Consumer Confidence Index

On Friday, in addition to all these events, preliminary data for the University of Michigan Consumer Confidence Index for February will be released.

The University of Michigan’s Consumer Confidence was upwardly revised to 79 in January 2024 from a preliminary figure of 78.9. This marks the highest level since July 2021. The current conditions sub-index saw a downward revision to 81.9 from the initial figure of 83.3.

In terms of inflation expectations, the outlook for the year remained unchanged at 2.9%, representing the lowest level since December 2020. However, the 5-year inflation outlook was revised upward to 2.9% from the initial 2.8%.

The index is anticipated to rise slightly to 80 from 79 in February 2024.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

- Services PMI Trends in the Eurozone

The service PMIs, except for the UK, continued their contractionary trends below the 50 thresholds.

In January 2024, the HCOB Eurozone Services PMI declined to 48.4 from the previous month’s 48.8, in line with the preliminary estimate and below market expectations of 49. This marks the sixth consecutive contraction in the services activity of the Eurozone.

New business experienced a seventh consecutive monthly decline, reflecting weak demand conditions amid elevated borrowing costs, which subdued consumer appetite. Business confidence, however, remained supported by expectations of reduced living costs and lower interest rates in the upcoming year.

- Sentix Investor Confidence in Eurozone

The Sentix investor confidence data for February in the Eurozone improved from -15.8 to -12.9, reaching the highest level since April. Despite the fourth consecutive month of an increasing trend, the negative trend persisted.

- Producer Price Index (PPI) Declines Continue

The Producer Price Index (PPI) in the Eurozone witnessed a decline of 0.8% in December, following a 0.3% decrease in November. This marked the sharpest decline since May 2023, with the annual rate dropping from 8.8% to 10.6%, maintaining the downward trajectory for the eighth consecutive month.

- Germany’s Inflation and Industrial Production Data

In Germany, the headline Consumer Price Index (CPI) for January exhibited a monthly increase of 0.2%, aligning with the preliminary data and showing a year-over-year decline from 3.7% to 2.9%, the lowest since June 2021.

The core CPI, excluding food and energy, decreased from 3.5% to 3.4%, marking the lowest level since June 2022.

German industrial production, after a 0.2% monthly decline in November, further contracted by 1.6% in December, surpassing expectations and extending the monthly decline for the seventh consecutive month. However, the annual contraction rate slowed from 4.3% to 3%.

- Consumer Inflation Expectations

According to the ECB’s Consumer Expectations Survey in Germany, consumers’ inflation expectations for the next 12 months decreased from 3.5% to 3.2%, the lowest since February 2022. However, the outlook for the next three years slightly increased from 2.4% to 2.5%.

- Significant Contraction in Retail Sales

Eurozone retail sales saw a substantial contraction of 1.1% in December, following a 0.3% increase in November. The annual decline rate increased from 0.4% to 0.8%, indicating the fifteenth consecutive month of contraction.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

This week’s data calendar in Europe includes the release of Germany’s ZEW current conditions and expectations indices for February.

In January, despite mild expectations for a recovery, the ZEW Current Conditions Index slightly retreated from -77.1 to -77.3, maintaining its weak trajectory in the negative zone. However, the ZEW Expectations Index surpassed expectations by rising from 12.8 to 15.2, marking its third consecutive month of positive movement and achieving the highest level since February.

Projections for February anticipate a slight decrease in the ZEW Current Conditions Index to -79, accompanied by a minor increase in the Expectations Index to 17.5.

On Wednesday, the revised GDP growth data for Q4 will be released for the Eurozone. Following quarterly growth of 0.1% in Q1 and Q2, the Eurozone experienced a slight contraction of 0.1% in Q3, while Q4 remained stagnant with 0% growth, signaling a rebound from the brink of recession.

On the same day, industrial production data for December 2023 will be released for the Eurozone. In November, industrial production declined by 0.3% on a monthly basis, consistent with expectations. For December, expectations suggest a continued monthly decline of 0.3%.

Thursday will bring the release of inflation data for January in the UK, followed by preliminary GDP growth data for Q4 and industrial and manufacturing production data for December.

In November, headline Consumer Price Index (CPI) showed a 0.2% monthly decrease, followed by a 0.4% increase in December, exceeding expectations. The year-on-year rate rose from 3.9%, to 4%.

Expectations for January anticipate a slight monthly decrease of 0.3%, leading to a year-on-year increase from 4% to 4.2%.

Concurrently, preliminary data for fourth-quarter Gross Domestic Product (GDP) growth in the UK will be revealed on Thursday. The UK economy is expected to contract by 0.1% on a quarterly basis in Q4.

Take the guesswork out of investing: Backtest your strategies with ease!

Economic Indicators in Asia for the Week

On the Asian front, on Thursday, preliminary GDP growth data for Q4 in Japan will be monitored. On an annualized basis, following a 3.6% growth in Q2, there was a contraction of 2.9% in Q3. For Q4, it is expected that the Japanese economy will grow by 0.3% on a quarterly basis and contract by 1.4% on an annualized basis.

On the other hand, on Friday, the meeting of the Central Bank of Russia will be closely watched. In December, the Bank of Russia implemented a widely anticipated move by increasing its key interest rate by 100 basis points to 16%. The persistently rising inflation expectations among consumers and businesses posed a threat of unsustainable price growth, justifying the necessity for an uptick in the key policy rate.

No change is expected in the policy rate.

Other economic signals from Asia to follow include China’s 1Y MLF announcement, trade balance, and producer inflation data in India.