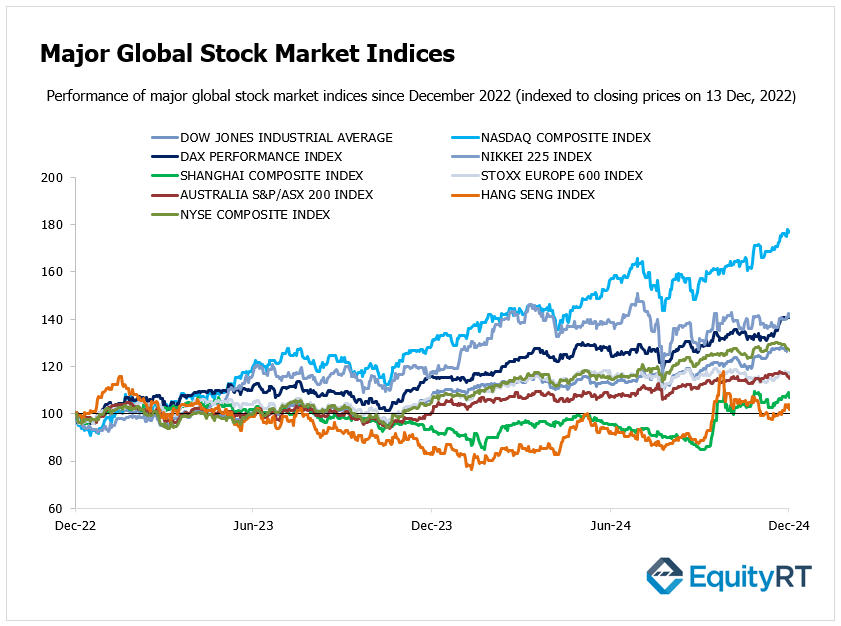

Global Stock Market Highlights

US stocks delivered a mixed performance last Friday as the post-election rally showed signs of fading. Investors remained cautious ahead of this week’s Federal Reserve meeting, where policymakers are expected to provide clarity on the direction of interest rates.

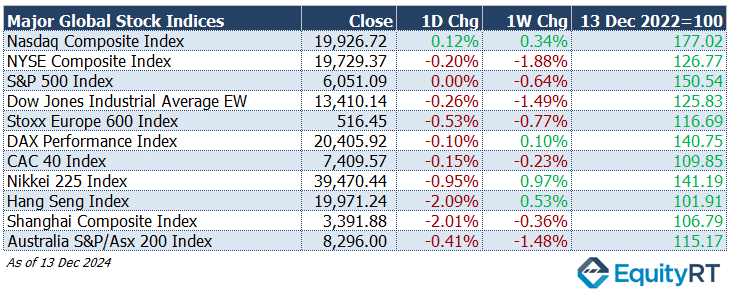

- Nasdaq Composite Index rose to 19,926.72, gaining 0.12% for the day and 0.34% for the week.

- NYSE Composite Index fell to 19,729.37, down 0.20% for the day and 1.88% for the week.

- S&P 500 Index remained flat at 6,051.09, with a 0.00% daily change and a -0.64% weekly decline.

- Dow Jones Industrial Average EW declined to 13,410.14, losing 0.26% for the day and 1.49% for the week.

European stock markets delivered a mixed performance as investors weighed economic data and market outlooks in the region.

- Stoxx Europe 600 Index dropped to 516.45, down 0.53% for the day and 0.77% for the week.

- DAX Performance Index closed at 20,405.92, slipping 0.10% for the day but up 0.10% for the week.

- CAC-40 Index fell to 7,409.57, recording a daily loss of 0.15% while gaining 0.47% for the week.

Asian markets broadly declined on Friday, with Chinese stocks leading the losses as investors were disappointed by the lack of substantive policy measures from the Central Economic Work Conference.

- Shanghai Composite Index fell to 3,391.88, losing 2.01% for the day and 0.36% for the week.

