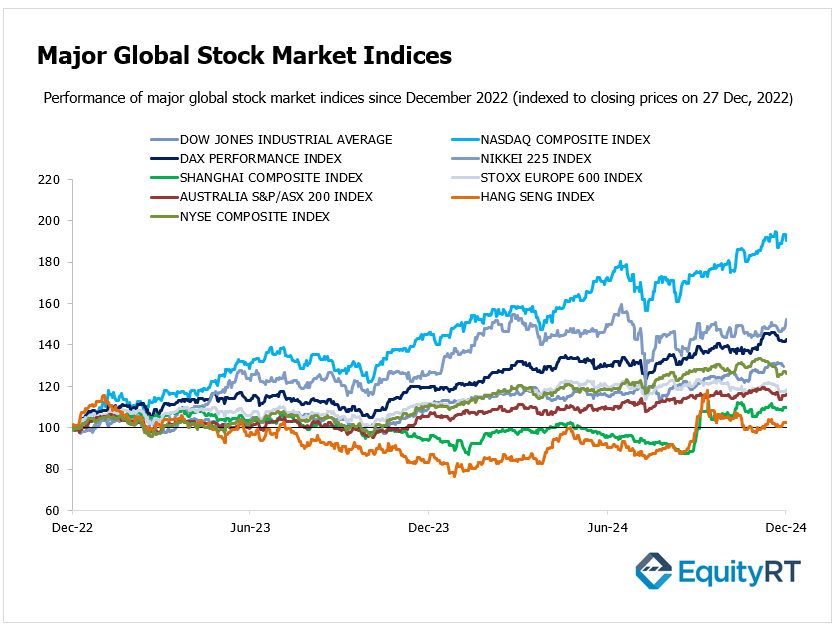

Global Stock Market Highlights

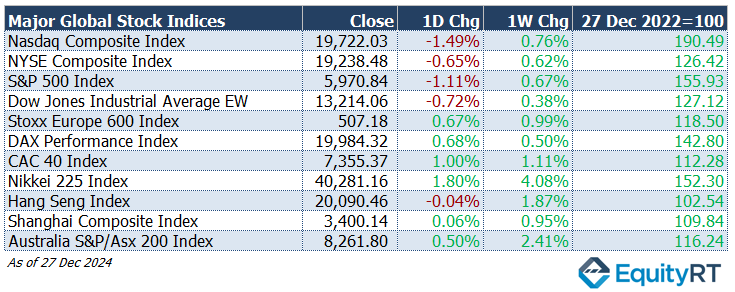

Wall Street indices closed Friday with losses, influenced by low trading volumes in the stock markets ahead of year-end and intense selling pressure, particularly on technology stocks.

- Nasdaq Composite Index fell to 19,722.03, declining -1.49% daily but gaining 0.76% for the week.

- NYSE Composite Index dropped to 19,238.48, down -0.65% on the day but up 0.62% for the week.

- S&P 500 Index closed at 5,970.84, losing -1.11% daily while rising 0.67% for the week.

- Dow Jones Industrial Average EW decreased to 13,214.06, falling -0.72% on the day but edging up 0.38% for the week.

European stocks ended Friday on a positive note as regional markets reopened after the Christmas holiday closure.

- Stoxx Europe 600 Index advanced to 507.18, gaining 0.67% daily and 0.99% for the week.

- DAX Performance Index rose to 19,984.32, up 0.68% for the day and 0.50% for the week.

- CAC-40 Index increased to 7,355.37, climbing 1.00% daily and 1.11% for the week.

Asia-Pacific markets were mixed on Friday as Wall Street closed out a holiday-shortened week on a down note.

- Shanghai Composite Index rose to 3,400.14, inching up 0.06% daily and 0.95% weekly.

- Hang Seng Index edged down slightly to 20,090.46, dropping -0.04% for the day but advancing 1.87% for the week.

- Nikkei 225 Index surged to 40,281.16, gaining 1.80% on the day and a strong 4.08% for the week.

- Australia’s S&P/ASX 200 Index climbed to 8,261.80, gaining 0.50% for the day and 2.41% over the week.

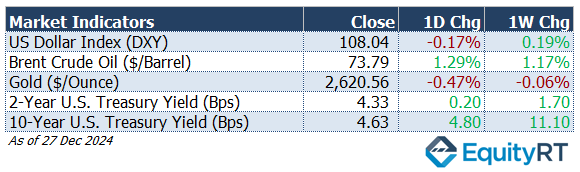

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, edged lower to 108.04, declining -0.17% on the day but increasing 0.19% for the week.

