Global Markets Recap

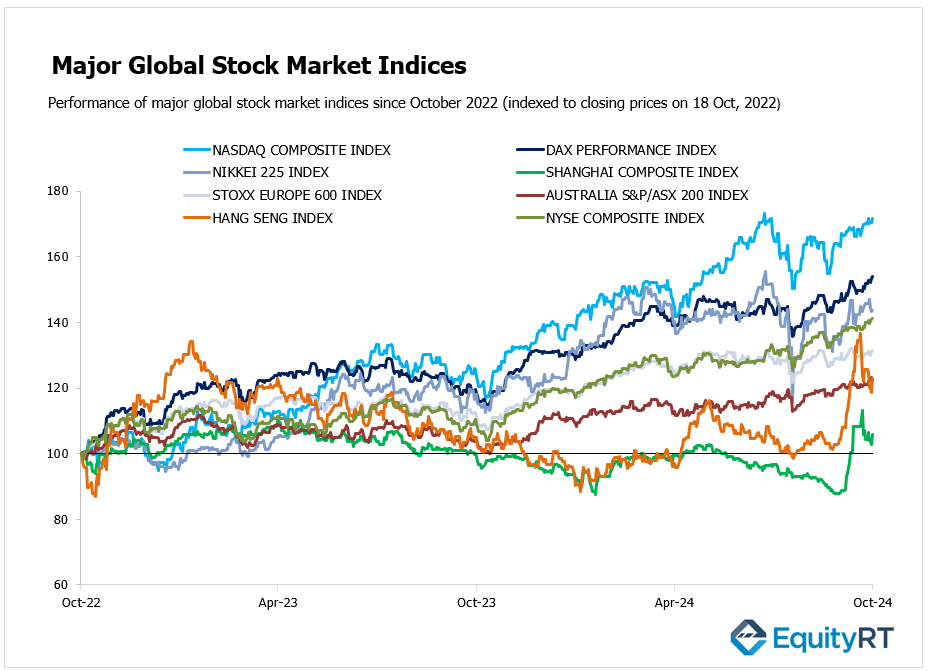

Last Friday, U.S. stock markets closed higher, with major indices extending their gains to mark their longest weekly winning streak of the year. The strong market performance was largely driven by a positive earnings report from Netflix, along with declining crude oil prices and falling Treasury yields, which supported investor sentiment.

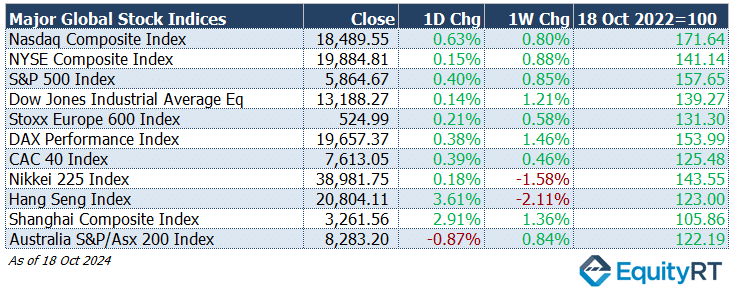

- Nasdaq Composite Index rose to 18,489.55, gaining 0.63% for the day and 0.80% over the week.

- NYSE Composite Index ended at 19,884.81, increasing 0.15% on the day with a 0.88% weekly gain.

- S&P 500 Index reached 5,864.67, advancing 0.40% for the day and 0.85% for the week.

- Dow Jones Industrial Average EW closed at 13,188.27, rising 0.14% on the day and 1.21% over the week.

European stocks ended the week on a positive note, mainly boosted by a rebound in tech stocks. It was a volatile week with mixed corporate earnings and a rate cut from the European Central Bank (ECB). The STOXX 600 index managed to record its second consecutive weekly gain.

- Stoxx Europe 600 Index reached 524.99, gaining 0.21% for the day and 0.58% over the week.

- DAX Performance Index climbed to 19,657.37, rising 0.38% on the day and 1.46% for the week.

