Global Stock Market Highlights

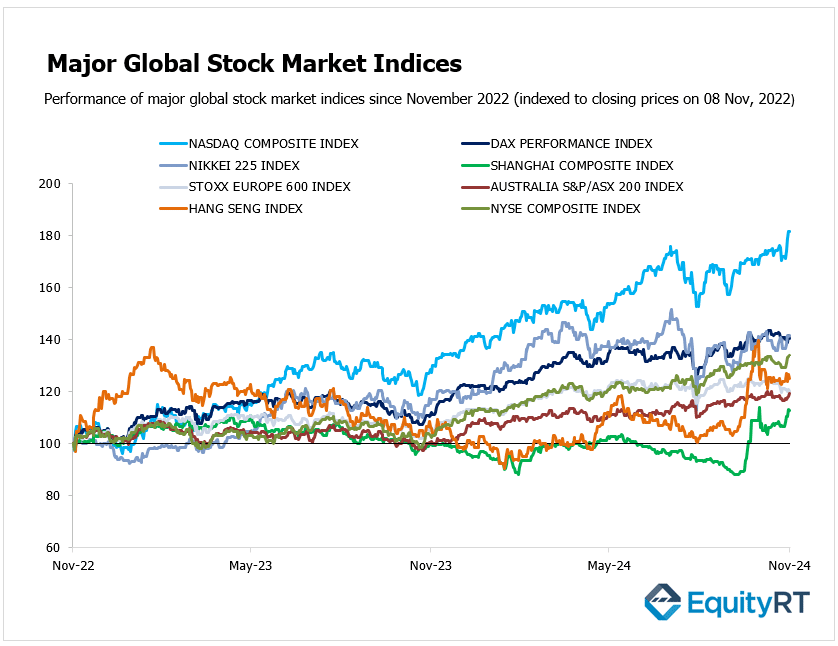

U.S. stocks closed at record highs on Friday, with the Dow and S&P 500 posting their best weekly performance in a year. This surge followed the conclusion of the U.S. presidential election, continued Fed rate cuts, and a preliminary reading of the University of Michigan’s consumer confidence index reaching a seven-month high.

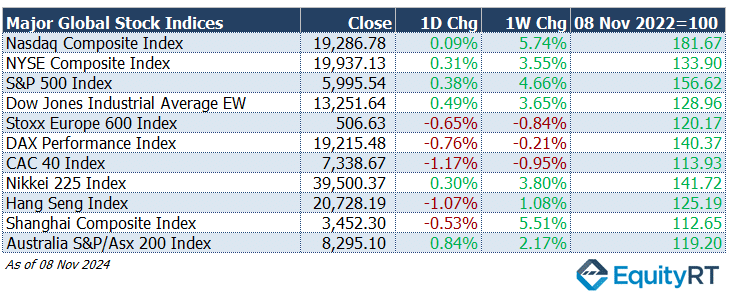

- Nasdaq Composite Index edged up to 19,286.78, gaining 0.09% for the day and 5.74% over the week.

- NYSE Composite Index closed at 19,937.13, showing a daily increase of 0.31% and a weekly rise of 3.55%.

- S&P 500 Index reached 5,995.54, with a daily boost of 0.38% and a 4.66% gain for the week.

- Dow Jones Industrial Average EW climbed to 13,251.64, rising by 0.49% on the day and 3.65% over the week.

In the U.S., bond markets will be closed today due to Veterans Day, but stock exchanges will remain open.

European markets traded lower, influenced by mixed corporate earnings and recent quarter-point rate cuts from both the U.S. Federal Reserve and the Bank of England.

- Stoxx Europe 600 Index declined to 506.63, slipping 0.65% for the day and down 0.84% for the week.

- DAX Performance Index dropped to 19,215.48, decreasing 0.76% today and slightly down by 0.21% this week.

- CAC-40 Index fell to 7,338.67, losing 1.17% today and 0.95% over the week.

Asian markets ended mixed on Friday, reacting to a recent interest rate cut by the U.S. Federal Reserve, while major U.S. indexes continued their rally following the presidential election.

- Shanghai Composite Index closed at 3,452.30, losing 0.53% today but gaining 5.51% over the week.

- Hang Seng Index dropped to 20,728.19, down 1.07% for the day but rose by 1.08% this week.

- Nikkei 225 Index increased to 39,500.37, gaining 0.30% for the day and 3.80% for the week.

- Australia’s S&P/ASX 200 Index rose to 8,295.10, up 0.84% for the day and 2.17% for the week.

