Global Markets Recap

U.S. Markets:

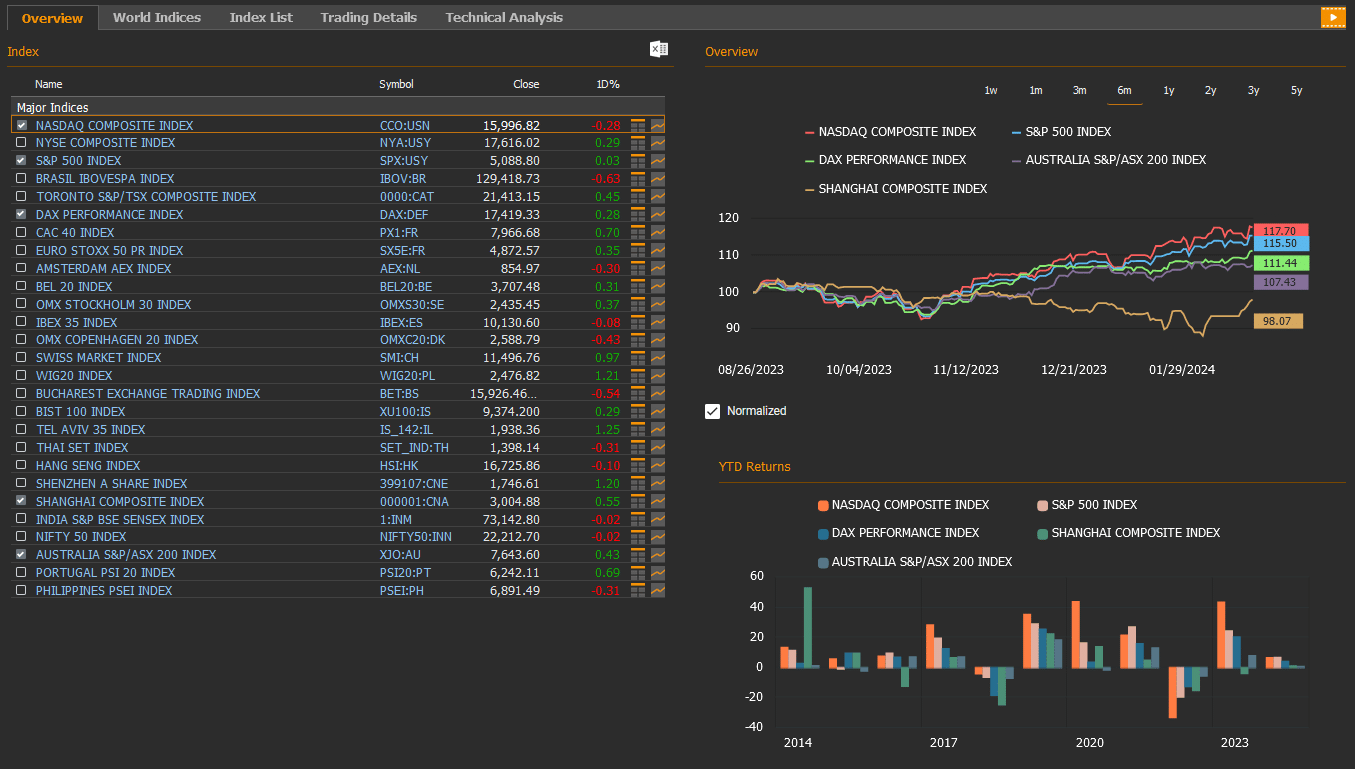

- On Friday, Wall Street indices showed a mixed performance as cautious statements regarding possible interest rate cuts continued from Fed members. The S&P 500 index SPX:USY gained 0.03% to close at 5,008.80, the Nasdaq composite index CCO:USN dropped 0.28% to 15,996.82, the NYSE composite index NYA:USY gained 0.29% to 17,616.02, and the Dow Jones Industrial Average index DJIA rose 0.16% to 39,131.53.

- The Dollar index DXY, a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 103.9 marking a 0.2% weekly drop.

- The Brent crude oil LCO07:USC closed the previous week at USD 81.62 per barrel, reflecting a weekly 2.2% loss.

- The price of gold XAU/USD:USC closed last week with an 1.1% increase, settling at USD 2,035,71 per ounce.

- The 10-year U.S. Treasury yield completed the week with a 4.89 basis points decrease, settling at 4.25%. The 2-year U.S. Treasury yield, particularly responsive to Federal Reserve policy rates, finished 4.69% up by 3.1 basis points.