- The Brent crude oil, the global oil price benchmark, rose to $73.79 per barrel, gaining 1.29% daily and 1.17% over the week.

- The Gold surged to $2,622.13 per ounce, up 1.10% on the day, though down 0.95% for the week as safe-haven demand fluctuated.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, increased to 4.33 bps, adding 0.20 bps daily and 1.70 bps for the week.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, climbed to 4.63 bps, surging 4.80 bps on the day and 11.10 bps for the week.

U.S. and European markets will have shorter trading sessions this week due to the Christmas holiday. U.S. markets will be closed on Wednesday, while major European markets, along with Hong Kong in Asia, will remain closed on both Wednesday and Thursday.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

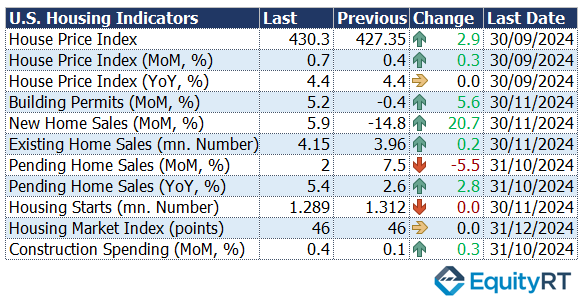

Upcoming U.S. Economic Indicators to Watch This Week

In the U.S., housing market data will be in focus, starting with the November Pending Home Sales, which tracks homes under contract but not yet closed.

Tomorrow, the S&P/Case-Shiller 20-City Home Price Index for October will be released, followed by November construction spending data on Thursday.

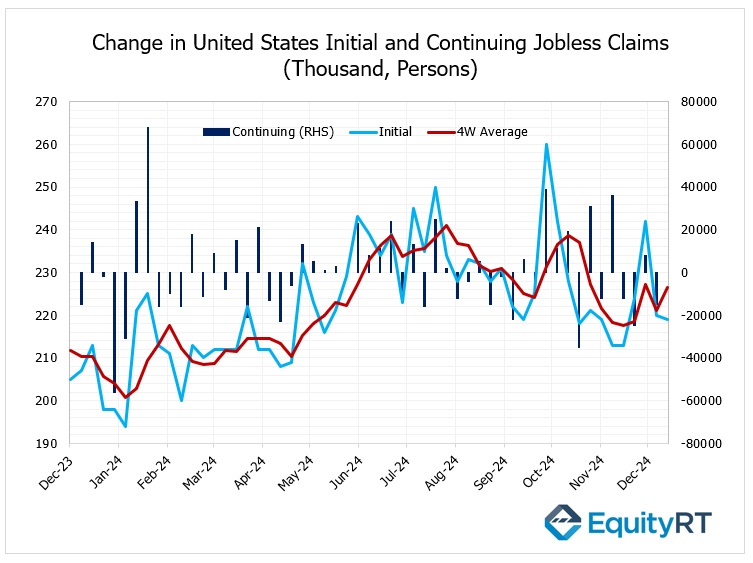

On Thursday, labor market data will also be monitored, including the weekly initial jobless claims. The most recent data showed a decrease from 220,000 to 219,000, contrary to expectations of a slight increase, indicating continued tightness in the labor market.

The 4-week average of jobless claims in the United States rose to 226,500 on December 21, up from 225,500 the previous week.

The final S&P Global Manufacturing PMI for December, offering insights into the latest trends in economic activity, will be released on Thursday.

On Friday, the ISM Manufacturing Index for December will be published.

The preliminary December manufacturing PMI had declined from 49.7 to 48.3, signaling a further contraction in the manufacturing sector and marking six consecutive months of decline.

The ISM Manufacturing Index rose from 46.5 to 48.4 in November, driven by an increase in new orders after seven months of contraction. This suggested a slowing in the pace of contraction in the manufacturing sector, though it remained in the contraction zone for the past eight months.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

Across Europe, the final HCOB Manufacturing PMI data for December, which will provide insights into the latest economic outlook, will be released on Thursday. According to preliminary figures, manufacturing PMIs remained in contraction territory across the region in December due to weak demand.

In this context, in the Eurozone, the PMI was recorded at 45.2, similar to the previous month, signaling that the pace of contraction in the manufacturing sector remained steady.