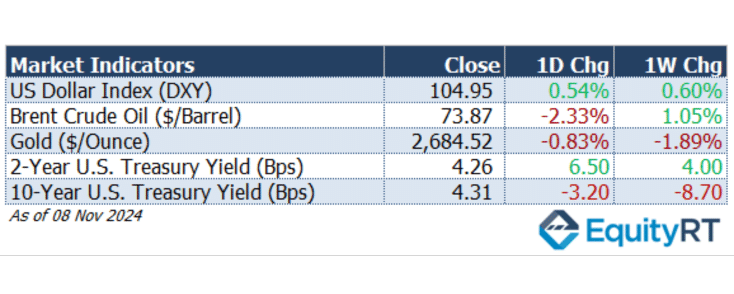

- The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 104.95, up 0.54% on the day and showing a weekly increase of 0.60%.

- The Brent crude oil (#LCO07) the global oil price benchmark, ended at $73.87 per barrel, falling 2.33% for the day but rising 1.05% over the week, reflecting volatility in energy markets.

- The gold (#XAU) was priced at $2,684.52 per ounce, down 0.83% on the day and 1.89% lower for the week amid mixed market signals.

- The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, closed at 4.26 basis points, gaining 6.50 bps on the day and 4.00 bps for the week, influenced by short-term rate hikes.

- The 10-year U.S. Treasury yield (#USGG10YR) finished at 4.31 basis points, decreasing by 3.20 bps on the day and down 8.70 bps for the week, showing easing pressures on long-term yields.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

This week’s economic calendar is filled with key U.S. macro data and Federal Reserve speeches, all of which could provide significant insights into the nation’s economic trajectory.

On Tuesday, the spotlight will initially be on the NFIB Business Optimism Index for October, with a slight increase from 91.5 to 91.9 expected, reflecting the current business climate’s sentiment.

It is a key indicator of the health of the small business sector and reflects their expectations regarding economic conditions, business prospects, and hiring plans.

On the same day, Fed Governor Christopher Waller is scheduled to speak, followed by Richmond Fed President Thomas Barkin, both potentially offering additional context on the Fed’s stance moving forward.

The RCM/TIPP Economic Optimism Index for November is anticipated to rise to 47.3, up from the previous 46.9. The Index rose by 0.8 points to 46.9 in October 2024, marking the highest level since April 2023.

Wednesday brings more significant data releases, beginning with the weekly MBA Mortgage data.

The MBA 30-Year Mortgage Rate rose to 6.81% during the week ending November 1, marking an increase from 6.73% the previous week. This is the second consecutive week of rising rates and the highest level since late July 2024.

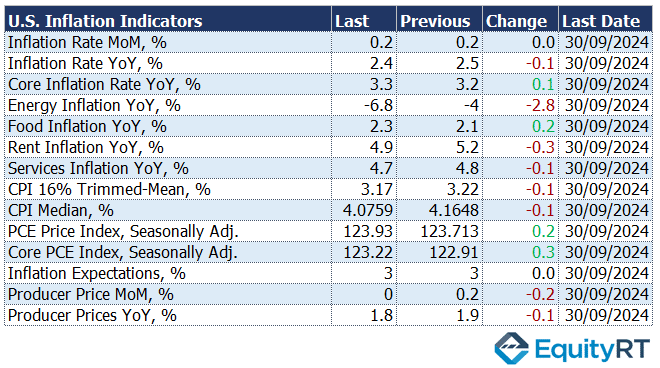

Additionally, the October Consumer Price Index (CPI) data, anticipated at 0.2% month-over-month and 2.6% year-over-year, will be released on Wednesday.

Core inflation is expected to hold steady, with both monthly and annual inflation rates projected at 0.3% and 3.3%, respectively.

The CPI rose 0.2% in September, matching the previous two months’ gains and surpassing expectations of 0.1%.

On an annual basis, inflation continued to decelerate for the sixth consecutive month, falling to 2.4% from 2.5% in August. This marked the lowest inflation rate since February 2021 but still exceeded forecasts of 2.3%.

Core inflation remained steady at 0.3% month-over-month, in line with August’s figure but higher than the 0.2% forecasted by analysts. It indicated persistent inflationary pressures beyond just energy costs, which will likely remain a focal point for policymakers and investors.

These data points suggest that inflationary pressures are easing but still present in certain areas, particularly core goods and services, which could influence future decisions by the Federal Reserve.

The Producer Price Index (PPI) data, due Thursday, will be another vital economic indicator, especially for assessing wholesale inflation trends.

The headline PPI is forecasted to inch up by 0.2% month-over-month, raising the annual rate to 2.3%, while core PPI is projected to increase by 0.3% month-over-month and by 3% year-on-year.

