Global Markets Recap

U.S. Markets:

- Friday’s report showing higher-than-expected growth in March non-farm payrolls and a decrease in the unemployment rate changed market expectations. As a result, Wall Street indices ended the day with gains.

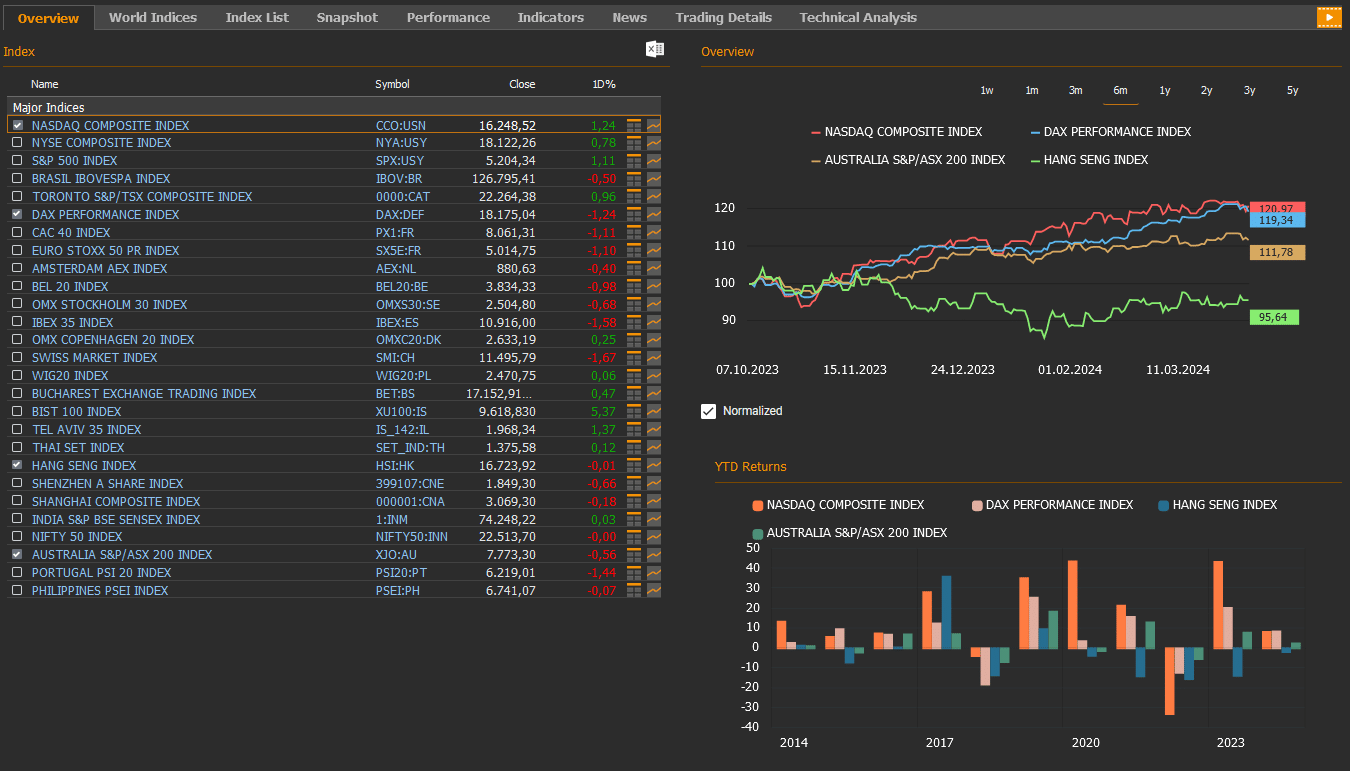

- On Friday, the Nasdaq composite index (CCO:USN) closed the day with a 1.24% gain at 16,248.52, the NYSE composite index (NYA:USY) rose by 0.78% to 18,122.26, the S&P 500 index (SPX:USY) rose by 1.11% to close at 5,204.34, and the Dow Jones Industrial Average index (DJI:DJ) rose by 0.8% to 38,904.04.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 104.3 marking a 0.24% weekly loss.

- The Brent crude oil (LCO07:USC) closed the previous week at USD 91.17 per barrel, reflecting a 4.83% weekly rise.

