Global Markets Recap

U.S. Markets:

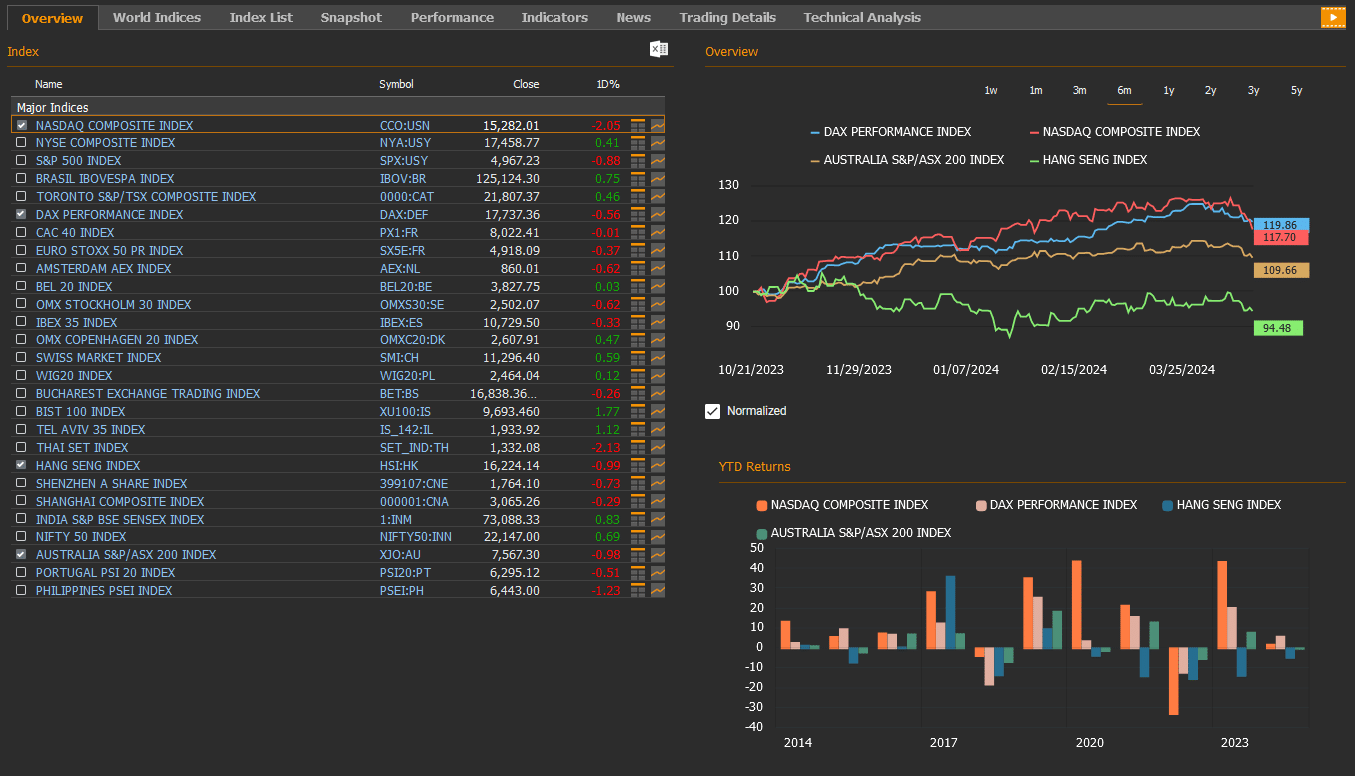

- Following cautious remarks from several Fed members about potential interest rate cuts, Wall Street indices closed the day lower, led by technology companies. The Nasdaq composite index (CCO:USN) closed the day with a 2,05% loss at 15,282.01, the NYSE composite index (NYA:USY) rose by 0.41% to 17,458.77, the S&P 500 index (SPX:USY) fell by 0.88% to close at 4,967.23, and the Dow Jones Industrial Average index (DJI:DJ) rose by 0.56% to 37,986.40.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 106.13 marking an 0.1% weekly rise.

- The Brent crude oil (LCO07:USC) closed the previous week at USD 87.29 per barrel, reflecting a 3.5% weekly loss.

- The price of gold (XAU/USD:USC) closed last week with a 2.1% rise, settling at USD 2,391.84 per ounce.

