Global Stock Market Highlights

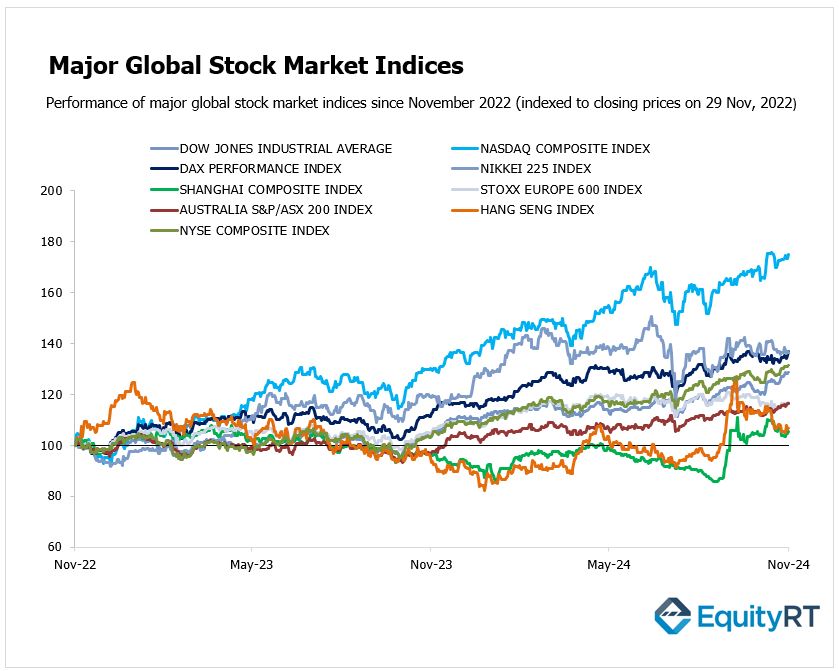

Stocks climbed on Friday, closing out a strong month of gains as the market continued its rally following the recent elections. This rally pushed major indexes to all-time highs.

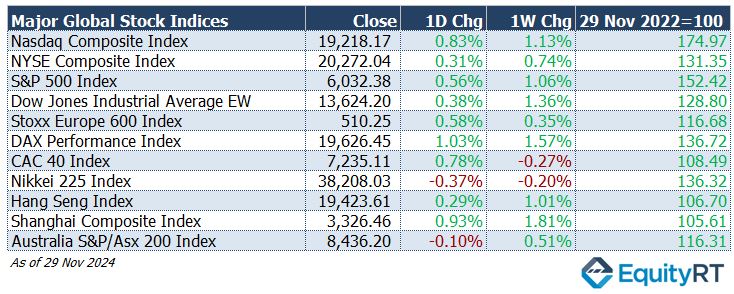

- Nasdaq Composite Index rose to 19,218.17, gaining 0.83% for the day and 1.13% for the week.

- NYSE Composite Index increased to 20,272.04, advancing 0.31% for the day and 0.74% for the week.

- S&P 500 Index climbed to 6,032.38, up 0.56% for the day and 1.06% for the week.

- Dow Jones Industrial Average EW climbed to 13,624.20, rising 0.38% for the day and 1.36% for the week.

European stocks ended higher on Friday after a mixed start to the day, as investors analyzed the latest inflation figures from the Euro Area.

- Stoxx Europe 600 Index rose to 510.25, gaining 0.58% for the day and 0.35% for the week.

- DAX Performance Index surged to 19,626.45, climbing 1.03% for the day and 1.57% for the week.

- CAC-40 Index increased to 7,235.11, up 0.78% for the day but declining 0.27% for the week.

Asian shares were mixed on Friday after U.S. markets were closed Thursday due to the Thanksgiving holiday. Investors are anticipating a significant economic planning meeting typically scheduled for December.

- Shanghai Composite Index climbed to 3,326.46, increasing 0.93% for the day and 1.81% for the week.

- Hang Seng Index edged up to 19,423.61, gaining 0.29% for the day and 1.01% for the week.

- Nikkei 225 Index fell to 38,208.03, dropping 0.37% for the day and 0.20% for the week.

- Australia’s S&P/ASX 200 Index slipped to 8,436.20, down 0.10% for the day but rising 0.51% for the week.

