Global Markets Recap

U.S. Markets:

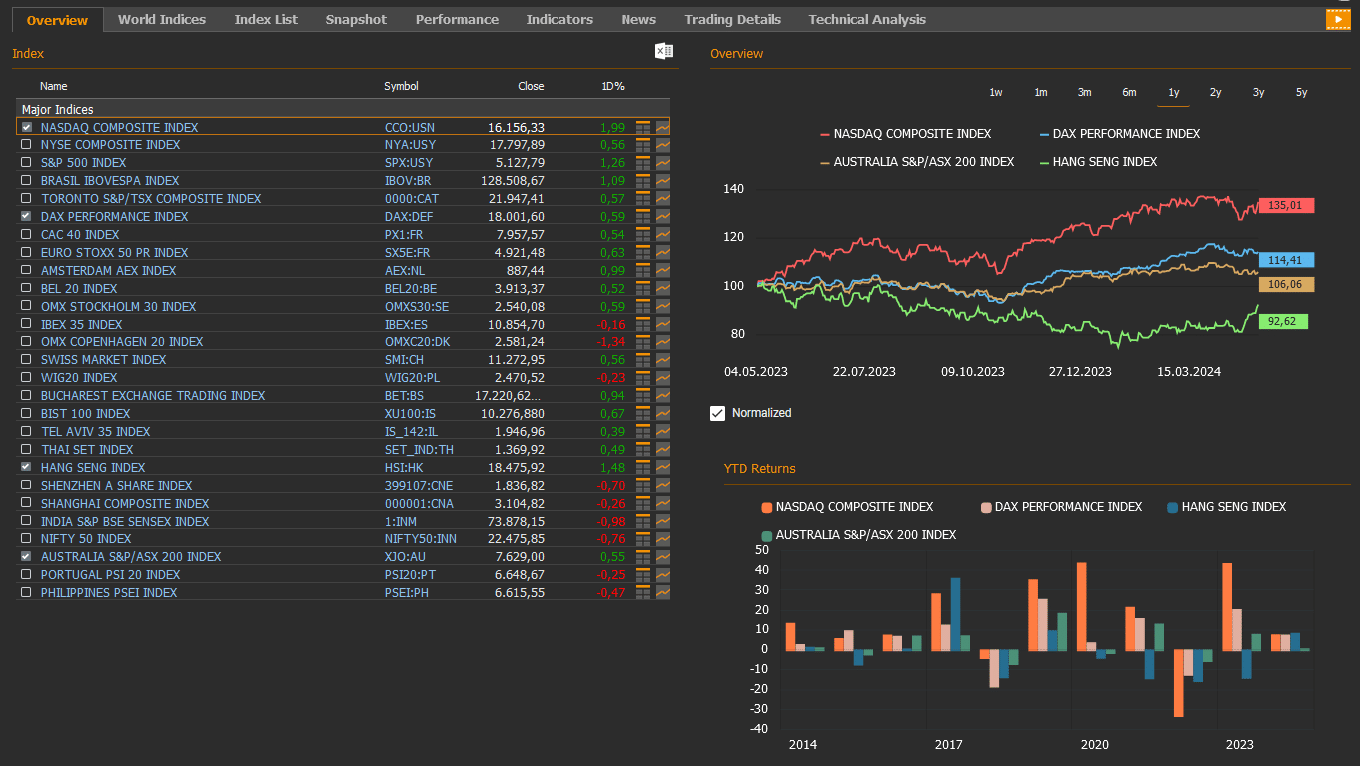

- On Friday, with the strengthening expectations of interest rate cuts from the Federal Reserve this year, the Wall Street indices closed with sharp gains of over 1%. The Nasdaq composite index (CCO:USN) closed the day with a 1.99% gain at 16,156.33, the NYSE composite index (NYA:USY) rose by 0.56% to 17,797.89, the S&P 500 index (SPX:USY) rose by 1.26% to close at 5,127.79, and the Dow Jones Industrial Average index (DJI:DJ) rose by 1.18% to 38,675.68.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 105.08 marking a 1% weekly loss.

- The Brent crude oil (LCO07:USC) closed the previous week at USD 89.96 per barrel, reflecting a 6% weekly loss.

- The price of gold (XAU/USD:USC) closed last week with a 1.6% loss, settling at USD 2,301.30 per ounce.

- The 10-year U.S. Treasury yield (USGG10YR:BND) completed the week with a 15.8 basis points decrease, settling at 4.51%. The 2-year U.S. Treasury yield (USGG2YR:BND), particularly responsive to Federal Reserve policy rates, finished at 4.83% with a 17.5 basis points loss.

European Markets:

- European stocks mostly ended higher on Friday. The Stoxx Europe 600 index (SXXP:FR) closed up 0.46% to 505.53. The German DAX index (DAX:DEF) rose by 0.59% to 18,001.60, and the French CAC 40 index(PX1:FR) rose 0.54% 7,957.57.

