Global Markets Recap

U.S. Markets:

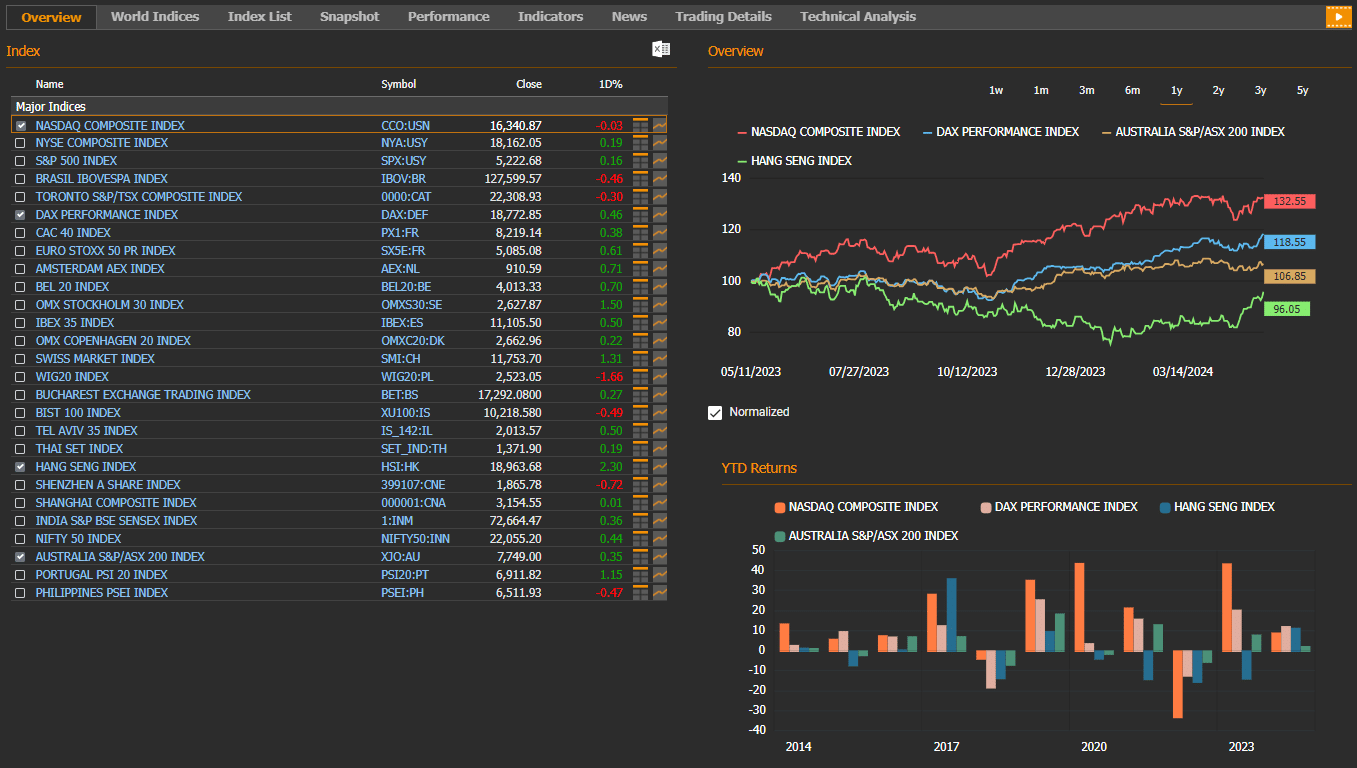

- Despite a notable decline in the University of Michigan Consumer Sentiment Index for May, investors remained wary of rising inflation expectations, resulting in a mixed performance in Wall Street indices at Friday’s close. The Nasdaq composite index (CCO:USN) closed flat at 16,340.87, the NYSE composite index (NYA:USY) rose by 0.19% to 18,162.05, the S&P 500 index (SPX:USY) rose by 0.16% to close at 5,222.68, and the Dow Jones Industrial Average Equal Weight index (DJIEW:USY) rose by 0.23% to 12,191.17.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 105.31 marking a 0.22% weekly gain.