- CAC-40 Index increased to 7,613.05, up 0.39% for the day and 0.46% over the week.

Asian markets ended last week on a mixed note. Japan’s inflation hit its lowest level since April, easing some economic pressure.

In China, the government expanded support for the property market by increasing credit and relaxing mortgage rules, aiming to stabilize the sector. Technology stocks performed well, led by companies like Taiwan Semiconductor Manufacturing Company (TSMC) after strong earnings and positive expectations for AI growth. However, other sectors, such as property and retail, remained cautious due to ongoing concerns.

Australian markets ended the week with losses as the S&P/ASX 200 index fell by 0.87%. Weaker performances in sectors like mining and energy, which are critical to the Australian economy, contributed to this decline.

- Shanghai Composite Index surged to 3,261.56, rising 2.91% on the day and 1.36% over the week.

- Hang Seng Index jumped to 20,804.11, gaining 3.61% on the day despite a weekly decline of 2.11%.

- Nikkei 225 Index settled at 38,981.75, advancing 0.18% for the day but falling 1.58% over the week.

- Australia’s S&P/ASX 200 Index dropped to 8,283.20, decreasing 0.87% on the day but rising 0.84% over the week.

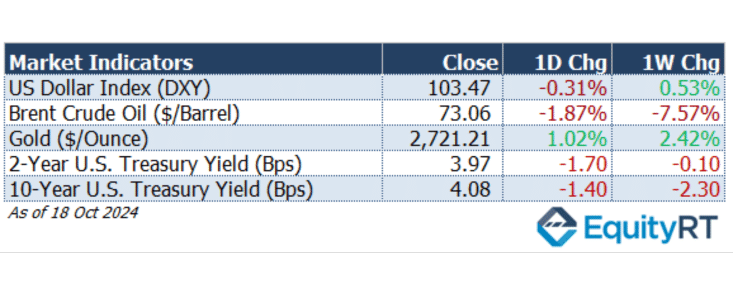

The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, edged down to 103.47, reflecting a 0.31% decline on the day, but it posted a 0.53% gain over the week.

The Brent crude oil (#LCO07) the global oil price benchmark, dropped to $73.06 per barrel, marking a daily decrease of 1.87% and a significant weekly loss of 7.57%.

The price of gold (#XAU) rose to $2,721.21 per ounce, gaining 1.02% on the day and 2.42% over the week.

The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, slightly decreased to 3.97%, down by 1.70 basis points on the day, with a weekly change of -0.10 bps.

The 10-year U.S. Treasury yield (#USGG10YR) fell to 4.08%, shedding 1.40 bps daily and 2.30 bps weekly.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

On the U.S. side, the October S&P Global Manufacturing and Services PMI data, which will signal the latest outlook for economic activity, will be monitored on Thursday.

On Wednesday, the Beige Book report, compiled from assessments by the 12 regional Federal Reserve Bank presidents, will be published, providing current evaluations of the U.S. economy and expectations for the future.