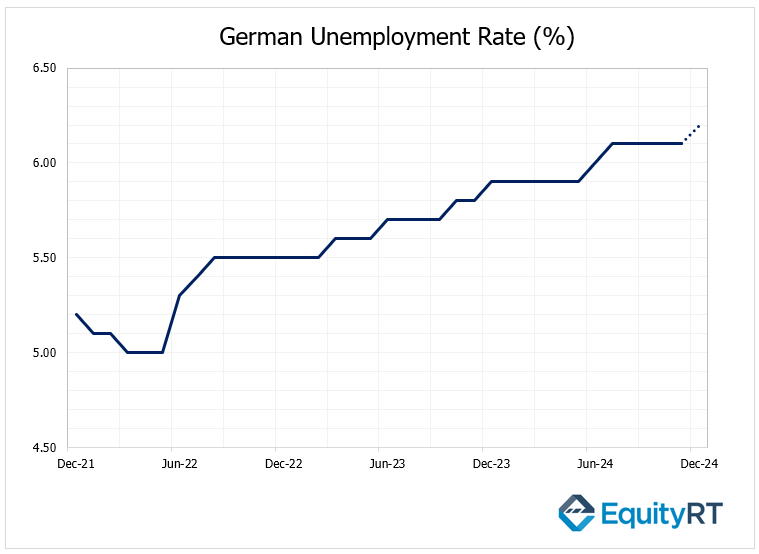

On Friday, Germany’s unemployment rate for December will be released, with expectations of an increase to 6.2%. The unemployment rate in Germany remained at 6.1% in November 2024, matching expectations and marking its highest level since February 2021.

The number of unemployed people rose by 7,000 to 2.86 million, well below the expected increase of 20,000. Job openings also dropped to 668,000, 65,000 fewer than a year earlier, signalling a slowdown in hiring.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

In Asia, attention will focus on China’s official PMI data for December, covering manufacturing and non-manufacturing sectors, which will provide signals about the state of the economy. These figures are set to be released tomorrow, followed by the Caixin Manufacturing PMI on Thursday, offering insights into the performance of small and medium-sized enterprises in December.

In November, China’s official Manufacturing PMI rose from 50.1 to 50.3, indicating a slight acceleration in manufacturing growth over the past two months and marking the highest level since April. Meanwhile, the official Non-Manufacturing PMI, which covers the services and construction sectors, declined from 50.2 to the neutral threshold of 50, signaling a shift in the non-manufacturing sectors from growth to stagnation.

Additionally, the Caixin Manufacturing PMI for November increased from 50.3 to 51.5 due to a recovery in new orders and production. This rise signaled an acceleration in manufacturing growth and marked the highest level since June.

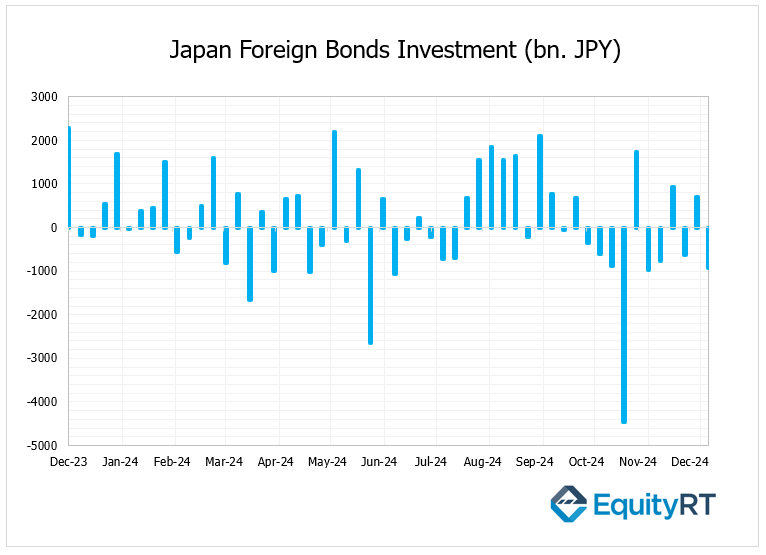

On Friday, Japan’s weekly foreign bond investment data will be tracked. In the week ending December 21, 2024, Japanese bond investments abroad experienced a decline of 919.20 billion yen, highlighting a net outflow during this period.

The Foreign bond investment measures the flow of funds from Japan’s public sector (excluding the Bank of Japan) into foreign bonds. It reflects the net difference between capital inflows (sales of foreign securities by residents) and capital outflows (purchases of foreign securities by residents). A positive net figure indicates capital inflow, while a negative figure signals capital outflow.

China’s People’s Bank of China (PBoC) is anticipated to maintain the 1-Year Medium Lending Facility (MLF) rate at 2.0%.