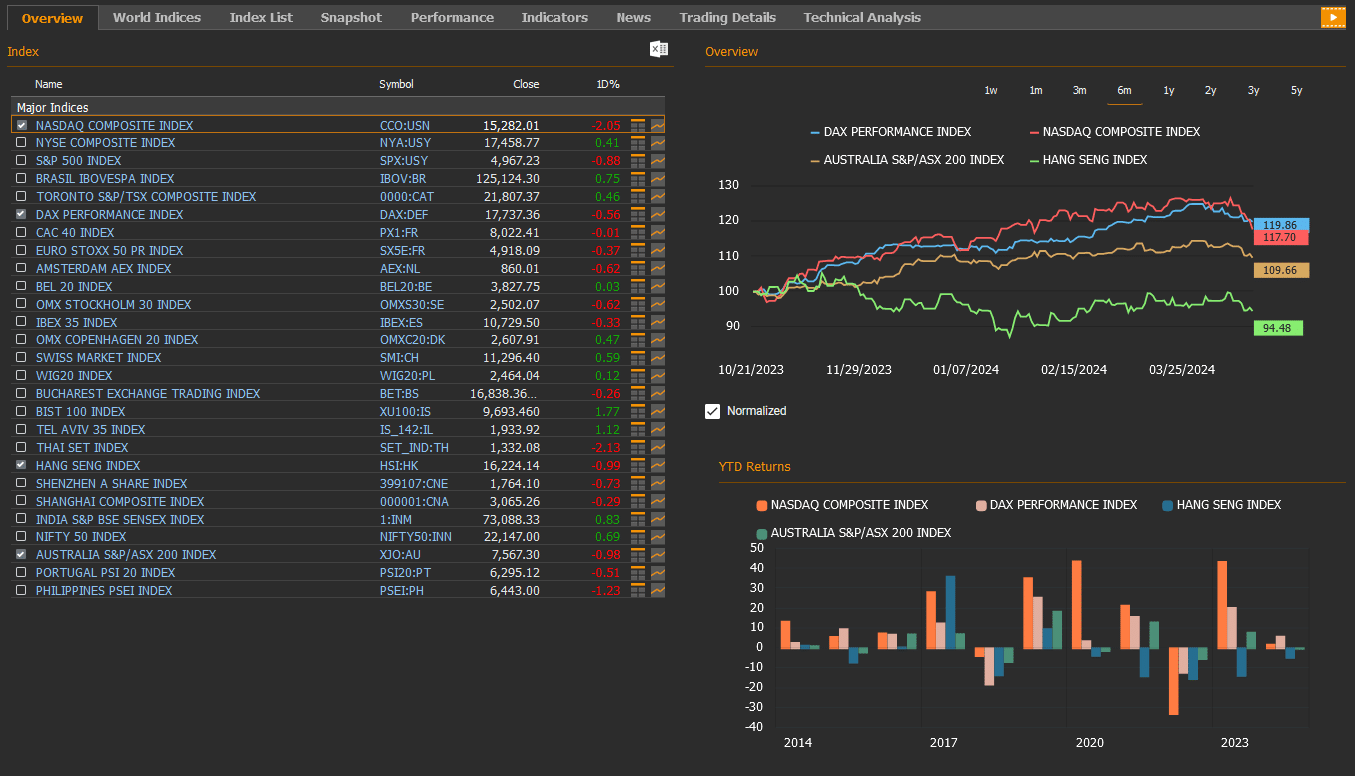

Global Markets Recap

U.S. Markets:

- Last Friday, the consistent performance of the monthly PCE deflator data, which the Fed specifically tracks for price developments, had a positive impact, leading to gains in Wall Street indices. The Nasdaq composite index (CCO:USN) closed the day with a 2.03% gain at 15,927.90, the NYSE composite index (NYA:USY) rose by 0.18% to 17,763.27, the S&P 500 index (SPX:USY) rose by 1.02% to close at 5,099.96, and the Dow Jones Industrial Average index (DJI:DJ) rose by 0.40% to 38,239.66.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 106.09 marking an 0.04% weekly loss.