European Markets:

- European stocks finished up Friday, as the Stoxx Europe 600 index SXXP gained 0.43% to 497.25. The German DAX index increased 0.28% to 17,419.33, the French CAC 40 indexadded 0.70% to 7,966.68.

Asian Markets:

- Stocks in the Asia-Pacific region grew Friday, Feb 23. Hong Kong stocks weakened with the Hang Seng index down 0.1% to 16,725.86, while Tokyo Stock Exchange was closed. China’s Shanghai Composite index rose 0.6% to 3,004.88.

- The S&P/ASX 200 Benchmark index in the Australian stock market rose 0.43% to 7,643.60.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Overview of Key Economic Indicators in the US Last Week

Let’s take a look at the macroeconomic indicators and developments tracked in the US last week:

- Manufacturing and Services PMIs

Flash Manufacturing Purchasing Managers’ Index (PMI) for February rose from 50.7 to 51.5, indicating a slight acceleration in sector growth—maintaining its highest level since September 2022. Despite expectations of stability at 50.7, the sector saw increased production, robust new orders, and the fastest growth since April. Notably, supply chain improvements were observed, leading to the strongest employment increase since September 2023.

Flash Services PMI for February declined from 52.5 to 51.3, signaling a slight slowdown in sector growth. Despite the lowest growth rate in three months, the sector continued its expansion for the 13th consecutive month. While employment continued to increase, a cautious approach due to slowing sales growth resulted in a hiring slowdown. Input prices increased at a slower pace for firms, while product selling prices continued to rise.

- Federal Reserve’s January FOMC Minutes

Released minutes from the January Federal Reserve’s FOMC meeting indicate a cautious stance on interest rate cuts and concerns about inflation risks. Members express a preference for more evidence before considering a rate cut, highlighting the risk of a halt in progress if total demand strengthens or supply-side improvements slow down unexpectedly.

- U.S. Mortgage Applications and Interest Rates

Data from the Mortgage Bankers Association reveals a significant 10.6% decline in mortgage applications for the week ending February 16, the sharpest drop in the past 10 months. The 30-year fixed mortgage interest rate increased by 19 basis points, reaching 7.06%, the highest level since December. This rise is attributed to the robust U.S. labor market and diminished expectations of a near-term interest rate cut by the Federal Reserve, following higher-than-expected CPI and PPI data in January.

- Weekly Unemployment Claims

For the week ending February 17, weekly initial jobless claims unexpectedly declined from 213,000 to 201,000, reaching the lowest level in the past five weeks. Despite mild expectations for an increase, the figures remained consistently below historical averages, indicating a tight labor market.

- U.S. Existing Home Sales in January

Existing-home sales for January recorded a monthly increase of 3.1%, reaching the highest level in the past five months, supported by a decline in mortgage interest rates. However, the sales trajectory remained below pre-pandemic levels.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

U.S. Economic Data Highlights for the Week

In the upcoming week, the markets will be tracking the following economic indicators:

- PCE Price Index and Employment Data

On Wednesday, the U.S. Federal Reserve’s crucial inflation gauge, the Personal Consumption Expenditures (PCE) Price Index, will released for Q4. The annualized quarterly PCE Price Index retreated from 2.6% to 1.7% in Q4, indicating a moderation in price pressures. The core PCE Price Index remained at 2%.

On Thursday, the PCE deflator for January will be released, offering insights into monthly and annual inflation dynamics. Expectations include a monthly increase from 0.2% to 0.3% and a slight decline in the annual rate from 2.6% to 2.4%.

Personal income is expected to rise from 0.3% to 0.4% monthly, while personal spending is anticipated to slow from 0.7% to 0.2%. Moreover, Thursday’s focus will be on weekly initial jobless claims, a key employment market indicator.

- U.S. GDP Growth and Personal Consumption

The second estimate of the Gross Domestic Product (GDP) growth rate for Q4 2023 is set to be released on Wednesday. Following a slight dip from 2.2% in Q1 to 2.1% in Q2, the U.S. economy experienced a surge to 4.9% in Q3. Although growth moderated to 3.3% in Q4, it surpassed expectations of a 2% increase.

For the entire year 2023, U.S. GDP expanded by 2.5%, outpacing the 1.9% growth recorded in 2022 and exceeding the Fed’s forecast of 2.6%.

The Q4 GDP data showed a significant deceleration in the growth rate of consumer spending (2.8% vs. 3.1%), impacting the overall slowdown despite beating expectations (2.5%). Moreover, the slowdown in private inventories, government spending, and residential investments contributed to the overall deceleration in Q4.