- The Brent crude oil (LCO07:USC) closed the previous week at USD 82.79 per barrel, reflecting a 0.21% weekly loss.

- The price of gold (XAU/USD:USC) closed last week with a 2.5% gain, settling at USD 2,359.75 per ounce.

- The 10-year U.S. Treasury yield (USGG10YR:BND) completed the week with a 0.87 basis points loss, settling at 4.50%. The 2-year U.S. Treasury yield (USGG2YR:BND), particularly responsive to Federal Reserve policy rates, finished at 4.87% with a 4.5 basis points gain.

European Markets:

- European stocks mostly ended higher on Friday. The Stoxx Europe 600 index (SXXP:FR) closed up 0.77% to 520.76. The German DAX index (DAX:DEF) rose by 0.46% to 18,772.85, and the French CAC 40 index (PX1:FR) rose 0.38% 8,219.14.

Asian Markets:

- Stocks in the Asia-Pacific region mostly rose last Friday. The Hang Seng index (HSI:HK) rose by 2.3% to 18,963.68, while the Nikkei 225 index (100000018:JPT) lost by 0.41% to 38,229.11 and China’s Shanghai Composite index (000001:CNA) closed flat at 3,154.55.

- The S&P/ASX 200 Benchmark index (XJO:AU) in the Australian stock market rose by 0.35% to 7,749.00.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Overview of Key Economic Indicators in the US

Let’s take a look at the macroeconomic indicators and developments tracked in the US last week:

- University of Michigan Consumer Sentiment Index

In the United States, the preliminary May University of Michigan Consumer Sentiment Index unexpectedly dropped from 77.2 to 67.4, marking a decline above expectations and reaching its lowest level in the last six months. Additionally, consumers’ short-term inflation expectations rose from 3.2% to 3.5%, reaching their highest level in the last six months, while long-term inflation expectations also increased from 3% to 3.1%, hitting their highest level in the last six months.

- Weekly Initial Jobless Claims

Weekly initial jobless claims for the week ending May 4 rose from 209,000 to 231,000, surpassing expectations and reaching the highest level in the last six months. This indicates a partial cooling in the labor market, although it remains below historical averages.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

U.S. Economic Data Highlights for the Week

- Focus on Federal Reserve Speech

The markets’ attention in the U.S. will be on Federal Reserve Chairman Powell’s speech tomorrow. Investors will be seeking new signals regarding the Fed’s future monetary policy and potential interest rate cuts. Additionally, key data to be closely monitored for insights into Fed policy include the April Producer Price Index (PPI) data on Tuesday and the Consumer Price Index (CPI) data on Wednesday.

- Inflation Insights

In March, the headline CPI remained at 0.4% month-on-month, in line with expectations, while the year-on-year rate increased from 3.2% to 3.5%, reaching its highest level since September and surpassing expectations. Core CPI, which excludes food and energy prices, remained at 0.4% month-on-month, surpassing expectations, and stood at 3.8% year-on-year.

April is expected to see a slight decrease in both headline and core CPI.

In March, the headline PPI decreased from 0.6% to 0.2% month-on-month, below expectations, while the year-on-year rate increased from 1.6% to 2.1%, marking its highest level since April 2023. Core PPI decreased from 0.3% to 0.2% month-on-month, while the year-on-year rate increased to 2.4%, its highest level in seven months.

April is expected to see a slight increase in both headline and core PPI.

- Industrial Production and Retail Sales Data

Thursday will see the release of April industrial production and capacity utilization data, providing insights into production trends.

The New York Fed Empire State Manufacturing Index for May will also be released, expected to rebound to -10 from -14.3 in April.

Additionally, April retail sales data will be released, with expectations of a 0.4% increase in headline retail sales and a 0.2% increase in core retail sales.