Asian Markets:

- Stocks in the Asia-Pacific region mostly rose last Friday. The Hang Seng index (HSI:HK) rose by 1.48% to 18,475.92, while the Nikkei 225 index (100000018:JPT) lost by 0,1% to 38,236.07 and China’s Shanghai Composite index (000001:CNA) closed down by 0.26% to 3,104.82.

- The S&P/ASX 200 Benchmark index (XJO:AU) in the Australian stock market rose by 0.55% to 7,629.00.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Overview of Key Economic Indicators in the US

Let’s take a look at the macroeconomic indicators and developments tracked in the US last week:

- Fed Policy Decision

The Federal Reserve (Fed) maintained its target range for the federal funds rate at 5.25%-5.50%, consistent with expectations, signaling a steady monetary policy stance. The decision, made unanimously, emphasized that there hasn’t been sufficient progress towards the 2% inflation target. The Fed reiterated its stance that it would not consider lowering interest rates until there is more confidence in sustainable progress towards the 2% inflation target.

- Labor Market Indicators

In April, nonfarm payroll growth fell from 315,000 to 175,000, surpassing expectations and marking the lowest level in the past six months. Additionally, the unemployment rate increased slightly from 3.8% to 3.9%, with the number of unemployed persons rising by 63,000 to 6.49 million and the number of employed persons increasing by 25,000 to 161.5 million.

For the week ending April 27, weekly initial jobless claims remained at historically low levels, reaching 208,000, consistent with the previous week’s level. This indicates ongoing tightness in the labor market, despite expectations of a slight increase.

Average hourly earnings growth slowed from 0.3% to 0.2% month-over-month in April, with the year-over-year growth rate declining from 4.1% to 3.9%, marking the lowest level since June 2021 and falling below expectations of a 4% slowdown.

- Service Sector Activity

The final PMI data for the S&P Global services sector in April was revised slightly upward from 50.9 to 51.3, indicating a slight increase in growth in the services sector, maintaining its growth trajectory in the growth zone for the past 15 months.

- Trade Balance and Orders

In March, the trade deficit slightly declined from $69.5 billion to $69.4 billion, remaining near record highs for the past ten months. Imports decreased by 1.6% to $327 billion, while exports also declined by 2% to $257.6 billion, partially reversing the record level seen in February.

- Durable Goods and Factory Orders

Durable goods orders increased by 2.6% in March, following a 0.7% increase in February, while factory orders rose by 1.6% in March, consistent with expectations, indicating continued growth in these sectors.

- Consumer Confidence and Housing Market

The Conference Board’s consumer confidence index in April decreased to 97, its lowest level since 2022, due to increasingly pessimistic views on current and future job and business conditions.

Additionally, the S&P/Case-Shiller Home Price Index showed a monthly increase of 0.7% in February, exceeding expectations, and a year-over-year increase of 7.3%, the highest since October 2022.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

U.S. Economic Data Highlights for the Week

In the United States, data on weekly initial jobless claims will be monitored on Thursday. The last reported weekly initial jobless claims, despite expectations of a slight increase (212,000), remained at 208,000, the lowest level in the past two months and below historical averages, indicating a continued tight labor market.

On Friday, the preliminary data for the University of Michigan Consumer Confidence Index for May will also be tracked. The consumer confidence index for April was revised slightly downward from 77.9 to 77.2. The current conditions sub-index was revised downward from 79.3 to 79, while the expectations sub-index was revised downward from 77 to 76.

Other indicators to watch this week include consumer credit change in March, used car prices in April and MBA 30-Year mortgage rate.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

- Eurozone Inflation Data

In the Eurozone, headline Consumer Price Index (CPI) increased by 0.6% in April, in line with expectations following a 0.8% increase in March. However, the annual CPI remained at 2.4%, the lowest level in the past five months. Core CPI slightly declined from 2.9% to 2.7% year-on-year in April, exceeding expectations but marking the lowest level since March 2022.

- Eurozone and German Economic Performance

The Eurozone economy recorded a quarterly growth rate of 0.3% in the first quarter of the year, surpassing expectations of 0.1% and indicating an exit from the slight recession observed in the previous two quarters. Year-on-year growth increased from 0.1% to 0.4%.

Germany’s economy showed partial recovery in the first quarter, with a growth rate of 0.2% following a 0.5% contraction in the last quarter of the previous year, performing above expectations of 0.1%. However, on an annual basis, it contracted by 0.2%, similar to the previous quarter.

- Eurozone Manufacturing PM

Across Europe, the final Purchasing Managers’ Index (PMI) data for the manufacturing sector for April showed contraction due to tightening financial conditions and weak demand.

- UK Services Sector PMI

In the United Kingdom, the final Purchasing Managers’ Index (PMI) data for the services sector for April was revised upward from 54.9 to 55, indicating a slight acceleration in growth in the services sector. This marks the sixth consecutive month of expansion and the strongest growth in nearly a year.