- Durable Goods Orders and Consumer Confidence

On Tuesday, durable goods orders data for January will be monitored. Following a 5.4% increase in November, there was no change in new orders for manufactured durable goods in the United States in December 2023,. This figure fell short of market expectations, which anticipated a 1.1% rise. Excluding transportation, there was a 0.6% increase in new orders, and excluding defense, new orders experienced a 0.5% increase. Excluding defense aircraft, a key indicator of business investment, orders rose 0.9% in November and 0.2% in December, signaling a recovery in investments in the last two months.

Additionally, consumer confidence indices for February will be released, with the Conference Board Consumer Confidence Index on Tuesday and the final version of the Michigan University Consumer Confidence Index on Friday.

- Conference Board Index and University of Michigan Consumer Sentiment

In January, the Conference Board Consumer Confidence Index surpassed expectations, reaching the highest level since December 2021 at 114.8, indicating consumers’ positive views on inflation trends, expectations of lower interest rates, and increasing optimism about the labor market. The Current Conditions Index, reflecting consumers’ evaluations of existing job and labor market conditions, increased by 14.1 points to reach 161.3. The Expectations Index, reflecting short-term assessments for the future, rose by 1.9 points to 83.8.

- University of Michigan Consumer Sentiment

The preliminary data for the University of Michigan Consumer Sentiment in February showed a slight increase from 79 to 79.6, slightly below expectations of 80. Despite this, it maintained its highest level since July 2021. The rise in consumer confidence was influenced by growing expectations among consumers that inflation would decelerate, and labor market strengthening would persist. The Current Conditions sub-index in February slightly decreased from 81.9 to 81.5, while the Expectations sub-index increased from 77.1 to 78.4.

Short-term inflation expectations for consumers increased slightly from 2.9% to 3%, while long-term inflation expectations remained unchanged at 2.9%. These indicators suggest consumers anticipate a mild uptick in inflation over the next 12 months.

- Manufacturing Sector PMI and ISM Indices

On Friday, the final data for the manufacturing sector from Global and the ISM Manufacturing Purchasing Managers’ Index (PMI) will be released.

According to flash data in February, the manufacturing sector PMI increased from 50.7 to 51.5, indicating a slight acceleration in growth, beating forecasts of 50.5. January’s ISM Manufacturing PMI improved from 47.1 to 49.1, signifying a slowdown in the contraction pace and achieving its highest level since October 2022.

- Housing Market Indicators

Various housing market indicators will also be in focus this week. On Monday, new home sales data for January will be released, followed by December’s S&P/Case-Shiller Home Price Index on Tuesday. Thursday will see pending home sales for January, providing insight into the number of home sales contracts signed but not yet closed. Finally, on Friday, construction spending data for January will be released.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

- Euro Area Inflation Data

In January, consumer prices in the Euro Area decreased by 0.4% month-over-month, influenced by declines in services (-0.1%) and non-energy industrial goods (-2.4%).

Prices for food, alcohol & tobacco increased by 0.9%, and energy prices rose by 1.2%. The Euro Area’s inflation rate remained at 2.8%, slightly below December’s 2.9% but exceeding the ECB’s 2% target.

The core inflation rate, excluding volatile food and energy prices, continued its sixth consecutive monthly decline to 3.3%, the lowest since March 2022. On a monthly basis, the core Consumer Price Index (CPI) fell by 0.9%.

- Euro Area Manufacturing and Services PMI Data

Flash Manufacturing PMIs in the region remained below the growth threshold of 50, signaling contraction due to tightening financial conditions and weakening demand. In February, manufacturing PMIs decreased from 45.5 to 42.3 in Germany and from 46.6 to 46.1 in the Euro Area, indicating a slight acceleration in the contraction of the manufacturing sector.

Conversely, in France, the PMI increased from 43.1 to 46.8, and in the United Kingdom, it rose from 47 to 47.1, suggesting a slight deceleration in the contraction pace of the manufacturing sector.

Overall, the Eurozone’s manufacturing output continued to decline for the eleventh consecutive month in February, driven by significant drops in new orders and export orders.

In February, flash services sector PMIs for the Euro Area, excluding the United Kingdom, pointed to contraction with readings below the 50 threshold. Germany saw an increase from 47.7 to 48.2, and France rose from 45.4 to 48, indicating a slight slowdown in contraction.

In the Euro Area, the service PMI increased from 48.4 to 50, signaling a shift from contraction to stagnation. The United Kingdom’s service PMI remained stable at 54.3, indicating continued growth.

