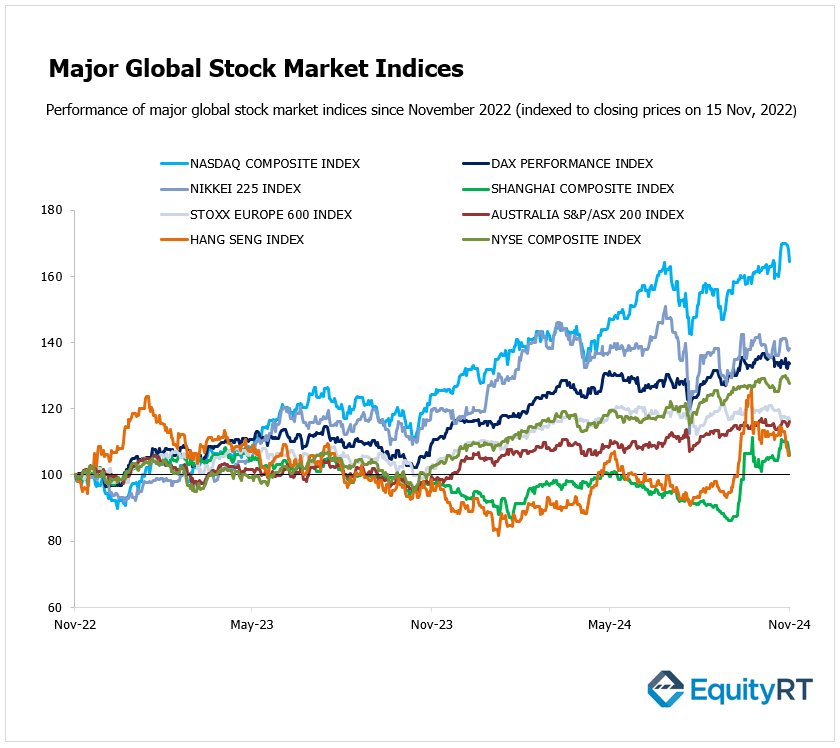

Global Stock Market Highlights

U.S. stocks experienced their sharpest decline since Election Day, as the initial rally spurred by Donald Trump’s victory and the Federal Reserve’s interest rate cut began to lose momentum.

- Nasdaq Composite Index dropped to 18,680.12, down 2.24% for the day and 3.15% for the week.

- NYSE Composite Index fell to 19,645.76, declining 0.45% on the day and 1.46% over the week.

- S&P 500 Index closed at 5,870.62, losing 1.32% for the day and 2.08% for the week.

- Dow Jones Industrial Average EW remained flat at 13,226.53, with a 0.19% weekly decline.

European markets ended the week lower on Friday. Investors weighed new economic data and considered the potential direction of interest rate cuts following hawkish remarks by U.S. Federal Reserve Chair Jerome Powell.

- Stoxx Europe 600 Index slipped to 503.12, down 0.77% for the day and 0.69% for the week.

- DAX Performance Index ended at 19,210.81, down 0.27% on the day but relatively unchanged over the week with a 0.02% drop.

- CAC-40 Index fell to 7,269.63, decreasing 0.58% for the day and 0.94% for the week.

Asia markets showed mixed results on Friday following Wall Street’s decline after U.S. Federal Reserve Chair Jerome Powell indicated there is no urgency to implement rate cuts.

- Shanghai Composite Index decreased to 3,330.73, losing 1.45% for the day and 3.52% weekly.

- Hang Seng Index settled at 19,426.34, dropping 0.05% on the day and a significant 6.28% over the week.

- Nikkei 225 Index rose slightly to 38,642.91, gaining 0.28% for the day but losing 2.17% over the week.

- Australia’s S&P/ASX 200 Index edged up to 8,285.20, gaining 0.74% for the day but slipping 0.12% over the week.

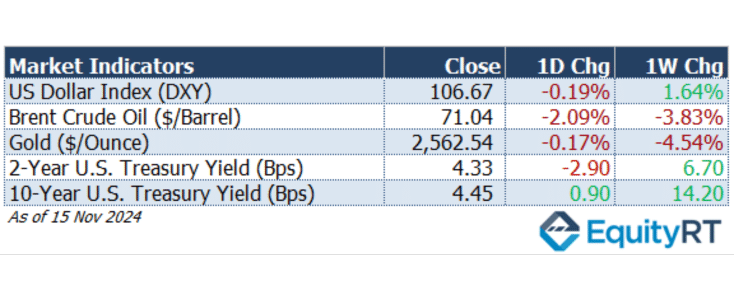

- The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 106.67, marking a daily dip of 0.19%, while climbing 64% over the week.

