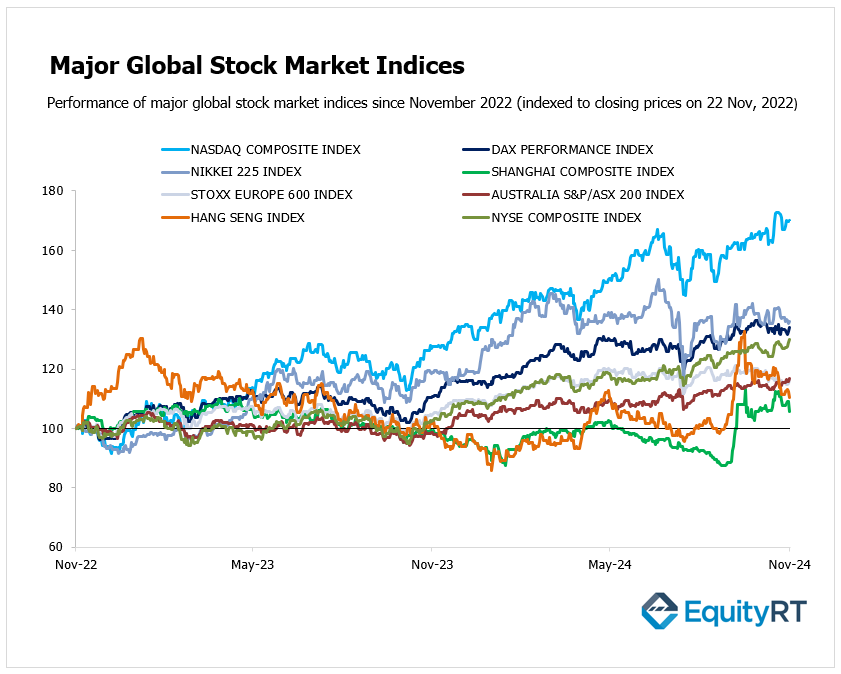

Global Stock Market Highlights

Wall Street ended higher on Friday, with all three major indexes recording weekly gains, as investors found reassurance in data indicating strong economic activity in the world’s largest economy.

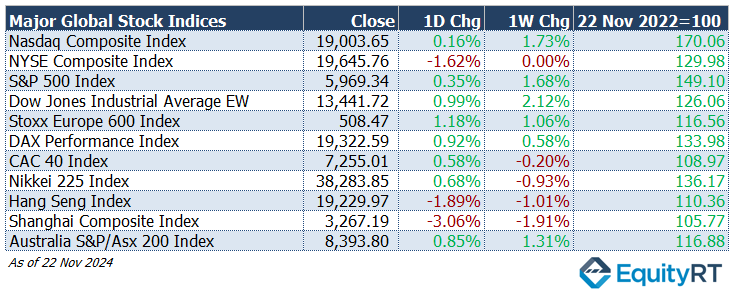

- Nasdaq Composite Index edged up to 19,003.65, gaining 0.16% for the day and 1.73% for the week.

- NYSE Composite Index fell to 19,645.76, down 1.62% for the day and unchanged for the week.

- S&P 500 Index rose to 5,969.34, adding 0.35% for the day and 1.68% for the week.

- Dow Jones Industrial Average EW climbed to 13,441.72, increasing 0.99% for the day and 2.12% for the week.

Stock and bond markets will be closed on Thursday, Nov. 28, in observance of the Thanksgiving holiday.

European stocks ended mostly higher on Friday as investors absorbed weak economic data from the region, which fuelled expectations of upcoming central bank rate cuts.

- Stoxx Europe 600 Index rose to 508.47, up 1.18% for the day and 1.06% for the week.

- DAX Performance Index reached 19,322.59, rising 0.92% for the day and 0.58% for the week.

- CAC-40 Index increased to 7,255.01, up 0.58% for the day but down 0.20% for the week.

Asia markets showed mixed results on Friday. Chinese stocks fell as mounting economic concerns weighed on the market. Shares in Japan and Australia advanced.

- Shanghai Composite Index dropped to 3,267.19, falling 3.06% for the day and 1.91% for the week.

- Hang Seng Index declined to 19,229.97, losing 1.89% for the day and 1.01% for the week.

- Nikkei 225 Index gained to 38,283.85, up 0.68% for the day but declined 0.93% for the week.

