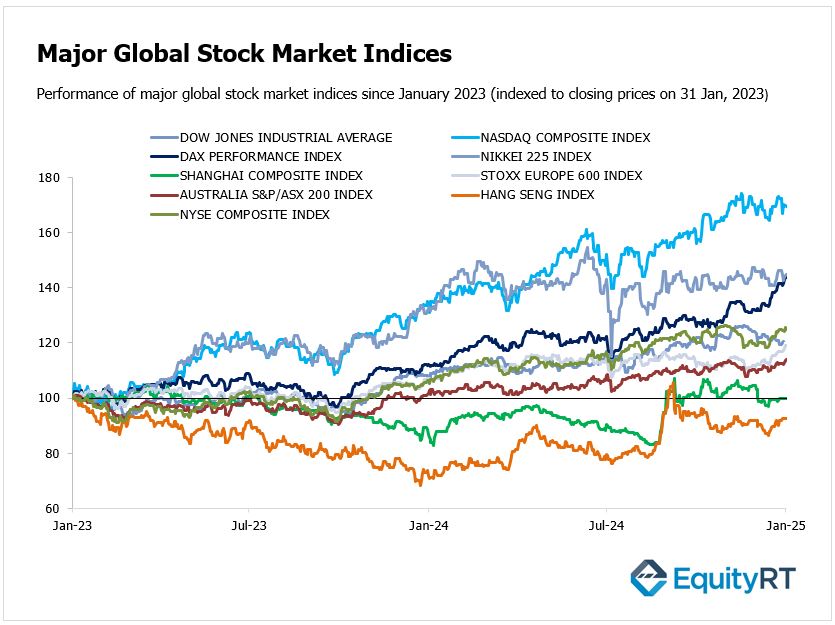

Global Stock Market Highlights

Last Friday, U.S. stock markets declined after the White House confirmed that President Donald Trump would proceed with previously announced tariffs on key trading partners. Despite the day’s losses, all three major indexes recorded gains for January, with the Dow rising by 5.5%, the S&P 500 by 3.2%, and the Nasdaq by 1.9%.

Investor sentiment was cautious, driven by concerns over the economic repercussions of the newly imposed tariffs.

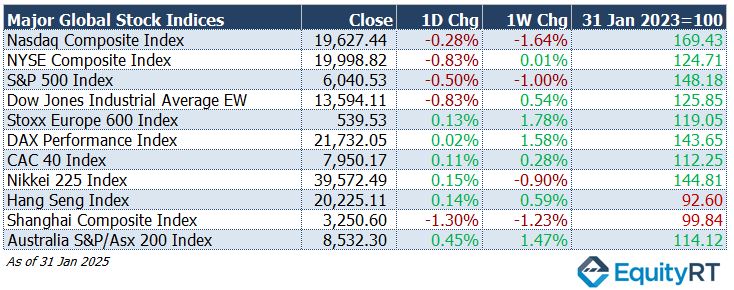

- Nasdaq Composite Index closed at 19,627.44, declining 0.28% on the day and 1.64% for the week.

- NYSE Composite Index closed at 19,998.82, falling 0.83% on the day but edging up 0.01% for the week.

- S&P 500 Index ended at 6,040.53, dropping 0.50% on the day and 1.00% for the week.

- Dow Jones Industrial Average EW finished at 13,594.11, losing 0.83% on the day but gaining 0.54% for the week.

Last Friday, European markets benefited from strong corporate earnings, monetary policy easing by the European Central Bank, and a favorable economic outlook, leading to a positive start in 2025. Over the month of January, European stock markets outperformed their global counterparts.

- Stoxx Europe 600 Index settled at 539.53, rising 0.13% on the day and 1.78% over the week.

- DAX Performance Index closed at 21,732.05, advancing 0.02% on the day and 1.58% for the week.

- CAC-40 Index ended at 7,950.17, up 0.11% on the day and 0.28% for the week.

Asian stock markets experienced mixed performances:

- Shanghai Composite Index ended at 3,250.60, falling 1.30% on the day and 1.23% for the week.

- Hang Seng Index closed at 20,225.11, increasing 0.14% on the day and 0.59% for the week.

- Nikkei 225 Index finished at 39,572.49, gaining 0.15% on the day but declining 0.90% for the week.