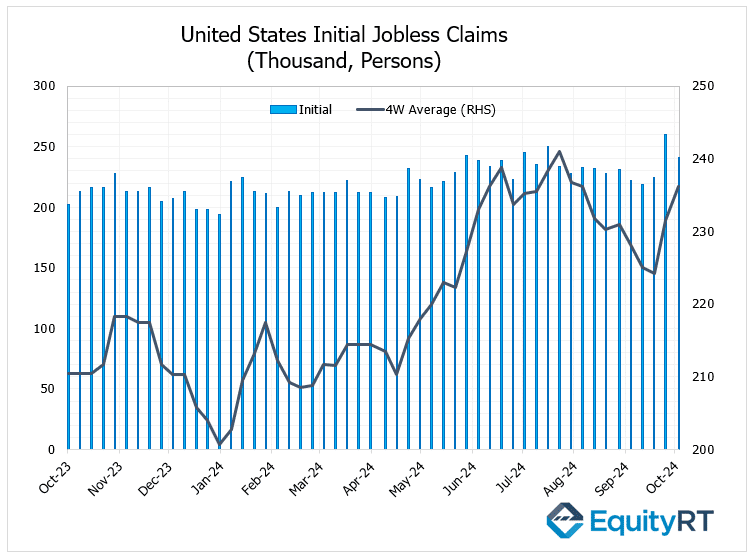

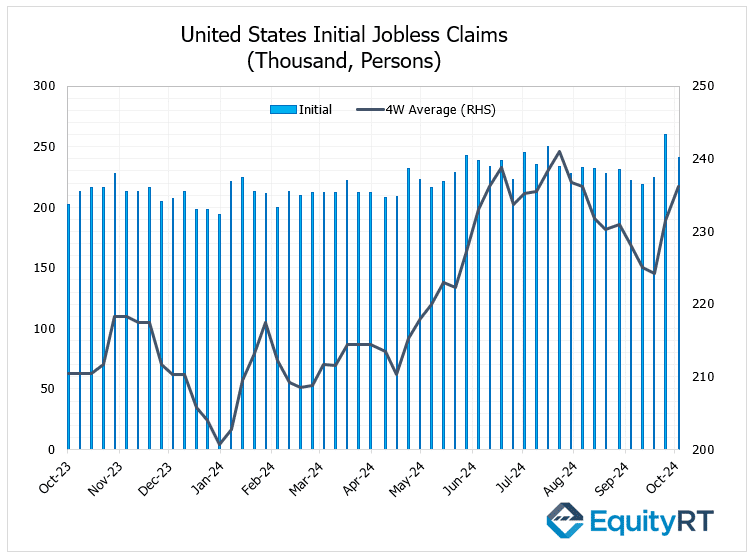

Data from the employment market will be closely monitored on Thursday, specifically the weekly initial jobless claims.

The most recent report indicated a decline in initial jobless claims from 260,000 to 241,000, despite expectations of a slight increase. These figures remain low compared to historical averages. The four-week moving average for initial claims, which helps to lessen weekly volatility, increased by 4,750, bringing it to 236,250.

Additionally, on Wednesday, data on existing home sales for September will be released, followed by new home sales data on Thursday.

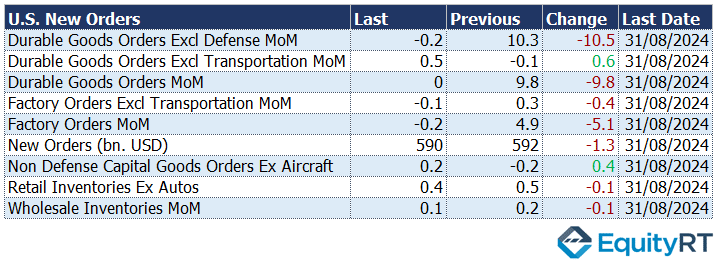

On Friday, the preliminary durable goods orders for September will be released to show production trends in the United States.

In August 2024, new orders for durable goods in the US remained relatively stable compared to the previous month, following a revised 9.8% surge in July—the highest increase in four years. This result defies market expectations of a 2.6% decline, challenging the widespread pessimism about manufacturing activity in the United States and suggesting that the current slowdown could be short-lived.

According to preliminary data, a 0.9% decline in durable goods orders is anticipated for September.

On Friday the final reading of the University of Michigan’s consumer confidence index for October will also be released. Although a slight increase was expected, the preliminary index fell from 70.1 to 68.9.

Regional PMI’s, the Richmond Fed Manufacturing Index, Chicago Fed National Activity Index, and Kansas Fed Manufacturing Index will also be released this week.

On the corporate front, earnings reports from major companies like Tesla, Coca-Cola, 3M, General Motors, and Verizon are expected.

The Bank of Canada (BoC)’s meeting will be closely watched on Wednesday. After reducing the policy interest rate by 25 basis points in both June and July, the bank lowered it again by 25 basis points during the September meeting, bringing it from 4.50% to 4.25%.

In this week’s meeting, a further cut of 50 basis points to 3.75% is anticipated.