- Australia’s S&P/ASX 200 Index increased to 8,393.80, up 0.85% for the day and 1.31% for the week.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 52, rising 0.44% for the day and 0.98% for the week.

- The Brent crude oil the global oil price benchmark, advancing 1.27% on the day and 2.13% over the week as markets responded to tightening supply concerns.

- The Gold closed at $2,562.54 per ounce, gaining 1.75% for the day and 3.56% over the week, fuelled by demand for safe-haven assets amid market volatility.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, increased to 4.38%, up 2.70 bps for the day and 6.50 bps for the week, reflecting expectations of tighter monetary policy.

- The 10-year U.S. Treasury yield declined to 4.41%, falling 1.40 bps on the day and 4.30 bps for the week, driven by bond market strength.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

The shortened holiday week in the United States will be marked by several key economic releases, starting with the FOMC minutes on Tuesday, a day earlier than usual due to the Thanksgiving holiday. This week’s meeting minutes are expected to offer further insights into policy and rate plans.

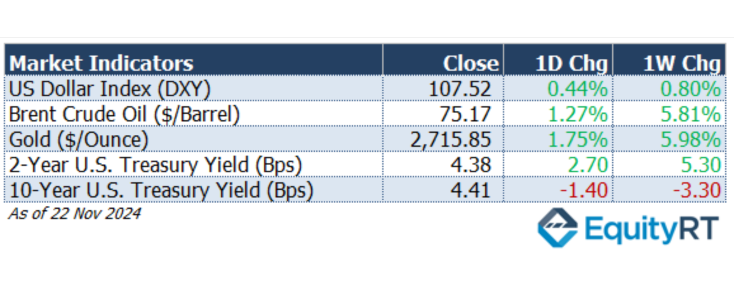

On Wednesday, U.S. Personal Consumption Expenditures (PCE) data for October is expected to show a 0.2% month-over-month increase, consistent with the previous reading.

Core PCE is projected to remain steady at 0.3%.

In September, the headline PCE index rose 0.2% month-over-month, aligning with expectations and reflecting a stable pace of price increases. On a yearly basis, PCE inflation eased to 2.1%, down from a revised 2.3% in August, marking its lowest level since 2021.

Meanwhile, the core PCE index registered a monthly rise of 0.3% in September, the largest in five months, following a 0.2% increase in August. While core inflation remains relatively steady, its persistence above the Fed’s 2% target indicates that tighter monetary policy could remain in place for an extended period.

Personal income is anticipated to grow by 0.3%, while personal spending is projected to increase by 0.4%, slightly down from September’s 0.5% gain.

The second estimate for Q3 GDP is expected to confirm a 2.8% growth rate, indicating continued strength in the U.S. economy.

The US economy grew at a slower pace in the third quarter of 2024, expanding by 2.8% on an annualized basis, which was lower than the previous quarter and forecasts. While personal spending surged, it was not enough to offset the slowdown in other areas.

Government spending also contributed significantly. Meanwhile, both exports and imports saw solid increases, particularly in capital goods.

Durable goods orders are also projected to show a modest rebound of 0.1%.

Additionally, several other significant reports will be released, including corporate profits, wholesale inventories, and regional manufacturing indices (Chicago, Dallas, and Richmond Fed), as well as the S&P/Case-Shiller and FHFA house price indices, the Conference Board’s Consumer Confidence Index, and data on new and pending home sales.

In Canada, Q3 GDP growth figures will be released on Thursday, providing insights into the country’s economic performance.

Canada’s economy grew by 0.5% in Q2 2024, marking its second consecutive quarter of expansion. Government spending and business investment were the main drivers. On an annualized basis, GDP rose by 2.1%, surpassing expectations and marking the strongest growth since Q1 2023.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

