Global Markets Recap

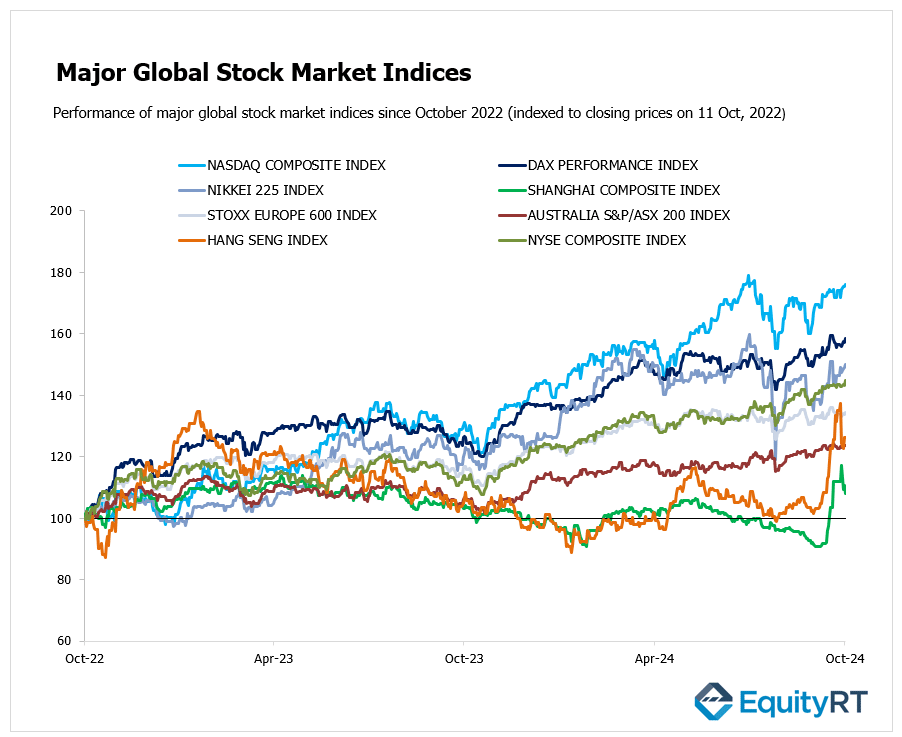

Wall Street indices rose nearly 1% on Friday despite increased uncertainty regarding the Fed’s interest rate cuts from recent data releases.

Today, U.S. bond markets will be closed for Columbus Day, but stock markets remain open.

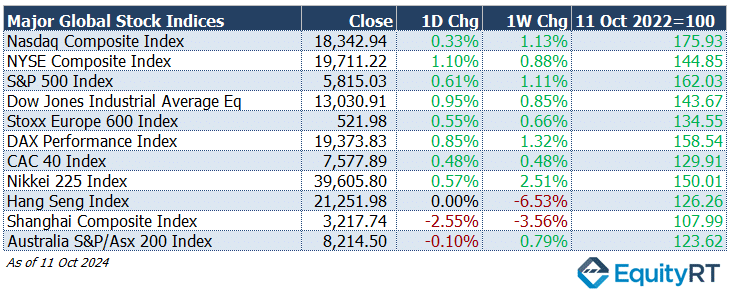

- Nasdaq Composite Index closed at 18,342.94, up 0.33% for the day, and showing a 1.13% increase over the week.

- NYSE Composite Index ended at 19,711.22, gaining 1.10% on the day and 0.88% over the week.

- S&P 500 Index rose to 5,815.03, advancing 0.61% for the day with a 1.11% weekly gain.

- Dow Jones Industrial Average EW closed at 13,030.91, increasing by 0.95% on the day and 0.85% over the week.

European markets ended Friday on a positive note as investors weighed U.K. growth data and anticipated upcoming fiscal stimulus measures from China.

- Stoxx Europe 600 Index reached 521.98, up 0.55% for the day and 0.66% for the week.

- DAX Performance Index finished at 19,373.83, climbing 0.85% on the day and 1.32% for the week.

- CAC-40 Index settled at 7,577.89, rising 0.48% for the day and remaining flat with a 0.48% weekly increase.

China stocks led losses in Asia-Pacific markets on Friday, following Wall Street’s decline as investors reacted to persistent U.S. inflation concerns. Investors had been on edge ahead of China’s Ministry of Finance press conference last Saturday, where new stimulus measures were widely anticipated.

Hong Kong markets remained closed due to a public holiday.

- Shanghai Composite Index dropped to 3,217.74, falling 2.55% for the day and declining by 3.56% over the week.

- Nikkei 225 Index closed at 39,605.80, gaining 0.57% on the day and 2.51% over the week.

- Australia’s S&P/ASX 200 Index settled at 8,214.50, with a slight daily loss of 0.10%, but gaining 0.79% for the week.

