Global Markets Recap

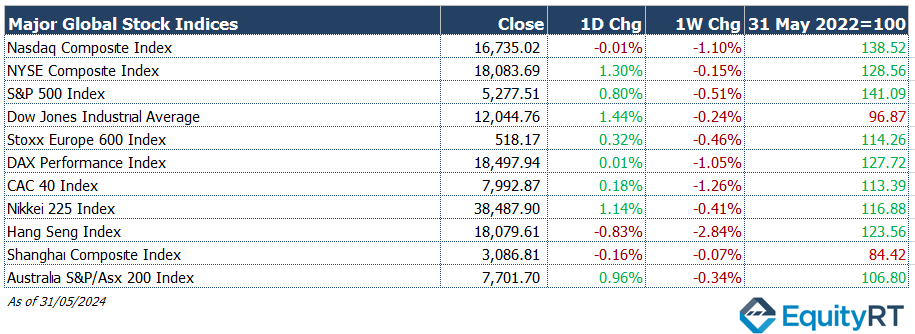

Last Friday, Wall Street closed higher as investors anticipated Fed interest rate cuts this year, driven by April’s PCE deflator data.

European stocks closed higher on Friday, contrasting with the downward trend seen in the Asia-Pacific region’s stock markets.

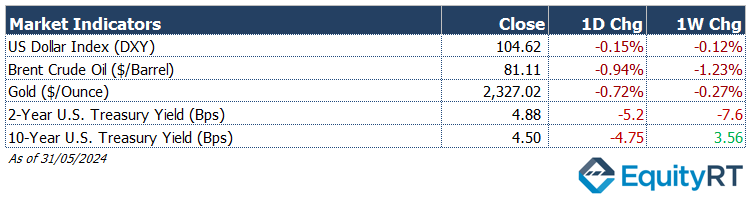

The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 104.6 marking a 0.12% weekly loss.

The Brent crude oil (#LCO07) closed the previous week at USD 81.1 per barrel, reflecting a 1.23% weekly loss.

The price of gold (#XAU) closed last week with a 3.3% loss, settling at USD 2,333.40 per ounce.

The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, finished at 4.88% with a 7.6 basis points weekly loss. The 10-year U.S. Treasury yield (#USGG10YR) completed the week with a 3.56 basis points gain, settling at 4.50%.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Overview of Key Economic Indicators in the US

Let’s take a look at the macroeconomic indicators and developments tracked in the US last week:

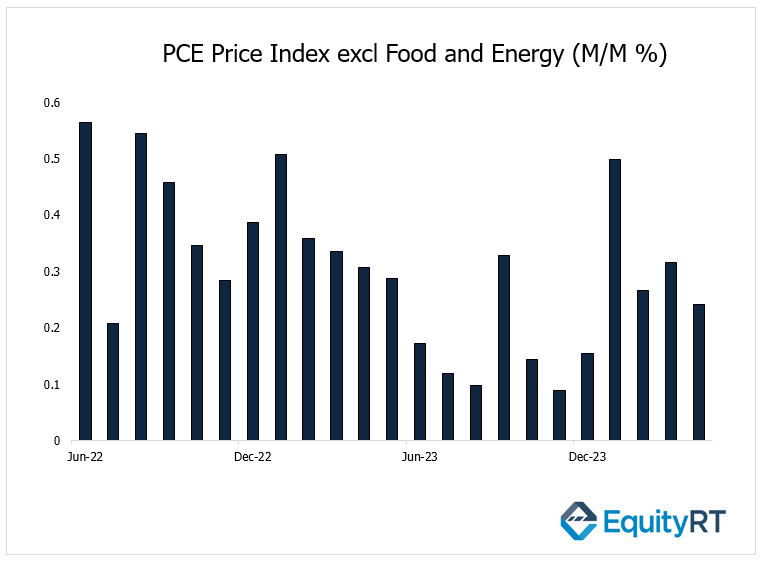

In the United States, the April data on the Personal Consumption Expenditures (PCE) deflator, closely monitored by the Fed for monthly price developments, showed a monthly increase of 0.3%, consistent with expectations and similar to the previous month, while on an annual basis, it was recorded at 2.7%, also resembling the previous month’s figure.