- The Brent crude oil (LCO07:USC) closed the previous week at USD 89.29 per barrel, reflecting a 2.29% weekly gain.

- The price of gold (XAU/USD:USC) closed last week with a 2.26% loss, settling at USD 2,337.64 per ounce.

- The 10-year U.S. Treasury yield (USGG10YR:BND) completed the week with a 4.4 basis points increase, settling at 4.67%. The 2-year U.S. Treasury yield (USGG2YR:BND), particularly responsive to Federal Reserve policy rates, finished at 5.00% with a 0.5 basis points rise.

European Markets:

- European stocks mostly ended higher on Friday. The Stoxx Europe 600 index (SXXP:FR) closed up 1,11% to 507.98. The German DAX index (DAX:DEF) rose by 1.36% to 18,161.01, and the French CAC 40 index(PX1:FR) rose 0,89% 8,088.24.

Asian Markets:

- Stocks in the Asia-Pacific region mostly rose last Friday. The Hang Seng index (HSI:HK) rose by 2.12% to 17,651.15, while the Nikkei 225 index (100000018:JPT) gained by 0,81% to 37,934.76 and China’s Shanghai Composite index (000001:CNA) decreased by 1.17% to 3,088.64.

- The S&P/ASX 200 Benchmark index (XJO:AU) in the Australian stock market dropped by 1.39% to 7,575.90

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Overview of Key Economic Indicators in the US

Let’s take a look at the macroeconomic indicators and developments tracked in the US last week:

- PCE Deflator and Personal Income/Spending Data for March

In the United States, the March data for the Personal Consumption Expenditures (PCE) deflator, which the Fed closely monitors, along with personal income and spending, were released. The headline PCE deflator showed a monthly increase of 0.3%, similar to the previous month, while on a yearly basis, it rose slightly from 2.5% to 2.7%, reaching its highest level in the last four months.

The core PCE deflator also recorded a monthly increase of 0.3%, similar to the previous month, while on a yearly basis, it remained steady at 2.8%, maintaining its lowest level since March 2021.

In March, the monthly growth rate of personal incomes increased to 0.5%, in line with expectations, while the monthly growth rate of personal spending exceeded expectations (0.8% increase), indicating a continued strong trend in consumption demand.

- Michigan University Consumer Sentiment Index for April

The final Michigan University Consumer Sentiment Index for April was revised slightly downward from 77.9 to 77.2. In April, the current conditions sub-index was revised slightly downward from 79.3 to 79, and the expectations sub-index was revised slightly downward from 77 to 76. Additionally, consumers’ 1-Year expectations were revised slightly upward from 3.1% to 3.2%, reaching the highest level in the last five months, while 5-Year inflation expectations remained steady at 3%, maintaining their highest level in the last five months.

- Advance GDP Growth Estimate for the First Quarter

The U.S. economy expanded by an annualized rate of 1.6% in the first quarter of 2024, down from 3.4% in the previous quarter and falling below forecasts of 2.5%.

This growth rate marked the lowest since the contractions experienced in the first half of 2022, as indicated by the advance estimate. A slowdown was observed in consumer spending, growing at 2.5% compared to 3.3% previously. This deceleration was primarily attributed to a decline in goods consumption (-0.4% vs 3%), while spending on services accelerated further (4% vs 3.4%).

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

U.S. Economic Data Highlights for the Week

- Federal Reserve Decision and Economic Indicators in Focus

In the United States, the focus of the markets will be on Wednesday’s Federal Reserve interest rate decision and Fed Chair Powell’s speech.

During its March meeting, the Fed maintained the federal funds rate range at 5.25% to 5.50%, in line with expectations, marking the fifth consecutive meeting without any changes in interest rates. It was observed that the decision was taken unanimously. The Fed reiterated its stance that it did not see it appropriate to lower the policy rate until there was more confidence that inflation would sustainably decline towards 2%, emphasizing the need for greater confidence in inflation for a rate cut.