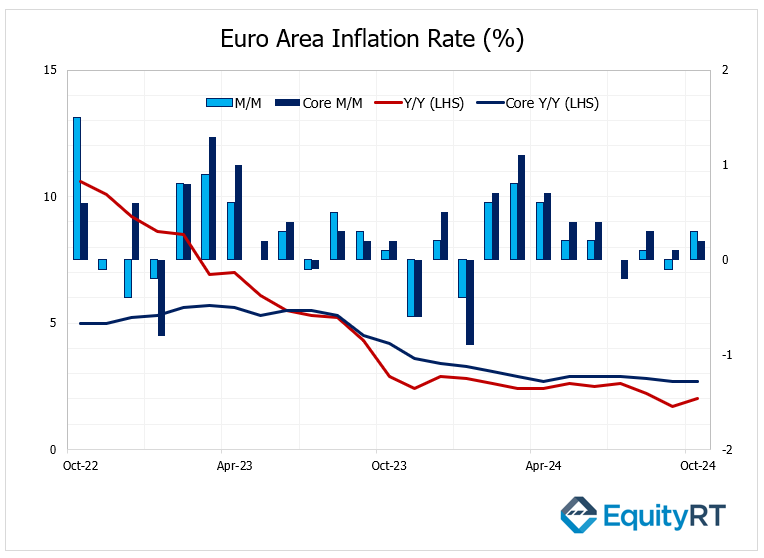

This week, the preliminary inflation figures in the Euro Area for November will be tracked on Friday. Euro Area inflation is expected to rise for the second consecutive month, reaching 2.4%, up from 2% in October.

In October 2024, annual inflation in the Euro Area increased to 2%, up from 1.7% in September, aligning with the European Central Bank’s target. This rise was anticipated due to base effects, as last year’s sharp declines in energy prices no longer influenced the annual rate. While energy prices fell at a slower pace, inflation for food, alcohol, b, and non-energy industrial goods accelerated.

Core inflation remained unchanged at 2.7%, the lowest level since February 2022. On a monthly basis, the Consumer Price Index (CPI) rose by 0.3%, marking the largest increase in six months.

Additional data to watch includes Economic Sentiment, final consumer confidence, and lending growth for the region.

In Germany, the Ifo Business Climate Index is anticipated to decline slightly. Other key releases include updates on retail sales, unemployment, and GfK Consumer Confidence.

Meanwhile, in the UK, a quieter week is expected, with focus on the CBI Distributive Trades survey, mortgage data, and the Bank of England’s credit indicators.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

Japan will experience a busy week of economic data releases, including key indicators such as retail sales, industrial production, unemployment, housing starts for October, and consumer confidence for November.

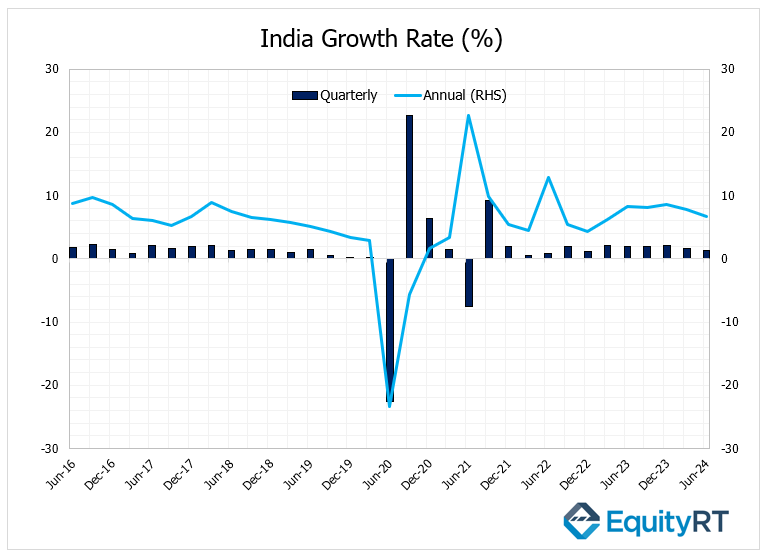

India will release its Q3 GDP data on Friday, with growth expected to slow to 6.5%, the weakest since Q1 2023.

In Q2 2024, the economy expanded by 6.7% year-on-year, down from 7.8% in the previous quarter and missing the forecast of 6.9%. This showed the slowest growth in five quarters, primarily due to reduced government spending as routine activities paused ahead of the general elections.

In Australia, October’s Consumer Price Index (CPI) is expected to show a pickup, marking a potential shift in inflationary trends as the country begins the third quarter.

Other economic data due to be released include construction and housing credit aggregates, providing further insight into the domestic economic landscape.

In South Korea, the Bank of Korea is expected to hold its interest rate steady at 3.25%, following recent rate cuts. The decision comes amid a delicate economic balance as the country faces both inflationary pressures and slowing global demand.

Finally, The Reserve Bank of New Zealand (RBNZ) is expected to implement another rate cut in its last meeting of the year, reducing the policy rate by 50 basis points to 4.25%. This decision aligns with the central bank’s efforts to bolster economic activity amid slowing global growth and domestic challenges.