- Hang Seng Index declined to 19,971.24, falling 2.09% for the day but gaining 0.53% for the week.

- Nikkei 225 Index dropped to 39,470.44, down 0.95% for the day but rising 0.97% for the week.

- Australia’s S&P/ASX 200 Index dropped to 8,296.00, losing 0.41% for the day and 1.48% for the week.

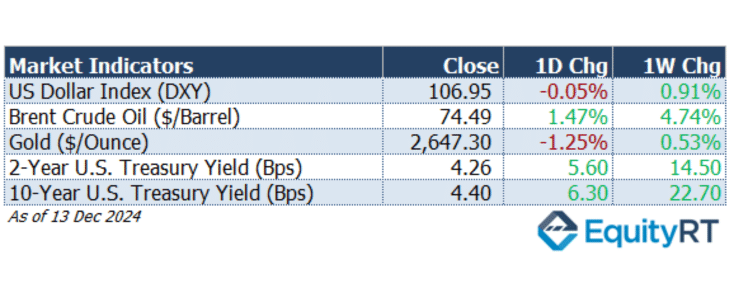

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, edged lower to 106.95, posting a 0.05% daily decline but rising 0.91% for the week, reflecting sustained dollar demand.

- The Brent crude oil the global oil price benchmark, climbed to $74.49 per barrel, gaining 1.47% on the day and 4.74% over the week as oil markets rebounded on supply concerns.

- The Gold slipped to $2,647.30 per ounce, declining 1.25% for the day but advancing 0.53% for the week, supported by safe-haven demand.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, increased to 4.26%, rising 5.60 basis points on the day and 14.50 basis points for the week, reflecting higher short-term rate expectations.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, climbed to 4.40%, gaining 6.30 basis points for the day and 22.70 basis points over the week as long-term bond yields surged.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

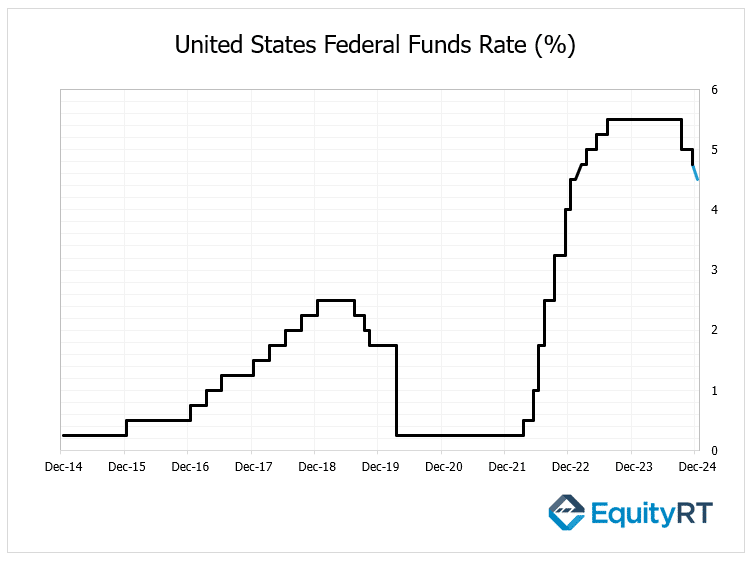

In the U.S., market attention will be on the Federal Reserve’s interest rate decision on Wednesday, followed by a speech from Fed Chair Jerome Powell.

Expectations are that the Fed will reduce the federal funds rate by 25 basis points, bringing it to a range of 4.25%-4.5%, marking the third rate cut of the year.

At its November meeting, the Fed had already lowered the rate by 25 basis points, from 4.75%-5.00% to 4.50%-4.75%, following a 50-basis point reduction in September.

This shift is part of a broader change in monetary policy, with markets anticipating a slower pace of rate cuts in 2025, with only three additional reductions expected. Alongside the rate decision, investors will closely watch the updated FOMC Economic Projections for guidance on the Fed’s policy direction for the coming year.