Producer price data and retail sales figures for Canada are also anticipated, along with mid-month inflation data for Brazil and Mexico.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

In Europe, all eyes will be on ECB President Lagarde’s speech scheduled for tomorrow. During her address, analysts will be looking for new indications regarding the future of monetary policy and the interest rate cut process.

Producer Price Index in Germany for September has been released today. In September 2024, Germany saw a year-on-year decline of 1.4% in producer prices, a further drop from the previous two months’ 0.8% decrease. This marks the 15th consecutive month of producer deflation, largely driven by a significant 6.6% drop in energy prices. Month-on-month, producer prices fell by 0.5%, surpassing forecasts of a 0.2% decline. This decrease is notable as it is the first since February, following a 0.2% rise in August.

The preliminary HCOB Manufacturing and Services PMI data for October will be released on Thursday, offering insights into the latest economic trends across the continent.

On Wednesday, the consumer confidence index for October in the Euro Area will be released. The September data was recorded at -12.9, the highest level since February 2022, although it continues to show a weak trend in the negative territory. A slight recovery in consumer confidence is anticipated for October, with expectations of an increase from -12.9 to -12.5.

On Friday, the IFO Business Climate Index for October will be published, reflecting the outlook of firms in Germany’s manufacturing, construction, wholesale, and retail sectors regarding the current economy and the next six months. The IFO index fell from 86.6 to 85.4 in September, falling short of expectations and marking the lowest level since January. A deeper analysis shows that the concerns about a recession in Europe’s largest economy have heightened, influenced by ongoing contractions in the manufacturing sector and sluggish consumer spending.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

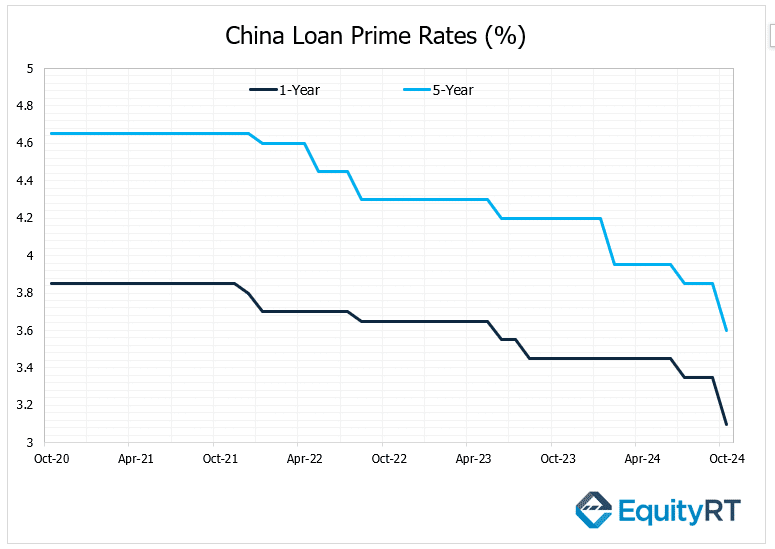

On Monday, the People’s Bank of China (PBoC) has reduced the one-year loan prime rate (LPR) by 25 basis points, bringing it down from 3.35% to 3.10%. Additionally, the five-year loan prime rate, which serves as a benchmark for long-term loans such as mortgages, was also lowered by 25 basis points, decreasing from 3.85% to 3.60%.

This move by the bank resulted in a more significant drop in interest rates than the market had anticipated (20 basis points), confirming its plans to accelerate monetary easing.

Other important data from China will include Foreign Direct Investment figures for September and the People’s Bank of China’s 1-Year MLF announcement on Friday.

In Japan, the PMIs for October and Tokyo’s inflation rates for the same month will also be published on Friday.

Also on Friday, the focus will be on the Bank of Russia’s meeting. Following a 200-basis point increase in July due to persistent inflationary pressures, the bank raised the policy rate by 100 basis points during the September meeting, increasing it from 18% to 19%, despite expectations to keep it unchanged. There are indications that the bank may keep the option open for a rate hike in the upcoming meeting, where a further increase of 100 basis points to 20% is expected.