Global Markets Recap

U.S. Markets:

- The U.S. saw a week marked by increased volatility tied to earnings reports. In the first half of the week, Google and Meta Platforms disappointed with their earnings, while Amazon and Intel pleased investors with their results. Technology companies, primarily Nasdaq, experienced a drop of over 10% from their peak, entering a correction phase.

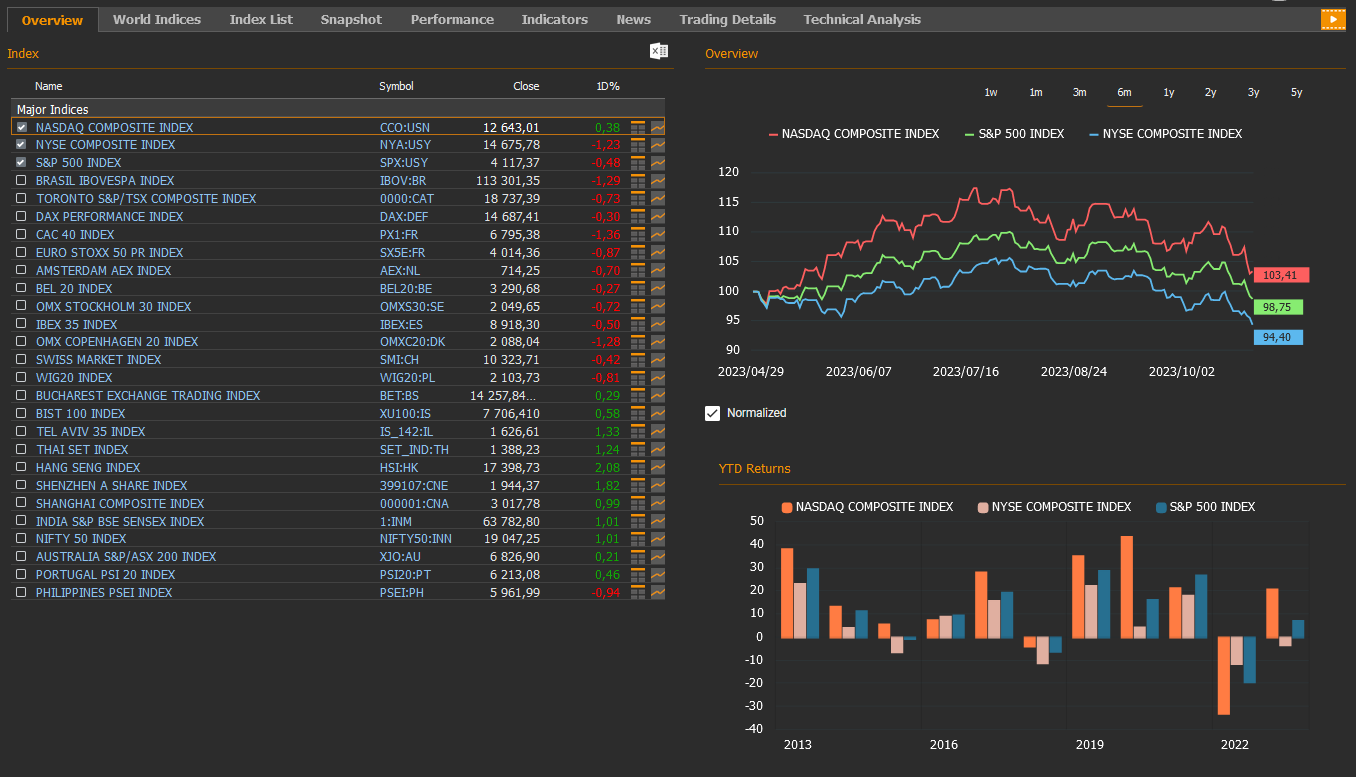

- On Friday, on a daily basis, the Nasdaq Composite index saw an increase of 0.38%, the S&P 500 index dropped by 0.48%, and the Dow Jones index closed the day with a decline of 1.12%. The NYSE Composite Index decreased by 1.23% to 14,675.78.