- Australia’s S&P/ASX 200 Index settled at 8,532.30, climbing 0.45% on the day and 1.47% for the week.

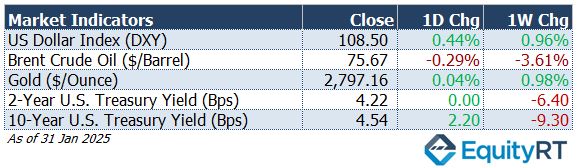

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 108.50, rising 0.44% on the day and 0.96% for the week.

- The Brent crude oil, the global oil price benchmark, settled at $75.67 per barrel, declining 0.29% on the day and 3.61% for the week.

- The Gold finished at $2,797.16 per ounce, up 0.04% on the day and 0.98% for the week.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, held steady at 4.22 bps, unchanged on the day but down 6.40 bps over the week.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, climbed to 4.54 bps, increasing 2.20 bps on the day but declining 9.30 bps for the week.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

This week in the U.S. promises to be eventful, with the spotlight on the January jobs report. The economy is expected to have added 170,000 jobs, reflecting a sharp deceleration from December’s robust gain of 256,000 jobs.

Despite the slowdown in hiring, the unemployment rate is projected to remain steady at 4.1%, indicating continued labor market stability. Wage growth is also expected to hold at 0.3%, suggesting little change in income growth momentum.

Other labor market indicators, such as the JOLTs report, ADP employment, and Challenger job cuts, will provide additional context on hiring trends and job openings, offering a broader perspective on labor dynamics.

Several data points will shed light on the U.S. economy’s performance in early 2025:

The services ISM PMI are expected to expand slightly, while manufacturing may continue to contract, albeit at a slower pace.

Michigan Consumer Sentiment Index: Preliminary estimates for February suggest a modest improvement in consumer confidence, a key driver of economic activity.

Other notable releases include, final S&P Global PMIs, factory orders, trade balance, unit labor costs and productivity, construction spending and consumer credit data

Additionally, the Treasury Department will announce its quarterly issuance plans, which could influence bond markets and broader financial conditions.

Investors will also pay close attention to comments from multiple Federal Reserve officials, as they seek clues about the timing of the Fed’s next potential rate cut. Market participants are closely monitoring the central bank’s stance amid slowing economic activity and ongoing inflation concerns.

On the corporate front, the week features earnings reports from industry heavyweights, including:

Amazon, Alphabet, Palantir Technologies, Merck, PepsiCo, AMD, Amgen, Pfizer, Walt Disney, Qualcomm, Uber, Eli Lilly, Philip Morris International, and Honeywell.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

This week in Europe, the focus will be on key economic developments.

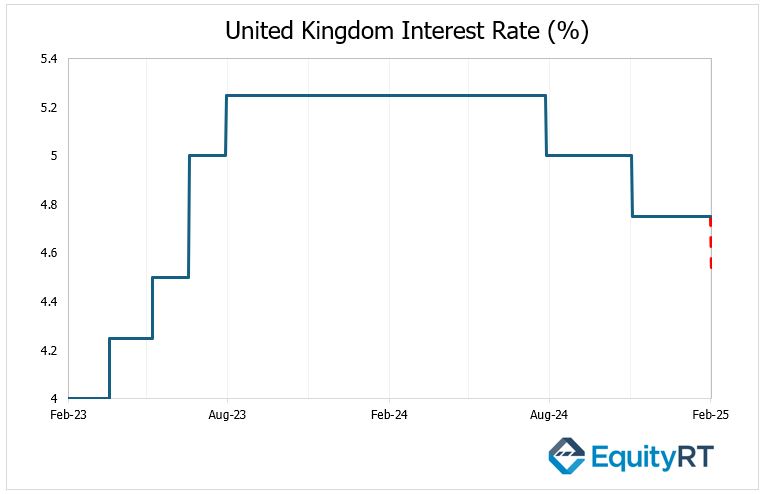

On Thursday, the Bank of England (BoE) meeting will be closely watched. Last year, the BoE lowered its policy interest rate twice, first with a 25-basis-point cut in August, followed by another 25-basis-point cut at its November meeting, reducing the rate from 5% to 4.75%.