- The 10-year U.S. Treasury yield (USGG10YR:BND) completed the week with a 10.5 basis points increase, settling at 4.62%. The 2-year U.S. Treasury yield (USGG2YR:BND), particularly responsive to Federal Reserve policy rates, finished at 5.00% with an 8.5 basis points rise.

European Markets:

- European stocks mostly ended lower on Friday. The Stoxx Europe 600 index (SXXP:FR) closed down 0.08% to 499.29. The German DAX index (DAX:DEF) fell by 0.56% to 17,737.36, and the French CAC 40 index(PX1:FR) was flat at 8,022.41.

Asian Markets:

- Stocks in the Asia-Pacific region mostly declined last Friday. The Hang Seng index (HSI:HK) dipped by 0.99% to 16,224.14, while the Nikkei 225 index (100000018:JPT) gained by 2.66% to 37,068.35 and China’s Shanghai Composite index (000001:CNA) decreased by 0.29% to 3,065.26.

- The S&P/ASX 200 Benchmark index (XJO:AU) in the Australian stock market dropped by 0.98% to 7,567.30.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Overview of Key Economic Indicators in the US

Let’s take a look at the macroeconomic indicators and developments tracked in the US last week:

The April edition of the Beige Book report, compiled from economic data from the 12 Federal Reserve districts, indicated a slight increase in overall economic activity since late February and cautiously optimistic economic outlook.

Despite expectations of a slight increase, weekly initial jobless claims remained at a low level of 212,000, similar to the previous week, signaling ongoing strength in the labor market. Continuing jobless claims, regarded as an indicator of the number of individuals receiving unemployment benefits, rose to 1,812 thousand. This marked the highest level since the last week of January, up from 1,810 thousand in the previous week.

March data for industrial production and capacity utilization in the U.S. were released, showing a monthly 0.4% increase in industrial production, in line with expectations, and a slight rise in capacity utilization to 78.4%, slightly below expectations (78.5%).

Retail sales in March showed a 0.7% increase, surpassing expectations (0.3%) and following a 0.9% increase in February, suggesting consumer spending remains robust. Excluding food services, auto dealers, building materials stores, and gasoline stations, core retail sales, increased by 1.1%.

The New York Fed Empire State Manufacturing Index rebounded to -14.3 in April from -20.9, although it fell below expectations (-9), indicating continued weakness in the manufacturing sector for the fifth consecutive month.

In April 2024, the Philadelphia Fed Manufacturing Index surged by 12 points to 15.5, significantly surpassing market expectations of 1.5. This marked the third consecutive positive reading and the highest level since April 2022.

Existing home sales declined by 4.3% in March, surpassing expectations, indicating pressure on demand due to high interest rates and housing prices, and signaling weakness in the housing market.

Housing starts declined by 14.7% in March, surpassing expectations, while building permits also saw a 4.3% decline, exceeding expectations.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

U.S. Economic Data Highlights for the Week

- S&P Global Manufacturing and Services PMI Data

In the United States, the April S&P Global Manufacturing and Services PMI data, which will provide signals about the current state of economic activity, will be closely monitored tomorrow. In March, the manufacturing sector PMI data was revised downward from 52.5 to 51.9, indicating a slight slowdown in growth in the manufacturing sector due to a deceleration in the increase in new orders.

Meanwhile, the services sector PMI data for March, at 51.7, although consistent with preliminary data, signaled the slowest pace of growth in the services sector in the last three months, maintaining growth in the expansion zone for the past 14 months.

It is expected that the preliminary PMI data for both the manufacturing and services sectors for April will increase slightly to the 52 level, indicating a slight acceleration in growth rates in these sectors.

- Durable Goods Orders

Wednesday’s release of the durable goods orders preliminary data for March will provide insights into the trend in production.

Durable goods orders increased by 1.3% in February after a two-month decline (a 0.3% decrease in December and a 6.9% decrease in January), signaling a partial recovery. Details showed that the increase in February was driven by increases in orders for non-defense aircraft and parts (up by 24.6%), defense aircraft and parts (up by 9.8%), computers (up by 5.4%), and transportation equipment (up by 3.3%). Additionally, excluding aircraft, non-defense capital goods orders rebounded by 0.7% in February following a 0.4% decline in January.

March’s preliminary data suggests that durable goods orders will continue their upward trend with a 2.5% increase.