- The Dollar index ended the previous week with no change on a daily basis, closing at a level of 106.6.

- The price per barrel of Brent crude oil, last week, closed at 90.5 USD, marking a 1.8% decrease.

- The 10-year Treasury yield in the United States ended the previous week with a 8 basis point decrease, dropping a level of 4.83%. On the other hand, the 2-year Treasury yield, which is more sensitive to changes in monetary policy, ended the week at 5.00%, with a 7 basis point decrease.

European Markets:

- European stocks finished lower Friday, with the Stoxx Europe 600 Index SXXP, falling 0.84% to 429.58. The German DAXdropped 0.3% to 14,687, the French CAC 40 Index declined 1.4% to 6,798 and the FTSE 100 Index UKX fell 0.90% to 7,291.

- The yield on the 10-year UK Treasury bond yield dropped 6.66 basis points to 4.54%, and the yield on the German 10-year bond declined 3.33 basis points to 2.83%.

Asian Markets:

- Asia-Pacific stocks mostly climbed Friday. The Hang Seng Index increased 2.1% to 17,398.73, while the Nikkei 225 Index rose 1.27% to 30,991.69. The Shanghai Composite Index added 0.99% to 3,017.78.

- The S&P/ASX 200 Benchmark Index in Australian stock market gained 0.21% to 6,826.90.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

US Market Outlook and Economic Events

- Positive Economic Indicators in the United States

Positive data on the third-quarter GDP growth and durable goods orders for September in the United States have raised expectations regarding the Federal Reserve’s monetary policy. These favorable reports reflect the resilience of the country’s economy.

- Janet Yellen’s Perspective

U.S. Treasury Secretary Janet Yellen attributed the rising Treasury yields to the expanding economy rather than increased federal spending. She also emphasized that the current economic performance doesn’t indicate a recession in the near future.

Yellen predicts that, given the current economic performance, there is a high likelihood that interest rates will remain high for an extended period.

- Performance in the Manufacturing and Service Sectors

Preliminary data from S&P Global on economic activities in the United States offers insights into recent economic trends. Despite expectations of a slight contraction, the Manufacturing Sector PMI increased from 49.8 to 50, indicating that manufacturing activities have emerged from the contraction phase into a more stable period. Notably, new orders are growing at the fastest rate in the past year. Input prices increased, primarily due to rising prices of petroleum and petroleum-based raw materials. However, optimism regarding the future of the manufacturing sector is declining, suggesting potential slowing of sector activities in the near future.

The preliminary Service PMI for October in the United States increased from 50.1 to 50.9, surpassing expectations. This indicates an accelerated growth in the service sector, marking the fastest growth in the past three months. A detailed examination shows that the increase in new orders has slowed compared to the previous month. Nevertheless, firms have increased their employment levels. Furthermore, the rising optimism among service sector firms suggests a potential revival in service sector activities in the near future.

- Third-Quarter GDP Growth

The annualized quarter-on-quarter GDP growth rate in the United States increased from 2.2% in the second quarter to 2.9% in the third quarter, surpassing expectations (4.9%). A detailed analysis of the third-quarter growth data shows that, largely due to a significant increase in consumer spending, which constitutes a substantial part of the nation’s economy, the growth rate has reached its highest level since the last quarter of 2021.

Moreover, private inventory investments, net exports, federal and local government expenditures, and residential fixed investments all increased in the third quarter, while the decline in non-residential fixed investments constrained the growth.

- U.S. Personal Consumption Expenditures (PCE) Price Index

The initial data for the third quarter regarding the Personal Consumption Expenditures (PCE) price index, an important inflation indicator monitored by the Federal Reserve, have been released. According to this data, the annualized quarterly PCE price index has increased from 2.5% in the second quarter to 2.9% in the third quarter (expectations: 2.1%), indicating a significant rise.