Overall, the Eurozone’s service PMI suggested a transition from a six-month contraction to stabilization in February, driven by a slowdown in new business growth in the service sector.

- Germany’s Fourth Quarter GDP Growth

In Q4 2023, Germany’s economy contracted by 0.3%, breaking a streak of two consecutive stagnant periods. The decline was attributed to challenges such as rising prices, increased borrowing costs, and subdued external demand, particularly impacting the manufacturing and construction sectors.

Gross fixed capital formation saw a significant decrease of 1.9%, driven by reductions in investments in construction (-1.7%) and machinery and equipment (-3.5%). Inventory changes subtracted 0.1 percentage points from growth. However, private consumption rose by 0.2%, and public spending increased by 0.3%. The contribution from net trade remained neutral as both exports and imports declined by 1.6% and 1.7%, respectively. On a year-on-year basis, the economy contracted by 0.2% in Q4, marking its entry into a technical recession for the first time since 2020-2021.

- IFO Business Climate Index

In February, the IFO Business Climate indicator for Germany showed a marginal increase to 85.5, staying relatively stable compared to the previous three-and-a-half-year low of 85.2 in January. This result was in line with market expectations.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

- European Consumer Climate and Inflation Indicators

On Tuesday, Germany’s GfK Consumer Climate Indicator for March will be tracked.

Unexpectedly, the GfK Consumer Climate Indicator declined to -29.7 in February, down from a revised -25.4 in January. This figure, significantly below market expectations of -24.5, represents the lowest in 11 months. The drop is attributed to declines in income expectations (-20.0 vs -6.9 in January), the propensity to buy (-14.8 vs -8.8), and economic prospects (-6.6 vs -0.4).

The final Euro Area Consumer Confidence Index for February will be released on Wednesday, following preliminary data showing a slight improvement from -16.1 to -15.5.

Preliminary Consumer Price Index (CPI) data for February in Germany and the Eurozone will be released on Thursday and Friday, respectively. In January, German headline CPI showed a monthly increase of 0.2%, with an annual decrease from 3.7% to 2.9%.

Preliminary data for February is expected to show a monthly increase in the headline CPI from 0.2% to 0.5%, with a slight decrease in the annual rate from 2.9% to 2.6%.

On Friday, final PMI data for manufacturing sector in Euro Area, providing insights into the current economic outlook, will be monitored for the month of February.

Take the guesswork out of investing: Backtest your strategies with ease!

Economic Indicators in Asia for the Week

- People’s Bank of China (PBoC) Decisions

The PBoC has maintained the 1-year Loan Prime Rate (LPR) at 3.45%, contrary to expectations of a 5 basis points reduction for short-term loans. However, the 5-year LPR, indicative of long-term loans such as housing loans, saw a larger-than-expected drop from 4.20% to 3.95%, surpassing predictions of a 10 basis points reduction. Notably, this marks the first cut in the 5-year LPR since June of the previous year and is the most significant reduction since 2019.

- South Korea’s Central Bank Policy

The Bank of Korea maintained its policy interest rate at 3.5% in its ninth consecutive meeting, aligning with expectations. The decision reflects the central bank’s cautious approach to economic policies amidst ongoing global uncertainties.

- Chinese Manufacturing PMIs

On Friday, China will release official Manufacturing PMI, non-Manufacturing PMI and Caixin China General Manufacturing PMI data for February.

In January, China’s official NBS Manufacturing PMI stood at 49.2, in line with market expectations and a slight improvement from December’s 6-month low of 49.0. However, this marked the fourth consecutive month of contraction in factory activity, reflecting Beijing’s challenges in stimulating economic recovery amidst deflationary pressures, weak demand, and ongoing struggles in the property sector.

In January, the Caixin China General Manufacturing PMI unexpectedly held steady at 50.8, matching December’s figure but surpassing market expectations of 50.6. This marked the third consecutive month of growth in factory activity, in contrast to official data indicating prolonged weakness leading up to the Lunar New Year.

- New Zealand Central Bank Meeting

The Reserve Bank of New Zealand (RBNZ) is scheduled to convene on Wednesday for its meeting. In the prior November meeting, the RBNZ opted to leave the policy interest rate untouched at 5.50%. With a focus on the enduring presence of elevated inflation, it is anticipated that the central bank will retain the current policy interest rate in the upcoming meeting.

Other economic indicators to follow in Asia will include Japan’s inflation rate, Hong Kong’s and India’s GDP growth rates and Thailand’s industrial production.