Global Markets Recap

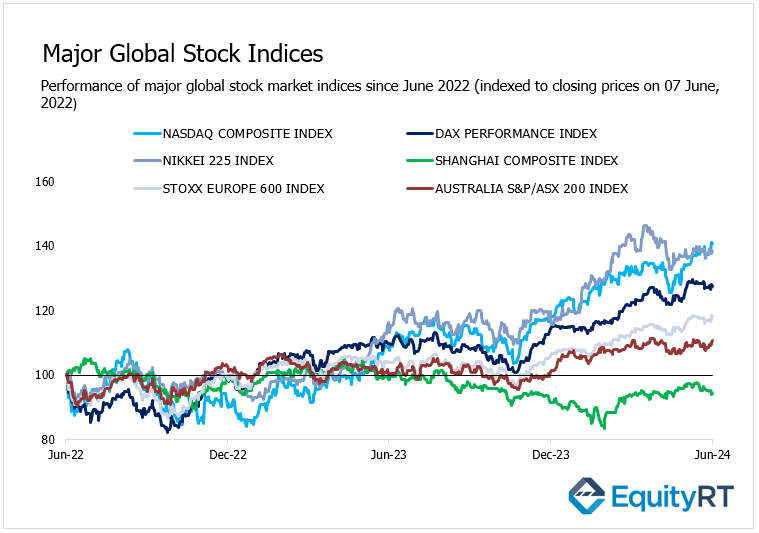

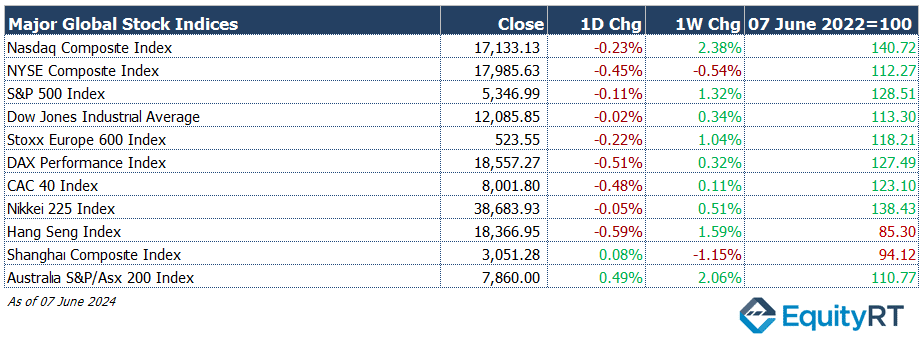

On Friday, Wall Street indices closed the day with losses after the non-farm employment growth and the average hourly earnings increase rate for May in the US exceeded expectations. This weakened investors’ expectations that the Fed would start cutting interest rates this year.

European stocks closed lower on Friday, contrasting with the upward trend seen in the Asia-Pacific region’s stock markets. Markets in Australia, China, and Hong Kong were closed on Monday due to a holiday

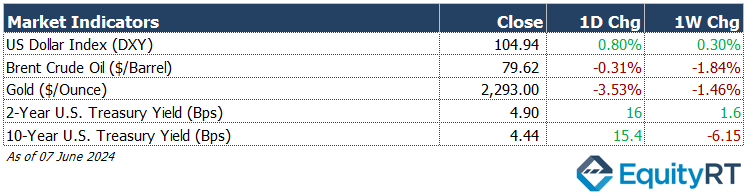

The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 104.9 marking a 0.30% weekly rise.

The Brent crude oil (#LCO07) closed the previous week at USD 79.6 per barrel, reflecting a 1.84% weekly loss.

The price of gold (#XAU) closed last week with a 1.46% loss, settling at USD 2,293.00 per ounce.

The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, closed at 4.90% with a 1.6 basis points weekly gain. The 10-year U.S. Treasury yield (#USGG10YR) completed the week with a 6.15 basis points loss, settling at 4.44%.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Overview of Key Economic Indicators in the US

Let’s take a look at the macroeconomic indicators and developments tracked in the US last week:

