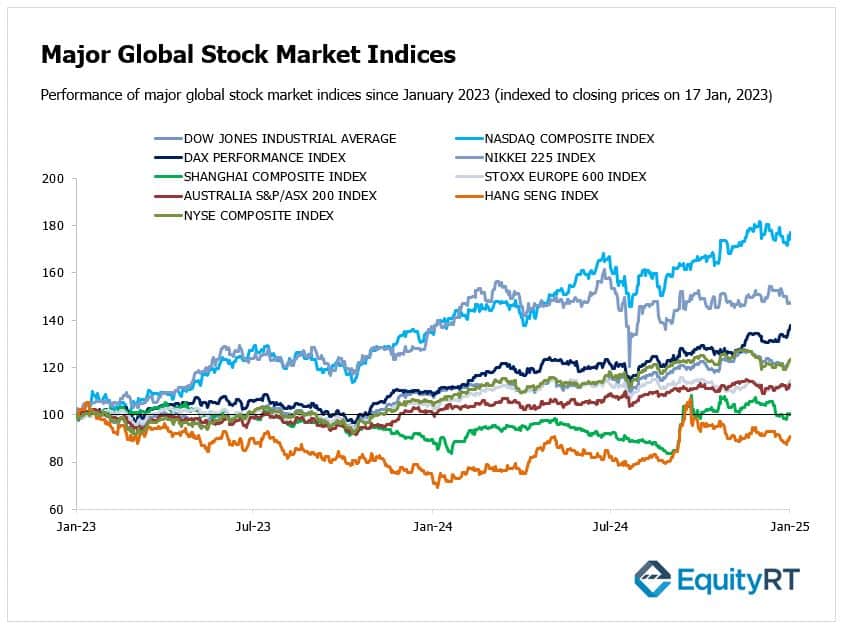

Global Stock Market Highlights

Last Friday, Stocks ended with strong gains, pushing the S&P 500 and Dow Jones Industrial Average to their largest weekly increases since the November presidential election. The Dow climbed 0.7%, the S&P 500 rose 1%, and the Nasdaq Composite gained 1.5%. This marked the first weekly advance in three weeks for the major indexes, as investors look ahead to Donald Trump’s inauguration on Monday.

**The stock markets will be closed that day in observance of Martin Luther King Jr. Day.

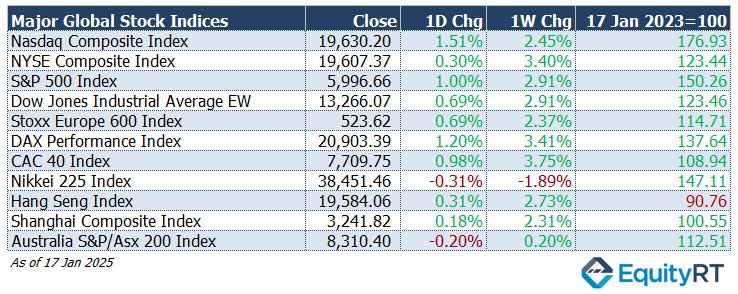

- Nasdaq Composite Index closed at 19,630.20, rising 1.51% on the day and 2.45% for the week.

- NYSE Composite Index ended at 19,607.37, gaining 0.30% daily and 3.40% weekly.

- S&P 500 Index settled at 5,996.66, up 1.00% for the day and 2.91% for the week.

- Dow Jones Industrial Average EW closed at 13,266.07, increasing 0.69% daily and 2.91% weekly.

European stock markets extended their gains, with the DAX hitting new highs multiple times this week. The rally was fuelled by optimism over potential monetary policy easing and robust corporate quarterly earnings.

- Stoxx Europe 600 Index finished at 523.62, up 0.69% on the day and 2.37% over the week.

- DAX Performance Index closed at 20,903.39, rising 1.20% daily and 3.41% weekly.

- CAC-40 Index ended at 7,709.75, gaining 0.98% on the day and 3.75% for the week.

Asian markets had a mixed performance on Friday as investors digested key economic data from China, weighing its implications for regional growth.

- Shanghai Composite Index closed at 38,451.46, falling 0.31% on the day and 1.89% for the week.

- Hang Seng Index finished at 19,584.06, up 0.31% daily and 2.73% weekly.

- Nikkei 225 Index closed at 39,190.40, declining 1.05% for the day and 1.77% for the week.