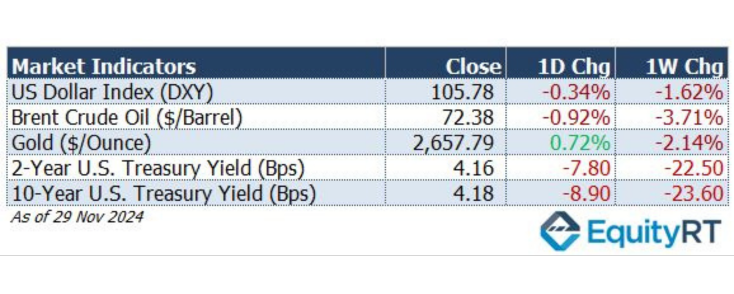

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, declined to 105.78, dropping 0.34% for the day and 1.62% over the week as market sentiment shifted towards riskier assets.

- The Brent crude oil the global oil price benchmark, declined 0.92% on the day and 3.71% over the week amid easing supply concerns.

- The Gold rose 0.72% on the day to $2,657.79 but dropped 2.14% for the week as investor demand fluctuated.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, decreased by 7.80 basis points on the day and 22.50 bps for the week as bond prices gained.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, fell 8.90 basis points on the day and 23.60 bps for the week, signalling strong demand for safe-haven assets.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

This week in the United States, the focus will be on the November jobs report and comments from Federal Reserve officials, including Chair Jerome Powell, who will speak at the New York Times DealBook Summit. Markets will be paying close attention to these updates for hints about the economy and future interest rate decisions.

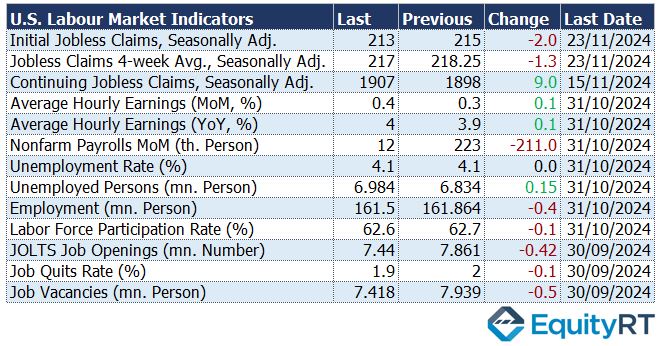

The November jobs report, set for release on Friday, will be closely watched, with a strong rebound expected. The economy is projected to add 183,000 new jobs, a significant recovery from the 12,000 added in October.

The unemployment rate is likely to remain steady at 4.1%, while wage growth may moderate slightly to 0.3% from the previous month’s 0.4%.

The JOLTS report is expected to show a small increase in job openings, signaling continued demand for workers.

Job growth in October was much weaker than expected, with only 12,000 jobs added, well below the 223,000 in September and market expectations of 113,000.

The labor force participation rate dropped by 0.1 percentage point to 62.7%. Meanwhile, job openings decreased to the lowest level since January 2021, pointing to signs of a cooling labor market.

Other important reports this week include the ISM Manufacturing and Services PMI. The manufacturing sector is expected to show signs of improvement, while the services sector may slow down slightly.

Consumer confidence looks set to improve, with the Michigan Consumer Sentiment Index predicted to rise in December.

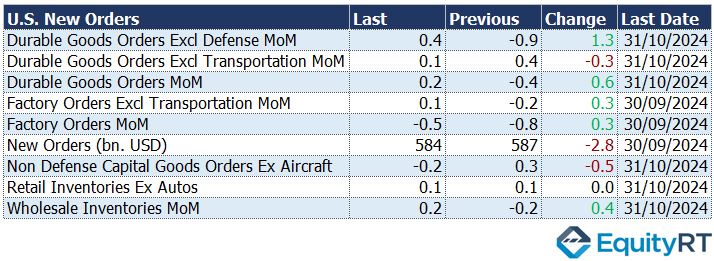

Factory orders in the US are also expected to recover in October, with a 0.4% increase.

Factory orders decreased by 0.5% to $584.2 billion in September 2024, following a revised 0.8% drop in August. This was broadly in line with market expectations, which anticipated a 0.4% decline.

Additional data will include S&P Global PMIs, ADP employment figures, Challenger job cuts, trade numbers, and construction spending.

Investors will also keep an eye on speeches from Fed officials, which could give clues about future rate hikes or pauses.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

In the Euro Area, the unemployment rate is expected to stay at 6.3% in October, the lowest level ever recorded.