- The price of gold (XAU/USD:USC) closed last week with a 4.35% rise, settling at USD 2,329.50 per ounce.

- The 10-year U.S. Treasury yield (USGG10YR:BND) completed the week with a 0.20 basis points increase, settling at 4.41%. The 2-year U.S. Treasury yield (USGG2YR:BND), particularly responsive to Federal Reserve policy rates, finished at 4.73% with an 0.11 basis points rise.

European Markets:

- European stocks mostly ended lower on Friday. The Stoxx Europe 600 index (SXXP:FR) declined by 0.84% to 506.55. The German DAX index (DAX:DEF) fell by 1.24% to 18,175.04, and the French CAC 40 index(PX1:FR) dropped 1.11% to 8,061.31.

Asian Markets:

- Stocks in the Asia-Pacific region mostly declined last Friday. The Hang Seng index (HSI:HK) dipped by 0.01% to 16,732.85, while the Nikkei 225 index (100000018:JPT) fell by 1.96% to 38,992.08 and China’s Shanghai Composite index (000001:CNA) decreased by 0.18% to 3,069.30.

- The S&P/ASX 200 Benchmark index (XJO:AU) in the Australian stock market dropped by 0.56% to 7,773.30.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Overview of Key Economic Indicators in the US

Let’s take a look at the macroeconomic indicators and developments tracked in the US last week:

- US Labor Market Data for March

In the US, labor market data for March, including non-farm payrolls, the unemployment rate, and average hourly earnings, were released on Friday.

Non-farm payrolls increased by more than expected, rising from 270,000 to 303,000, marking the highest level in the past ten months. Previous month’s data was revised slightly downward from 275,000 to 270,000, while expectations were for non-farm payroll growth to reach 214,000.

The unemployment rate, slightly decreased from 3.9% to 3.8% in March, in line with expectations. The number of unemployed individuals decreased by 29,000 to 6.4 million, while the number of employed individuals increased by 496,000 to 161.5 million.

The monthly increase of average hourly earnings, an indicator of inflation trends, in March was in line with expectations, rising from 0.2% to 0.3%, while the annual increase slowed from 4.3% to 4.1%.

- PMI Data and Economic Signals

Recent economic activity in the US was reflected in the final PMI data for the S&P Global services sector and the ISM non-manufacturing PMI for March.

March’s services sector PMI, aligning with preliminary data at 51.7, showed the slowest growth rate in three months but maintained growth for 14 consecutive months. However, the ISM non-manufacturing index for March declined from 52.6 to 51.4, contrary to expectations, primarily due to a slowdown in new orders growth, indicating a weakened expansion in non-manufacturing sectors, marking the slowest growth in three months.

- Private Sector Employment and Factory Orders

The private sector employment increase according to the ADP private sector employment data for March rose from 155,000 to 184,000 on a monthly basis, reaching the highest level in the past eight months, exceeding expectations (increase of 150,000), and the previous month’s data was slightly revised upward from 140,000 to 155,000.

In the US, durable goods orders rose by 1.3% in February, rebounding from two months of decline. Factory orders also showed improvement, increasing by 1.4% in February after a 3.8% drop in January, surpassing expectations.

- Foreign Trade Deficit

In February, the monthly foreign trade deficit rose from $67.6 billion to $68.9 billion, exceeding expectations and reaching the highest level in the past ten months. Imports in February increased by 2.2% to $331.9 billion, the highest level since October 2022, while exports also reached a record level of $263 billion, increasing by 2.3%.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

U.S. Economic Data Highlights for the Week

- Focus on Fed’s Meeting Minutes

In the United States, the focus for markets will be on Wednesday’s release of the FOMC’s meeting minutes for March. Fed Chairman Powell, in his recent speech last week, mentioned that members would wait for inflation to fall further before considering a rate cut. Powell stated that they did not anticipate lowering the policy rate until they were confident that inflation would sustainably decline to 2%, considering the strength of the economy and the progress made in inflation so far. Therefore, the minutes to be released this week will be tracked for further clues on the timing of a possible rate cut by the Fed.