The increase in the core PCE deflator also occurred at a monthly rate of 0.2%, similar to the previous month, and at an annual rate of 2.8%, similarly matching the previous month’s level.

In April, the monthly increase in personal income slowed down from 0.5% to 0.3%, aligning with expectations, while the monthly increase in personal spending decelerated from 0.7% to 0.2%, falling below expectations (0.3%), indicating a weakening in consumption demand.

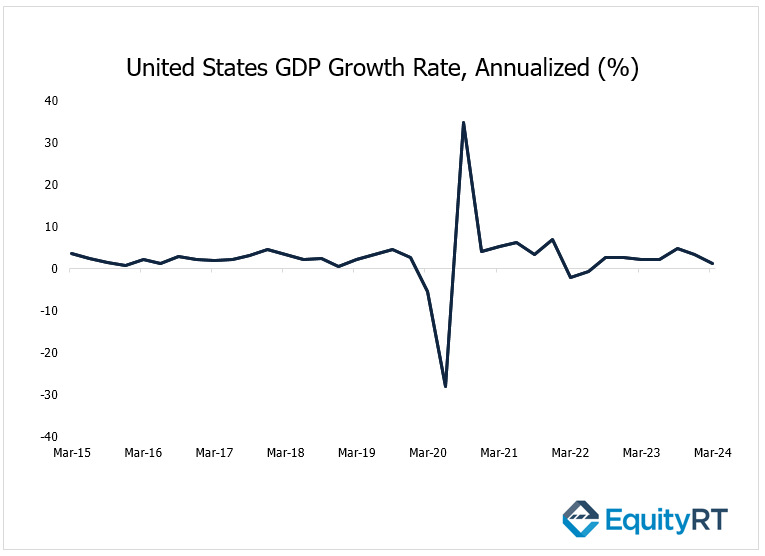

The annualized quarterly growth rate of the U.S. economy, after a slight slowdown from 2.2% in Q1/23 to 2.1% in Q2, surged to 4.9% in Q3, then slowed to 3.4% in Q4. However, in Q1/2024, the growth rate was downwardly revised from 1.6% to 1.3%, in line with expectations, marking the lowest growth rate since the contraction in Q2/22.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Key U.S. Economic Indicators to Watch This Week

In the United States, key economic indicators signaling the recent state of economic activity will be observed through May’s final PMI data for both manufacturing and services sectors by S&P Global, along with the ISM Manufacturing and Non-Manufacturing indices for May, which will be released today and Wednesday, respectively.

On Tuesday, final data on durable goods orders for April and factory orders will be monitored regarding production trends. Durable goods orders, after a 0.8% increase in March, saw a 0.7% increase in April according to preliminary data, marking the third consecutive month of growth.

Factory orders, following a 1.2% increase in February, continued to rise by 1.6% in March, consistent with expectations, marking the second consecutive month of increase.

On the same day, April’s JOLTS Job Openings data will be released, followed by May’s ADP Private Sector Employment data on Wednesday, weekly initial jobless claims data on Thursday, and May’s Nonfarm Payrolls, Unemployment Rate, and Average Hourly Earnings data on Friday.

