Global Markets Recap

U.S. Markets:

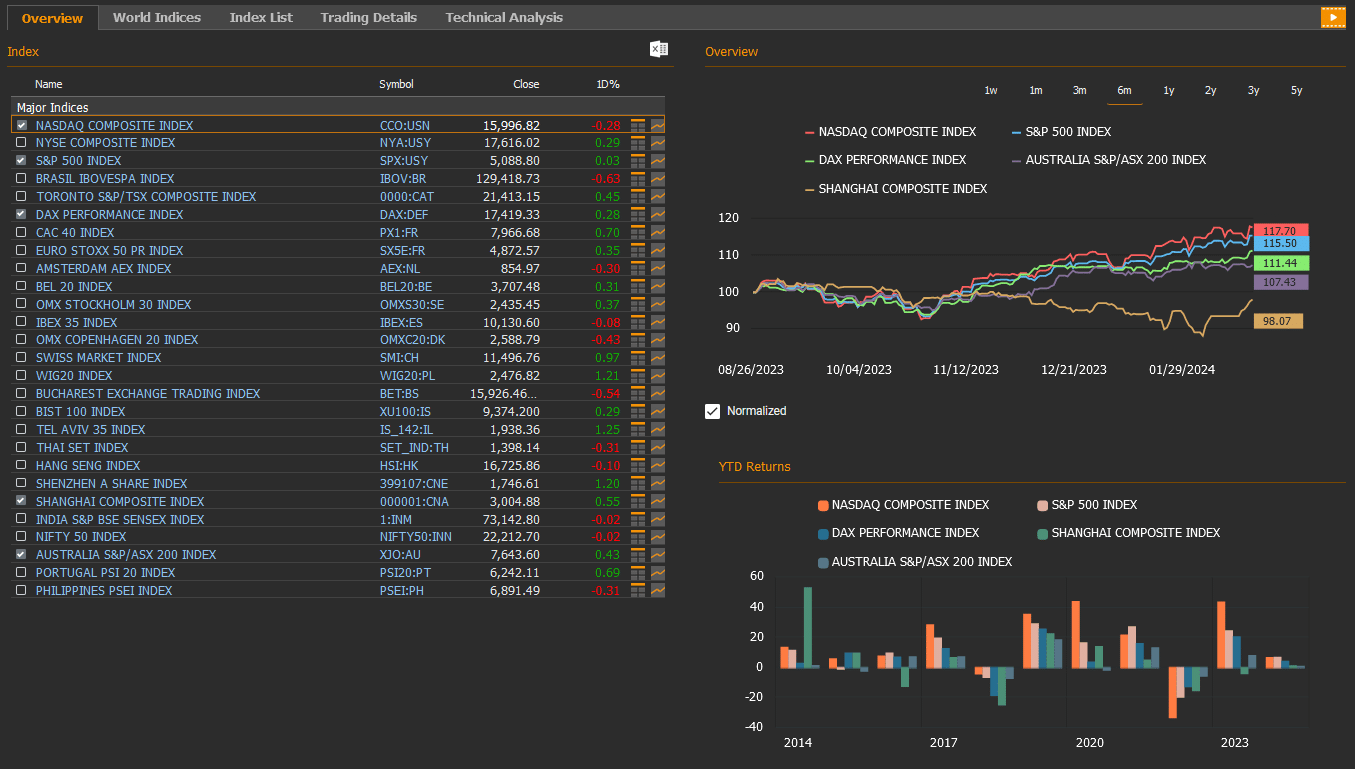

- On Friday, Wall Street indices closed higher, driven by increased expectations of a Fed interest rate cut and declines in U.S. Treasury bond yields. On a daily basis, the Nasdaq composite index (CCO:USN) rose 1.14% to 16,274.94, the NYSE composite index (NYA:USY) gained 0.69% to 17,728.27, the S&P 500 index (SPX:USY) gained 0.80% to close at 5,137.08, and the Dow Jones Industrial Average index (DJI:DJ) rose 0.23% to 39,087.38.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 103.9 marking a 0.2% weekly increase.

- The Brent crude oil (LCO07:USC) closed the previous week at USD 83.55 per barrel, reflecting a weekly 3.4% rise.

