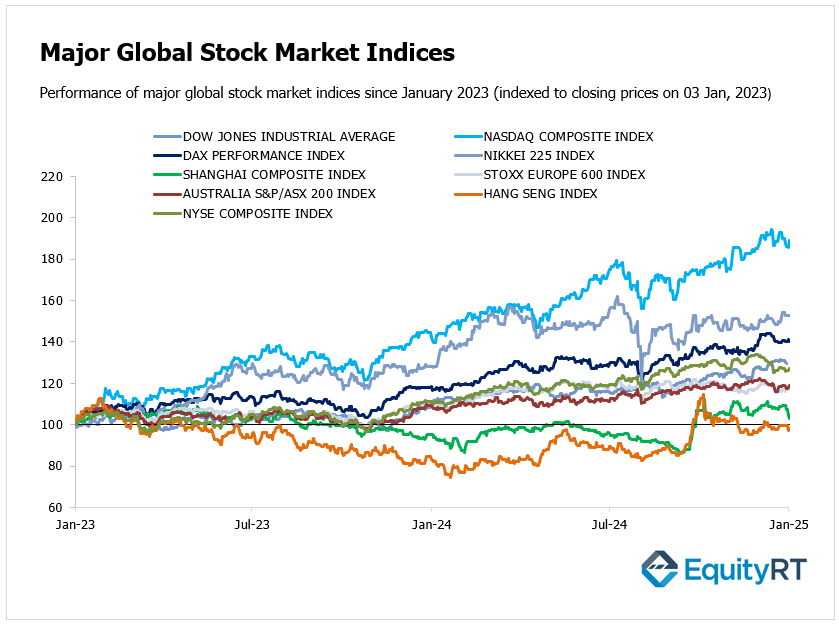

Global Stock Market Highlights

Last Friday, Wall Street shook off its holiday slump with a strong rally. The S&P 500 jumped 1.3% on Friday, marking its best day in nearly two months and its first gain since Christmas. Big Tech stocks drove the gains, with Nvidia and Tesla leading the market higher.

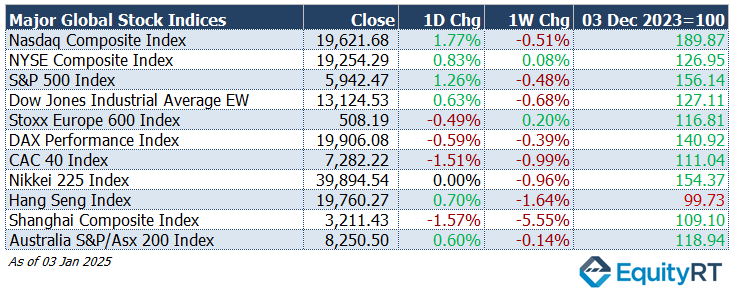

- Nasdaq Composite Index rose to 19,621.68, gaining 1.77% on the day but declining 0.51% for the week.

- NYSE Composite Index increased to 19,254.29, up 0.83% daily and 0.08% weekly.

- S&P 500 Index climbed to 5,942.47, advancing 1.26% on the day but slipping 0.48% for the week.

- Dow Jones Industrial Average EW edged up to 13,124.53, rising 0.63% daily but falling 0.68% for the week.

European shares ended the holiday-shortened week lower on Friday, marking a turbulent start to 2025 for global stocks. Investors remained focused on economic data and the potential impact of U.S. policy changes under Donald Trump’s presidency.

- Stoxx Europe 600 Index declined to 508.19, losing 0.49% on the day but gaining 0.20% for the week.

- DAX Performance Index dropped to 19,906.08, down 0.59% daily and 0.39% weekly.

- CAC-40 Index fell to 7,282.22, decreasing 1.51% on the day and 0.99% for the week.

Asian markets rose on Friday, defying Wall Street’s declines, as the dollar strengthened, and trading resumed after the New Year’s holiday.

- Shanghai Composite Index dropped sharply to 3,211.43, down 1.57% on the day and 5.55% for the week.

- Hang Seng Index climbed to 19,760.27, increasing 0.70% daily but losing 1.64% for the week.

- Nikkei 225 Index remained unchanged at 39,894.54, with no daily movement but a 0.96% weekly decline. (Data as of 30 December 2024. Tokyo remained closed until Monday.)

Australia’s S&P/ASX 200 Index rose to 8,250.50, gaining 0.60% daily but slipping 0.14% for the week.

