Global Markets Recap

U.S. Markets:

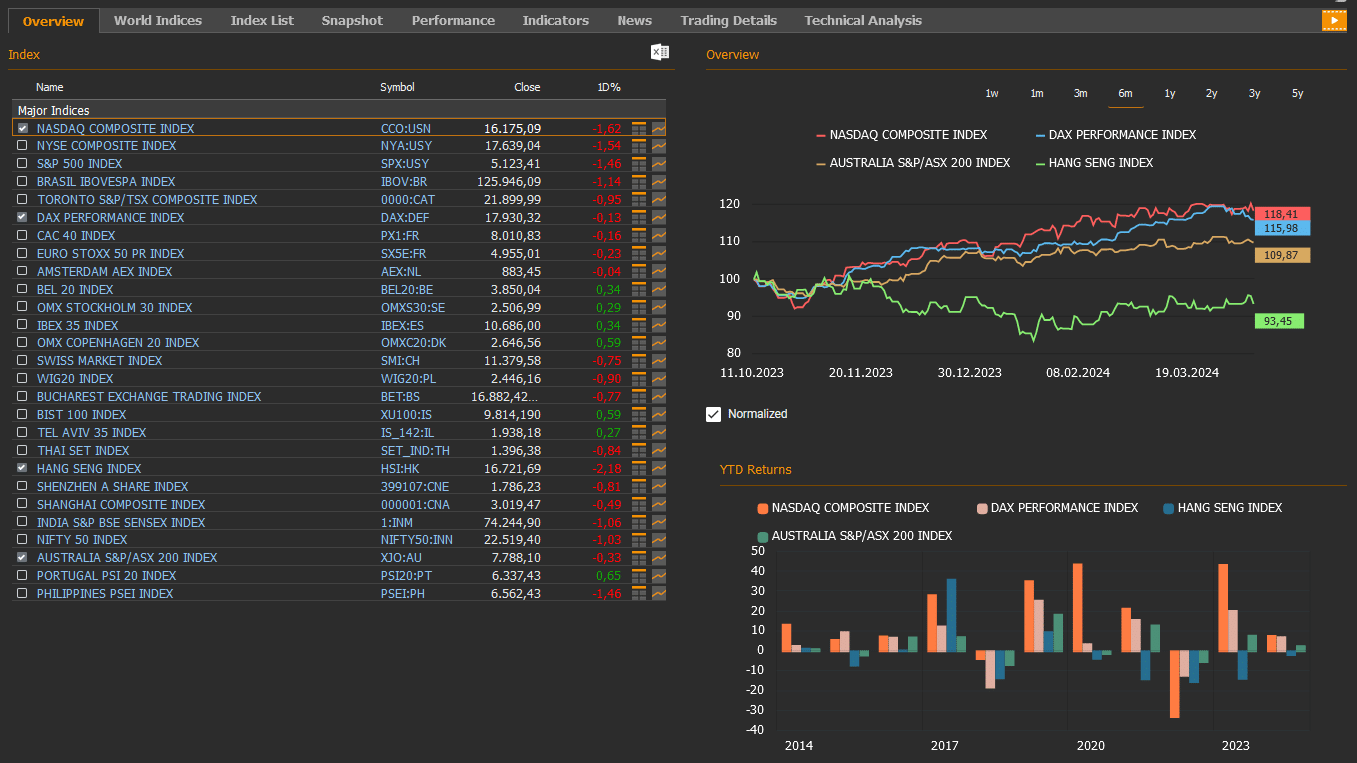

- Following the disappointing performance of major U.S. banks and the release of higher-than-expected Consumer Price Index (CPI) data for March, Friday witnessed a sell-off in U.S. stocks. The Nasdaq composite index (CCO:USN) closed the day with a 1.62% loss at 16,175.09, the NYSE composite index (NYA:USY) declined by 1.54% to 17,639.04, the S&P 500 index (SPX:USY) fell by 1.46% to close at 5,123.41, and the Dow Jones Industrial Average index (DJI:DJ) fell by 1.24% to 37,983.24.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 106.01 marking an 1.8% weekly rise.

- The Brent crude oil (LCO07:USC) closed the previous week at USD 90.45 per barrel, reflecting a 0.8% weekly loss.