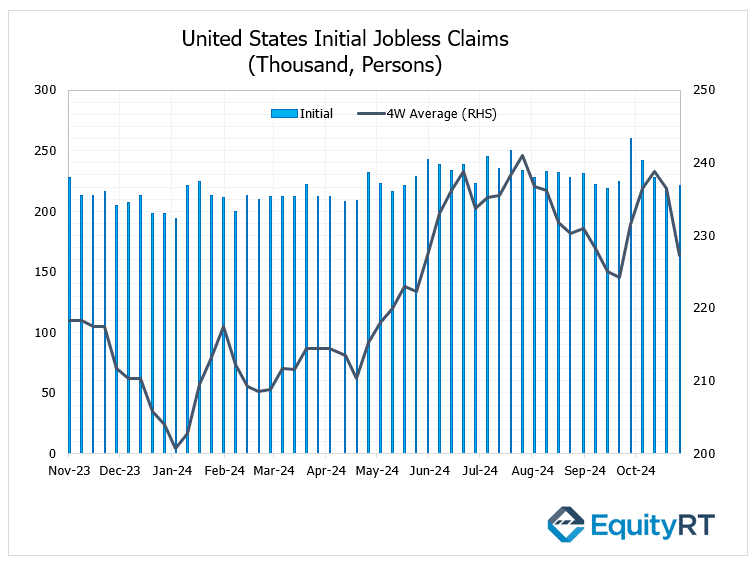

Job market insights will also come from the initial jobless claims, estimated at 222,000, and the continuing claims data.

In the final week of October 2024, the initial jobless claims rose by 3,000, reaching 221,000. This increase was in line with market expectations, yet the figure remained significantly below the earlier month’s averages, suggesting ongoing stability in the labour market.

Additionally, the four-week moving average, which smooths out weekly fluctuations, decreased by 9,750, settling at 227,250, indicating a resilient labour market despite the slight rise in claims.

Wrapping up the week on Friday, October’s retail sales data will be released, giving insights into the current state of domestic demand.

Monthly retail sales are expected to increase by 0.3%, like the previous month, while core retail sales are projected to rise by 0.3% month-over-month.

October’s industrial production and capacity utilization rate data will also be released on Friday. Expectations indicate a further decrease in industrial production by 0.4% month-over-month, with the capacity utilization rate likely to ease slightly to 77.1%.

Additionally, the New York Fed Empire State Manufacturing Index for November will be monitored to see the latest outlook on manufacturing output.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

Across Europe, attention will shift towards the European Central Bank (ECB) with the release of the accounts from its recent monetary policy meeting, following a series of rate cuts.

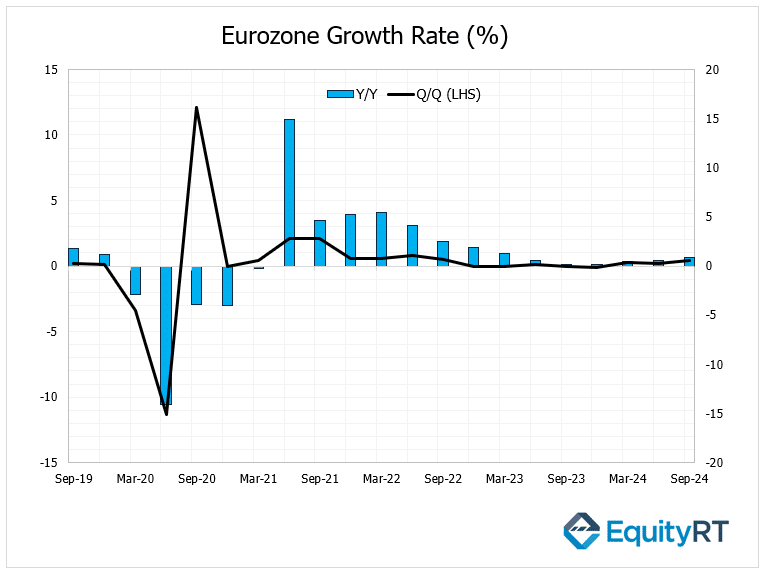

The Eurozone’s final Q3 GDP data will be under the spotlight on Thursday.

The Eurozone’s GDP grew by 0.4% quarter-on-quarter in the three months leading up to September 2024, marking its strongest growth rate in two years.

On a year-on-year basis, the Eurozone economy expanded by 0.9%, the strongest annual growth since the first quarter of 2023, exceeding the 0.6% growth in the previous quarter and outpacing the forecasted 0.8%.

Preliminary estimates indicate that the economy is recovering more robustly than anticipated.