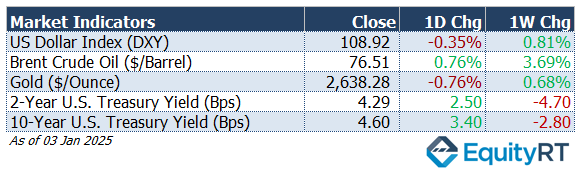

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, edged lower to 108.92, declining 0.35% on the day but gaining 0.81% for the week.

- The Brent crude oil, the global oil price benchmark, climbed to $76.51 per barrel, increasing 0.76% daily and 3.69% weekly.

- The Gold dropped to $2,638.28 per ounce, losing 0.76% on the day but rising 0.68% for the week.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, slipped to 4.29 bps, adding 2.50 bps on the day but dropping 4.70 bps for the week.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, rose to 4.60 bps, up 3.40 bps daily but down 2.80 bps for the week.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

In the U.S., the primary focus of the markets this week will be the release of the Federal Reserve’s December FOMC meeting minutes on Wednesday.

At its December meeting, the Fed reduced the federal funds rate range by 25 basis points, from 4.50%-4.75% to 4.25%-4.50%, in line with expectations. Additionally, the Fed released updated macroeconomic projections, which showed upward revisions to the median federal funds rate forecasts for the next three years.

The projections now anticipate 50 basis point cuts in both 2025 and 2026, and a 25-basis point cut in 2027, totaling 125 basis points over three years. This is a more gradual reduction compared to the September projections.

In terms of economic activity, key data releases this week include the final December S&P Global Services PMI today and the ISM Non-Manufacturing PMI tomorrow, both of which will provide signals on the current state of the economy.

Additionally, final November data on durable goods orders and factory orders will be released today, while the November trade balance is due tomorrow.

The US trade deficit narrowed to $73.8 billion in October 2024 from $83.8 billion in September, beating forecasts of $75 billion.

Exports fell 1.6% to $265.7 billion, led by declines in industrial supplies, consumer goods, and vehicles, while gains were seen in services like travel and intellectual property.

Imports dropped 4% to $339.6 billion, driven by lower purchases of computers, vehicles, crude oil, and pharmaceuticals.

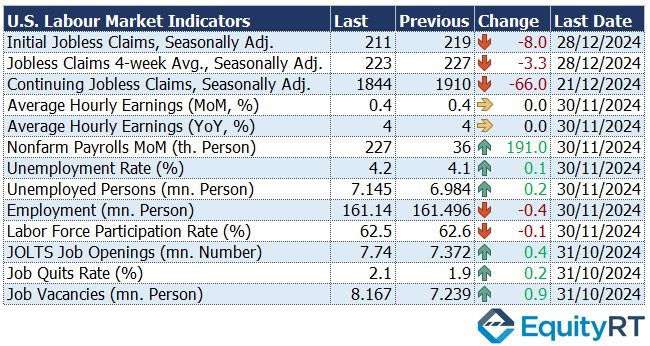

Labor market data will also be a critical focus for guiding the Fed’s monetary policy. On Tuesday, the November JOLTS job openings report will be released, followed by the December ADP private-sector employment data on Wednesday and weekly initial jobless claims data on Thursday.

On Friday, December’s nonfarm payrolls, unemployment rate, and average hourly earnings will be in focus.

In November 2024, the US economy added 227K jobs, rebounding sharply from an upwardly revised 36K in October. However, nonfarm payroll growth is expected to slow to 150K in December.

The unemployment rate increased to 4.2% in November from 4.1% in October, aligning with expectations, and is forecasted to hold steady at 4.2% in December.

Average hourly earnings growth is projected to decelerate from 0.4% to 0.3% monthly, while the annual rate is expected to remain at 4%. In November, average hourly earnings for private nonfarm employees rose by 0.4%, to $35.61, slightly exceeding market predictions of a 0.3% rise.

Friday will also feature the preliminary January University of Michigan Consumer Confidence Index, offering further insight into consumer sentiment.

In December 2024, the index was confirmed at 74, marking its highest level since April and an increase from 71.8 in November. 74.5 is expected.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

In Europe, key insights into the latest economic outlook will be provided by December’s HCOB Services PMI final data, which was released today.

Among the data guiding ECB’s monetary policy, December’s preliminary CPI figures for Germany were released today. The Euro Area CPI figures will be closely followed on Tuesday.

On Wednesday, the Euro Area ‘s final consumer confidence data for December will be released, along with November’s Producer Price Index (PPI) data for the region.