- Norway Central Bank Policy Announcement

The Norwegian Central Bank kept its policy interest rate unchanged at 4.50%, in line with expectations, signaling that the interest rate will remain at its current level for some time.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

- ECB Meeting Minutes Release

In Europe, the focal point of markets on Friday will be the release of the European Central Bank’s meeting minutes for April.

During the April meeting, the ECB kept interest rates unchanged, in line with expectations, maintaining the rates unchanged for the fifth consecutive meeting. The bank emphasized that interest rates remained at levels that would contribute significantly to the ongoing fight against inflation. The key refinancing rate was kept at 4.50%, the marginal lending rate at 4.75%, and the deposit facility rate at 4.00%. Additionally, it was stated that the bank would continue to adopt a data-based and meeting-by-meeting approach to determine the appropriate level and duration of its monetary policy constraints, without making commitments in advance to a specific level.

- Eurozone Services PMI

The final Purchasing Managers’ Index (PMI) data for the services sector for April was released today. The HCOB Eurozone Services PMI increased to 53.3, marking the strongest growth in nearly a year, surpassing the initial estimate of 52.9 and up from 51.5 in March. Increased demand was a primary factor in the higher output, with new business volumes expanding at the fastest rate since May of the previous year.

- Eurozone Producer Price Index (PPI)

The Producer Price Index (PPI) data for March was released in the Eurozone today. Producer prices decreased by 7.8% year-on-year in March 2024, following a revised 8.5% drop recorded in the preceding month, compared with market expectations of a 7.7% decline.

On a monthly basis, producer prices decreased by 0.4% in March 2024, in line with forecasts after a revised 1.1% fall in February. It was the fifth consecutive monthly decline, driven by a continued drop in energy costs.

- German Factory Orders and Industrial Production

In Germany, factory orders data for March will be released tomorrow, followed by industrial production data on Wednesday.

Factory orders in Germany showed a slight recovery in February with a 0.2% increase following a 11.4% decline in January. Year-on-year, the decline in factory orders slowed from 6.2% to 10.6%.

Industrial production in Germany increased by 2.1% in February, exceeding expectations, and continued its upward trend for the second consecutive month, while the year-on-year contraction rate slowed from 5.3% to 4.9%.

- Eurozone Retail Sales Data

Eurozone retail sales data for March will be released tomorrow. Retail sales in the Eurozone recorded a 0.5% decrease in February following a flat trend in January, while on an annual basis, the decline slowed from 0.9% to 0.7%.

Additionally, preliminary data on GDP growth for the first quarter of this year will be released in the UK on Friday. The UK economy experienced a slowdown in growth in the first quarter of last year, followed by a contraction in the third quarter and a further decline in the fourth quarter, entering a recession for the first time since 2020.

- Upcoming Central Bank Meetings

On Wednesday, the meeting of the Swedish Central Bank will be followed, with expectations of a 25 basis points cut in the policy interest rate to 3.75%, following the bank’s decision to keep the rate at 4.00% during its March meeting.

Thursday will see the Bank of England’s (BoE) meeting, where the bank is expected to keep its policy interest rate unchanged at 5.25%.

Take the guesswork out of investing: Backtest your strategies with ease!

Upcoming Economic Highlights Across Asia-Pacific

- Manufacturing PMI in China

In China, the official NBS Manufacturing PMI index fell from the previous month’s 12-month high of 50.8 to 50.4. Although it slightly undershot the market expectation of 50.3, it marked the second consecutive month above the threshold of 50. Examining the details, it’s observed that there has been a second consecutive expansion in factory activities amid ongoing efforts from Beijing to stimulate economic recovery.

- Inflation and Economic Growth in Indonesia

The annual inflation rate in Indonesia stood at 3.0% in April 2024, slightly below market expectations of 3.06%, following March’s seven-month high of 3.05%.

Additionally, Indonesia’s economy contracted by 0.83% quarter-on-quarter in the first quarter of 2024, compared to market forecasts of a 0.89% decline, after a 0.45% growth in the previous quarter.

- Consumer Confidence in Japan

The consumer confidence index in Japan declined to 38.3 in April 2024 from 39.5 in the previous month, below market forecasts of 39.7, despite being the highest reading since April 2019.

- Foreign Trade Data in China

Foreign trade data for April will be monitored in China on Thursday. In March, China’s exports declined by 7.5% year-on-year (expectation: 1.9% decrease), while imports also recorded a 1.9% year-on-year decrease (expectation: 1% increase). These figures indicated a weakening in both global and domestic economic activity.

- Central Bank Meeting in Australia

On Tuesday, the Reserve Bank of Australia will hold its meeting, with expectations of keeping the policy interest rate unchanged at 4.35%, consistent with market expectations.

Other data to watch in Asia this week includes China and Russia’s April foreign exchange reserves, the policy interest rate and industrial production for March in Malaysia, and household spending for March in Japan.