- Analysis of CPI and PPI Trends

Wednesday will mark the release of key data guiding the Federal Reserve’s monetary policy, starting with the Consumer Price Index (CPI) data for March, followed by the Producer Price Index (PPI) data for the same month on Thursday. In February, the headline CPI saw a monthly increase from 0.3% to 0.4%, marking its strongest rise in five months, and a slight uptick from 3.1% to 3.2% on an annual basis.

Meanwhile, the core CPI, excluding food and energy, recorded a higher-than-expected monthly increase of 0.4%, reaching its highest level in ten months. However, on an annual basis, it slightly decreased from 3.9% to 3.8%, marking its lowest level in nearly three years.

Projections anticipated a decline to 3.7%.

For March, the headline CPI is forecasted to ease to 0.3% monthly but rise to 3.4% annually, with the core CPI expected to slow to 0.3% monthly and slightly decrease to 3.7% annually.

Regarding the PPI, after a 0.3% rise in January, the headline PPI surged by 0.6% in February, surpassing expectations and recording its strongest increase in six months. On an annual basis, it rose from 1% to 1.6%, hitting its highest level in five months.

Similarly, the core PPI, while decelerating from a monthly increase of 0.5% to 0.3%, surpassed expectations and maintained a 2% annual rate. Forecasts for March suggest the headline PPI to moderate from 0.6% to 0.3% monthly and rise from 1.6% to 2.3% annually, while the core PPI is expected to slow from 0.3% to 0.2% monthly and increase from 2% to 2.3% annually.

- Job Market Data and Consumer Sentiment

On Thursday, the weekly initial jobless claims data will be monitored for labor market trends. The most recent weekly initial jobless claims rose from 212,000 to 221,000 above market expectations of 214,000, reaching the highest level in the past two months but remaining below historical averages, indicating continued tightness in the labor market.

On Friday, the preliminary University of Michigan Consumer Sentiment Index for April will be released. The University of Michigan Consumer Sentiment Index for March was revised upward from 76.5 to 79.4, reaching the highest level since July 2021.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

- Manufacturing and Service Sector PMIs in the Eurozone

In March, the final PMI data for the manufacturing sector in the Eurozone continued to show contraction, with the exception of the UK. While there was a slight easing of contraction in Germany, France, and the Eurozone overall, the UK’s PMI indicated a shift from contraction to expansion for the first time since July 2022.

Apart from France, final Purchasing Managers’ Index (PMI) data for services sector in March signaled growth above the 50 threshold, indicating expansion. The Eurozone’s service PMI increased from 51.1 to 51.5, suggesting a slight acceleration in service sector growth. In Germany, it rose from 49.8 to 50.1, indicating a shift from contraction to growth after six months. However, in France, it increased from 47.8 to 48.3, indicating a slight easing of contraction in the service sector.

- Inflation Trends and Retail Sales

Preliminary Consumer Price Index (CPI) data for March in the Eurozone showed an uptick of 0.8%, up from a 0.6% increase in February. This marked the strongest rise in the past year but fell short of expectations of a 0.9% increase. However, the yearly CPI decreased from 2.6% to 2.4%, hitting its lowest level in the past four months. Core CPI also declined slightly, dropping from 3.1% to 2.9%, its lowest since February 2022.

Retail sales in the Eurozone fell by 0.5% in February following a stagnant performance in January. On a yearly basis, the rate of decline eased from 0.9% to 0.7%, marking the seventeenth consecutive month of contraction.

- German Inflation Data

Preliminary Consumer Price Index (CPI) data for March in Germany showed a 0.4% increase compared to the previous month, in line with expectations of a 0.5% rise. However, on an annual basis, it decreased from 2.5% to 2.2%, the lowest level since May 2021. Core CPI also saw a slight decline, falling from 3.4% to 3.3%, maintaining its trend of reaching its lowest levels since June 2022.

- German Factory Orders

Germany’s factory orders data for February 2024 was released, shedding light on the nation’s production trends. After experiencing a sharp 11.4% decline in January, factory orders in February showed a modest recovery, increasing by 0.2%, albeit falling short of the anticipated 0.7% rise. However, on a yearly basis, the downturn in factory orders intensified from 6.2% to 10.6%. The increase in factory orders suggests optimism that any potential economic downturn in Germany may be moderate and brief.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

- ECB Meeting Expectations

In Europe, Thursday will be dominated by the ECB’s interest rate decision and ECB President Lagarde’s speech. In its March meeting, the ECB kept the main refinancing rate at 4.50%, the marginal lending rate at 4.75%, and the deposit facility rate at 4%.