Key data points will further inform market expectations, including the PCE report, which is projected to show a 0.5% rise in personal spending, while income growth is likely to have decelerated to 0.4%.

Retail sales are also expected to show a modest growth of 0.5% in November, slightly higher than October’s 0.4% increase, signaling steady consumer demand.

Industrial production is forecast to rebound by 0.1% after a 0.3% decline, hinting at recovery in manufacturing and production sectors.

The December flash S&P Global PMIs will offer a first look into private sector activity, though a slight slowdown is anticipated, suggesting that growth might be easing.

Additional key releases include final GDP growth, corporate earnings reports, and several regional economic indicators, such as the NY Empire State Manufacturing Index, the NAHB Housing Market Index, and the Philadelphia Fed Manufacturing Index.

Housing data, including housing starts, building permits, and existing home sales, will provide further insights into the housing market, while the final Michigan Consumer Sentiment Index will offer an overview of consumer confidence.

The University of Michigan’s consumer sentiment rose for the fifth straight month to 74 in December 2024, the highest since April, up from 71.8 in November and surpassing the forecast of 73.

In Canada, the Consumer Price Index (CPI) for November is expected to show no monthly change, following a 0.4% rise in October, indicating a period of price stability.

In Latin America, both Mexico and Chile are expected to lower their key interest rates by 25bps, continuing the trend of monetary easing across the region.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

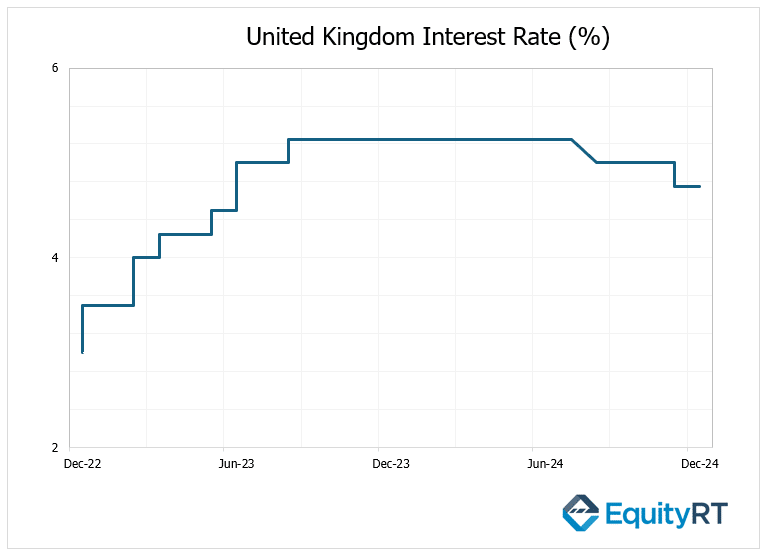

The Bank of England (BoE) is expected to keep interest rates unchanged on Thursday following its November rate cut, driven by ongoing concerns over persistent inflation. BoE Governor Bailey stated that inflation must stay close to the target, so interest rates cannot be cut too quickly or too much. However, if the economy develops as expected, gradual rate cuts are likely. He also mentioned that the December meeting would assess market rates to determine policy.

Investors will closely monitor inflation data, employment figures, and the PMI reading, which will provide insights into the economic impact of the recent Budget. This Budget introduced an employee-based tax hike, which appears to be dampening business confidence and labor demand, while potentially contributing to higher prices.

The manufacturing sector is anticipated to contract for the third consecutive month, although services activity is expected to show slight growth.

In the Eurozone, flash PMI data for Germany, France, and the broader region will be under scrutiny, with expectations for continued contraction in both manufacturing and services.

Economic sentiment indicators such as Germany’s Ifo, ZEW, and GfK reports are likely to reflect persistent weakness in the region.

Additionally, final inflation data for the Eurozone in November will be a key focus, along with trade and consumer confidence figures, and Germany’s producer prices.

The meetings of the Swedish and Norwegian central banks will be closely watched.

