Global Markets Recap

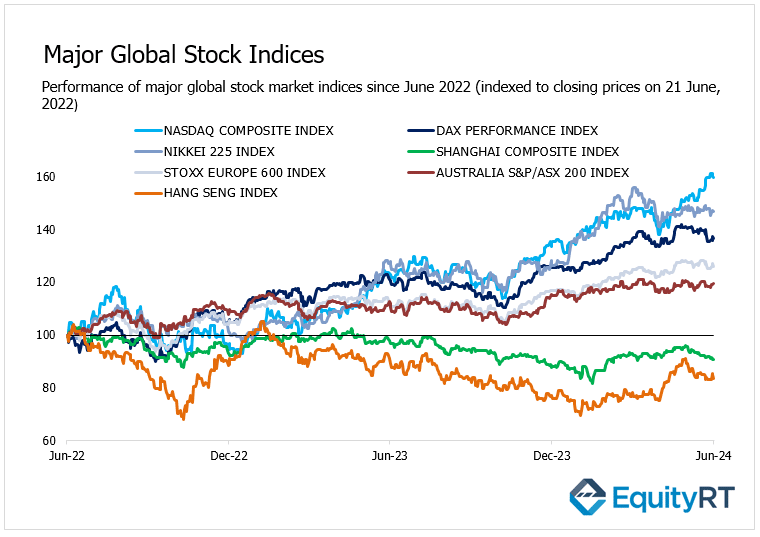

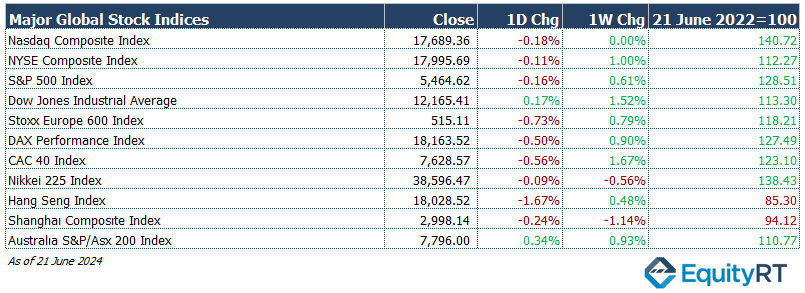

Following the release of June’s preliminary PMI data for the manufacturing and services sectors in the United States, which came in stronger than expected, market expectations regarding Federal Reserve interest rate cuts for this year weakened slightly. Additionally, the expiration of stock index options and futures contracts on the same day contributed to a predominantly downward close for Wall Street indices.

On Friday, European stocks and Asia-Pacific markets closed lower.

The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 105.82 marking a 0.29% weekly rise.

The Brent crude oil (#LCO07) closed the previous week at USD 85.07 per barrel, reflecting a 2.97% weekly gain.

The price of gold (#XAU) closed last week with a 0.44% loss, settling at USD 2,321.96 per ounce.

The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, closed at 4.74% with a 2.8 basis points weekly gain. The 10-year U.S. Treasury yield (#USGG10YR) completed the week with a 3.6 basis points gain, settling at 4.26%.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Key Economic Indicators Release Last Week in the US

Let’s take a look at the macroeconomic indicators and developments tracked in the US last week:

- Focus on S&P Global Manufacturing and Services PMI Data

In the U.S., attention was on the June PMI data from S&P Global, providing signals about the current economic activity. The preliminary PMI for the manufacturing sector increased from 51.3 to 51.7, indicating a slight acceleration in manufacturing growth due to increases in new orders and production. The preliminary PMI for the services sector rose from 54.8 to 55.1 in June, highlighting a mild acceleration in service sector growth driven by strong new business activity. This marked the highest level since April 2022, extending growth in the sector for the seventeenth consecutive month.