- Labour Market Indicators

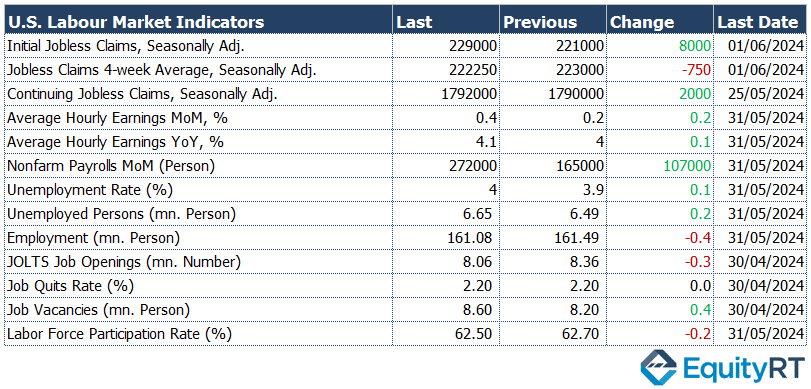

In the US, non-farm employment data for May showed a significant increase from 165,000 to 272,000, surpassing expectations of 180,000. Additionally, the previous month’s data saw a slight downward revision from 175,000 to 165,000, indicating robust job growth.

The unemployment rate in May edged up slightly from 3.9% to 4%, reaching the highest level since January 2022. This was above expectations for it to remain flat at 3.9%. The number of unemployed increased by 157,000 to 6.65 million, while the number of employed fell by 408,000 to 161.1 million, highlighting shifts in the labor market.

Average hourly earnings, a crucial inflation indicator, rose from 0.2% to 0.4% month-over-month in May, exceeding expectations of a 0.3% increase and marking the highest level in four months. Annually, the growth rate increased from 4% to 4.1%, defying expectations for it to remain steady.

The JOLTS report for April revealed a decrease in job openings from 8.36 million to 8.06 million, a sharper decline than the expected drop to 8.34 million. This suggests a slight cooling in labor demand, with job openings at their lowest since February 2021.

- Trade Deficit

In April, the US trade deficit widened from $68.6 billion to $74.6 billion, the highest since October 2022, but remained below expectations of a $76.1 billion deficit. Imports grew by 2.4% to $338.2 billion, while exports saw a modest increase of 0.8% to $263.7 billion, reflecting complex international trade dynamics.

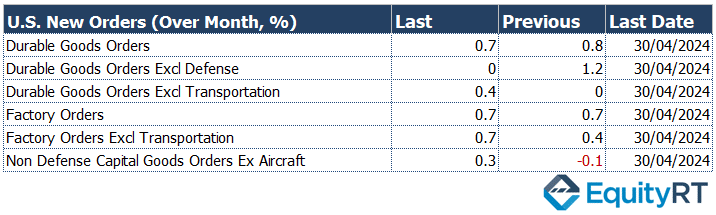

- Factory Orders

Factory orders increased by 0.7% in both March and April, surpassing expectations of a 0.6% rise. This consistent growth marks the third straight month of rising factory orders, highlighting resilience in the manufacturing sector.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Key U.S. Economic Indicators to Watch This Week

- Fed Interest Rate Decision and Powell’s Speech

In the US, all eyes are on the Federal Reserve’s upcoming interest rate decision and Chairman Powell’s speech scheduled for Wednesday. Alongside this, the Fed will unveil its new interest rate path and macroeconomic projections.

Chairman Powell’s recent remarks indicated that confidence in a decline in inflation is not as strong as in previous periods. He emphasized the need for patience regarding the inflation trajectory and suggested that the policy rate might remain high for an extended period. Many Fed members have echoed this sentiment, stating that they will be cautious about lowering interest rates. This indicates that potential rate cuts might occur later in the year.

It is widely anticipated that the Fed will keep interest rates unchanged at this week’s meeting.

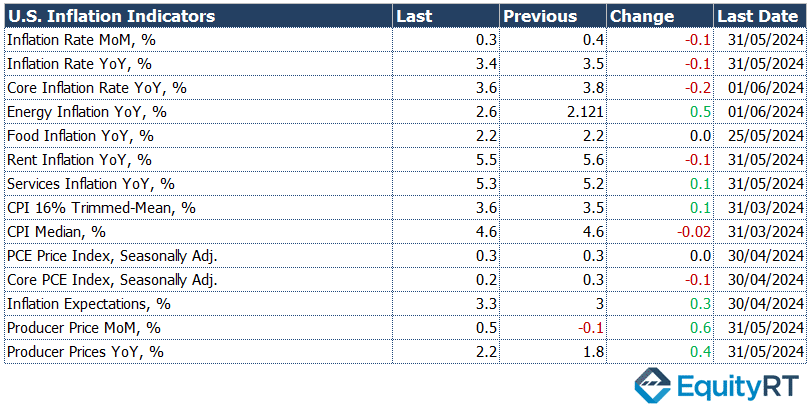

- April CPI and PPI Data Analysis

On Wednesday, the focus will be on the Consumer Price Index (CPI) for May, and on Thursday, the Producer Price Index (PPI) for May will be released.