- Manufacturing and Service Sector PMIs

Significant economic signals regarding the current state of economic activity will be provided by the final April PMI data from S&P Global for both the manufacturing and service sectors, as well as the April data for the ISM Manufacturing and ISM Non-Manufacturing Indices on Wednesday and Friday, respectively.

In April, the manufacturing PMI declined from 51.9 to 49.9 due to a slowdown in demand, reaching its lowest level in the last four months and indicating a return to contraction territory for the manufacturing sector after a three-month hiatus.

However, the ISM Manufacturing Index rose from 47.8 to 50.3 in March, indicating a return to growth territory for the manufacturing sector after sixteen months of contraction.

Additionally, the service PMI fell from 51.7 to 50.9 in April, signaling a slight slowdown in the pace of growth in the service sector due to a decline in new business orders, constrained by high interest rates and elevated prices. Despite this, it maintained its growth territory for the fifteenth consecutive month but at the slowest pace in the last five months.

- Trade Balance and Manufacturing Data

On Thursday, the trade balance data for March will be followed. In February, the monthly trade deficit rose from $67.6 billion to $68.9 billion, exceeding expectations, marking the highest level in the last ten months. In February, monthly imports rose to $331.9 billion, the highest level since October 2022, with a 2.2% increase, while exports reached a record level of $263 billion with a 2.3% increase.

Thursday will also see the release of the final durable goods orders data for March and factory orders data. Durable goods orders recorded a 2.6% increase in March, following a 0.7% increase in February, surpassing expectations and extending its rise into the second month.

- Housing Market and Labor Market Data

As for the housing market, the S&P/Case-Shiller Home Price Index for February will be released on Tuesday and construction spending for March will be released on Wednesday.

The monthly increase in the S&P/Case-Shiller Home Price Index slowed from 0.3% to 0.1% in January, marking its lowest level in the last eleven months. Construction spending, after a 0.2% decline in January, fell by 0.3% in February, extending its decline into the second month.

Friday’s data release will focus on labor market indicators. Key figures include the non-farm payroll, unemployment rate, and average hourly earnings data for April.

On Wednesday, JOLTS job openings for March and ADP private sector employment data for April will be released, followed by weekly initial jobless claims data on Thursday, and non-farm payroll, unemployment rate, and average hourly earnings data for April on Friday.

The latest weekly initial jobless claims, despite expectations of a slight increase, fell from 212,000 to 207,000, marking the lowest level in the last two months and remaining at historically low levels, indicating a tight labor market.

In March, non-farm payrolls increased from 270,000 to 303,000, exceeding expectations and reaching the highest level in the last ten months. Additionally, the unemployment rate, in line with expectations, decreased slightly from 3.9% to 3.8% in March. The number of unemployed persons increased by 29,000 to 6.4 million, while the number of employed persons increased by 496,000 to 161.5 million.

Looking at the trajectory of inflation, average hourly earnings, reflecting the rate of increase in wages, rose from 0.2% to 0.3% on a monthly basis in March, in line with expectations, while the annual rate of increase slowed from 4.3% to 4.1%.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

- May GfK Consumer Confidence Data in Germany

The GfK consumer confidence data for May in Germany, reflecting assessments for the upcoming month, rebounded from -27.3 to -24.2, surpassing expectations and reaching its highest level in the past two years. However, it continued to exhibit weak performance in the negative territory.

- April IFO Business Climate Index in Germany

The IFO business climate index data for April in Germany, reflecting evaluations by firms operating in the manufacturing, construction, wholesale, and retail trade sectors regarding the current and future six-month period in the economy, rose from 87.9 to 89.4, exceeding expectations. This marks the highest level since May 2023.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

- April HCOB Manufacturing Sector Final PMI Data

This week, the final HCOB manufacturing PMI data in April, providing insights into the latest economic outlook across Europe, will be closely monitored. According to preliminary data, manufacturing PMIs across the region contracted due to tightening financial conditions and weak demand in April.