At its December meeting, the BoE kept the policy rate steady at 4.75%, in line with expectations. BoE Governor Bailey emphasized the need for a gradual approach to future rate cuts, stating that, given the increasing uncertainty in the economy, they cannot commit to when or by how much rates will be lowered in 2025.

At this week’s meeting, the Bank is expected to cut the policy rate by 25 basis points, bringing it down from 4.75% to 4.50%.

In the Eurozone, inflation data will take center stage, with the annual rate projected to rise to a six-month high of 2.5%, potentially influencing the European Central Bank’s policy direction.

Germany’s factory orders are expected to rebound in December after a sharp 5.4% decline, although industrial production may still show signs of weakness. Retail sales across the Eurozone are anticipated to grow for the second consecutive month, signaling consumer resilience.

Spain’s manufacturing sector is expected to expand at a faster pace, Italy’s contraction may ease, and services activity in both countries is likely to slow. Final PMIs for Germany, France, and the Eurozone will also provide updated insights into regional economic health.

Other notable data releases include trade balances for Germany and France, Italy’s retail sales, France’s industrial production, and Sweden’s preliminary inflation figures.

In the UK, a lighter economic calendar includes the Bank of England’s monetary indicators and Nationwide housing price data.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

Markets in mainland China are set to reopen on Wednesday after the Lunar New Year holidays, shifting focus to the release of Caixin PMIs, following official NBS data that unexpectedly pointed to economic contractions.

Later in the week, CPI and PPI figures will provide further insights into China’s economic momentum.

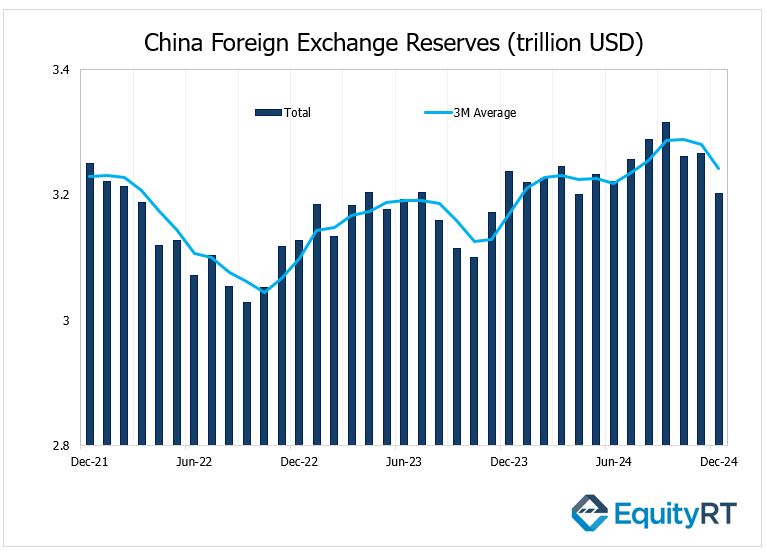

On Friday, China’s foreign exchange reserves for January will be released. China’s foreign exchanges reserves declined to $3.2 trillion in December 2024, marking their lowest level in eight months, down from $3.26 trillion in November and falling short of market expectations of $3.25 trillion. The decrease coincided with a strengthening U.S. dollar, as the yuan depreciated by 1.2% while the dollar advanced 2.6% against major currencies.

Meanwhile, China’s gold reserves rose slightly to 73.29 million fine troy ounces, compared to 72.96 million in the prior month. Despite this increase, the value of gold reserves fell to $191.34 billion from $193.43 billion, reflecting a decline in global gold prices.

In Japan, attention will center on the Summary of Opinions from the Bank of Japan’s latest meeting, offering potential clues about policy tightening for the year, alongside the release of December’s household expenditure data.

Meanwhile, in India, the Reserve Bank of India is expected to commence its rate-cutting cycle, aligning with recent liquidity injections after the government unveils the FY26 Budget.

South Korea and the Philippines are preparing to publish January inflation data, while ASEAN countries participating in PMI surveys will share updated economic activity results.

Indonesia and Hong Kong will also report their GDP figures, highlighting regional growth dynamics.

In Australia, December’s trade balance and the Ai Group Industry Index for January will provide a closer look at the nation’s economic trends.