- The price of gold (XAU/USD:USC) closed last week with a 0.6% rise, settling at USD 2,343.12 per ounce.

- The 10-year U.S. Treasury yield (USGG10YR:BND) completed the week with a 14 basis points increase, settling at 4.52%. The 2-year U.S. Treasury yield (USGG2YR:BND), particularly responsive to Federal Reserve policy rates, finished at 4.91% with an 18 basis points rise.

European Markets:

- European stocks mostly ended lower on Friday. The Stoxx Europe 600 index (SXXP:FR) rose by 0.14% to 505.25. The German DAX index (DAX:DEF) fell by 0.13% to 17,930.32, and the French CAC 40 index(PX1:FR) dropped 0.16% to 8,010.83.

Asian Markets:

- Stocks in the Asia-Pacific region mostly declined last Friday. The Hang Seng index (HSI:HK) dipped by 0.72% to 16,600.46, while the Nikkei 225 index (100000018:JPT) gained by 0.21% to 39,523.55 and China’s Shanghai Composite index (000001:CNA) decreased by 0.49% to 3,019.47.

- The S&P/ASX 200 Benchmark index (XJO:AU) in the Australian stock market dropped by 0.33% to 7,813.60.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Overview of Key Economic Indicators in the US

Let’s take a look at the macroeconomic indicators and developments tracked in the US last week:

- Fed’s Stance and Projections

Last week, the minutes of the Fed’s March meeting were released. During the meeting, the Fed maintained the federal funds rate range at 5.25%-5.50%, consistent with expectations. This decision marked the fifth consecutive meeting without changes in interest rates and was noted to have been made unanimously.

Fed Chair Powell, in his recent speech, mentioned that there was time to wait and see more inflation declines before considering a rate cut.

The minutes reiterated that the policy rate was likely at the peak of the tightening cycle, and nearly all members indicated that it would be appropriate to move towards a less restrictive stance on monetary policy at some point this year if the economy continued to evolve as expected. However, they also noted that they did not foresee lowering interest rates until there was more confidence in inflation sustainably reaching 2%.

- Inflation Trends

In the US, Consumer Price Index (CPI) and Producer Price Index (PPI) data for March were released. Headline CPI for March exceeded expectations on a monthly basis, rising by 0.4% compared to the previous month and reaching 3.5% on an annual basis, the highest level since September, surpassing expectations of a 3.4% increase. The increase in monthly CPI was mainly influenced by slower energy price growth compared to the previous month, alongside accelerated price increases in clothing and sustained high levels of service prices. Conversely, the slight increase in food prices, acceleration of the decline in new car prices, and decline in used car prices limited the monthly CPI increase.

Core CPI, which excludes food and energy prices, also exceeded expectations, rising by 0.4% on a monthly basis and maintaining its highest level in the last ten months, while rising by 3.8% on an annual basis.

On the other hand, PPI‘s monthly increase slowed to 0.2%, below expectations of 0.3%, due to a decline in energy prices. However, annual producer inflation rose to 2.1%, the highest level since April 2023, surpassing expectations of a rise to 2.2%.

- Labor Market and Consumer Sentiment

Weekly initial jobless claims for the week ending April 6 decreased to 211,000, the lowest level in the past four weeks, exceeding expectations and continuing to indicate a tight labor market.

Additionally, the preliminary University of Michigan Consumer Sentiment Index for April declined to 77.9, below expectations of 79, reflecting a decrease in both current conditions and expectations indices. Short-term inflation expectations increased slightly to 3.1%, reaching the highest level in the past four months, while long-term inflation expectations also rose slightly to 3%, the highest level in the past five months.

- Export and Import Prices

Export prices in the US increased by 0.3% in March 2024, slowing from the previous month’s 0.7% increase, while import prices rose by 0.4% month-over-month, slightly exceeding expectations of 0.3%. On a year-over-year basis, export prices fell by 1.4% in March 2024, while import prices fell by 0.8% in February 2024, marking the thirteenth consecutive month of decline.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

U.S. Economic Data Highlights for the Week

- Focus on Fed Chairman Powell’s Speech

In the United States, markets will be closely watching Fed Chairman Powell’s speech tomorrow. Investors will be looking for further clues on the Fed’s monetary policy and the timing of potential interest rate cuts.