On Thursday, trade balance data for April will be released. In March, the monthly trade deficit, despite partial expectations of an increase, slightly decreased from $69.5 billion to $69.4 billion, maintaining near-flat levels, marking the highest levels in the past ten months.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

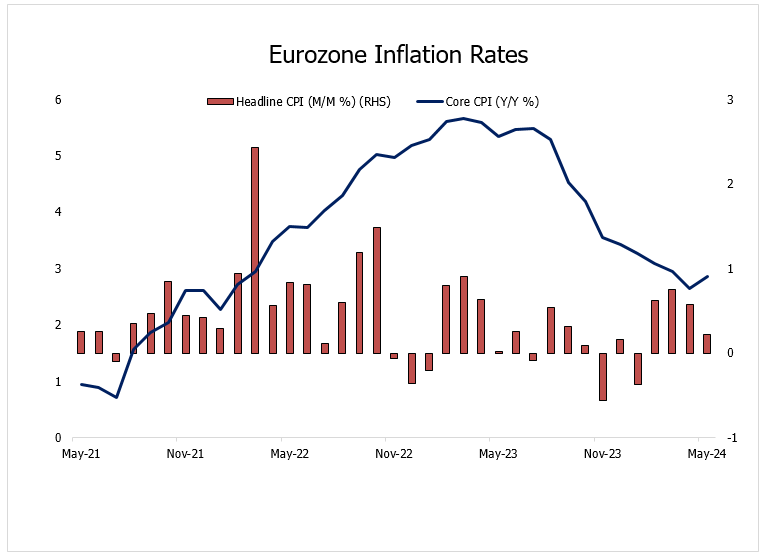

In Europe, the preliminary Consumer Price Index (CPI) data for May in the Eurozone was released. The monthly inflation rate slowed from 0.6% to 0.2% in May, in line with expectations, marking the lowest level in the past four months, while the annual rate increased slightly from 2.4% to 2.6%. The core CPI in the Eurozone also saw a slight increase from 2.7% to 2.9% on an annual basis in May.

In Germany, the headline CPI‘s monthly inflation rate slowed from 0.5% to 0.1% in May, falling below expectations (0.2%), while the annual rate increased slightly from 2.2% to 2.4%, reaching the highest level since May 2021. Additionally, Germany’s annual core CPI remained consistent with the previous month at 3% in May, maintaining its lowest level since March 2022.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

In Europe, all eyes are on Thursday’s ECB interest rate decision and President Lagarde’s speech. Markets anticipate a rate cut in the June meeting.

Providing insights into the recent economic outlook, the final PMI data for the manufacturing sector in May has been released across Europe today. The final PMI data for the services sector will follow on Wednesday.

Wednesday will also see the release of the Producer Price Index (PPI) data for April in the Eurozone. After a consecutive decrease in February and March, both monthly and annual PPI figures are expected to show a further decline in April.

Moreover, Thursday brings the release of retail sales data for April in the Eurozone. Following a rebound in March, both monthly and annual retail sales are expected to show a decline in April.

Friday will see the release of trade balance data for April in Germany. In March, exports exceeded expectations, indicating a partial recovery in external demand, while imports continued to rise at a slower pace, suggesting signs of a domestic recovery.

Finally, Friday will bring the final GDP growth figures for Q1 for the Eurozone. The Eurozone economy showed robust growth of 0.3% in Q1, marking the strongest growth since Q3/22 and signaling an exit from the mild recession observed in the previous two quarters.

Take the guesswork out of investing: Backtest your strategies with ease!

Key Economic Highlights This Week in Asia-Pacific

In China, the May Caixin Manufacturing PMI, signaling the trajectory of small and medium-sized enterprises, rose from 51.4 to 51.7, exceeding expectations, indicating a slight acceleration in manufacturing sector growth driven by increased new orders and production.

On the Asian front, Wednesday will see the release of the May Caixin Services PMI data in China. In April 2024, the Caixin Services PMI decreased to 52.5 from March’s 52.7, meeting expectations.

Friday will also feature the release of May’s external trade data in China. China’s trade surplus decreased to $72.35 billion in April 2024 from $86.46 billion in the same period a year earlier. The trade surplus with the United States increased to $27.2 billion in April from $22.94 billion in the previous month.

On Friday, attention will also turn to the meeting of the Central Bank of Russia. The Bank is expected to the keep the interest rate unchanged.

Other indicators to watch in Asia include South Korea’s final GDP growth rate for Q1 and inflation rate for May, China’s foreign exchange reserves for May and Japan’s household spending for April.