- Australia’s S&P/ASX 200 Index closed at 8,310.40, declining 0.20% daily but increasing 0.20% for the week.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, rose to 109.43, gaining 0.42% on the day but declining 0.20% for the week.

- The Brent crude oil, the global oil price benchmark, fell to $80.79 per barrel, down 0.62% daily but up 1.29% weekly.

- The Gold declined to $2,700.99 per ounce, losing 0.50% on the day but gaining 0.57% for the week.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, climbed to 4.29 bps, increasing by 5.70 bps daily but dropping 9.70 bps over the week.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, rose to 4.63 bps, up 1.30 bps daily but down 13.90 bps for the week.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

This week is set to offer a mix of political and economic developments, with Inauguration Day likely dominating headlines. Markets will balance the anticipation of policy shifts with ongoing corporate earnings and economic data, creating a potentially volatile but informative period for investors.

The earnings season gains momentum this week, with significant reports expected from major companies such as Netflix, Charles Schwab, Procter & Gamble, and Johnson & Johnson. These results will provide insight into corporate performance amid evolving macroeconomic conditions, particularly in consumer trends, healthcare, and technology sectors. Key players like General Electric, Texas Instruments, Union Pacific, and American Express could also influence market sentiment based on their outlooks and results.

On the economic front, the U.S. calendar is relatively light. Flash S&P Global PMIs will offer an early assessment of private-sector activity in January, potentially signaling how businesses are navigating the new year. Additional data points include existing home sales, which may reflect the impact of higher mortgage rates, and the final Michigan Consumer Sentiment reading, which will shed light on consumer confidence.

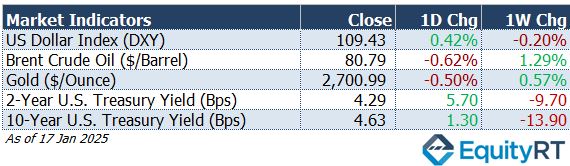

Weekly initial jobless claims for the week of January 18 will be monitored on Thursday. The most recently reported initial jobless claims rose from 203,000 to 217,000, slightly exceeding expectations of 210,000 but remaining at low levels, indicating continued resilience and tightness in the labor market. For the week of January 18, initial jobless claims are expected to remain low, coming in at around 215,000.

The 4-week average of jobless claims declined to 212.75 thousand as of January 11, down from 213.50 thousand the previous week.

Continuing jobless claims fell to 1,859 thousand in the week ending January 4, 2024, down from 1,867 thousand the previous week.

Despite the labor market’s strength and persistent inflation, the Federal Reserve is not expected to announce a rate cut at its January policy meeting.

In Canada, inflation is projected to decelerate for the second month to 1.7%, suggesting continued relief from price pressures. Retail sales and PPI data will also be watched for clues on the health of the Canadian economy.

Meanwhile, Mexico’s mid-month inflation data will provide insight into price dynamics in one of Latin America’s largest economies.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

In Europe, markets will closely follow flash PMI data for the Eurozone, Germany, France, and the UK, offering early insights into January’s economic performance. Germany’s services sector is expected to slow further, while manufacturing may face a steeper contraction, signaling continued challenges for Europe’s largest economy.

The ZEW Economic Sentiment Indicator for Germany is projected to ease from its recent four-month high, reflecting growing caution among analysts.

Eurozone consumer sentiment is forecast to stay in negative territory, underscoring persistent economic uncertainty across the region.

In the UK, the spotlight will be on the labor market, where unemployment is anticipated to rise to 4.4%. However, pay growth is expected to accelerate for the third consecutive month, a potential pressure-point for inflation and policy decisions.