- New York Fed Empire State Manufacturing Index and Retail Sales

Today, the NY Fed Empire State Manufacturing Index for April and retail sales data for March were released.

In April, the NY Empire State Manufacturing Index climbed to -14.3 from the previous month’s -20.9, yet it fell short of the market forecast of -9.0. This reading indicated a fifth consecutive month of decreased business activity in New York State, marked by notable declines in new orders and shipments, alongside a continued reduction in unfilled orders.

In March 2024, retail sales in the US increased by 0.7% compared to the previous month, surpassing the revised 0.9% growth observed in February and exceeding expectations of 0.3%. This indicates continued strength in consumer spending.

- Industrial Production and Capacity Utilization Data

On Tuesday, industrial production and capacity utilization data for March will be monitored to gauge the trajectory of manufacturing. Following a 0.5% decline in January and a marginal 0.1% increase in February, industrial production is expected to continue its upward trend with a 0.4% increase in March. Meanwhile, capacity utilization, which remained steady at 78.3% in February, is anticipated to see a slight uptick to 78.5% in March.

- Housing Starts, Building Permits, and Existing Home Sales

On Tuesday, housing starts for March, building permits indicating future housing demand, and existing home sales data will be released. Additionally, on Thursday, data on existing home sales will be monitored.

The Fed Beige Book will be published on Wednesday, providing updated assessments of the U.S. economy and expectations for the future.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

- ECB’s Interest Rate Decision and President Lagarde’s Speech

Last week in Europe, attention was on the European Central Bank’s (ECB) interest rate decision and President Lagarde’s speech. The ECB, in line with expectations, kept interest rates unchanged for the fifth consecutive meeting, emphasizing that interest rates remain at levels conducive to continued efforts to combat inflation. Accordingly, the ECB maintained the main refinancing rate at 4.50%, the marginal lending rate at 4.75%, and the deposit facility rate at 4%.

- Key Points from the Decision and Future Policy Considerations

The decision highlighted that inflation continues to lose momentum due to declines in food and commodity prices, although there are signs of improvement in key inflation indicators and a slowdown in wage growth. Moreover, financial conditions remain restrictive, past rate hikes continue to weigh on demand, and this has helped to pull inflation downwards. Additionally, the ECB reiterated its commitment to a data-driven and meeting-by-meeting approach to determine the appropriate level and duration of monetary policy constraints, without committing to specific levels in advance.

Lagarde indicated that fluctuations in inflation at current levels are expected in the coming months, with a return to the target anticipated next year, amid downward risks to economic growth. Lagarde reiterated that interest rates continue to play a significant role in the ongoing fight against inflation. She emphasized that decisions would not be made until the June meeting, where confirmation of a permanent return to target inflation would be assessed.

- Inflation Trends in Germany

In Germany, final CPI data for March showed a monthly increase of 0.4%, consistent with preliminary data, while the annual rate declined from 2.5% to 2.2%, marking the lowest level since May 2021. Additionally, core CPI in Germany eased slightly from 3.4% to 3.3% in March, maintaining its lowest levels since June 2022.

- Monthly Growth Data in the UK

In the UK, monthly GDP growth in February slowed to 0.1% from 0.3% in January, with the largest contribution coming from production, which rebounded by 1.1% after a 0.3% decline in January.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

- Euro Area Industrial Production Data

Today, Eurostat released industrial production data for March in the Euro Area. Industrial production rebounded by 0.8% month-over-month in February 2024, showing a partial recovery from the revised 3.0% decline in January and meeting market expectations.

Capital goods production increased by 1.2% (compared to -15.5% in January), while durable consumer goods rose by 1.4% (compared to -1.2%). Intermediate goods output also saw growth, increasing by 0.5% following a 2.3% rise in the previous month. However, there were decreases in output for both energy (-3.0% compared to 0.4%) and non-durable consumer goods (-0.9% compared to -0.2%).

On a yearly basis, industrial production contracted by 6.4% in February, extending the 6.6% decline observed in the previous month.

On Tuesday, the Euro Area’s foreign trade balance data for February will be published.