- The Brent crude oil (#LCO07) the global oil price benchmark, settled at $71.04 per barrel, experiencing a 2.09% drop on the day and a 3.83% weekly decline, reflecting ongoing pressures in energy markets.

- The gold (#XAU) closed at $2,562.54 per ounce, falling 0.17% for the day and seeing a sharp weekly drop of 4.54%, as investor sentiment shifted.

- The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, ended at 4.33 basis points, falling 2.90 bps on the day but showing a 6.70 bps increase over the week.

- The 10-year U.S. Treasury yield (#USGG10YR) climbed to 4.45 basis points, with a 0.90 bps daily gain and a notable 14.20 bps weekly rise, signalling growing long-term yield pressures.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

This week in the U.S. includes minimal economic data releases, with the primary focus on flash S&P Global PMI data. While the manufacturing sector is projected to remain in contraction territory, services sector growth is expected to accelerate.

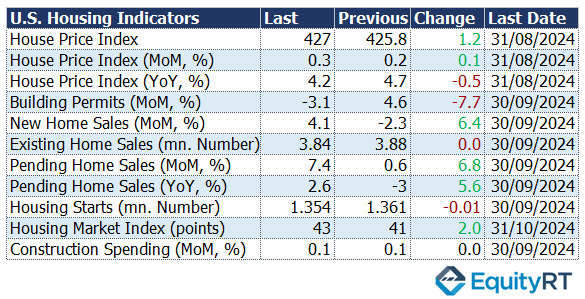

Additionally, housing market updates including the NAHB Housing Market Index, building permits, housing starts, and existing home sales will be closely monitored.

Tomorrow’s housing market data will include October housing starts and building permits, which signal future housing demand. On Thursday, the focus will shift to October’s existing home sales data.

In September, housing starts fell by 0.5% month-on-month, a larger decline than expected, while building permits dropped by 3.1% month-on-month, also exceeding expectations.

Existing home sales decreased by 2% month-on-month in September and, contrary to expectations of a slight increase in October, declined by 1%, marking the second consecutive month of decline. These figures pointed to a sharper-than-expected slowdown in the US housing market.

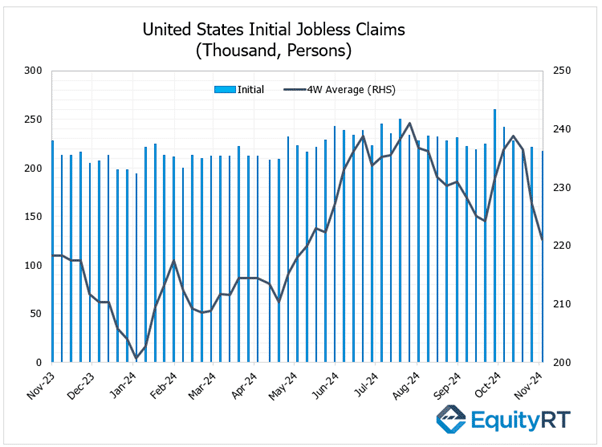

Additionally, on Thursday, the weekly initial jobless claims in the U.S. will be released.

The number of initial jobless claims dropped by 4,000 to 217,000 in the week ending November 9th, the lowest since May and well below market expectations of 223,000.

The four-week moving average, which smooths out weekly volatility, fell to 221,000 from 227,250 in the previous period, marking its lowest level in over six months.

Investors will also pay close attention to speeches by Federal Reserve officials and reports like the Philadelphia Fed Manufacturing Index, the Kansas Fed Manufacturing Index, and the final Michigan Consumer Sentiment survey.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

Key economic updates across Europe include flash PMI data for the Eurozone, Germany, France, and the UK. The Eurozone’s services sector is expected to post its tenth consecutive month of growth, while manufacturing activity is predicted to see further declines.