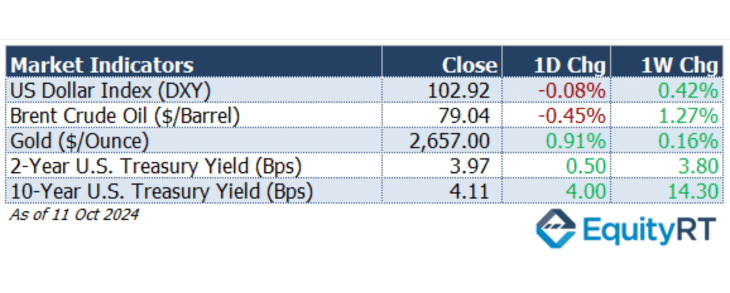

The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, slipped slightly to 102.92, down by 0.08% on the day.

The Brent crude oil (#LCO07) the global oil price benchmark, saw a modest drop, closing at $79.04 per barrel, reflecting a 0.45% decline.

The price of gold (#XAU) ) surged to $2,657.00 per ounce, gaining 0.91% in a strong daily performance.

The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, increased by 0.50 basis points to 3.97%.

The 10-year U.S. Treasury yield (#USGG10YR) saw a more significant rise, climbing by 4.00 basis points to reach 4.11%.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

In the United States, the spotlight will be on the upcoming retail sales data, anticipated to show a 0.3% rise in September, up from the 0.1% gain recorded in August.

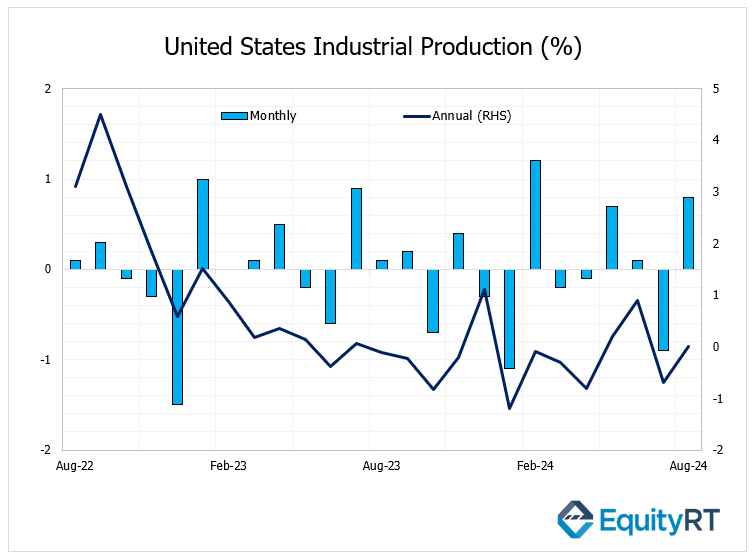

This week’s U.S. economic data releases include industrial production on Thursday, where a decline of 0.1% is expected, following a robust 0.8% increase last month.

In August 2024, U.S. industrial production rose by 0.8% from the previous month, marking the largest increase in six months and surpassing the expected 0.2% growth.

Manufacturing output, which accounts for 78% of total industrial production, saw a significant rise of 0.9%, beating the forecast of 0.3%. However, on a year-over-year basis, industrial production remained flat in August, following a revised 0.7% drop in July.

Within the sectors, manufacturing grew by 0.2%, mining increased by 0.1%, while utilities output declined by 0.9%.

Additionally, import and export prices will be reported on Wednesday.

Investors will also be monitoring building permits and housing starts, along with the NY Empire State Manufacturing Index and the Philadelphia Fed Manufacturing Index.

The new jobless claims data released on Thursday. The most recent figures showed a rise in weekly jobless claims to 258,000, up from 225,000, marking the highest level since August 2023 and surpassing expectations. Despite this increase, claims had previously remained below historical averages.

Several Federal Reserve officials will speak throughout the week, offering further insights into the economic outlook.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

The European Central Bank (ECB) is expected to take the spotlight this week, likely delivering another 25 bps cut in the deposit rate, continuing the trend set by similar reductions in September and June.

Germany’s ZEW economic sentiment is anticipated to improve slightly from its lowest levels since October 2023. Key data on Germany’s wholesale prices will also be released, along with updates on Eurozone industrial production, trade balance, current account, and construction output.

This week, the UK is set to release several important economic indicators.

