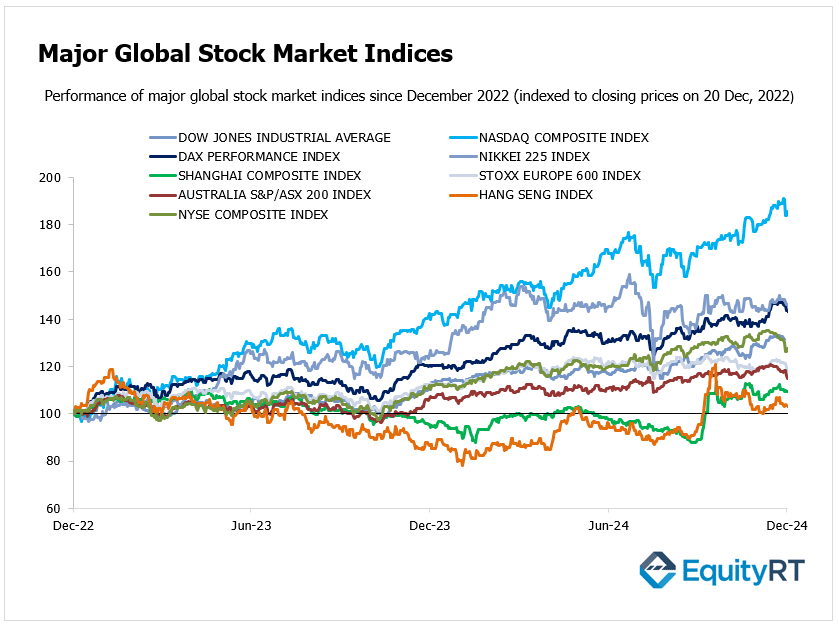

Global Stock Market Highlights

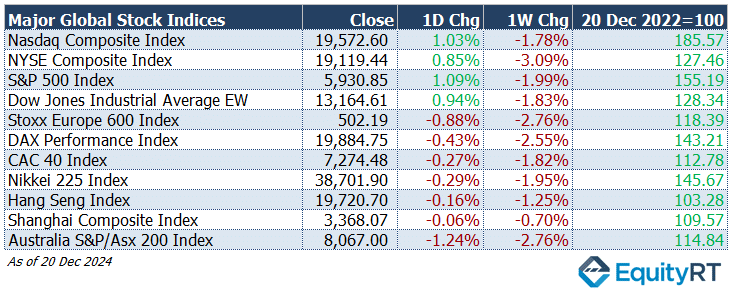

In the U.S., November PCE headline and core deflator data, closely monitored by the Fed, came in below expectations. This eased concerns about the Fed keeping interest rates high, leading Wall Street indices to close Friday with gains of over 1%.

- Nasdaq Composite Index rose to 19,572.60, gaining 1.03% daily but dropping -1.78% for the week.

- NYSE Composite Index climbed to 19,119.44, increasing by 0.85% in a day yet declining by -3.09% over the week.

- S&P 500 Index advanced to 5,930.85, up 1.09% daily while falling -1.99% on a weekly basis.

- Dow Jones Industrial Average EW closed at 13,164.61, up 0.94% for the day but down -1.83% for the week.

European markets ended lower on Friday as investors assessed a week packed with monetary policy announcements from major economies.

- Stoxx Europe 600 Index declined to 502.19, dropping -0.88% in a day and -2.76% over the week.

- DAX Performance Index fell to 19,884.75, losing -0.43% on the day and -2.55% for the week.

- CAC-40 Index edged lower to 7,274.48, down -0.27% daily and -1.82% weekly.

Asia-Pacific markets largely declined on Friday as investors reacted to Japan’s inflation data and China’s latest interest rate decision.

- Shanghai Composite Index fell to 3,368.07, falling -0.06% for the day and -0.70% over the week.

- Hang Seng Index declined to 19,720.70, losing -0.16% daily and -1.25% for the week.

- Nikkei 225 Index dropped to 38,701.90, decreasing -0.29% for the day and -1.95% over the week.