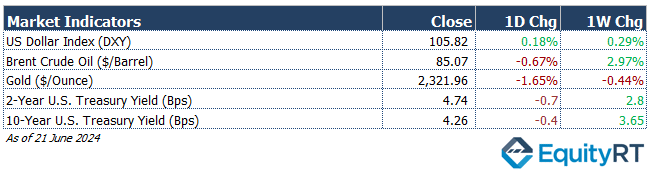

- Housing Market Trends Continue Downward

Data from the U.S. housing market showed continued declines. Existing home sales fell by 0.7% in May, following a 1.9% decline in April, marking the third consecutive month of decline. New housing starts decreased by 5.5% in May, following a 4.1% increase in April. Building permits also dropped by 3.8% in May, following a 3% decline in April, extending the downward trend for the third consecutive month.

- Employment Market Shows Resilience

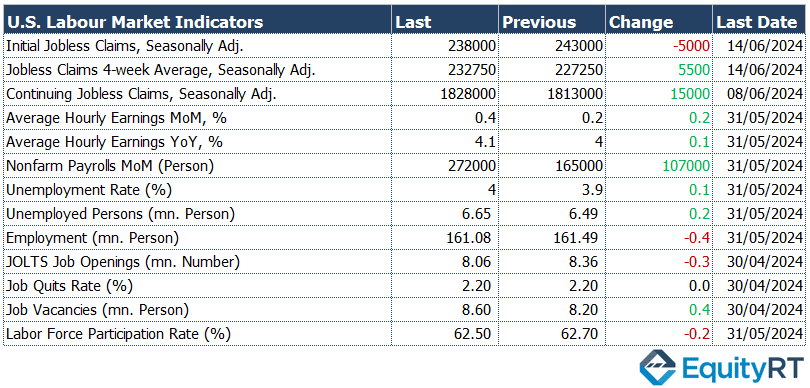

Weekly initial jobless claims for the week ending June 14 fell to 238,000, below expectations and down from 243,000, indicating a relatively tight labor market and remaining at historically low levels.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Key U.S. Economic Indicators to Watch This Week

- Focus on Consumer Confidence and Economic Indicators

On Thursday, attention in the U.S. will be on the May data for the Conference Board Consumer Confidence Index. Despite expectations of a slight decrease, the index rose from 97.5 to 102 in May, marking an increase after three months of decline. It is expected to dip slightly to 100 in June.

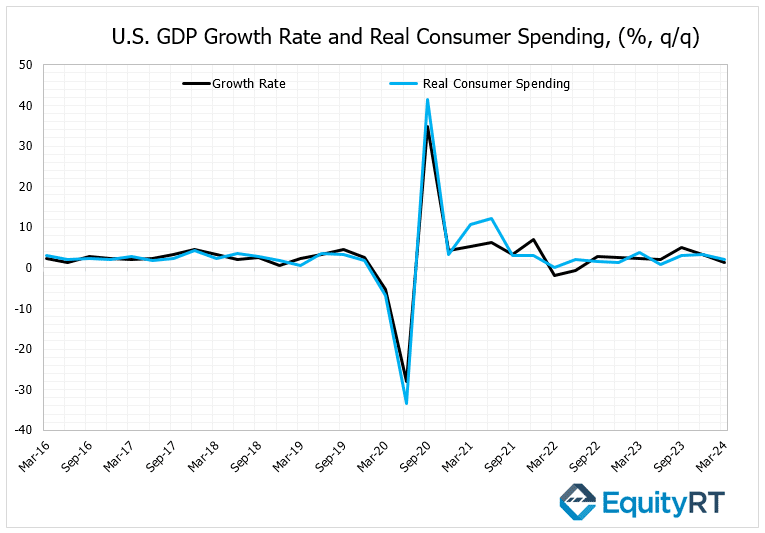

- Final GDP Growth Data for Q1 2024

Also on Thursday, the final annualized quarterly GDP growth data for the first quarter of the year will be released. Following a slight slowdown from 2.2% in Q1 to 2.1% in Q2 last year, GDP growth surged to 4.9% in Q3 and slowed to 3.4% in Q4. For Q1 2024, growth was revised downward from 1.6% to 1.3%, the lowest growth rate since the contraction in Q2 2022.

