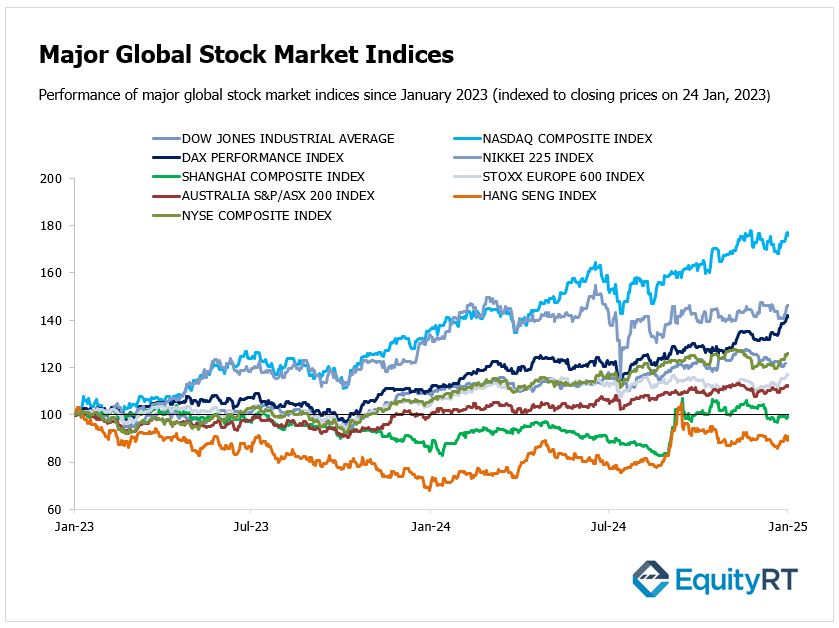

Global Stock Market Highlights

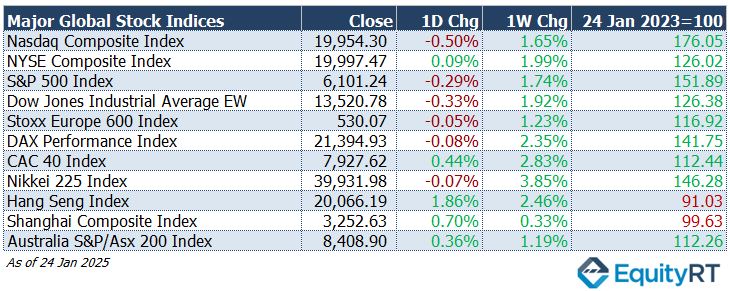

Last Friday, U.S. stock markets saw declines across major indices. However, all three managed to secure their second straight week of gains. The dip was driven by mixed economic data and corporate earnings, prompting investors to adopt a cautious stance ahead of the Federal Reserve’s upcoming meeting.

- Nasdaq Composite Index closed at 19,954.30, declining 0.50% on the day but rising 1.65% for the week.

- NYSE Composite Index closed at 19,997.47, gaining 0.09% on the day and 1.99% for the week.

- S&P 500 Index closed at 6,101.24, down 0.29% on the day but up 1.74% for the week.

- Dow Jones Industrial Average EW closed at 13,520.78, slipping 0.33% on the day but increasing 1.92% for the week.

European stock markets delivered mixed performances, with a nearly 1% rise fuelled by unexpected business growth and strong corporate earnings, especially in the luxury sector. Growing business confidence and expectations of further interest rate cuts by the European Central Bank added to the positive sentiment.

- Stoxx Europe 600 Index closed at 530.07, falling 0.05% on the day but advancing 1.23% for the week.

- DAX Performance Index closed at 21,394.93, losing 0.08% on the day but gaining 2.35% for the week.

- CAC-40 Index closed at 7,927.62, climbing 0.44% on the day and 2.83% for the week.

Asian stock markets experienced mixed performances:

- Shanghai Composite Index closed at 3,252.63, rising 0.70% on the day and 0.33% for the week.

- Hang Seng Index closed at 20,066.19, jumping 1.86% on the day and 2.46% for the week.

- Nikkei 225 Index closed at 39,931.98, decreasing 0.07% on the day but surging 3.85% for the week.

- Australia’s S&P/ASX 200 Index closed at 8,408.90, increasing 0.36% on the day and 1.19% for the week.

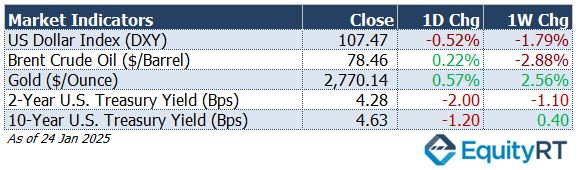

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 107.47, declining 0.52% on the day and 1.79% for the week.