- Jobless Claims and Housing Market Indicators

Thursday will also feature weekly initial jobless claims data, which rose to 231,000 from 209,000, signaling a partial cooling in the labor market.

Additionally, April housing market data, including housing starts and building permits, will provide insights into housing demand trends. March saw declines in both indicators, with expectations of further decreases in April.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

- ECB Meeting Minutes Release

In Europe, the European Central Bank (ECB) released the meeting minutes for April. The ECB emphasized its commitment to a data-driven and meeting-by-meeting approach to determining the appropriate level and duration of monetary policy constraints, without making commitments to specific levels beforehand. The minutes revealed that members concluded that due to the trend of inflation in the Eurozone expected to decrease to 2% next year, they could lower interest rates in June.

- Industrial Production in Germany

In Germany, industrial production showed a partial weakening in March, recording a decrease of 0.4% month-on-month following two consecutive monthly increases (1.3% increase in January and 1.7% increase in February), while the annual rate of contraction slowed from 5.3% to 3.3%.

- UK Economic Performance

The UK economy outperformed expectations in the first quarter of 2024, growing by 0.6% compared to expectations of a 0.4% increase, thus exiting recession. The UK economy had contracted by 0.1% on a quarterly basis in the third quarter of last year and entered a recession with a 0.3% contraction in the fourth quarter.

- Monetary Policy Decisions in the UK and Sweden

The Bank of England (BoE) kept its policy rate unchanged at 5.25% in line with expectations, maintaining the policy rate unchanged for the sixth consecutive meeting and at its highest level in the last 15 years.

Additionally, the Swedish Central Bank lowered its policy rate by 25 basis points to 3.75%, in line with expectations, marking the first rate cut since 2016.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

- German and Eurozone Final CPI Data

Germany and the Eurozone will release final Consumer Price Index (CPI) data for April this week. Preliminary data showed Germany’s CPI rose by 0.5% month-on-month, slightly below expectations, while the year-on-year rate remained at 2.2%. In the Eurozone, CPI increased by 0.6% month-on-month in April, with the year-on-year rate staying at 2.4%.

- Eurozone Industrial Production and GDP Growth

Eurozone industrial production data for April and revised GDP growth data for Q1 will be released. Industrial production partially recovered in February, while GDP growth for Q1 exceeded expectations, indicating an exit from a mild recession. Preliminary data showed that the Eurozone economy grew by 0.3% quarter-on-quarter, exceeding expectations of 0.1%

- ZEW Economic Sentiment Indices in Germany

Germany will also release ZEW Economic Sentiment Indices for May. The current conditions index increased slightly, while the expectations index rose significantly, attributed to positive evaluations of the economy and expectations for export-oriented countries.

Take the guesswork out of investing: Backtest your strategies with ease!

Upcoming Economic Highlights Across Asia-Pacific

- Chinese Inflation and Trade Data

Chinese Consumer Price Index (CPI) and Producer Price Index (PPI) data for April provided signals about global inflation trends. In April, China’s monthly CPI saw a slight increase of 0.1% after a 1% decline in March, while the year-on-year rate rose from 0.1% to 0.3%, marking its third consecutive monthly increase. Core CPI, excluding food and energy prices, also saw a slight increase from 0.6% in March to 0.7% in April.

Meanwhile, China’s monthly PPI decline rate increased from 0.1% to 0.2% month-on-month in April, and the year-on-year decline rate slowed from 2.8% to 2.5%, confirming a continued deflationary trend in producer prices for the nineteenth consecutive month.

China’s trade data for April showed a 1.5% increase in exports and an 8.4% increase in imports year-on-year, indicating a recovery in both global and domestic economic activity.

Later this week, China will release industrial production, retail sales, and fixed asset investment data for April. Additionally, Japan’s preliminary GDP growth data for the first quarter of this year will be released on Thursday, following a narrow escape from recession in the previous quarter.

Other data to watch in Asia this week includes Thailand’s first-quarter GDP growth figures, Indonesia and India’s trade balances, and the Philippines’ interest rate decision.