In April, the Consumer Price Index (CPI) showed a notable change. The headline CPI‘s monthly growth rate slowed from 0.4% to 0.3%, which was below the expected 0.4%. Annually, the rate decreased from 3.5% to 3.4%, marking the lowest level in four months. The core CPI, which excludes food and energy prices, also saw a slowdown from 0.4% to 0.3% monthly, aligning with expectations, and from 3.8% to 3.6% annually, the lowest since April 2021.

The Producer Price Index (PPI) for April painted a different picture. The headline PPI increased by 0.5% after a 0.1% decline in March, surpassing expectations of a 0.3% rise. Annually, the rate climbed from 1.8% to 2.2%, the highest in a year. The core PPI, excluding food and energy, rose by 0.5% monthly after a 0.1% decline in March, exceeding expectations of a 0.2% rise, and increased from 2.1% to 2.4% annually, the highest in eight months.

- May CPI and PPI Forecasts

Looking ahead to May, the headline CPI is expected to slow to 0.2% monthly while remaining steady at 3.4% annually. The core CPI is anticipated to maintain a 0.3% monthly growth and slightly decrease from 3.6% to 3.5% annually.

The headline PPI is expected to slow to 0.2% monthly and remain at 2.2% annually. Meanwhile, the core PPI is forecasted to slow to 0.3% monthly and decrease from 2.4% to 2.3% annually.

- Labour Market Data

On Thursday, the weekly new jobless claims data will be released. The previous week’s claims increased from 221,000 to 229,000, indicating a relatively tight labor market despite being above expectations and historically low levels.

- Consumer Sentiment Index

On Friday, the preliminary June data for the University of Michigan Consumer Sentiment Index will be released. The May index was revised upward from 67.4 to 69.1, remaining at its lowest level in six months.

Take the guesswork out of investing: Backtest your strategies with ease!

Key Economic Indicators Release Last Week in Europe

- ECB’s Recent Decision

The European Central Bank (ECB) cut interest rates by 25 basis points in its latest meeting, aligning with expectations. This marks the first rate reduction in nearly five years. The ECB lowered the main refinancing rate from 4.50% to 4.25%, the marginal lending facility rate from 4.75% to 4.50%, and the deposit facility rate from 4.00% to 3.75%.

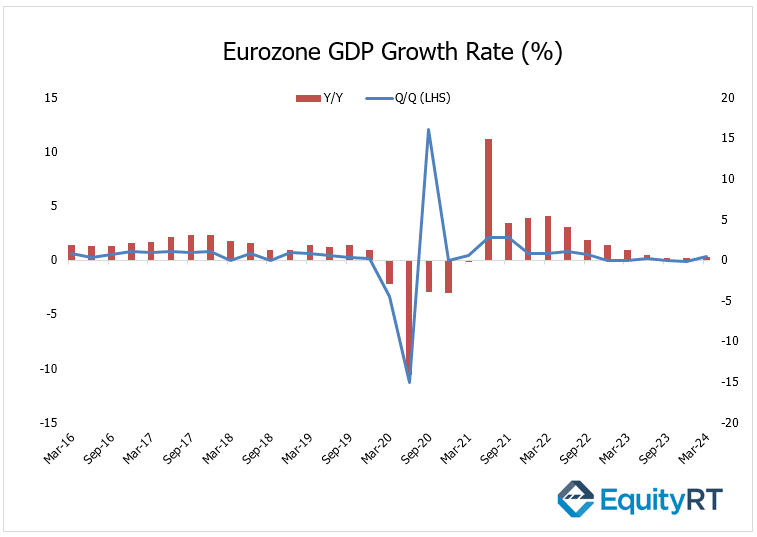

- Eurozone Economic Growth

The Eurozone economy grew by 0.3% in the first quarter of this year, in line with preliminary estimates, marking the strongest growth since Q3 2022. This growth offset the slight contraction of 0.1% in the previous quarter. On an annual basis, the growth rate increased from 0.1% to 0.4%.

- German Economic Performance

In Germany, exports increased by 1.1% in March and further accelerated to a 1.6% rise in April, surpassing expectations of a 1.1% increase. This marks the strongest export growth in 14 months and signals a recovery in external demand. Imports also grew by 0.5% in March and surged by 2.0% in April, exceeding the expected 0.5% rise and achieving the highest increase in seven months, indicating a rebound in domestic demand.

