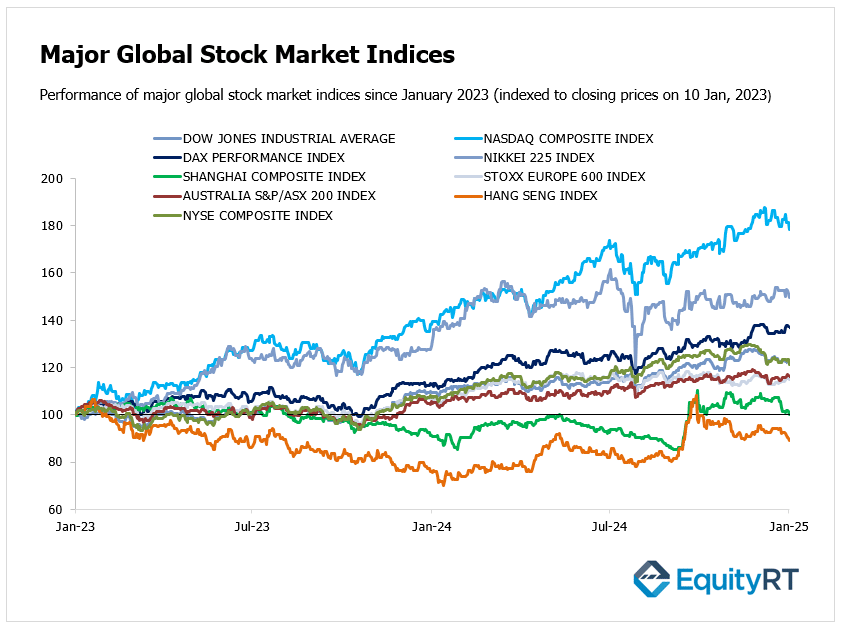

Global Stock Market Highlights

Last Friday, U.S. stocks fell as investors worried that strong job market reports could lead to higher inflation and interest rates, which would hurt Wall Street. Stocks followed the bond market’s lead, where rising yields added pressure.

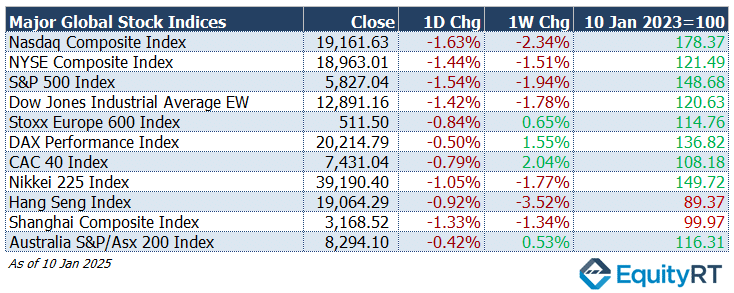

- Nasdaq Composite Index closed at 19,161.63, falling 1.63% on the day and 2.34% for the week

- NYSE Composite Index ended at 18,963.01, down 1.44% for the day and 1.51% for the week.

- S&P 500 Index settled at 5,827.04, declining 1.54% on the day and 1.94% over the week.

- Dow Jones Industrial Average EW closed at 12,891.16, falling 1.42% for the day and 1.78% for the week.

Major European stock indices experienced slight declines due to elevated government bond yields and anticipation of U.S. employment data.

- Stoxx Europe 600 Index finished at 511.50, down 0.84% on the day, but up 0.65% for the week.

- DAX Performance Index closed at 20,214.79, decreasing 0.50% for the day, but gaining 1.55% for the week.

- CAC-40 Index ended at 7,431.04, dropping 0.79% on the day, but rising 2.04% over the week.

Major Asian stock indices experienced declines amid concerns over potential U.S. tariffs and the Federal Reserve’s interest rate policies.

- Shanghai Composite Index ended at 3,168.52, down 1.33% for the day and 1.34% for the week.

- Hang Seng Index finished at 19,064.29, falling 0.92% on the day and 3.52% for the week.

- Nikkei 225 Index closed at 39,190.40, declining 1.05% for the day and 1.77% for the week.

- Australia’s S&P/ASX 200 Index closed at 8,294.10, declining 0.42% on the day, but rising 0.53% for the week.

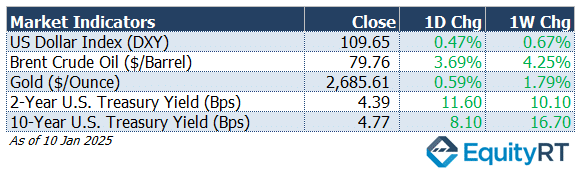

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 109.65, gaining 0.47% on the day and 0.67% over the week.

- The Brent crude oil, the global oil price benchmark, surged to $79.76 per barrel, rising 3.69% daily and 4.25% on a weekly basis.