Additionally, the core PCE price index, which excludes food and energy, decreased from 3.7% to 2.4%, falling below expectations (2.5%). This marks the lowest level since the last quarter of 2020.

- Michigan University Consumer Confidence Index

The final version of the Michigan University consumer confidence index for October was tracked in the United States.

The Michigan University consumer confidence index for October was revised slightly upward from 63 to 63.8, despite expectations of remaining flat. Nevertheless, it continued to maintain its lowest level in the last five months. When looking into details, in October, the current conditions sub-index was revised upward from 66.7 to 70.6, while the expectations sub-index was revised slightly downward from 60.7 to 59.3 due to increasing concerns about consumers’ personal financial situations. Furthermore, consumers’ one-year inflation expectations were revised upward from 3.8% to 4.2%, reaching the highest level in the last five months, while long-term annual inflation expectations remained at 3%.

- Durable Goods Orders for September

Data on durable goods orders for September in the United States have also been released. After a 5.6% decrease in July and a 0.1% decrease in August, durable goods orders increased significantly by 4.7% in September, surpassing expectations (1.7%).

A closer look at the data shows that a substantial increase in orders for non-defense aircraft and parts in September has significantly contributed to the increase in durable goods orders. Additionally, capital goods orders, excluding aircraft and defense, increased by 0.6% after a 1.1% increase in August, signaling positive trends in investments.

- Unemployment Claims for the Week Ending October 21

Unemployment claims data for the week ending October 21 in the United States indicates that initial jobless claims increased slightly from 200,000 to 210,000, remaining close to their lowest levels in recent history and reflecting the continued tightness in the labor market.

- Housing Market Data

Data on pending home sales, which represent homes that have been sold but have not yet closed, showed a 7.1% monthly decrease in August following a similar decrease in July. However, the data indicate a 1.1% increase in September, partly recovering from the expected decreases.

The data on new home sales increased by 12.3% in September following an 8.2% decrease in August, significantly exceeding expectations (1% increase). As a result, September’s new home sales on a monthly basis reached their highest level since February 2022 and the highest level since August 2020.

Tight supply in the market for existing homes, coupled with rising mortgage interest rates due to the Fed’s interest rate hikes, is leading to increased demand for new homes.

- Mortgage Applications

Data from the Mortgage Bankers Association (MBA) in the United States indicates that mortgage applications decreased by 1% in the week ending October 20, following a trend that has persisted since 1995.

The average interest rate for 30-year fixed-rate mortgages increased from 7.7% to 7.9%, marking the seventh consecutive weekly increase. The average interest rate for 15-year fixed-rate mortgages increased from 6.98% to 7.08%.

- Bank of Canada Keeps Interest Rate at 5%

The Bank of Canada has maintained its policy interest rate at 5%, the highest level since 2001, consistent with expectations, thus pausing interest rate hikes for the past two months. The Bank also signaled that future interest rate decisions will be based on the latest economic data, noting that past rate increases have weakened economic activity and constrained price increases.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Upcoming US Economic Indicators

Markets are entering another week, with expectations set for the Federal Reserve’s upcoming meeting. While the U.S. economy continues to show strength, it is widely anticipated that the Fed will keep interest rates unchanged at their meeting scheduled for Wednesday, November 1st. However, signs pointing toward the possibility of an impending interest rate hike are expected to be seen in the policy statement and comments by Fed Chair Jerome Powell.

Key macroeconomic data releases for the week include Consumer Confidence, JOLTS Job Openings, Durable Goods Orders and Factory Orders, Conference Board Confidence Index, S&P/Case-Shiller 20 House Price Index, the ISM Manufacturing and Services Indices, and Nonfarm Payrolls data.