The revision was largely driven by lower-than-expected growth in consumer spending (revised down from 2.5% to 2%) while other components such as private inventory investment and federal government spending were revised downward, with local government spending, non-residential fixed investment, and residential fixed investment revised upward.

- Personal Consumption Expenditures (PCE) and Durable Goods Orders

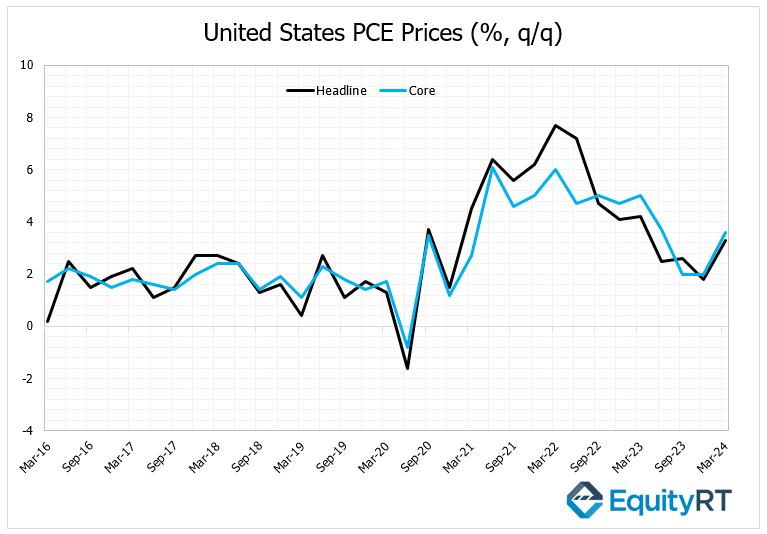

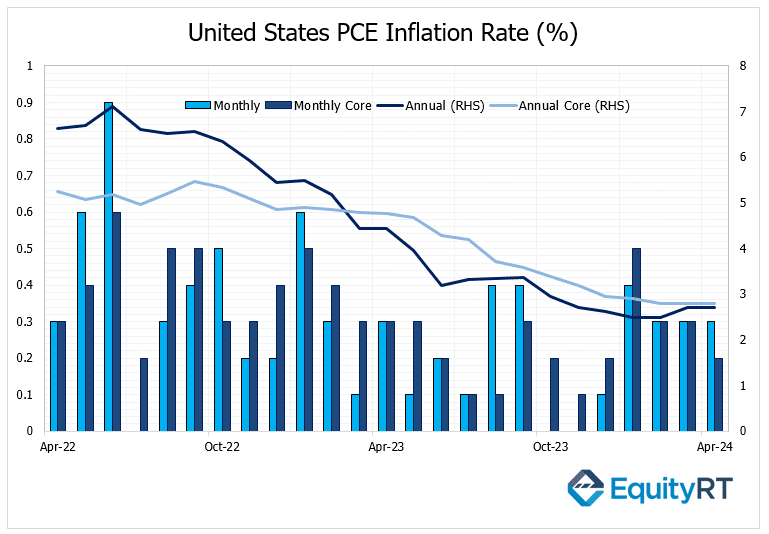

Thursday will also see the release of the final data for Q1 2024 on annualized quarterly basis for Personal Consumption Expenditures (PCE) price indexes, a key inflation indicator monitored by the Fed. The PCE price index for Q1 2024 was revised slightly downward from 3.4% to 3.3%, while the core PCE price index decreased from 3.9% to 3.6%, indicating a slight easing in price pressures.

In addition, the preliminary data for May’s durable goods orders will be monitored, following consecutive increases in March and April.

- Unemployment Claims and Other Economic Data

Thursday’s economic calendar includes the weekly initial jobless claims data, which showed a decline to 238,000 from 243,000, signaling a relatively tight labor market.