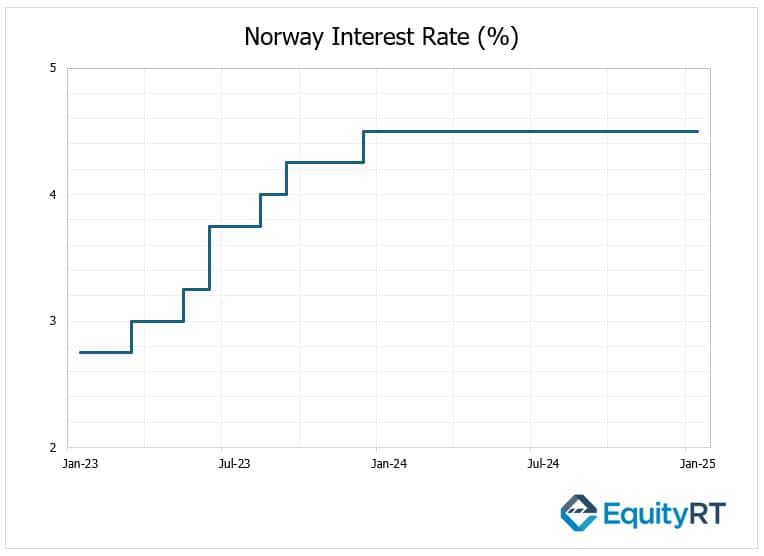

Norway’s central bank will announce its interest rate decision, with markets closely watching for any shifts in policy stance. The Norges Bank held its key policy rate steady at 4.5% during its December 2024 meeting, aligning with market expectations. However, it indicated that a rate cut is likely in March 2025.

Additional key data releases include Eurozone car registrations, and Germany’s PPI.

In the UK, GfK consumer confidence, CBI business optimism, industrial trends orders, and distributive trades will provide a broader view of economic conditions and sentiment.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

In Asia, China enters a quieter week for economic updates after confirming its 5% growth target for 2024. The People’s Bank of China (PBoC) kept the 1-year loan prime rate (LPR) unchanged at 3.10% during today’s meeting, while also maintaining the 5-year loan prime rate (LPR), a benchmark for long-term loans such as mortgages, at 3.60%.

This indicates that, following its rate cuts in October, the bank opted to keep rates steady in November, December, and today to observe the effects of the previous rate reductions.

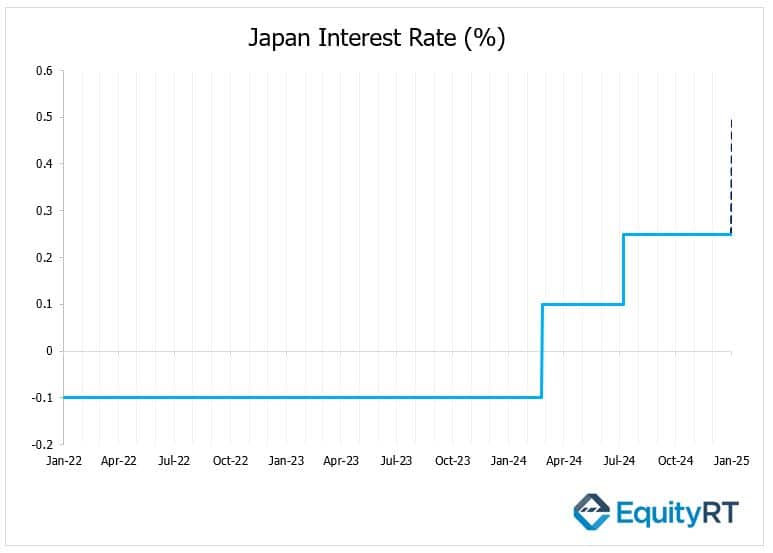

The Bank of Japan (BOJ) meeting will be closely watched on Friday. The BOJ ended its negative interest rate policy last March, raising the policy rate to 0.25% in July, citing an increased likelihood of sustainably reaching its 2% inflation target.

Following its decisions to keep the policy rate steady at 0.25% during the September and October meetings, in line with expectations, the BOJ noted at its December meeting that, despite some weaknesses, Japan’s economy had shown moderate recovery and was moving in line with forecasts. However, it also emphasized that uncertainty regarding the economic outlook and inflation remains high, leading it to maintain the policy rate.

At this week’s meeting, the BOJ is expected to raise the policy rate from 0.25% to 0.50%.

Additional releases, including flash PMIs and machinery orders, will provide further insights into Japan’s economic trajectory.

India’s focus will be on PMIs and foreign exchange reserves as concerns persist over the RBI’s management of the rupee. South Korea and Taiwan will turn to Q4 GDP results and confidence surveys, offering a clearer picture of economic stability in these key export-driven economies.

Malaysia will release its latest inflation figures and announce a policy rate decision, while Australia’s schedule features flash PMIs and the Westpac Leading Index. New Zealand, meanwhile, will draw attention with its Q4 CPI data, shedding light on inflation trends in the region.

While some economies have a quieter agenda, the week’s policy decisions and data releases will be critical in shaping regional growth expectations and market sentiment.