Earnings reports will remain in focus, with Apple set to report its earnings after the close of trading on Thursday. Other notable earnings announcements during the week include McDonald’s today, AMD tomorrow, Airbnb and PayPal on Wednesday, and Shopify, Palantir, and Coinbase on Thursday. These earnings reports will provide insight into the financial performance of these major companies and may influence market sentiment.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

- ECB’s Interest Rate Decision

In Europe, the focus was on the ECB’s interest rate decision and ECB President Lagarde’s speech. The ECB kept interest rates stable in line with expectations, pausing interest rate hikes. Accordingly, the key refinancing rate remained at 4.50%, the marginal lending rate at 4.75%, and the deposit facility rate at 4%.

- Data-Driven Approach

The decision statement mentioned that the Bank would continue to follow a data-based approach in determining the appropriate level and duration of constraints. It was emphasized that interest rates were believed to be at a level that would contribute significantly to lowering inflation to 2% when maintained for a sufficient period.

Furthermore, it was stated that future decisions would ensure that interest rates would be set at a sufficiently restrictive level as long as necessary and that although inflation continued to decline, it was expected to remain high for a very long time.

- Impact of Past Interest Rate Increases and Asset Purchase Programs

The statement also highlighted the impact of past interest rate increases, indicating that these had continued to be reflected in financial conditions, reducing demand while helping to lower inflation.

On the other hand, it was mentioned that the Asset Purchase Program (APP) portfolio size continued to shrink due to the absence of principal payments, and in the Pandemic Emergency Asset Purchase Program (PEPP), principal payments would continue until at least the end of 2024, but attention would be paid not to disrupt the goals of monetary policy.

- Lagarde’s Remarks

Following the interest rate decision, ECB President Lagarde stated that price pressures in the Eurozone remained strong, and inflation would continue to be high for a very long time, with interest rates remaining high for an extended period. She also emphasized that there was no discussion of interest rate cuts.

- Economic Weakness in Eurozone

Lagarde further noted that the Eurozone economy was weak, with the production side continuing to weaken, and investment and consumer spending negatively affected. In this context, it was mentioned that the risks to economic growth were downward, and that shrinking demand had a diminishing effect on inflation.

- Inflation Trends

Lagarde also pointed out that in September, inflation had significantly decreased due to base effects, and short-term inflation was expected to decrease, although the underlying causes of low inflation had decreased, some indicators needed to be closely monitored, especially rising long-term interest rates, and the predictability of energy prices had become difficult.

- Monetary Policy Elasticity

Lagarde emphasized that the elasticity of monetary policy was very high, and while acknowledging that demand and inflation were interrelated, she stated that monetary policy needed to be more elastic to affect the real economy.

- Preliminary PMIs and Consumer Confidence Index

Across Europe, in October, preliminary manufacturing PMIs indicated a contraction zone below the 50 growth threshold, primarily due to tightening financial conditions and weakening demand following the ECB’s interest rate hikes.

Looking at the preliminary services PMI for the Eurozone, it dropped from 48.7 to 47.8 in October, indicating a slight increase in the pace of contraction in the service sector and signaling a third consecutive month of contraction. This contraction in October was recorded as the most significant decline since February 2021 and May 2013 when excluding the pandemic period.

In Germany, the GfK consumer confidence index for November dropped from -26.7 to -28.1, showing a decrease above expectations and maintaining its lowest level since April.

- IFO Business Climate Index

In Germany, firms operating in the manufacturing, construction, wholesale, and retail trade sectors reflected their assessments for the current and upcoming six months in the IFO Business Climate Index for October.

The IFO Business Climate Index increased above expectations in October, reaching 86.9, up from 85.8 after a six-month period. When looking into details, the current conditions index increased from 88.7 to 89.2, and the expectations index increased from 83.1 to 84.7, reaching the highest level in the last five months, indicating a limited decrease in pessimism among companies about the upcoming months.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

European Economic Data and Central Bank Meetings

Eurozone PMI Data and Inflation Figures: The European economic outlook for the upcoming week will be influenced by October preliminary HICP figures and the IHS Market PMI surveys for the manufacturing and services sectors in the Eurozone. These data points will offer insights into the health of the region’s economy.