On Friday, focus will shift to the PCE deflator data for May, alongside personal income and spending data. The PCE deflator is expected to show a slowdown in monthly and annual increases, while personal income and spending are expected to rise slightly from April.

Furthermore, housing market data including the S&P/Case-Shiller Home Price Index for April, May’s new home sales data released on Wednesday, and pending home sales for May will be released throughout the week.

Lastly, the final Michigan Consumer Sentiment Index for June will be released on Friday, following a preliminary decrease from 69.1 to 65.6, marking the lowest level since November.

Take the guesswork out of investing: Backtest your strategies with ease!

Key Economic Indicators Release Last Week in Europe

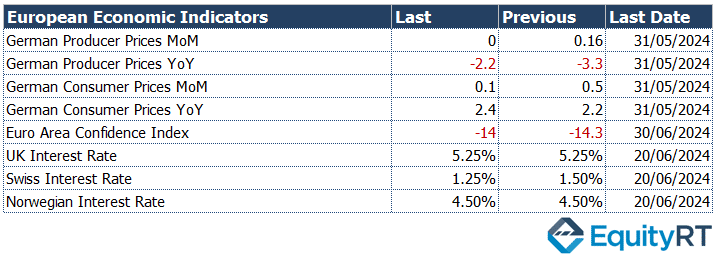

Recent economic indicators for June, such as the HCOB Manufacturing and Services PMI data, provided insights into the economic outlook across Europe:

Manufacturing PMI in the Eurozone declined from 47.3 to 45.6 in June, indicating a mild acceleration in contraction within the manufacturing sector and marking the lowest level in the past six months, except for the UK where it remained in expansion territory.

Services PMI in the Eurozone decreased from 53.2 to 52.6 in June, reaching its lowest level in the last three months but still indicating growth above the threshold for the past five months.

- Economic Developments in Germany

In Germany, the Producer Price Index (PPI) remained flat at 0% in May after a 0.2% increase in April, ending a two-month upward trend. Expectations had suggested a 0.3% monthly increase. On an annual basis, the PPI decline rate slowed from 3.3% to 2.2% in May, marking the eleventh consecutive month of decline.

- Consumer Confidence and Central Bank Actions

The preliminary Consumer Confidence Index for June in the Eurozone improved slightly from -14.3 to -14, maintaining its weak trajectory in negative territory but showing a slight recovery to the highest levels since February 2022.

The Bank of England (BoE) kept its policy interest rate unchanged at 5.25%, in line with expectations.

The Swiss National Bank reduced its policy interest rate from 1.50% to 1.25%, contrary to expectations of no change.

The Norwegian Central Bank kept its policy interest rate unchanged at 4.50%, in line with expectations, and indicated that the rate would likely remain at this level until autumn.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Outlook: Key Events Driving Market Sentiment and Growth Prospects

- Economic Assessments in Germany and Consumer Confidence in the Eurozone

Today, the IFO Business Climate Index for June was released in Germany, reflecting assessments from firms in manufacturing, construction, wholesale, and retail sectors regarding the current and future economic conditions for the next six months.

Additionally, on Wednesday, the GfK Consumer Confidence Index for July, reflecting expectations for the upcoming month, will be observed in Germany. The June data showed an unexpected improvement from -24 to -20.9, reaching its highest level since April 2022 but still maintaining a weak trajectory in negative territory.

- Eurozone Consumer Confidence and UK GDP Growth Data

Thursday will see the final Consumer Confidence Index for June in the Eurozone. The preliminary data showed a slight improvement from -14.3 to -14, maintaining its trajectory at the highest levels since February 2022 but still indicating weak sentiment in negative territory.