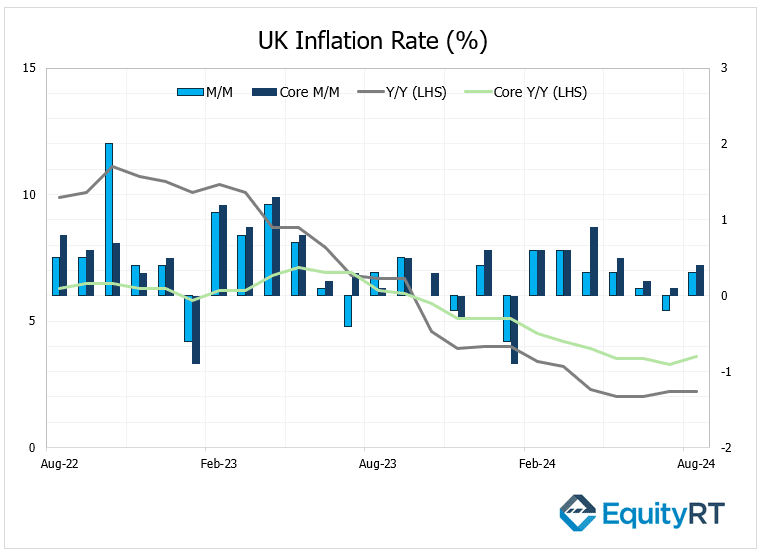

On Wednesday, inflation data will be published, with forecasts suggesting a drop in the inflation rate to 1.9%, the lowest since July 2021, down from 2.2% in August. Core inflation is also expected to ease slightly to 3.5%.

In August 2024, the annual inflation rate in the UK remained stable at 2.2%, matching July’s figure and aligning with expectations. Monthly inflation rose by 0.3%, rebounding from a 0.2% decline in July, which also met market forecasts.

Labour market data will be released on Tuesday, where the unemployment rate is forecasted to hold steady at 4.1%. Wage growth, excluding bonuses, is expected to slow to 5% from 5.1%.

On Friday, retail sales data will be published, with forecasts suggesting a contraction of 0.3%, following a 1% increase in August.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

China has a busy week ahead with key economic releases, including Q3 GDP, which is expected to confirm the country’s struggle to reach its 5% annual growth target. This aligns with Beijing’s push for accelerated fiscal stimulus.

Markets will also closely watch September data on trade balance, industrial production, retail sales, the unemployment rate, new yuan loans, housing prices, and both PPI and CPI.

On Monday, trade balance and new yuan loans data was released. In September 2024, China’s exports experienced a sharp slowdown, increasing by only 2.4% year-over-year.

Imports saw a minor increase of 0.3% compared to the previous year, again lower than the 0.5% rise in August and below the expected 0.9%.

China’s trade surplus for September dropped to $81.71 billion, down from $91.02 billion in August.

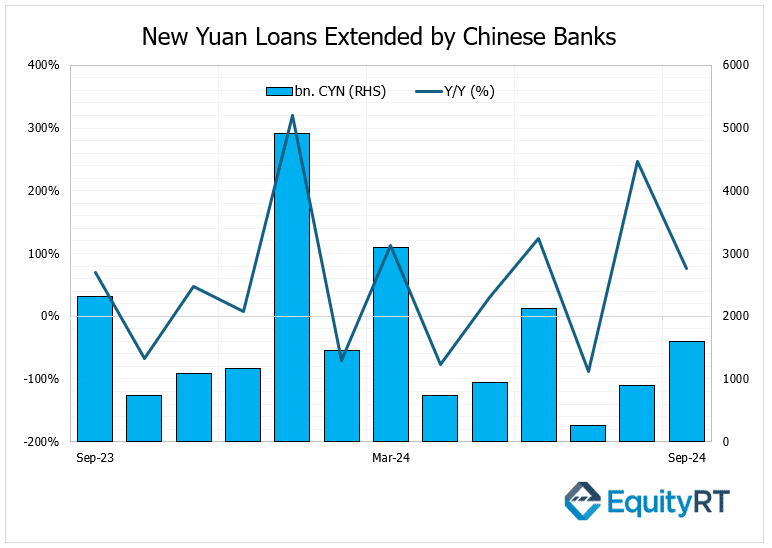

In September 2024, Chinese banks issued CNY 1.590 trillion in new yuan loans, an increase from the CNY 900 billion extended in August. However, this fell short of market expectations, which anticipated CNY 1.9 trillion in new credit.

It was the smallest amount of loans extended in September since 2018, continuing a trend of disappointing credit growth by the People’s Bank of China (PBoC).

Investors are particularly focused on the Ministry of Finance’s emergency briefing on Tuesday, where additional fiscal measures are expected after earlier efforts failed to impress.

Japan also faces a packed week of economic data, highlighted by September’s inflation rate, trade balance, and machinery orders from August.

In India, attention will be on September’s inflation, which is likely to exceed the Reserve Bank of India’s 4% target due to base effects.

Interest rate decisions will come from Indonesia, Thailand, and the Philippines, while Singapore and Malaysia will report their Q3 GDP.

The Bank of Indonesia unexpectedly cut its interest rate by 25 bps to 6% during its September 2024 meeting and in its October meeting, the Bank is expected to cut its interest rate by 25 bps to 5.75%

On Wednesday, South Korea will provide an update on its unemployment rate. The unemployment rate in South Korea went down to 2.4% in August 2024 from 2.5% in July.

In Australia, the spotlight will be on labor market data for September and the Reserve Bank of Australia’s (RBA) latest monetary policy bulletin, while New Zealand will release its Q3 inflation figures.