- Quarterly GDP Growth and PCE Price Index Data

Thursday will see the release of the advance estimate of the annualized quarterly GDP growth for the first quarter of the year. After a slight deceleration from 2.2% in the first quarter of last year to 2.1% in the second quarter, the growth rate of the U.S. economy increased to 4.9% in the third quarter. In the fourth quarter, the growth rate was upwardly revised from 3.2% to 3.4%, surpassing expectations (3.2%).

The upward revision in the growth rate of consumption expenditures, which represent a significant portion of the economy, rising from 3% to 3.3%, along with the upward revision in non-residential fixed investment, contributed significantly to the upward revision in fourth-quarter growth.

Looking at the whole year, the U.S. economy recorded a 2.5% growth in 2023, consistent with the revised data.

A slowdown in the annualized quarterly GDP growth rate from 3.4% to 2.5% is expected for the first quarter of this year.

Additionally, the preliminary data for the annualized quarterly Personal Consumption Expenditures (PCE) price indices for the first quarter of the year, closely monitored by the Fed as a significant inflation indicator, will also be released on Thursday.

The annualized quarterly PCE price index slowed from 2.6% to 1.8% in the fourth quarter of last year, reaching its lowest level since the second quarter of 2020, indicating a moderation in price pressures. Although the core PCE price index was slightly downwardly revised from 2.1% to 2% in the fourth quarter, it continued to trend at its lowest levels since the fourth quarter of 2020.

- Additional Economic Indicators to Watch

Thursday will see the release of the weekly initial jobless claims data. Previous week’s initial jobless claims remained at a low level of 212,000, similar to the previous month, and continued to indicate tightness in the labor market.

Friday will bring the release of the March PCE deflator data and personal income and spending data for March. It is expected that the monthly increase rate of the PCE deflator in March will be consistent with the previous month at 0.3%, with the annualized rate expected to rise slightly from 2.5% to 2.6%. The core PCE deflator is also expected to register a monthly increase rate of 0.3%, similar to the previous month, and an annualized rate of 2.7%, down from 2.8%.

Personal income is expected to increase from 0.3% to 0.5% on a monthly basis in March, while personal spending is expected to slow from 0.8% to 0.6%.

Moreover, Friday will also bring the final version of the University of Michigan Consumer Confidence Index for April in the United States. According to preliminary data, the University of Michigan consumer confidence index for April decreased from 79.4 to 77.9, falling below expectations (79).

In addition to the housing market data, March new home sales will be released on Tuesday, while Thursday will see the release of pending home sales for March, which indicates the number of homes under contract but not yet transferred.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

- Producer Price Index (PPI) in Germany

In Germany, the Producer Price Index (PPI) data for March was released last week. Following a 0.4% decrease in February, the PPI in Germany increased by 0.2% in March on a monthly basis. On an annual basis, the rate of decrease in March decreased from 4.1% to 2.9%, marking the ninth consecutive month of decline.

- Final Consumer Price Index (CPI) Data for the Eurozone

The final Consumer Price Index (CPI) data for March was tracked for the Eurozone, which influences the ECB’s monetary policy decisions. In the Eurozone, the headline CPI rose by 0.8% in March, driven by increased costs for services (0.7%) and non-energy industrial goods (1.9%). This follows a 0.6% increase in February, aligning with preliminary data.

On an annual basis, the CPI in March decreased from 2.6% to 2.4%, reaching its lowest level in the past four months and slightly exceeding the European Central Bank’s target of 2%.

Meanwhile, the core CPI in the Eurozone decreased from 3.1% to 2.9% on an annual basis in March, marking its lowest level since February 2022.

- Consumer Price Index (CPI) in the United Kingdom

In the United Kingdom, the Consumer Price Index (CPI) increased by 0.6% in March on a monthly basis, similar to the previous month, exceeding expectations (0.4% increase).

On an annual basis, the CPI decreased slightly from 3.4% to 3.2% in March, maintaining its lowest level since September 2021, although expectations were for a slowdown to 3.1%. The deceleration was mainly due to a slowdown in food inflation, which stood at 4.0% compared to 5.0% in February.

- External Trade Balance in the Eurozone

The external trade surplus in the Eurozone widened from 11.6 billion euros to 23.6 billion euros on a monthly basis in February, reaching its highest level since December 2020. On a monthly basis, exports in the region increased by 4.1%, while imports decreased by 1.3%.