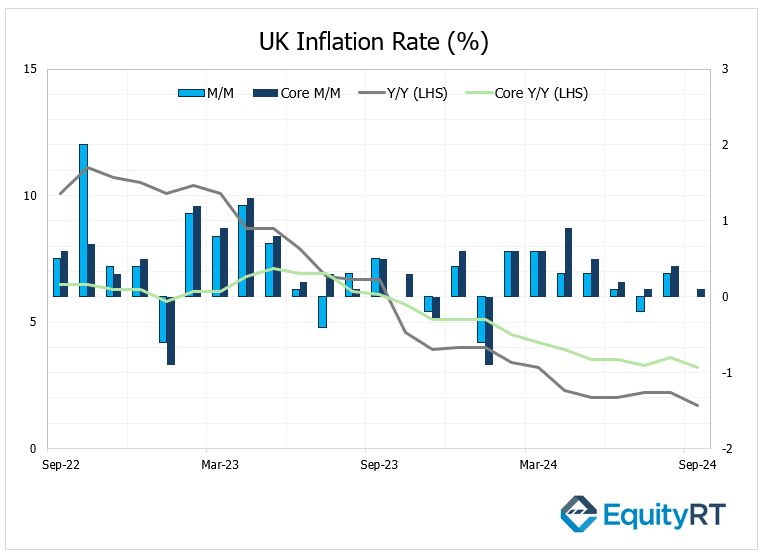

On Wednesday, the UK will release October CPI data, which will guide the Bank of England’s monetary policy. In the UK, October inflation is expected to be 2.2%, in line with the Bank of England’s year-end forecast of 2.5%.

The annual inflation rate in the UK dropped to 1.7% in September 2024, the lowest since April 2021, down from 2.2% in the previous two months and lower than the forecast of 1.9%.

The biggest decrease came from transport.

The month-on-month core inflation rate in the UK fell to 0.10% in September, down from 0.50% in August 2024. The annual core inflation rate also decreased to 3.2% in September 2024, down from 3.6% in the prior months, marking the lowest rate since September 2021.

Other notable data releases include Eurozone consumer confidence, final inflation figures, wage growth, and trade balance.

Germany will release producer prices and Q3 GDP revisions.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

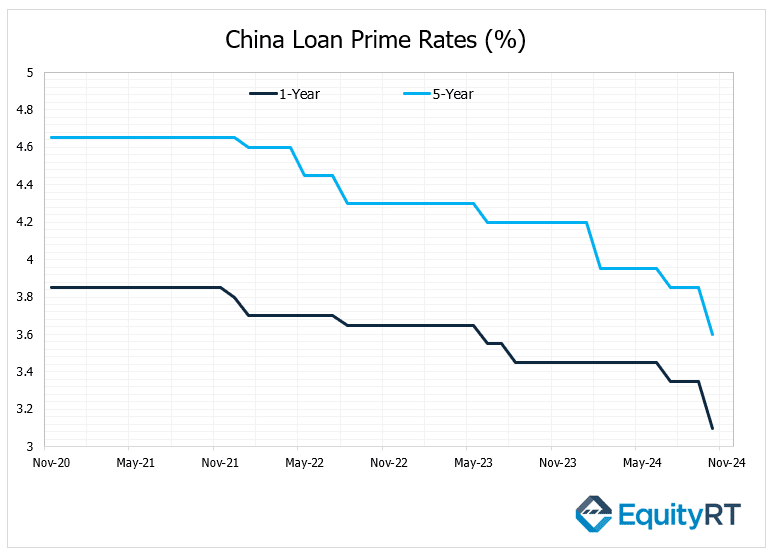

In Asia, the focus on Wednesday will be on the People’s Bank of China (PBoC) meeting. In China, the People’s Bank of China is expected to hold rates steady, following last month’s aggressive rate cuts. This decision comes amid pressure on the yuan due to a stronger U.S. dollar, limiting the central bank’s flexibility for additional easing.

Japan will release a packed lineup of reports, including October’s inflation rate and trade balance, followed by November’s PMI updates. PMI data is also awaited from India and Australia.

In Australia, markets will look at the Reserve Bank of Australia’s (RBA) meeting minutes for clues on potential rate cuts.

The Bank of Indonesia is projected to keep its interest rate unchanged, while Thailand is set to release Q3 GDP data. Malaysia will publish its October CPI data.