The Swedish Central Bank cut its policy rate by 50 basis points to 2.75% in November, following previous rate cuts. In this week’s meeting, a 25-basis point cut to 2.50% is expected. Meanwhile, the Norwegian Central Bank kept its policy rate at 4.50% in November and signalled it would remain unchanged in December. It is expected to maintain the rate at 4.50% in this week’s meeting as well.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

In China, the final data releases of the year included November’s industrial production, retail sales, unemployment rate, housing prices, and fixed asset investment, offering a clearer picture of the economic response to recent monetary stimulus.

On an annual basis, the growth rate of industrial production in November rose slightly from 5.3% to 5.4%, in line with expectations.

The annual growth rate of retail sales slowed sharply from 4.8% to 3%, marking a notable decline from the highest level since February.

The annual growth rate of fixed asset investments slightly decelerated from 3.4% to 3.3% in November, while expectations were for a mild increase to 3.5%.

In Asia, monetary policy decisions will also take center stage. The People’s Bank of China (PBoC) is expected to keep its loan prime rates unchanged, following its commitment to additional rate cuts in the coming year.

The Bank of Japan is expected to hold its key rate following the US Federal Reserve’s decision, with most of the market anticipating no change rather than a rate hike.

Other potential policy adjustments may occur in Indonesia, Thailand, and the Philippines. Economic data from the region will also be closely watched, with higher inflation expected in Japan and Malaysia.

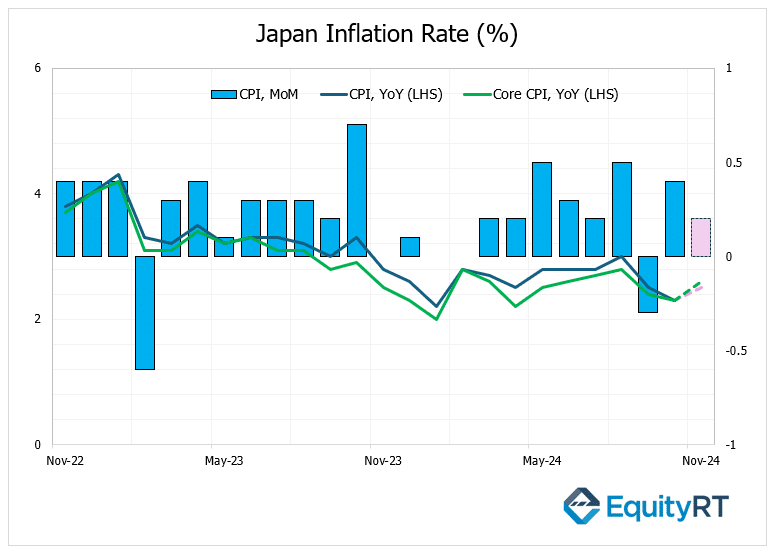

On Friday Japan’s inflation figures for November will be released.

The annual inflation rate in Japan eased to 2.3% in October 2024, down from 2.5% in September, marking the lowest level since January. The increase in electricity prices slowed to 4.0%, the smallest rise in six months. On a monthly basis, the CPI rose by 0.4%, reversing the 0.3% decline seen in September.

Japan’s core CPI rose by 2.3% year-on-year in October, marking the lowest growth since April but slightly above the 2.2% forecast. Despite the slowdown, core inflation has remained above the Bank of Japan’s 2% target for over two years, prompting the BOJ to raise interest rates twice in 2024. The November core CPI reading is expected to rise to %2.6.

Flash PMI data from Japan, Australia, and India will provide early insights into private sector performance, while Australia will release its Westpac Consumer Confidence Index.

Additionally, New Zealand is expected to enter a technical recession, with Q3 GDP likely to show further contraction, adding to the economic challenges in the region. New Zealand’s economy contracted by 0.5% year-on-year in Q2 2024, as expected, after a 0.5% expansion in the previous quarter. Quarterly GDP shrank by 0.4%, following a 0.1% decline in Q1.