Global Markets Recap

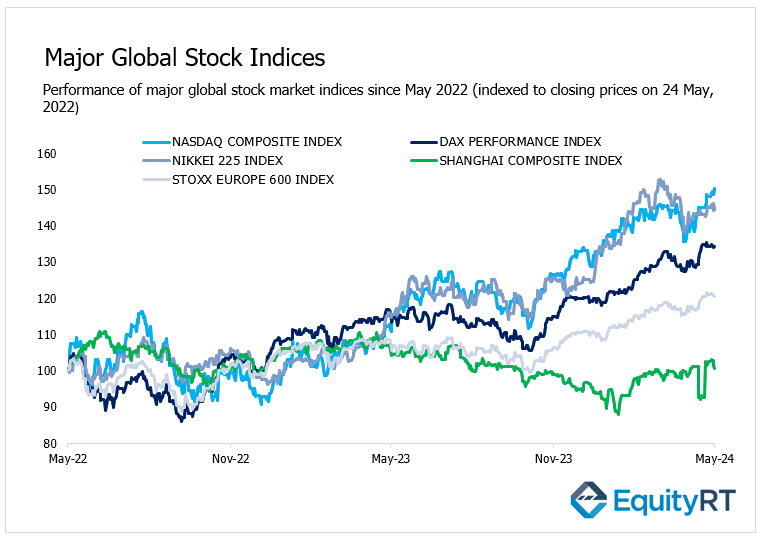

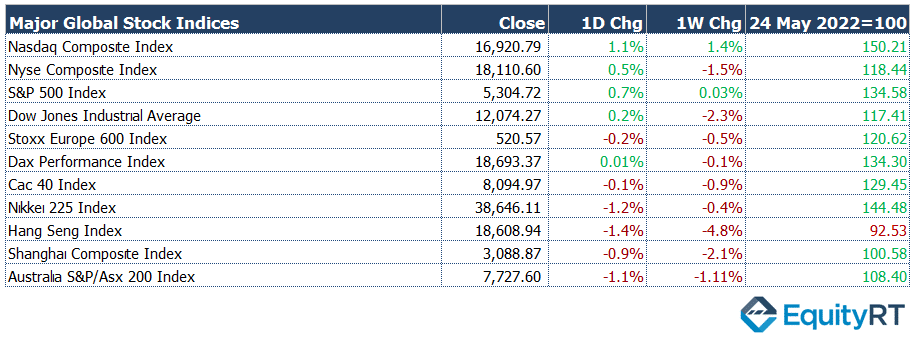

On Friday, Wall Street indices closed the day with gains, supported by the upward revision of the University of Michigan consumer sentiment index’s final reading. Additionally, Nvidia’s stronger-than-expected earnings results helped lift the markets.

U.S. markets will be closed on Monday in observance of Memorial Day.

The stocks in the Europe and Asia-Pacific region mostly ended lower on Friday.

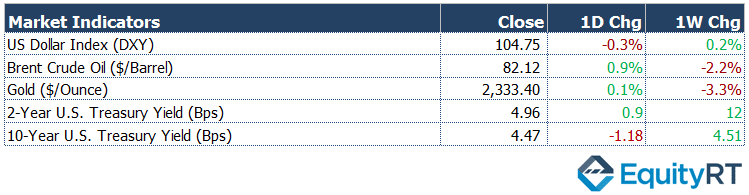

The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 104.7 marking a 0.2% weekly rise.

The Brent crude oil (#LCO07) closed the previous week at USD 82.12 per barrel, reflecting a 2.2% weekly loss.

The price of gold (#XAU) closed last week with a 3.3% loss, settling at USD 2,333.40 per ounce.

The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, finished at 4.96% with a 0.9 basis points rise. The 10-year U.S. Treasury yield (#USGG10YR) completed the week with a 1.18 basis points loss, settling at 4.47%.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Overview of Key Economic Indicators in the US

Let’s take a look at the macroeconomic indicators and developments tracked in the US last week:

The minutes from the Federal Reserve’s May meeting were released, highlighting members’ concerns about inflation and their lack of confidence in cutting interest rates. The recent data suggested that the disinflation process might take longer than expected. Additionally, some members indicated their readiness to tighten monetary policy if inflation risks increased.

The preliminary S&P Global PMI data for May, indicating the latest economic activity, were tracked. The final PMI for the manufacturing sector rose to 50.9 from the threshold level of 50, driven by increases in new orders and production, signaling a shift from stagnation to growth. Expectations had been for a decline to 49.9.