German industrial production fell by 0.4% in March and continued its decline with a 0.1% drop in April, contrary to expectations of a 0.2% increase. On an annual basis, the contraction rate of industrial production slowed from 4.3% to 3.9%.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Outlook: Key Events Driving Market Sentiment and Growth Prospects

- German CPI Announcement

Wednesday brings the final CPI figures for May in Germany, a crucial factor influencing ECB’s monetary policies. Projections suggest a 0.1% monthly increase and a 2.4% annual rise.

- UK GDP Growth Report

Watch out for April’s monthly GDP growth data from the UK. While January saw a 0.3% increase, February showed a 0.2% rise, and March recorded a 0.4% growth. Expectations for April indicate a stabilizing trend, with growth projected to remain flat at 0%.

- Eurozone Industrial Production

Thursday unveils April’s industrial production across the Eurozone. Following a 1% increase in February and a 0.6% rise in March, expectations are for a modest 0.1% monthly growth in April. Additionally, the annual decline in industrial production is forecasted to slow down to 1%.

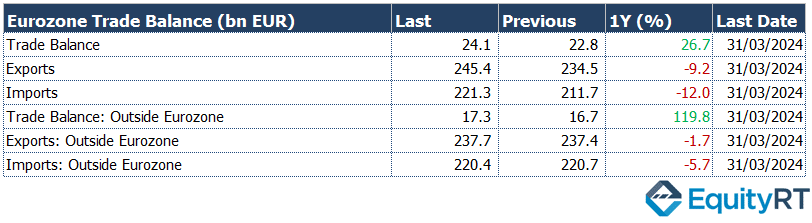

- Eurozone Trade Balance Data

Friday presents the trade balance figures for April in the Eurozone. March witnessed a surge in the trade surplus to €24.1 billion, the highest since December 2020. However, the surplus is anticipated to decrease to €15.7 billion in April.

Take the guesswork out of investing: Backtest your strategies with ease!

Key Economic Highlights This Week in Asia-Pacific

- China’s Trade and Inflation Data

In May, China’s annual export growth exceeded expectations, rising by 7.6%, indicating a rebound in external demand. However, import growth was more subdued, increasing by 1.8% annually, below expectations of 4.2%, reflecting weak domestic demand.

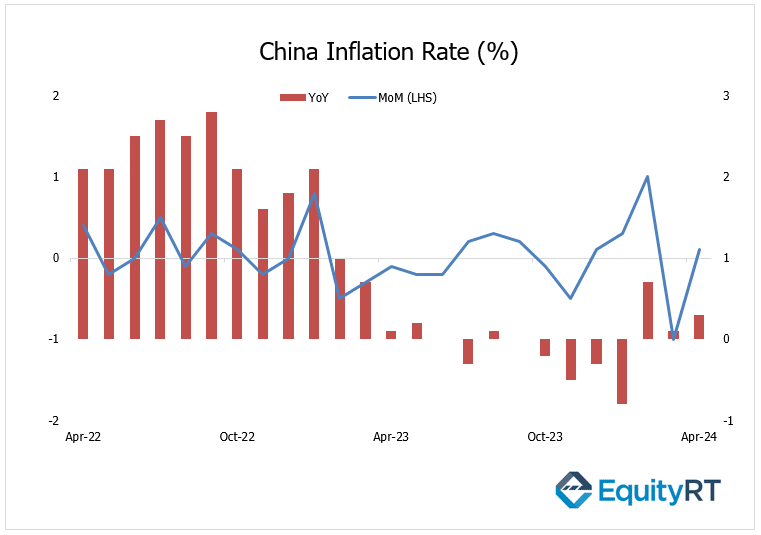

On Wednesday, China’s May CPI and PPI data will be providing insights into global inflation trends. In May, the Consumer Price Index (CPI) is expected to stay at 0.3% annually, while the Producer Price Index (PPI) decline is anticipated to ease from 2.5% to 1.8% annually.

- Russia’s Central Bank Policy

The Central Bank of Russia kept its policy rate unchanged at 16% for the fourth consecutive meeting, aligning with expectations.

- Japan’s Monetary Policy

On Friday, attention shifts to the Bank of Japan’s (BOJ) meeting. Following the cessation of negative interest rates in March, the BOJ maintained its policy rate between 0% and 0.10% in April. While the bank is expected to keep rates steady in this week’s meeting, any new signals regarding future monetary policy will be closely monitored.

Other key indicators to watch this week in Asia include Japan’s Q1 final GDP figures, India’s industrial production and inflation rate for April, China’s new yuan loans and FDI data, and the housing price index for May.