Wednesday will see the release of the final CPI data for March in the Euro Area, which will influence the ECB’s monetary policy decisions. According to preliminary data, headline inflation in the Euro Area increased by 0.8% in March, showing the strongest year-over-year increase in the last year but falling slightly below expectations of a 0.9% rise. Core CPI also slightly declined year-over-year, from 3.1% to 2.9%, below expectations of 3%, marking its lowest level since February 2022.

Additionally, Germany will release the ZEW expectations indices for April, providing insights into the current state and future outlook of the economy. In March, the ZEW expectations index surpassed expectations, rising from 19.9 to 31.7, marking its fifth consecutive month in positive territory and reaching its highest level since February 2022.

- UK Inflation Data and Price Indices

On Wednesday, the UK will release the CPI data for March, which is expected to guide the Bank of England’s monetary policy decisions.

In February, headline CPI increased by 0.6% month-over-month, slightly below expectations, but showed the strongest increase in nine months. Year-over-year, CPI slowed from 4% to 3.4%, reaching its lowest level since September 2021.

Core CPI also fell below expectations, declining from 5.1% to 4.5% year-over-year, maintaining its lowest levels since January 2022.

- Upcoming Economic Data in Germany and the Euro Area

Thursday will bring the release of the February current account balance for the Euro Area, followed by Germany’s producer price index (PPI) for March on Friday.

In February, Germany’s PPI saw a higher-than-expected decline of 0.4% month-over-month following a 0.2% increase in January, while year-over-year, the decline slowed from 4.4% to 4.1%, marking its eighth consecutive month of decline. March is expected to see a flat month-over-month PPI and a slower year-over-year decline to 3.2%.

Take the guesswork out of investing: Backtest your strategies with ease!

Upcoming Economic Highlights Across Asia-Pacific

- China’s Inflation and Foreign Trade Data

China’s inflation and trade data for March have been released.

In March, China’s headline CPI decreased by 1% month-over-month following a 1% increase in February, reversing the upward trend seen over the past three months. Year-over-year, the inflation rate slowed from 0.7% to 0.1%, below expectations of a 0.4% slowdown.

Core CPI, excluding food and energy prices, also decelerated from its highest level since January 2022, reaching 0.6% year-over-year in March from 1.2% in February.

In terms of producer prices, the monthly decline in the producer price index (PPI) slowed from 0.2% to 0.1% in March, while the year-over-year decline accelerated from 2.7% to 2.8%, marking the sharpest decline since November and continuing the deflationary trend in producer prices for the eighteenth consecutive month.

Regarding foreign trade, China’s exports declined by 7.5% year-over-year in March (expectation: a 3% decrease), while imports also decreased by 1.9% year-over-year (expectation: a 1.2% increase). These figures indicate a weakening in both global and domestic economic activity.

- People’s Bank of China (PBoC) Maintains MLF Rate

The People’s Bank of China (PBoC) has decided to maintain the rate on CNY 100 billion worth of one-year policy loans provided to select financial institutions, known as the medium-term lending facility (MLF), at 2.5% as of April 15th. This move comes amidst efforts to prioritize the stability of the yuan, especially as the local currency faces renewed depreciation pressure.

- Japan’s Core Machinery Orders

In Japan, core machinery orders, excluding those for ships and electric power companies, surged by 7.7% month-on-month to 886.8 billion yen in February 2024. This marks a significant reversal from a 0.7% fall observed in January and significantly surpasses market expectations for a 0.8% gain.

- Q1 GDP Growth in China

On Tuesday, attention will turn to China as GDP growth data for the first quarter of this year is set to be released. Economists anticipate a slight slowdown in China’s annual GDP growth rate from 5.2% to 5% for the first quarter of this year.

Additionally, China will release data on economic activity for the month of March, including industrial production, retail sales, unemployment rate, and fixed asset investment.

In the January-February period, industrial production in China exceeded expectations with a 7% year-on-year increase, while fixed asset investment also outperformed expectations with a 4.2% increase. However, retail sales slightly fell short of expectations with a 5.5% increase.

- Central Bank Policy Updates

The Bank of Korea has kept its policy interest rate unchanged at 3.50% for the tenth consecutive time.

Similarly, the Reserve Bank of New Zealand has maintained its policy interest rate at 5.50% for the sixth consecutive time.

Other indicators to watch along the week include Indonesia’s foreign trade data, Japan’s interest rate decision, and Malaysia’s growth figures.