The services PMI jumped from 51.3 to 54.8 due to a strong rebound in new business, indicating accelerated growth and the strongest expansion in the past year. This marked the 16th consecutive month of growth in the service sector.

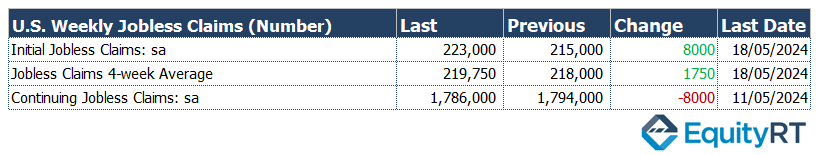

For the week ending May 18, new jobless claims in the U.S. fell to 215,000 from 223,000, exceeding expectations and indicating a tight labor market. These claims remained historically low.

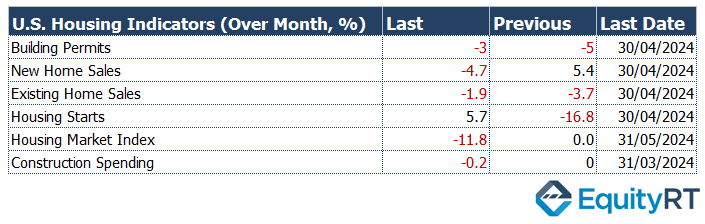

In the U.S. housing market, new home sales declined by 4.7% in April, following a 5.4% increase in March.

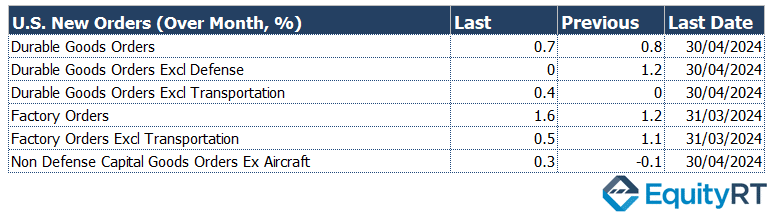

The preliminary data for durable goods orders in April showed a 0.7% increase, continuing the trend of growth for the third consecutive month. This was slightly below the 0.8% growth seen in March but contrary to expectations of a 0.8% decline.

The Michigan Consumer Sentiment Index for May was revised upwards from 67.4 to 69.1, although it remained at one of the lowest levels in the past six months. Short-term inflation expectations were revised down from 3.5% to 3.3%, and long-term expectations from 3.1% to 3%.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Key U.S. Economic Indicators to Watch This Week

On Wednesday, the Federal Reserve’s Beige Book Report, which compiles economic data from the Federal Reserve’s 12 regional banks, will be published.

On Thursday, the revised annualized quarterly GDP growth rate for the first quarter of this year , the revised quarterly data for the Personal Consumption Expenditures (PCE) price index, pending home sales data for April, and weekly initial jobless claims data will be release on Thursday.

On Friday, the PCE deflator data for April, along with personal income and spending figures, will be released.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

The preliminary PMI data for the manufacturing and services sectors in May, provided by HCOB, was tracked across Europe. In May, the manufacturing PMIs indicated a contraction across the region, excluding the UK, due to tightened financial conditions and weak demand.

In the Eurozone, the manufacturing PMI reached 47.4, the highest level in 15 months, with the rate of production decline at its lowest in 14 months and new orders falling at the slowest pace in two years. The services PMIs remained in the growth zone above 50, except for France. The Eurozone services PMI remained steady at 53.3, indicating sustained growth.