The European Central Bank (ECB) is expected to keep interest rates unchanged at its meeting this week.

- German Foreign Trade Data and Industrial Production

Today, foreign trade data for February was released in Germany, providing insights into the country’s trade performance. Exports from Germany decreased by 2% month-on-month to EUR 132.9 billion in February 2024, exceeding market expectations of a 0.5% fall. Imports into Germany, however, rose by 3.2% month-on-month to EUR 111.5 billion, defying market forecasts of a 1% drop. As a result, Germany’s foreign trade surplus declined to EUR 21.4 billion, below market forecasts.

German industrial production increased by 2.1% month-over-month in February 2024, surpassing market estimates of 0.3%. This marked the second consecutive month of growth, indicating the fastest expansion since January 2023.

- Final CPI for Germany

The final Consumer Price Index (CPI) data for March in Germany will be released on Friday. Preliminary data indicated a 0.4% increase in headline CPI on a monthly basis in March, falling slightly below expectations. However, on an annual basis, it decreased from 2.5% to 2.2%, reaching its lowest level since May 2021.

Core CPI also saw a slight decline, maintaining its trend of reaching its lowest levels since June 2022.

- UK Monthly GDP Growth Data

On Friday, monthly Gross Domestic Product (GDP) growth data for February will be released in the UK.

January 2024 saw a 0.3% year-on-year decrease in the monthly GDP, consistent with December’s stable reading and in line with market forecasts. This represents the fourth consecutive month without annual growth. However, there was a 0.2% expansion from December to January, meeting market expectations following a 0.1% decline in December. This rebound follows the technical recession experienced in the latter part of 2023.

Other indicators to watch along the week include Germany’s current account, France’s foreign exchange reserves, Italy’s retail sales and industrial production, UK’s goods trade balance, construction output and industrial production.

Take the guesswork out of investing: Backtest your strategies with ease!

Upcoming Economic Highlights Across Asia-Pacific

- China’s Support for SMEs

The People’s Bank of China (PBoC) announced a relending program of 500 billion yuan (69 billion USD) aimed at supporting technological innovation and transformation for small and medium-sized enterprises.

- China’s Inflation Data and Trade Figures

In Asia, China’s Consumer Price Index (CPI) and Producer Price Index (PPI) data for March, which also provide signals regarding global inflation trends, will be released on Thursday.

China’s headline CPI saw a significant increase of 1% in February, marking the strongest rise since January 2021. However, on a yearly basis, it had been experiencing deflationary pressures over the past four months before rising by 0.7% in February due to robust spending during the Chinese New Year holiday.

Core CPI excluding food and energy prices reached its highest level since January 2022 with a yearly increase of 1.2% in February.

Meanwhile, China experienced a 2.7% year-on-year decline in producer prices, diverging from both market expectations and the 2.5% decrease recorded in January.

For March, a slowdown in the yearly increase of headline CPI to 0.4% and a further decline in PPI to -2.8% are expected.

Additionally, foreign trade data for March will be published on Friday. China’s exports in January-February exceeded expectations with a 7.1% increase compared to the same period last year, while imports also rose by 3.5%, indicating a recovery in global and domestic economic activity.

- Japan’s Services Sentiment

In March 2024, Japan’s service sector index dropped to 49.8 from 51.3 in the previous month, marking its lowest level since January 2023. This decline was attributed to a decrease in housing-related items, leading to a downturn in household budget trends.

- Philippines Benchmark Interest Rate

In April 2024, the Philippines’ central bank maintained its benchmark interest rate at 6.50% for the fourth consecutive meeting. This decision aligned with market forecasts and kept the rate at its peak since 2007, amidst a surge in inflationary forces.

- Upcoming New Zealand Central Bank Meeting

On Wednesday, the Reserve Bank of New Zealand’s meeting will be closely monitored. The bank kept its policy rate unchanged at 5.50% in its February meeting for the fifth consecutive time. The bank is expected to maintain its policy rate at this week’s meeting as well.

Other indicators to watch along the week include Japan’s interest rate decision, consumer confidence and inflation rate, China’s GDP growth, industrial production and retail sales and Australia’s inflation rate.