On Monday, Germany will release its preliminary consumer price index (CPI) data for October. In recent months, Germany’s headline CPI experienced a 0.3% monthly increase in June, July, and August, and in September, it rose by 0.3% as expected.

On Tuesday, the preliminary harmonized index of consumer prices (HICP) data for October will be released for the Eurozone. In September, the monthly inflation rate for the HICP declined from 0.5% to 0.3%, and the yearly inflation rate fell from 5.2% to 4.3%, the lowest since October 2021. The core HICP’s yearly rate in September decreased from 5.3% to 4.5%, the lowest since August last year.

The preliminary data for October suggests a further slowdown in the monthly inflation rate in the Eurozone from 0.3% to 0.2%, and the yearly rate is expected to decline from 4.5% to 3.1%. The core HICP is also expected to drop from 4.5% to 4.2%.

Bank of England Interest Rate Decision: The Bank of England (BoE) will announce its interest rate decision on Thursday. The previous BoE meeting saw a division among members regarding a rate hike, and the central bank chose to keep rates unchanged. The decision was seen as temporary, and the BoE may take further action if inflation begins to decline as expected.

Norwegian Central Bank Meeting: On Thursday, the Norwegian Central Bank will also make its interest rate decision. In its previous meeting, the central bank raised rates and indicated the likelihood of further tightening in the future. The decision will be influenced by economic developments, and another rate hike is anticipated in December.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Asia for the Week

Chinese Economic Indicators and BOJ Meeting

- China’s Manufacturing and Non-Manufacturing PMI: In China, this week will be marked by the release of October’s official manufacturing and non-manufacturing PMI data, as well as Caixin’s manufacturing PMI figures.

September’s official manufacturing PMI indicated that China’s manufacturing sector had returned to growth since April. The non-manufacturing PMI also showed a slight increase, marking the ninth consecutive month of growth in non-manufacturing sectors.

Caixin’s manufacturing PMI data on Thursday will provide insights into the activities of small and medium-sized enterprises in China.

- Bank of Japan (BOJ) Interest Rate Decision: The Bank of Japan’s interest rate decision is scheduled for Tuesday. During their last meeting, the BOJ signaled an upcoming change in monetary policy, emphasizing the need for an ultra-loose policy until a sustainable 2% inflation level is reached.

It is anticipated that the central bank will maintain its current interest rate and yield curve control policy during this week’s meeting.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Key Takeaways

U.S. Economic Events:

- Positive economic indicators, including strong Q3 GDP growth and durable goods orders, reflect economic resilience.

- Treasury Secretary Janet Yellen attributes rising yields to economic expansion and predicts extended high-interest rates.

- Stabilizing manufacturing and accelerated service sector growth but concerns about manufacturing slowdown.

- Higher-than-expected Q3 GDP growth driven by consumer spending.

- Rising inflation, increased consumer confidence, and fluctuations in the housing market.

European Economic Events:

- ECB paused interest rate hikes, emphasized data-driven policy, and cited high inflation expectations.

- Preliminary HICP and PMI data provide insights into the Eurozone’s economic health.

- GfK consumer confidence index in Germany shows a limited decrease in pessimism among companies.

- Weak Eurozone economy with continued weakening on the production side.

- Inflation trends and the elasticity of monetary policy are areas of focus.

Asian Economic Events:

- China’s official PMI data indicate manufacturing sector growth since April and continued growth in non-manufacturing sectors.

- Caixin’s manufacturing PMI provides insights into small and medium-sized enterprises in China.

- The Bank of Japan (BOJ) is expected to maintain its current monetary policy, emphasizing the need for 2% sustainable inflation.

- Regional focus on China’s economic activities and their implications for global markets.