- The Brent crude oil, the global oil price benchmark, closed at $78.46 per barrel, rising 0.22% on the day but falling 2.88% for the week.

- The Gold closed at $2,770.14 per ounce, gaining 0.57% on the day and 2.56% for the week.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, closed at 4.28 bps, dropping 2.00 bps on the day and 1.10 bps for the week.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, closed at 4.63 bps, decreasing 1.20 bps on the day but rising 0.40 bps for the week.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

In the U.S., the focus of the markets will be on the Federal Reserve’s interest rate decision on Wednesday, along with Fed Chair Powell’s speech. The Federal Reserve is anticipated to maintain the federal funds rate in the 4.25%-4.5% range, pausing after three consecutive rate cuts in 2024. Market participants will closely track the Fed’s statement for clues on its 2025 policy direction, particularly after the central bank signaled in December that only two rate reductions are expected next year.

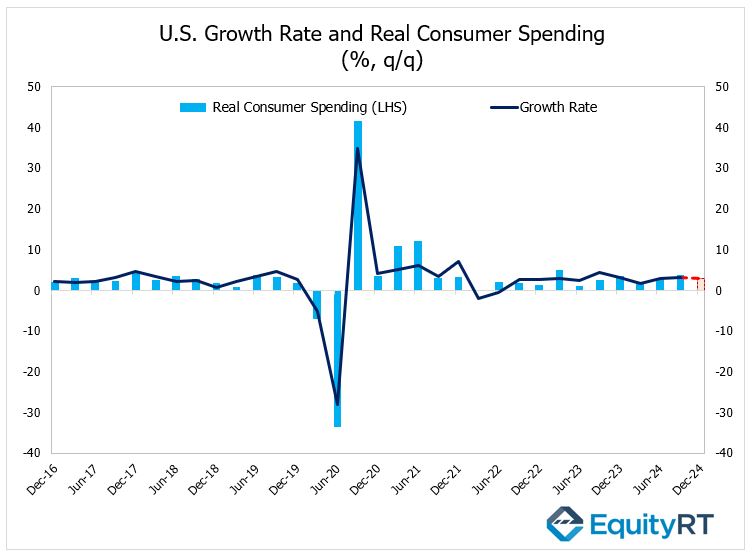

On Thursday, the U.S. will release its advance estimate for annualized quarterly GDP growth for Q4 of last year. In Q1, the economy grew by 1.6%, followed by 3% in Q2 and 3.1% in Q3.

Consumer spending, which constitutes a significant portion of the U.S. economy, accelerated from 2.8% in Q2 to 3.7% in Q3, the fastest pace in six quarters.

For Q4, the advance estimate is anticipated to show a slowdown, with the economy growing at a rate of 3%.

On the same day, preliminary data for the annualized quarterly Personal Consumption Expenditures (PCE) price index for the fourth quarter, a key inflation indicator monitored by the Fed, will also be released.

The headline PCE price index had slowed to 1.5% in the third quarter, down from 2.5% in the second quarter of last year, reaching its lowest level since the second quarter of 2020. Similarly, the core PCE price index dropped to 2.2% in the third quarter, after being recorded at 2.8% in the second quarter, marking its lowest level in the past three quarters.

Thursday will also bring labor market data, specifically the weekly initial jobless claims. The most recent data showed claims rising from 217,000 to 223,000, slightly above expectations and marking the highest level in six weeks. Despite this increase, the low levels of initial jobless claims have continued to indicate resilience and tightness in the labor market.

On Friday, attention will turn to December’s PCE deflator data, closely watched by the Fed for monthly price developments, as well as personal income and spending figures for December.

Additional releases include data on new and pending home sales, FHFA and Case-Shiller house price indices, the Chicago Fed National Activity Index, Dallas Fed Manufacturing and Services Index, and Richmond Fed Manufacturing Index.

On the corporate earnings front, this week will be action-packed.

Tech heavyweights Microsoft, Meta, Tesla, and Apple are set to release their quarterly results, alongside major players such as AT&T, Boeing, Starbucks, T-Mobile, Exxon Mobil and Chevron.