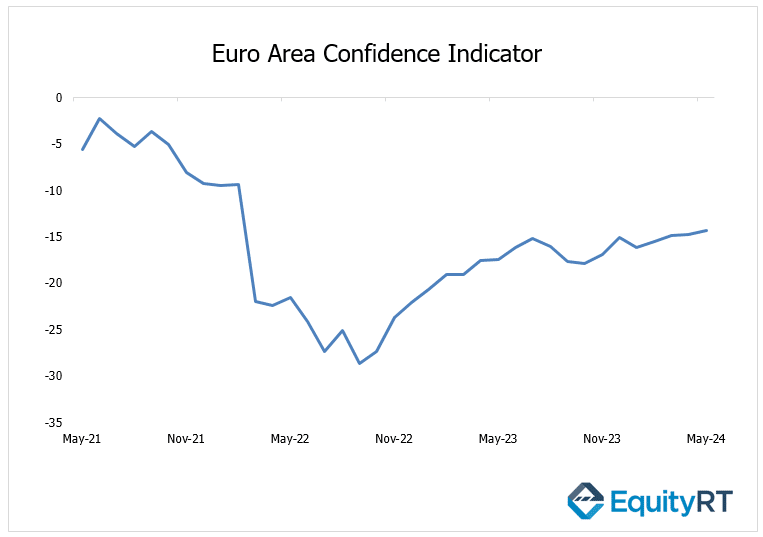

The preliminary consumer confidence index for May in the Eurozone improved slightly from -14.7 to -14.3, reaching its highest level since February 2022, although it remained in negative territory.

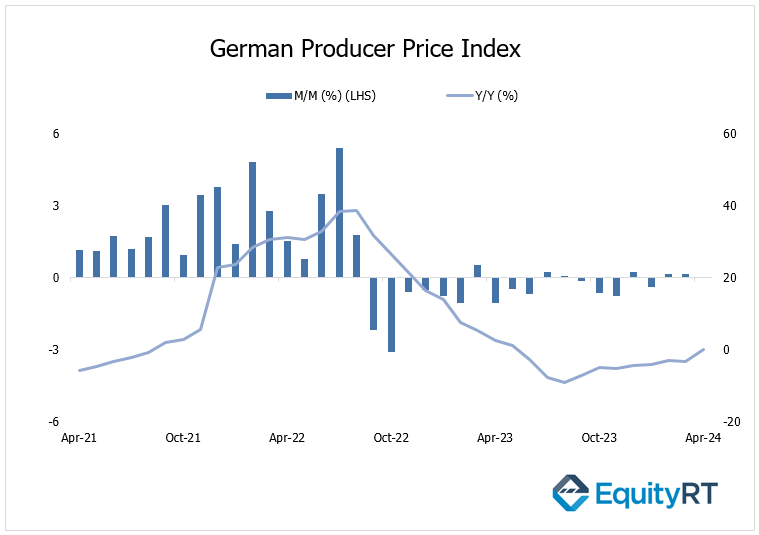

In April, Germany’s PPI increased by 0.2% month-on-month, matching the rise in March and continuing the two-month upward trend, though below the expected 0.3%. On an annual basis, the decline rate accelerated from 2.9% to 3.3%, marking the tenth consecutive month of decrease.

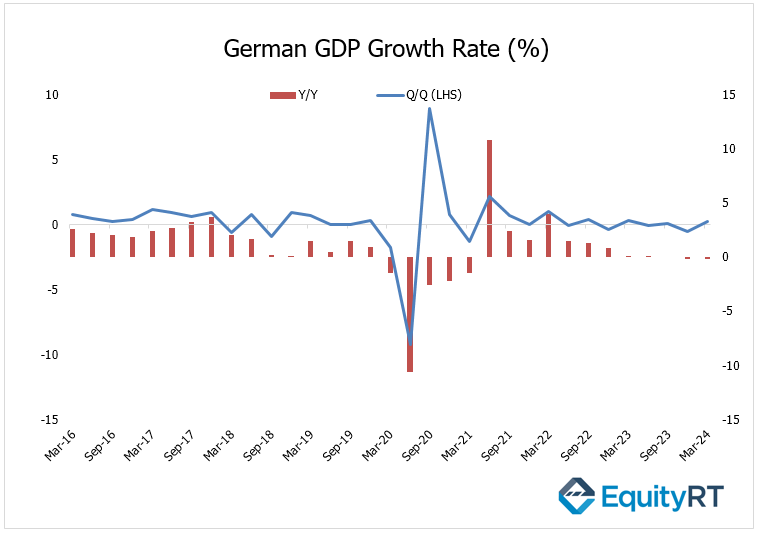

Germany’s GDP grew by 0.2% in the first quarter of this year, aligning with preliminary data, partially recovering from a 0.5% contraction in the last quarter of the previous year. On an annual basis, the economy contracted by 0.2%, similar to the previous quarter entering a technical recession.