- The price of gold (XAU/USD:USC) closed last week with a 2.3% increase, settling at USD 2,083,40 per ounce.

- The 10-year U.S. Treasury yield (USGG10YR:BND) completed the week with a 7 basis points decrease, settling at 4.18%. The 2-year U.S. Treasury yield (USGG2YR:BND), particularly responsive to Federal Reserve policy rates, finished at 4.53% down by 16 basis points.

European Markets:

- European stocks finished up Friday, as the Stoxx Europe 600 index (SXXP:FR) gained 0.60% to 497.58. The German DAX index (DAX:DEF) increased 0.32% to 17,735.07, and the French CAC 40 index(PX1:FR) added 0.09% to 7,937.17.

Asian Markets:

- Stocks in the Asia-Pacific region grew on Friday, March 01. Hong Kong stocks rose with the Hang Seng index (HSI:HK) up 0.5% at 16,589.44, while the Nikkei 225 index (100000018:JPT) gained 1.9% to 39,910.82 and China’s Shanghai Composite index (000001:CNA) rose 0.4% to 3,027.02.

- The S&P/ASX 200 Benchmark index (XJO:AU) in the Australian stock market rose 0.6% to 7,745.60.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Overview of Key Economic Indicators in the US Last Week

Let’s take a look at the macroeconomic indicators and developments tracked in the US last week:

- Manufacturing PMIs and Consumer Sentiment Index

Providing a final glimpse into economic activity, the S&P Global Manufacturing PMI for February was revised upward from 51.5 to 52.2. The data indicates a rapid expansion in the country’s manufacturing sector, marking the swiftest growth since July 2022.

The ISM Manufacturing Purchasing Managers’ Index for February fell from 49.1 to 47.8, indicating a mild acceleration in the contraction pace in the manufacturing sector and extending its contraction streak to sixteen months.

The final Michigan University Consumer Sentiment Index for February was revised downward from 79.6 to 76.9. Details reveal a slight downward revision in both the current conditions sub-index and expectations sub-index.

- PCE and Personal Income/Spending Dynamics

In January, the monthly increase in the PCE deflator rose to 0.3%, aligning with expectations and marking an increase from 0.1%. However, on an annual basis, it slowed from 2.6% to 2.4%, reaching the lowest level since February 2021.

The monthly increase in the Core PCE deflator for January, in line with expectations, reached 0.4%. On an annual basis, it slightly decreased from 2.9% to 2.8%, marking the lowest level since March 2021.

Personal income showed robust monthly growth, rising from 0.3% to 1%, surpassing expectations. Conversely, the monthly growth in personal spending notably slowed from 0.7% to 0.2%, aligning with expectations.

Revised data for the annualized quarterly Personal Consumption Expenditures (PCE) price index, a pivotal inflation indicator monitored by the Fed, saw a slight upward revision from 1.7% to 1.8% for the fourth quarter, it indicated a mild easing of price pressures, reaching the lowest level since the second quarter of 2020.

Similarly, the Core PCE price index for the fourth quarter was revised slightly upward from 2% to 2.1%, remaining at historically low levels since the end of 2020.

- Revised Annualized Quarterly GDP Growth

In Q4 2023, the US economy expanded at an annualized rate of 3.2%, slightly below the initial estimate of 3.3% and down from the 4.9% growth in Q3. The revision was primarily influenced by a decline in private inventories, subtracting 0.27 percentage points from growth compared to the earlier estimate, which added 0.07 percentage points.

On a positive note, consumer spending was revised higher at 3%, led by increased services (2.8%) while goods saw a lesser rise (3.2%). Government spending showed a significant increase (4.2% vs 3.3%), and both exports (6.4% vs 6.3%) and imports (2.7% vs 1.9%) exceeded expectations.

- Housing Market Dynamics

In the U.S., data on the housing market indicates a slowdown in the monthly growth rate of new single-family houses sales for January, dropping from 7.2% to 1.5%.

Pending home sales for January recorded a significant monthly decrease of 4.9%, marking the largest decline since August 2023, indicating a shift in the housing market dynamics.

The Case-Shiller Home Price Index had a monthly growth rate of 0.3%, maintaining its trend at the lowest level in the past nine months.