- Industrial Production in the Eurozone

In the Eurozone, industrial production recorded a partial recovery in February, increasing by 0.8% in line with expectations following a 3% decrease in January on a monthly basis. However, on an annual basis, industrial production decreased by 6.4% in February following a 6.6% decrease in January, marking the second consecutive month of decline.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

- Preliminary PMI Data for Manufacturing and Services Sectors in Europe

The HCOB Manufacturing and Services Sector Purchasing Managers’ Index (PMI) data for April, providing insights into the current economic outlook across Europe, will be monitored tomorrow. In March, manufacturing PMIs across the region continued to contract below the 50 growth threshold, except for the UK, due to tightening financial conditions and weak demand. Meanwhile, service PMIs in the region, except for France, remained in the growth zone above the 50 threshold in March.

Today, the preliminary consumer confidence index data for April will be released in the Eurozone. In March, the consumer confidence index for the Eurozone remained weak in the negative zone, albeit slightly recovering from -15.5 to -14.9. It is expected to see a slight further recovery to -14 in April.

Additionally, Germany’s consumer confidence data for May will be released on Thursday. In April, the GfK consumer confidence index slightly recovered from -28.8 to -27.4, maintaining its weak trend in the negative zone.

- IFO Business Climate Index in Germany

The IFO Business Climate Index for April, representing the evaluations of firms operating in manufacturing, construction, wholesale, and retail trade sectors in Germany for the current and future six-month period, will be released on Wednesday. The index is expected to continue its slight recovery to 88.9 in April.

- Government Deficit and Debt to GDP Ratios in the Eurozone

The government budget deficit to GDP ratio in the Eurozone decreased slightly to 3.6% in 2023, down from a revised 3.7% in 2022. Eleven Member States reported deficits exceeding 3% of GDP.

The Eurozone’s government debt to GDP ratio declined to 88.6% by the end of 2023, down from a revised 90.8% at the end of 2022, reaching its lowest level in four years.

Take the guesswork out of investing: Backtest your strategies with ease!

Upcoming Economic Highlights Across Asia-Pacific

- First Quarter GDP Growth in China

Following a quarterly growth of 1.2% in the fourth quarter of last year, the Chinese economy showed a growth of 1.6% in the first quarter of this year, surpassing expectations of 1.5% growth.

The annual growth rate also rose from 5.2% to 5.3% in the first quarter, contrary to expectations of a slowdown to 5%. It marked the sharpest annual expansion since the second quarter of 2023, driven by ongoing support measures from Beijing and spending related to the Lunar New Year festival. Fixed investment grew by 4.5% during the first three months of 2024.

- Industrial Production and Retail Sales in March

March data revealed that industrial output and retail sales increased less than anticipated, highlighting the need for further policy easing. In March, industrial production in China recorded a year-on-year increase of 4.5%, much softer than a 7% growth in January-February combined and below market forecasts of 5.4% growth, while retail sales saw a 3.1% increase, falling below expectations of 4.5% growth and decelerating from a 5.5% increase in February. This marked the 14th consecutive month of growth in retail trade, but it was the smallest gain since July 2023.

- New Home Prices in China

In March 2024, China’s new home prices dropped by 2.2% year-on-year, accelerating from a 1.4% decline in the previous month. This marked the ninth consecutive month of decline and the sharpest pace since August 2015. Despite multiple support measures from the government aimed at mitigating the impact of a prolonged property downturn and a fragile economic recovery, the downward trend persists.

- Inflation Rate in Japan

In March 2024, Japan’s annual inflation rate eased slightly to 2.7%, down from February’s three-month peak of 2.8%, aligning with market consensus. The core inflation rate decreased to 2.6% from a four-month high of 2.8%, slightly below forecasts of 2.7%. On a monthly basis, consumer prices increased by 0.2% in March, marking the largest increase since last October, following two consecutive months of no change.

- Central Bank Meetings

The People’s Bank of China (PBoC) maintained the benchmark one-year loan prime rate (1-year LPR) at 3.45%, which serves as an indicator for short-term loans, while also keeping the benchmark five-year loan prime rate (5-year LPR) steady at 3.95% for long-term loans like mortgage loans.

The upcoming meeting of the Bank of Japan (BOJ) on Friday will be closely watched. No change in the policy rate is expected.

The meeting of the Russian Central Bank will also be monitored. It is expected that the bank will maintain its policy interest rate at 16% during this week’s meeting.

Other indicators to watch along the week include Australia’s inflation rate and Indonesia’s interest rate decision on Wednesday.