- Australia’s S&P/ASX 200 Index dropped to 8,067.00, with a daily loss of -1.24% and a weekly decline of -2.76%.

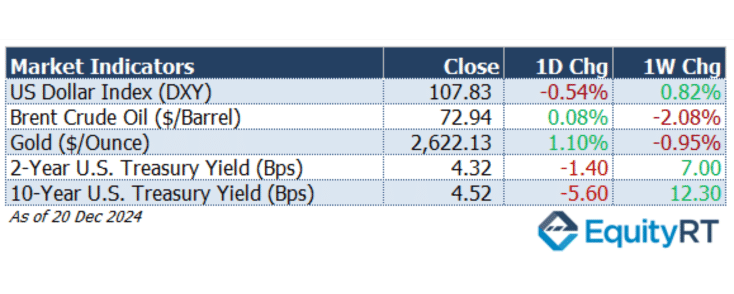

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, edged lower to 106.95, posting a 0.05% daily decline but rising 0.91% for the week, reflecting sustained dollar demand.

- The Brent crude oil the global oil price benchmark, climbed to $74.49 per barrel, gaining 1.47% on the day and 4.74% over the week as oil markets rebounded on supply concerns.

- The Gold slipped to $2,647.30 per ounce, declining 1.25% for the day but advancing 0.53% for the week, supported by safe-haven demand.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, increased to 4.26%, rising 5.60 basis points on the day and 14.50 basis points for the week, reflecting higher short-term rate expectations.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, climbed to 4.40%, gaining 6.30 basis points for the day and 22.70 basis points over the week as long-term bond yields surged.

U.S. and European markets will have shorter trading sessions this week due to the Christmas holiday. U.S. markets will be closed on Wednesday, while major European markets, along with Hong Kong in Asia, will remain closed on both Wednesday and Thursday.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

In the U.S., attention today will focus on December’s Conference Board Consumer Confidence Index data. Last month, the index rose from 109.6 to 111.7, exceeding expectations and marking its highest level in two years.

The rise in consumer confidence in November was largely driven by improved perceptions of labor market conditions and a significantly more optimistic view of future job opportunities, which reached their highest level in three years. Additionally, 12-month inflation expectations fell from 5.3% to 4.9%, the lowest level since March 2020.

For December, the index is expected to rise further to 113.

This week’s key data releases include tomorrow’s November’s preliminary durable goods orders data. In October, durable goods orders rose 0.3% following declines of 0.9% in August and 0.4% in September, driven by sharp increases in defense aircraft (+16.6%) and non-defense aircraft (+8.3%) orders. However, core capital goods orders, excluding defense and aircraft, dipped 0.2%, signaling weaker business investment.

November new home sales data will also be released tomorrow. October sales plunged 17.3%, the steepest drop since 2013, and hit their lowest level since 2022, following a 4.1% rise in September. November is expected to show a partial recovery with a 9% increase.

The S&P/Case-Shiller 20-City Home Price Index for October will be released on Friday. September data showed a monthly growth slowdown from 0.3% to 0.2%, and annual growth declined from 5.2% to 4.6%, the lowest level in the year.

On Thursday, focus will be on the weekly initial jobless claims data, offering insights into the U.S. labor market.

U.S. initial jobless claims dropped by 22,000 to 220,000 in the week ending December 14, significantly below market expectations of 230,000. This sharp decline eased concerns about weakening labor conditions following the unexpected surge in claims the previous week.

The data aligns with the Federal Reserve’s recent outlook, suggesting that only minimal interest rate cuts may be necessary next year as inflation remains the primary concern over a slowing labor market. Continuing jobless claims also fell by 5,000 to 1,874,000 during the same period. However, the four-week moving average, which smooths out weekly fluctuations, inched up to 225,500.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