The Bank of Canada is expected to implement another 25-basis point rate cut, marking its sixth consecutive reduction. Investors will also track Canada’s monthly GDP growth figures.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

In Europe, the markets will center their attention on the European Central Bank’s interest rate decision on Thursday, as well as ECB President Lagarde’s speech. The European Central Bank (ECB) is expected to continue its rate-cutting trajectory in 2025, with a 25-basis point reduction widely anticipated. ECB President Christine Lagarde has stated that inflation is likely to reach the 2% target this year, creating room to ease monetary policy further and support weaker economies in the region.

Key economic updates this week include Q4 GDP figures from the Eurozone, Germany, Italy, France, and Spain. Germany’s economy contracted by 0.3% quarter-on-quarter in Q2 of last year, followed by a modest growth of 0.1% in Q3. However, on an annual basis, the economy shrank by 0.3% in the third quarter. For Q4, Germany’s economy is expected to contract by 0.1% both quarterly and annually.

In contrast, the Eurozone economy grew by 0.2% quarter-on-quarter in Q2 of last year and accelerated to 0.4% growth in Q3. On an annual basis, the region recorded a 0.9% growth rate in the third quarter, marking its strongest performance since Q1 2023. Looking ahead to Q4, the Eurozone economy is forecast to grow by 0.1% quarter-on-quarter and 1% year-on-year.

On the inflation front, Germany’s annual inflation rate for January is forecast to rise to 2.7%, with no monthly change. In Germany, headline CPI increased by 0.5% month-over-month in December, following a 0.2% decline in November. On an annual basis, it rose from 2.2% in November to 2.6% in December, marking the highest level since January 2024 and staying above the ECB’s 2% target for the second consecutive month. Additionally, Germany’s annual core CPI stood at 3% in December.

Other notable releases include Germany’s retail sales data and Switzerland’s foreign trade figures and retail sales.

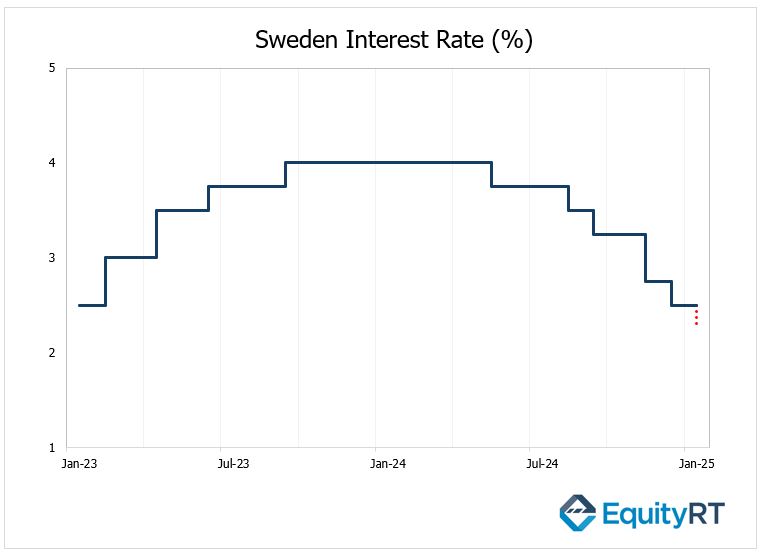

On Wednesday, Sweden’s interest rate decision will also be closely monitored. The Swedish Central Bank, after cutting the policy rate by 25 basis points in May, August, and September and by 50 basis points in November last year, aligned with expectations in its December meeting by reducing the rate by 25 basis points from 2.75% to 2.50%. The decision to lower rates was influenced by November’s inflation, which hit its lowest level since July 2021. Additionally, the Bank indicated that further rate cuts might be considered in the first half of 2025 if inflation and economic activity projections remain unchanged.

This week, the Bank is expected to lower the policy rate by 25 basis points to 2.25%.

In the UK, a lighter economic calendar includes the Bank of England’s monetary indicators and Nationwide housing price data.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

In China, the spotlight was on the official NBS PMI, which reflected some recovery in activity, fueled by stimulus measures implemented last quarter. This data release coincides with the lead-up to the week-long Lunar New Year holiday, during which financial and commodity markets will remain closed.

Japan is set for its usual end-of-month data release, including industrial production, retail sales, unemployment figures, consumer confidence and housing starts. Among these, the Tokyo CPI will receive special attention as investors seek clues about the Bank of Japan’s next potential rate hike, a possibility recently hinted at by policymakers.

In South Korea, January’s foreign trade data will be released, with export growth taking the stage as a key indicator of global demand for semiconductors and electronic hardware.

In Australia, Q4 CPI data will be the focal point, with inflation expected to moderate further. Additionally, the NAB Business Confidence Index will give insights into the country’s economic sentiment.