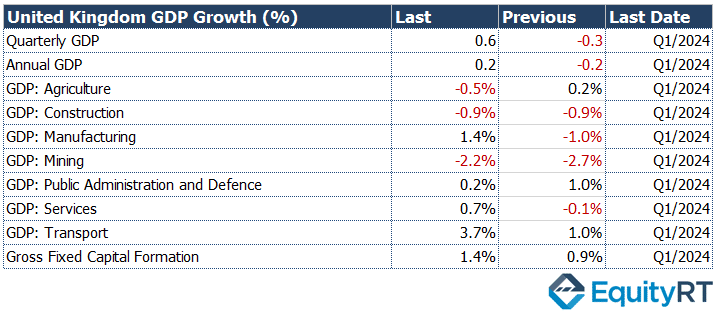

On Friday, final GDP growth data for Q1 2024 will be released in the UK. After entering a recession with consecutive quarterly contractions of 0.1% and 0.3% in Q3 and Q4 of the previous year, respectively, the UK economy showed unexpected resilience in Q1 2024 with a growth rate of 0.6%, surpassing expectations of a 0.4% increase.

Further analysis revealed a 0.8% increase in industrial production and a 0.7% rise in the services sector, offset by a 0.9% contraction in the construction sector.

On an annual basis, the economy rebounded with 0.2% growth in Q1 2024 following a 0.2% contraction in Q4 of the previous year.

- Swedish Central Bank Policy Decision

Thursday will also feature the meeting of the Swedish Central Bank. In its May meeting, the bank lowered its policy interest rate by 25 basis points to 3.75%, marking its first rate cut since 2016 and becoming the second central bank among developed countries to ease policy after the Swiss National Bank.

Expectations are for the bank to maintain its policy interest rate unchanged in its upcoming meeting.

Take the guesswork out of investing: Backtest your strategies with ease!

Key Economic Highlights This Week in Asia-Pacific

- Economic Updates from China

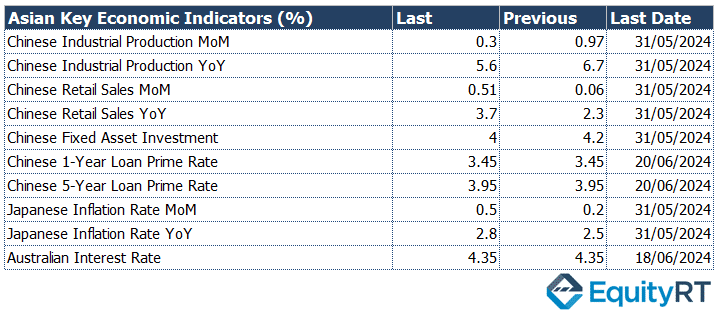

Year-on-year growth in industrial production slowed from 6.7% to 5.6% in May, falling below expectations of 6.3%. This slowdown indicates a deceleration in industrial activity.

Year-on-year growth in fixed asset investment decreased from 4.2% to 4.0% in May, also below expectations of 4.1%. This suggests a moderation in investment spending across various sectors.

Year-on-year growth in retail sales accelerated from 2.3% to 3.7% in May, surpassing expectations of 2.6%. This increase marks the strongest growth since February, indicating robust consumer spending.

The People’s Bank of China (PBoC) maintained the benchmark one-year Loan Prime Rate (LPR) for short-term loans at 3.45% and the five-year LPR for long-term loans at 3.95%, unchanged from previous levels.

- Inflation in Japan

Annual inflation in Japan rose to 2.8% in May 2024 from 2.5% in April, marking the highest level since February. Core inflation increased to 2.5% from the previous month’s 3-month low of 2.2%, slightly below market forecasts of 2.6%. Monthly, the Consumer Price Index (CPI) increased by 0.5%, the largest monthly rise since October.

- Monetary Policy in Australia

The Reserve Bank of Australia (RBA) kept its policy interest rate unchanged at 4.35%, aligning with expectations. However, the bank indicated the possibility of raising interest rates further if price pressures remain elevated in the coming months.

This weeks other economic indicators to watch in Asia include China’s Industrial profits (YTD) for May and National Bureau of Statistics (NBS) Purchasing Managers’ Index (PMIs) for June, Japan’s preliminary industrial production and unemployment rate for May and South Korea’s exports and imports data for June.