The European Central Bank (ECB) has projected that the Eurozone’s GDP will grow by 0.8% for the full year of 2024, aligning with the recent figures showing resilience in the region’s economic recovery.

Germany’s ZEW sentiment index is expected to show improvement, potentially signaling a recovery in economic sentiment.

On Tuesday, final inflation data will be released for Germany. In Germany, headline CPI rose by 0.4% in October after being flat in September, reaching the highest level in six months and hitting the ECB’s 2% target. Core CPI also edged up from 2.7% to 2.9%.

Additionally, Germany’s wholesale prices, will be released on Friday.

The UK economy is projected to grow by 0.2% in Q3, a slowdown from the 0.5% growth in Q2. September’s GDP is expected to rise by 0.2%, with industrial production continuing its upward trend for a second consecutive month.

The unemployment rate is expected to reach 4.1%, with wage growth anticipated to rise, suggesting continued strength in the labour market. Key trade data for the UK is also set for release on Friday.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

This week, a mix of key data from major Asian economies, including China, Japan, India, South Korea, and Australia, will shape expectations for global growth and could influence monetary policy decisions in the region.

China is set to release a comprehensive batch of economic data for October, which will give clues on the initial effects of the monetary stimulus measures recently introduced by the government. Investors will be closely tracking these figures to assess how effectively the stimulus is supporting the economy.

Key data releases include industrial production, retail sales, new yuan loans, housing prices, the unemployment rate, as well as both consumer and producer inflation rates.

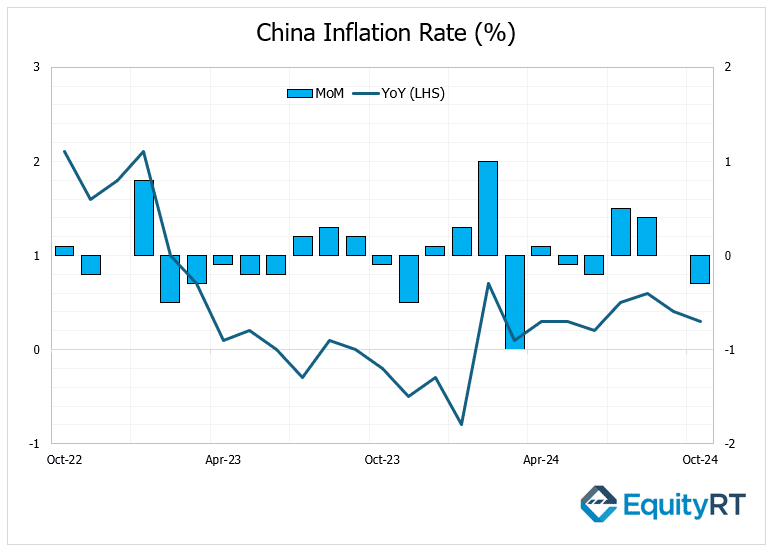

China’s annual inflation rate eased to 0.3% in October 2024, down from 0.4% in September and below expectations, marking the ninth consecutive month of consumer inflation but the lowest since June, indicating rising deflation risks despite Beijing’s stimulus measures.

Meanwhile, producer prices fell by 2.9% year-on-year, exceeding the expected 2.5% drop, continuing a 25-month deflationary trend that points to persistently weak domestic demand despite ongoing government support.

Along with the economic data, there will be close attention on Beijing’s recent decision to carry out a CNY 10 trillion debt swap with local governments. This move aims to ease fiscal pressure and boost growth. The swap is generating considerable interest as it is expected to impact China’s fiscal policies and debt management in the future.

In Japan, the economic spotlight will be on the Q3 GDP estimates, which are expected to show a slowdown in economic growth, reflecting the challenges of managing inflation and external economic pressures.

Investors will also be keeping an eye on Japan’s current account balance and the Bank of Japan’s (BoJ) Summary of Economic Opinions, which could provide further insight into the central bank’s view of the economy and its future monetary policy stance.

India will experience a busy week of economic data releases, with the inflation rate for October expected to rise further, potentially testing the Reserve Bank of India’s (RBI) upper tolerance limit. Along with inflation, India will update key metrics such as industrial production and its trade balance, giving a picture of the country’s economic trajectory.

In South Korea, the unemployment rate will be released, which offers a snapshot of labor market conditions.

In Australia, all eyes will be on consumer sentiment surveys from Westpac and business confidence surveys from NAB.

Investors will also be watching for updates on Australia’s labor market data for October, as any signs of weakness could influence expectations about the Reserve Bank of Australia’s monetary policy stance.