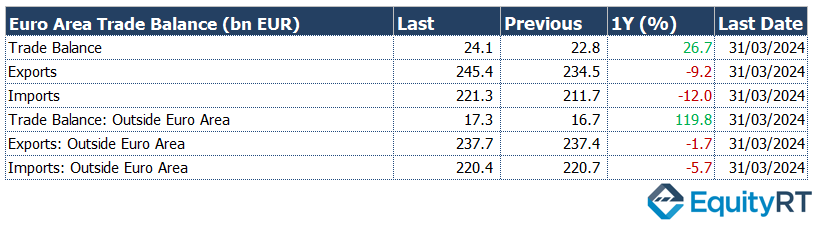

The Euro Area trade balance data for March showed an increase in the trade surplus from €22.8 billion to €24.1 billion, the highest level since December 2020.

Exports from the Euro Area fell by 9.2% year-on-year to €245.4 billion in March 2024. Meanwhile, imports to the Euro Area decreased by 12% year-on-year to €221.3 billion during the same period.

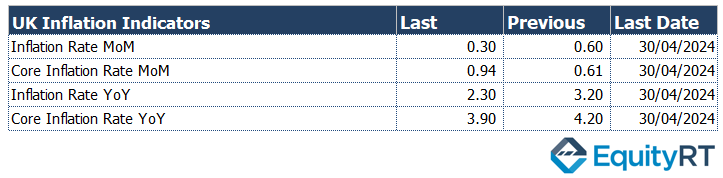

The UK’s CPI for April slowed to 0.3% month-on-month, the lowest in three months but above expectations of 0.1%. Annually, the CPI decreased from 3.2% to 2.3%, the lowest since July 2021, while expectations were for a slowdown to 2.1%.

The core CPI‘s monthly growth rate rose from 0.6% to 0.9%, exceeding the expected 0.7%, while the annual rate slightly slowed from 4.2% to 3.9%, the lowest since October 2021, with expectations at 3.6%.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

In Europe, the IFO business climate index for May was released today. This index reflects the assessments of firms in the manufacturing, construction, wholesale, and retail trade sectors in Germany regarding the current economic situation and their expectations for the next six months.

The Ifo Business Climate indicator for Germany remained unchanged at 89.3 in May 2024, matching the downwardly revised 89.3 in April, and falling short of the anticipated 90.4.

The GfK consumer confidence index for June, which indicates expectations for the coming month, will be followed on Wednesday.

On Thursday, the final consumer confidence index for May in the Eurozone will be monitored. The preliminary data for May showed a slight improvement from -14.7 to -14.3, maintaining its highest level since February 2022, although still in negative territory.

On Wednesday, the preliminary CPI data for May in Germany will be published, followed by the preliminary CPI data for the Eurozone on Friday.

Take the guesswork out of investing: Backtest your strategies with ease!

Upcoming Economic Highlights Across Asia-Pacific

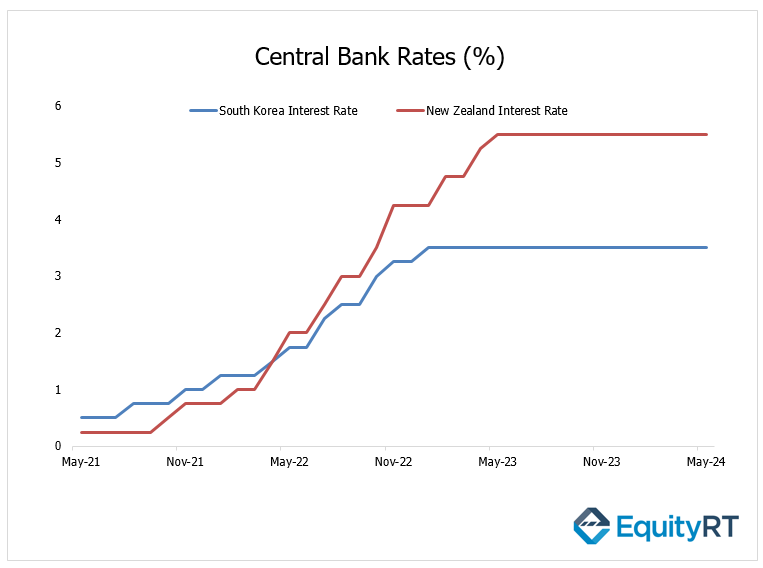

The Central Bank of New Zealand, in line with expectations, held its policy rate steady at 5.50% for the seventh consecutive time.

The Central Bank of South Korea maintained its policy rate at 3.50% for the eleventh consecutive time.

On Friday, China’s official PMI data for May, covering both the manufacturing and non-manufacturing sectors, will be released, providing signals about the state of the economy.

Other indicators to watch in Asia include Japan’s consumer confidence for May, South Korea’s industrial production index for April and Indonesia’s inflation rates for May.