- The Gold climbed to $2,685.61 per ounce, marking a daily increase of 0.59% and a weekly gain of 1.79%.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, rose to 4.39 bps, up 11.60 bps on the day and 10.10 bps for the week.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, increased to 4.77 bps, gaining 8.10 bps daily and 16.70 bps over the week.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

This week in the United States, the earnings season will gain momentum, with several financial institutions set to report their quarterly results. Major banks such as JPMorgan Chase, Wells Fargo, Goldman Sachs, Citigroup, Bank of America, and Morgan Stanley will be at the forefront of these reports.

Investors will be keen to assess how these banks performed amidst the current economic environment, including potential shifts in interest rates and market volatility. Additionally, asset management giant BlackRock and brokerage firm Charles Schwab are also scheduled to release their earnings, adding further significance to the week’s financial reporting.

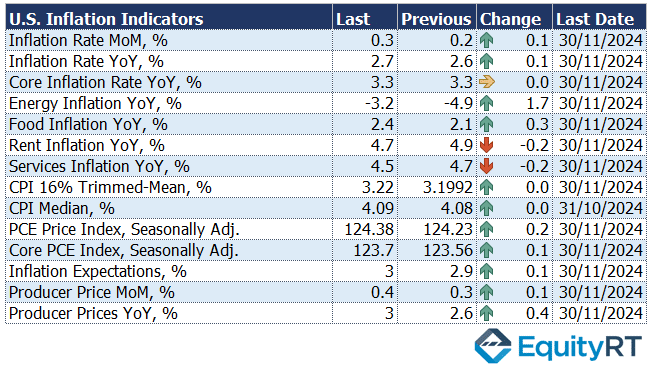

All eyes in the U.S. will be on inflation this week, with the Consumer Price Index (CPI) report taking centre stage on Wednesday.

Analysts expect the annual inflation rate to rise for the third consecutive month, reaching 2.8%, which would indicate persistent inflationary pressures. However, the monthly inflation rate is likely to hold steady at 0.3%, signaling a more measured pace of price increases in the near term. The core inflation rate is projected to remain unchanged at 3.3% annually, with a slight moderation in the monthly rate, expected to ease to 0.3% from the previous 0.4%.

Alongside CPI data, the Producer Price Index (PPI) is anticipated to show an annual increase of 3%, maintaining the same level as the previous period. The monthly change in PPI is expected to slow slightly to 0.3%, compared to 0.4% in the prior month.

Both inflation figures will be closely watched by policymakers and market participants to gauge whether inflationary pressures are moderating or persisting, influencing future interest rate decisions by the Federal Reserve.

Retail sales data will also provide key insights into consumer spending behavior and economic resilience. A 0.5% increase is expected in retail sales, which would be a deceleration compared to the previous month’s 0.7% rise. This softer growth could suggest a slight cooling in consumer demand.

Industrial production is projected to rebound by 0.2%, which could signal some stabilization in the manufacturing sector.

Other important economic indicators to watch include building permits and housing starts, which will provide insights into the state of the housing market. The NAHB Housing Market Index will give a snapshot of homebuilders’ confidence, while the Philadelphia Fed Manufacturing Index and the NY Empire State Manufacturing Index will offer views on regional manufacturing conditions. Additionally, the NFIB Business Optimism Index and consumer inflation expectations will shed light on sentiment among small businesses and consumers, respectively.

Amidst all these data releases, traders and investors will closely monitor comments from Federal Reserve officials, who are likely to provide further clues on the central bank’s stance on interest rates and monetary policy.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

In Europe, the focus will shift to the European Central Bank’s (ECB) account of its December policy meeting, which will offer insights into the bank’s future monetary policy direction. Investors and analysts will look for any indications of whether the ECB plans to maintain or adjust its current stance on interest rates and inflation control measures.

In addition to the ECB’s update, final inflation data for the Euro Area in December is anticipated to show the annual inflation rate rising from 2.2% to 2.4%. This uptick could reflect persistent inflationary pressures, which the ECB may address through future policy moves. Alongside inflation data, industrial production figures for November are expected to reveal signs of recovery, suggesting that the region’s industrial sector is gaining momentum after a challenging period.

Germany, Europe’s largest economy, will release its 2024 GDP data, with forecasts indicating a 0.2% contraction. This would mark the second consecutive year of economic decline, raising concerns about the country’s economic resilience. Germany will also report on wholesale prices and final Consumer Price Index (CPI) figures, giving a clearer picture of inflationary trends in Europe’s largest economy.

Poland’s central bank is expected to keep its benchmark interest rate at 5.75% for the 14th consecutive meeting. This continued policy stance reflects the bank’s cautious approach to controlling inflation and supporting economic stability.