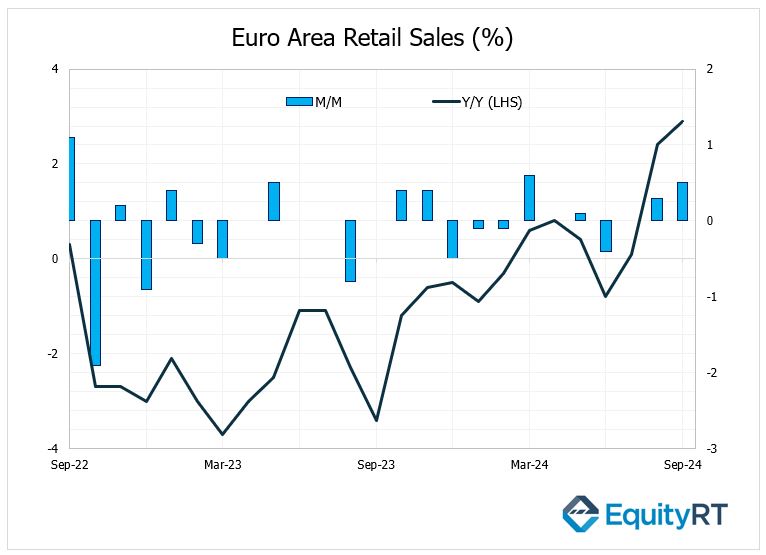

Retail sales data for the Euro Area, set to be released on Thursday, is expected to show a decline for the first time in four months, indicating weaker consumer activity.

Retail sales unexpectedly rose by 0.5% in September, surpassing the 0.4% increase expected. This followed an upward revision of the previous month’s growth to 1.1% from 0.2%. Despite this positive surprise, concerns remain about the sustainability of the trend, as consumers have been more inclined to save rather than spend.

In Germany, factory orders are predicted to fall after a strong 4.2% increase in September, while manufacturing production in France is expected to recover from an earlier decline.

In the UK, the Nationwide House Price Index is expected to rise for the third consecutive month, suggesting resilience in the housing market.

Other important data this week includes final Q3 GDP numbers for the Euro Area. The Euro Area’s GDP grew by 0.9% year-on-year in Q3 2024, the strongest performance since Q1 2023. On a quarterly basis, GDP expanded by 0.4%, following a 0.2% rise in Q2, matching the initial estimate.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

In China, attention will be on the official and Caixin PMIs, which will provide the first indicators for November. These figures are expected to show that recent monetary support and fiscal stimulus have helped boost China’s economy, with positive signs in both domestically focused and export-driven sectors.

In Japan, the spotlight will be on key speeches and signals from Bank of Japan (BoJ) policymakers, as speculation grows that the central bank may implement another rate hike in its final meeting of 2024.

The Reserve Bank of India (RBI) is expected to keep its key rate unchanged.

In South Korea, a busy week of economic releases will focus on exports, inflation, and the PMI data.

Indonesia, Taiwan, and the Philippines will release their inflation figures.

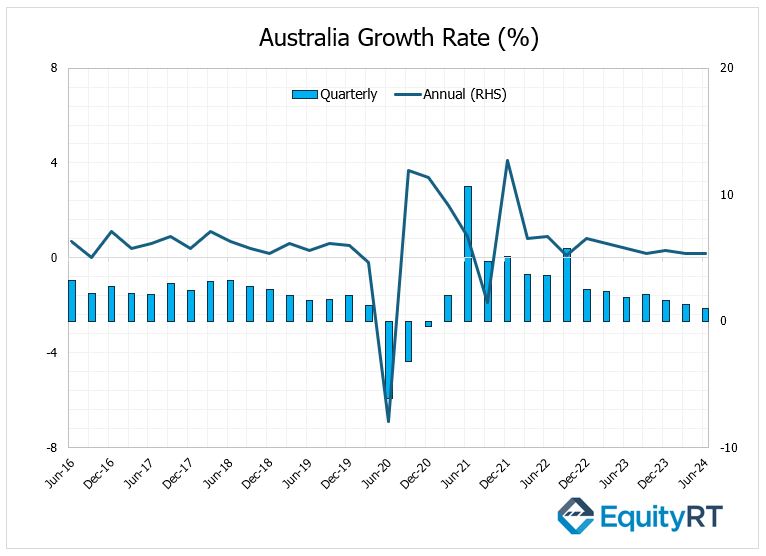

In Australia, the key event will be the third-quarter GDP report, which is expected to show a stronger pace of growth.

The Australian economy grew by 0.2% quarter-on-quarter in Q2 2024, marking its 11th consecutive quarter of expansion but falling short of market expectations of 0.3%. Year-on-year, GDP rose by 1%, the slowest annual growth rate since Q4 2020. This sluggish pace, the softest in five quarters, was largely supported by an increase in government spending.

Other important data releases include October’s trade balance, retail sales, building permits, housing credit, and the Ai Group Industry Index.