Construction spending experienced a monthly decline of 0.2% in January following a 1.1% increase in December and falling short of the market consensus of a 0.2% rise. This marks the first contraction since December 2022.

- Durable Goods Orders

January saw a notable decline in new orders for manufactured durable goods, falling by 6.1% after a 0.3% decrease in December. This decline marks the sharpest drop since April 2020. The unexpected fall in January was driven by significant decreases in orders for non-defense aircraft and parts (down by 58.9%), transportation equipment (down by 16.2%), and communication equipment (down by 8.4%).

On the positive side, orders for non-defense capital goods excluding aircraft showed signs of partial recovery. After a 0.6% decrease in December, orders increased by 0.1% in January, providing a signal of a potential rebound in investments.

- Consumer Confidence: February Conference Board Index

In February, the Conference Board Consumer Confidence Index in the U.S. fell from 110.9 to 106.7, ending its three-month upward trend. Despite expectations of a slight increase, increased pessimism about current conditions and future job market conditions contributed to the decline.

- Weekly Initial Jobless Claims

In the labor market, initial jobless claims for the week ending February 24 rose higher than expectations, reaching 215,000 from the previous level of 202,000. Despite being the highest in the last three weeks, these claims remain at historically low levels, indicating continued tightness in the labor market.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

U.S. Economic Data Highlights for the Week

- Federal Reserve Communication and Economic Indicators

This week, all eyes in the U.S. financial markets are on the speeches by Federal Reserve Chairman Powell before the Congress on Wednesday and Thursday. Analysts eagerly await signals on the Fed’s monetary policy, interest rate trajectory, and potential timing of expected rate cuts.

On Tuesday, final PMI data for the S&P Global services sector and the ISM non-manufacturing index for February will be tracked by investors.

Thursday will bring the release of the trade balance data for January. In December, the monthly trade deficit slightly increased from $61.9 billion to $62.2 billion. With expectations aligned with the previous month, January’s trade deficit is projected to rise to $63.4 billion.

- Labor Market Indicators

Several labor market indicators throughout the week will be crucial for understanding the employment landscape. Wednesday will see the release of the JOLTS job openings data for January, with expectations of a slight decrease from the previous month’s 9.03 million to 8.89 million.

The ADP private sector employment report for February, scheduled for Thursday, is expected to show an increase of 150,000 jobs, reflecting a rebound from the previous month’s lower-than-expected figures.

Thursday’s weekly initial jobless claims data will provide further insights into the labor market’s resilience. Despite reaching the highest level in the last three weeks, the figures have consistently stayed below historical averages, indicating ongoing tightness in the job market.

- Employment Report

Friday will bring the highly anticipated nonfarm payrolls report for February, encompassing data on employment, the unemployment rate, and average hourly earnings.

Following a remarkable increase to 353,000 in January, nonfarm payrolls are expected to moderate to 200,000 in February.

The unemployment rate is projected to remain at 3.7%, while average hourly earnings growth is anticipated to slow from 0.6% to 0.3% on a monthly basis and decrease from 4.5% to 4.4% on an annual basis.

- Federal Reserve Beige Book

Adding to the economic insights, Wednesday will witness the release of the Federal Reserve’s Beige Book. Compiled from economic data provided by the 12 regional banks, this report will offer updated assessments and future expectations for the U.S. economy, providing a comprehensive view for market participants.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

- Headline and Core CPI Figures

The preliminary Consumer Price Index (CPI) for February in Germany showed a monthly increase of 0.4%, slightly below expectations of a 0.5% rise following a 0.2% increase in January. However, on a yearly basis, the headline CPI decreased from 2.9% to 2.5%, reaching its lowest level since June 2021, slightly below the anticipated decrease to 2.6%. The core CPI in Germany also recorded a modest decline, reaching 3.4%, the lowest level since June 2022.

- Consumer Climate in Germany

The GfK Consumer Climate Indicator for Germany saw a marginal improvement from -29.6 to -29, marking the lowest level in the past 11 months but matching market expectations. Consumer sentiment, however, continued its weak trend in the negative zone.