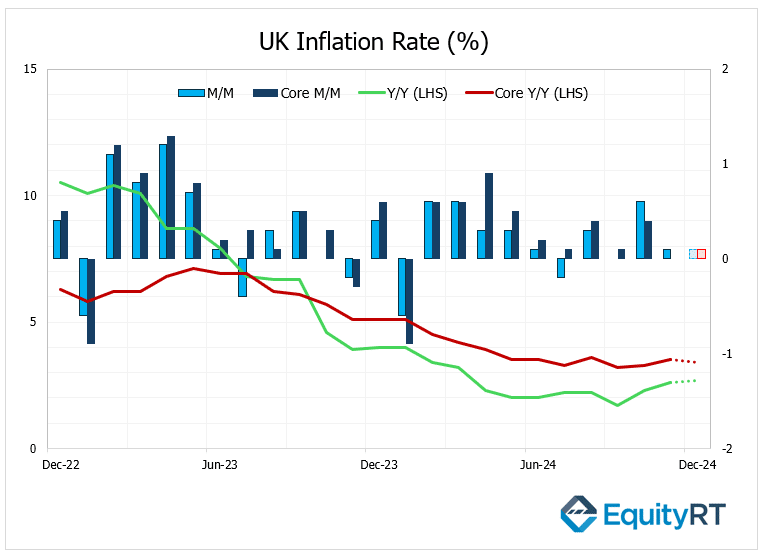

In the UK, the economic calendar is packed with important reports on inflation, GDP, and retail sales. The annual inflation rate is projected to rise to 2.7%, marking the highest level in nine months. Core inflation, however, is expected to ease slightly to 3.4%, indicating that underlying inflationary pressures may be stabilizing.

November GDP is forecast to rebound by 0.2%, signaling a potential recovery after two months of contraction. Industrial and manufacturing production are also expected to show signs of recovery, suggesting a modest revival in these sectors.

Retail sales are expected to grow for the second consecutive month, with a forecasted acceleration to 0.4%, indicating that consumer spending is picking up after previous declines.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

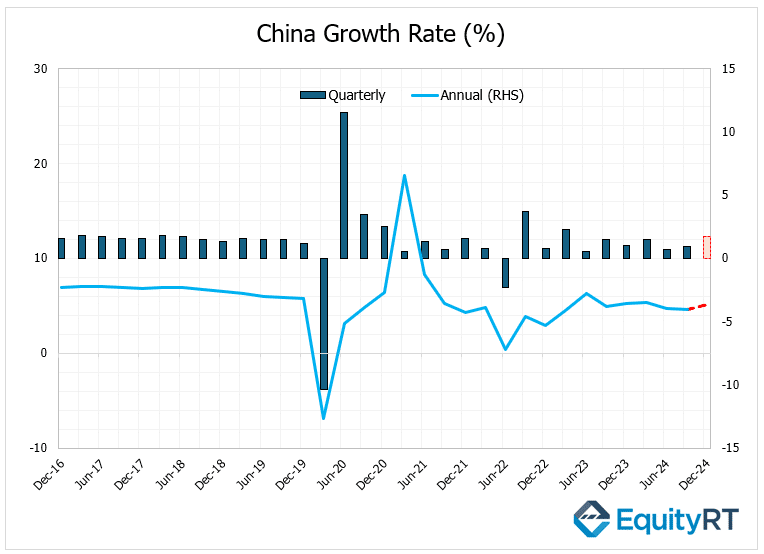

China will have a busy week ahead, with several important economic reports due for release.

On Friday, China’s Q4 GDP growth is expected to accelerate to 5.1%, up from 4.6% in Q3. This growth is anticipated to be supported by government stimulus measures, including a reduction in the reserve requirement ratio and an increase in local government special-purpose bonds, which are designed to boost economic activity. For the full year of 2024, growth is projected to reach 5%.

China’s December trade data exceeded expectations, reflecting shifts ahead of significant policy changes. Exports surged by 10.7% year-over-year, up from 6.7% in November and beating forecasts of 7.5%, as U.S. businesses placed increased orders before President Trump’s tariffs took effect. On the import side, domestic demand showed signs of recovery, with imports rising 1% after a 3.9% drop in November, defying predictions of a 1% decline. This marks the strongest import growth since July, suggesting a rebound in China’s internal market activity.

Industrial production growth in December is expected to remain steady at 5.4%, indicating continued stability in manufacturing. Retail sales are also anticipated to have accelerated, suggesting that consumer demand may have picked up in the final month of 2024.

In Japan, key economic data releases will include the Eco Watchers Survey, which provides a snapshot of economic sentiment, as well as current account data, which will shed light on the country’s trade balance and capital flows. Bank lending figures will also be released, offering insights into the state of credit in the economy, while the Producer Price Index (PPI) will provide a look at inflationary pressures in the industrial sector.

In India, consumer inflation is expected to ease slightly to 5.3% from 5.48%, signaling a potential stabilization in price increases for consumers. However, wholesale inflation is forecast to rise to 2.3% from 1.89%, which could indicate higher costs for producers that may eventually be passed on to consumers.

In South Korea, the central bank is expected to cut its policy rate by 25 basis points to 2.75%, reflecting ongoing efforts to support economic growth.

In Australia, the unemployment rate is likely to have edged up to 4% in December, compared to 3.9% in November, as the labor market may show signs of cooling. The economy is expected to have added 10,000 jobs in the last month of 2024, suggesting modest job growth. Additionally, the Westpac Consumer Confidence report will be released, offering insights into the outlook of Australian consumers and their willingness to spend in the new year.