Consumer confidence in the Euro Area fell by 0.8 points to -14.5 in December 2024, falling back below its long-term average and worse than market expectations of -14, according to preliminary estimates. This was the lowest reading since April this year. -14.5 is expected for the final reading.

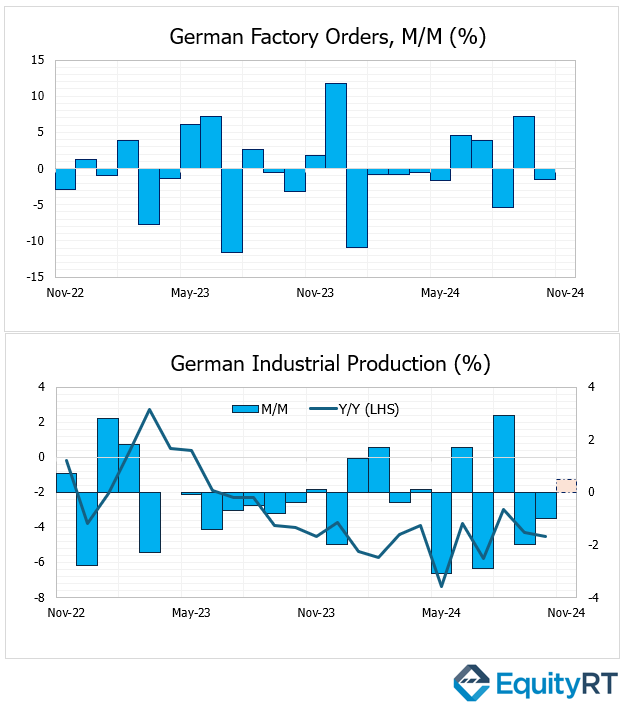

Germany’s November factory orders will be announced on Wednesday, followed by November industrial production data on Thursday, providing insights into the state of production.

Factory orders fell 1.5% in October 2024, better than the expected 2% drop, following a 7.2% surge in September. November orders are anticipated to remain flat.

Industrial production declined 1% in October, missing forecasts of a 1.2% rebound, with energy production down 8.9% year-over-year and automotive output falling 1.9%.

Industrial production for November is expected to rise by 0.5%.

On the same day, Germany’s November trade balance figures will also be monitored.

November retail sales data for the Euro Area, which will signal trends in domestic demand, will be released on Thursday.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

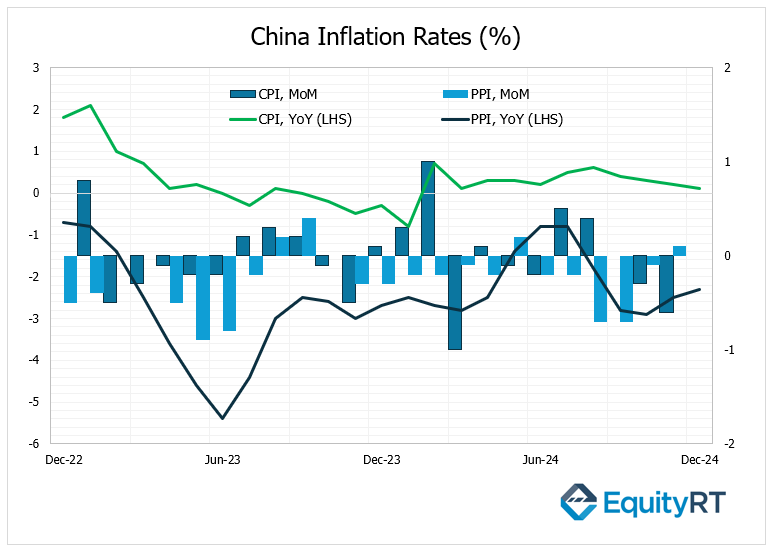

On the Asian side, China’s December Consumer Price Index (CPI) and Producer Price Index (PPI) data will be released on Thursday. The latest CPI and PPI figures indicated that despite recent stimulus measures and a supportive monetary policy stance, deflation risks persist in the country.

China’s annual inflation rate unexpectedly decreased to 0.2% in November 2024, down from 0.3% in October and below market expectations of 0.5%. This marked the lowest inflation rate since June. Monthly core inflation rate decreased to -0.10 percent in November from 0 percent in October of 2024.

On Tuesday, China’s foreign exchange reserves will be released. China’s foreign exchange reserves increased by $4.8 billion to reach $3.266 trillion in November 2024, surpassing market expectations of a decline to $3.23 trillion and up from $3.261 trillion in October. This rise came as the US dollar strengthened against other currencies.