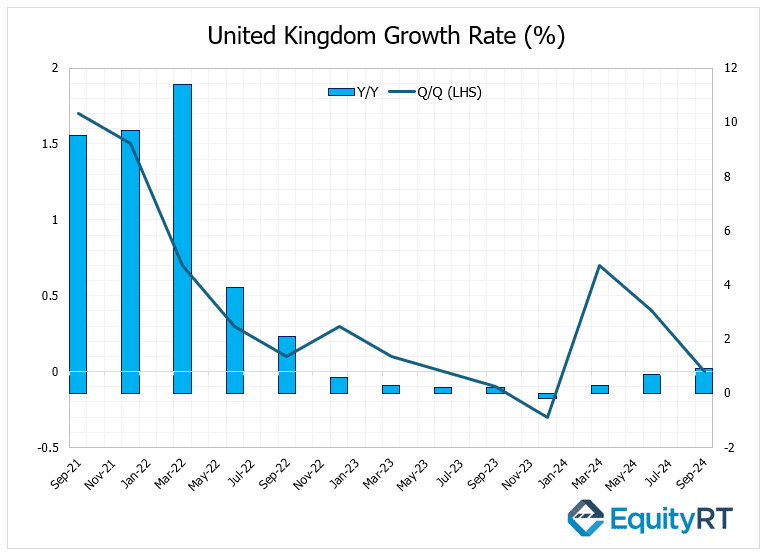

In a week with a weak data flow in Europe, the most notable focus today was on the final GDP growth data for Q3 2024 from the UK.

The British economy stalled in Q3 2024, with growth revised down to 0.1%, below the 0.4% growth seen in Q2. The services sector saw no growth, with a notable decline in financial and insurance activities. Production also contracted by 0.4%, driven by a significant drop in energy supply. Household spending grew by 0.5%, and private investment rose more than expected. However, government consumption was lower than anticipated, and gross capital formation fell due to weaker acquisitions of valuables.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

This week in South Korea, attention will be on the December Consumer Confidence Index data, which is expected to slightly decline from 101 to 100.7, reflecting sentiment amid ongoing economic concerns.

In Japan, the highlight will be the release of the Bank of Japan’s monetary policy meeting minutes, providing insights into the central bank’s stance on future monetary measures.

Tokyo Core Consumer Price Index (CPI) is expected to show a slight decrease to 2.2% from the previous 2.5%.

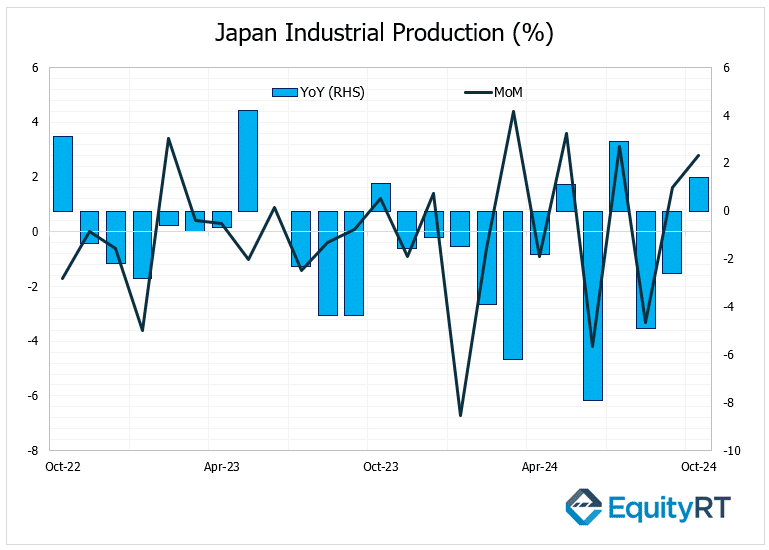

This Friday, Japan’s industrial production data will be released.

In October 2024, industrial production rose by 2.8% month-over-month, slightly below the preliminary estimate of 3.0%, but still an improvement from the 1.6% increase seen in September.

This marks the second consecutive month of expansion, and the strongest growth since July. Key contributors to the upturn included production machinery, motor vehicles and fabricated metals.

On a yearly basis, industrial production rose by 1.6%, a significant recovery from the 2.6% drop in September, signalling the first increase in three months.

A slowdown in monthly industrial production is expected, with a 3.4% decline in November.

China’s People’s Bank of China (PBoC) is anticipated to maintain the 1-Year Medium Lending Facility (MLF) rate at 2.0%.