- Inflation Data in Germany and the Euro Area

Today, preliminary consumer price inflation (CPI) data for April was released in Germany, showing that consumer prices rose by 2.2%, remaining steady at their lowest level since May 2021 and slightly below market forecasts of 2.3%. Core inflation, excluding volatile items like food and energy, dipped to 3.0% in April, marking its lowest level since March 2022.

On Tuesday, preliminary CPI data for April will be watched closely in the Eurozone. In March, headline CPI in the Eurozone recorded a 0.8% increase on a monthly basis, marking the strongest rise in the past year. However, the annual CPI rate declined from 2.6% to 2.4% in March, reaching its lowest level in the last four months. Core CPI also slightly declined from 3.1% to 2.9% year-on-year, hitting its lowest level since February 2022.

- Final Consumer Confidence Indicator for April in the Euro Area

The final consumer confidence indicator in the Euro Area for April was announced. Economic sentiment in the Euro Area dropped to 95.6 in April 2024, missing market expectations of 96.9. This decline was driven by a sharp drop in confidence among manufacturers, reaching its lowest level since July 2020. Morale also worsened among service providers, retailers, and constructors.

- Preliminary GDP Growth Data for the First Quarter in Germany and the Euro Area

On Tuesday, preliminary GDP growth data for the first quarter of this year will be released in both Germany and the Eurozone. The German economy contracted by 0.3% in 2023 due to high inflation and tightening financial conditions amid ECB interest rate hikes. The Euro Area economy recorded limited growth of 0.4% in 2023.

- Norwegian Central Bank Meeting

On Friday, the meeting of the Norwegian Central Bank will be closely followed. During its March 2024 meeting, the Norges Bank maintained its key interest rate at 4.5%, consistent with market projections. The bank indicated its intention to keep the rate unchanged until autumn, with a gradual downward adjustment thereafter.

Take the guesswork out of investing: Backtest your strategies with ease!

Upcoming Economic Highlights Across Asia-Pacific

- Monetary Policy Decision by the Bank of Japan

During today’s meeting, the Bank of Japan (BOJ) opted to keep its policy interest rate within the range of 0 to 0.10%, following its decision to end its negative interest rate policy last month. Additionally, the BOJ announced its intention to continue purchasing bonds.

- Industrial Profits in China

Profits earned by China’s industrial firms increased by 4.3% year-on-year to CNY 1,505.5305 billion in the first quarter of 2024. However, this growth rate was significantly slower than the 10.2% increase observed in the previous period. The latest data underscores the challenges faced by the Chinese government in sustaining economic recovery amidst a downturn in the property market, persistent weakness in domestic demand, and ongoing deflation risks.

- Manufacturing and Non-Manufacturing Sectors in China

The official Manufacturing Purchasing Managers’ Index (PMI) and Non-Manufacturing PMI data for April, which will provide signals about the trajectory of the economy in China, along with the Caixin Manufacturing PMI data for small and medium-sized enterprises, indicating the performance of their activities, will be released on Tuesday.

In China, the official Manufacturing PMI, after five months of contraction, rose from 49.1 to 50.8 in March, indicating a return to the expansion zone and marking the strongest growth in the past year.

The official Non-Manufacturing PMI, providing insights into the performance of the service and construction sectors, increased from 51.4 to 53 in March, indicating accelerated growth in the non-manufacturing sectors and the strongest expansion since June of the previous year.

- Caixin Manufacturing PMI in China

The Caixin Manufacturing PMI data rose from 50.9 to 51.1 in March, indicating a slight increase in the growth rate in the manufacturing sector. It also indicated the strongest growth since February 2023 and continued expansion for the past five months.

Among other data to be released this week are South Korea’s industrial production index, trade data, and inflation data; Japan’s retail sales and industrial production index; as well as Indonesia’s global Manufacturing PMI and GDP growth data.