- Eurozone Consumer Confidence: February Overview

In the Eurozone, the final Consumer Confidence Index for February mirrored the preliminary data, showing a slight recovery from -16.1 to -15.5. Despite this mild improvement, the weak trajectory in the negative zone persisted, reflecting ongoing challenges in consumer confidence within the Eurozone.

- Manufacturing PMI in the Eurozone

In February, the final Purchasing Managers’ Index (PMI) data for the manufacturing sector across Europe continued to show contraction, staying below the growth threshold of 50. The manufacturing PMI for Germany increased slightly from 42.3 to 42.5, and for the Eurozone from 46.1 to 46.5. These upward revisions indicate a mild deceleration in the contraction pace of the manufacturing sector, attributed to the impact of tightening financial conditions and weakening demand.

- Inflation Trends in the Eurozone

The preliminary Consumer Price Index (CPI) data for February in the Eurozone revealed a monthly increase of 0.6% following a 0.4% decrease in January. The rise in monthly CPI was driven by increases in energy prices (1.5%) and service prices (0.8%). However, the year-on-year CPI for February slightly declined from 2.8% to 2.6%, marking the lowest level in the last three months.

Meanwhile, the core CPI, which excludes volatile components, decreased slightly from 3.3% to 3.1% year-on-year, surpassing expectations but maintaining its lowest level since March 2022.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

- ECB Interest Rate Decision and Lagarde’s Speech

In the European market, all eyes are on Thursday’s European Central Bank (ECB) interest rate decision and the speech by ECB President Lagarde.

- Service Sector PMI Data and Producer Price Indices

On Tuesday, the final Purchasing Managers’ Index (PMI) data for the service sector in the Eurozone will be released. Preliminary data for February suggested a contraction in the service sector below the 50 threshold, excluding the United Kingdom and the Eurozone.

Tuesday will also bring Producer Price Index (PPI) data for January in the Eurozone and Friday for Germany.

- Retail Sales and Trade Data

Wednesday will see the release of Eurozone retail sales data for January. Following a more substantial than expected decline of 1.1% in December, retail sales are anticipated to modestly increase by 0.1% in January.

Additionally, Wednesday will bring Germany’s January trade balance data. German exports saw a significant 4.6% monthly drop in December, signaling weakened external demand. Imports also fell by 6.7%, indicating a cooling domestic demand. A partial recovery is expected in January, with a 1.5% increase in exports and a 2% rise in imports.

- Factory Orders and GDP

Thursday will bring Germany’s January factory orders, providing insights into the trajectory of production.

On Friday, Eurozone’s final Gross Domestic Product (GDP) growth figures for the fourth quarter of the previous year will be released.

Take the guesswork out of investing: Backtest your strategies with ease!

Economic Indicators in Asia for the Week

In February, the official NBS Manufacturing PMI in China slightly declined from 49.2 to 49.1, indicating a mild increase in the contraction pace in the manufacturing sector. This marks the fifth consecutive month of contraction, attributed to deflationary risks, weak demand, challenges in the property sector, and the impact of the Lunar New Year break.

Contrastingly, the official NBS Non-Manufacturing PMI, providing insights into the performance of the service and construction sectors, rose from 50.7 to 51.4 in February. This signals a slight acceleration in growth within the non-manufacturing sectors, maintaining the highest level since September of the previous year. However, the non-manufacturing sector continued its growth streak for the fourteenth consecutive month.

The Caixin General Manufacturing PMI, increased from 50.8 to 50.9 in February above market estimates of 50.6. This indicates a slight acceleration in the growth rate within the manufacturing sector, marking the strongest growth since August 2023.

This week, particular attention will be on the upcoming China National People’s Congress, set to commence tomorrow and extend throughout the week. Discussions will encompass various aspects, including a recap of the country’s performance in the previous year, with a focus on the closely monitored Gross Domestic Product (GDP) growth rate.

The Caixin Services Purchasing Managers’ Indices (PMI) for February will be released. The January Caixin Services PMI indicated a slight slowdown in service sector growth, declining from 52.9 to 52.7, while still maintaining growth for the 13th consecutive month.

On Thursday, attention will shift to China’s trade balance data for February.

Other economic indicators to follow in Asia include Japan’s current account for January, South Korea’s inflation and PMI data, Malaysia’s policy rate announcement, and Australia’s fourth-quarter GDP growth.