Global Markets Recap

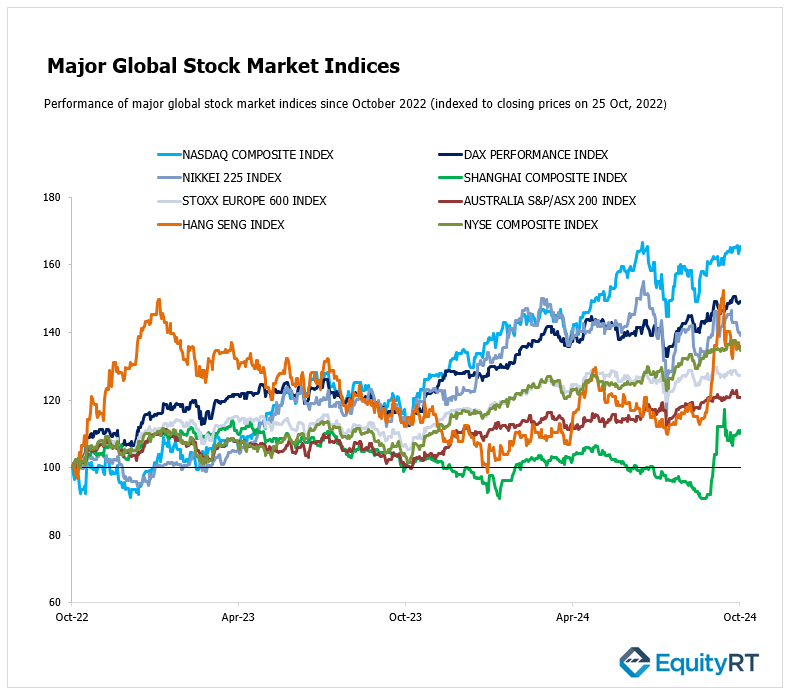

U.S. stock markets ended the week on a downtrend as climbing government bond yields weighed on equity valuations.

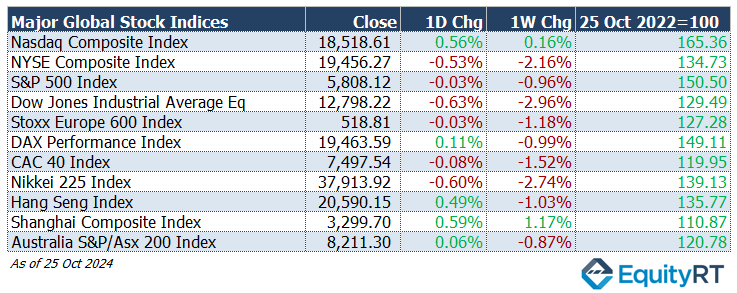

- Nasdaq Composite Index rose to 18,518.61, gaining 0.56% for the day and 0.16% over the week.

- NYSE Composite Index ended at 19,456.27, decreasing 0.53% on the day and down 2.16% for the week.

- S&P 500 Index closed at 5,808.12, falling 0.03% for the day and declining 0.96% over the week.

- Dow Jones Industrial Average EW finished at 12,798.22, down 0.63% for the day and dropping 2.96% for the week.

European benchmarks finished the week in negative territory. Across sectors, most experienced losses, driven by weaker sentiment. The mining and energy sectors were the hardest hit, dragging down overall performance.

- Stoxx Europe 600 Index remained flat at 518.81, down 0.03% for the day and 1.18% for the week.

- DAX Performance Index edged up to 19,463.59, gaining 0.11% for the day but slipping 0.99% over the week.

- CAC-40 Index closed at 7,497.54, falling 0.08% for the day and 1.52% for the week.

Stock markets across the Asia-Pacific region mostly fell during the week, mirroring global trends. Australia’s ASX 200 declined by under 1%, driven largely by weakness in the mining sector. On the other hand, Chinese markets found some stability as investors reevaluated the government’s recent stimulus measures.

- Shanghai Composite Index increased to 3,299.70, up 0.59% for the day and 1.17% for the week.

- Hang Seng Index increased to 20,590.15, rising 0.49% for the day but down 1.03% over the week.

- Nikkei 225 Index dropped to 37,913.92, down 0.60% for the day and 2.74% over the week.

- Australia’s S&P/ASX 200 Index closed at 8,211.30, inching up 0.06% for the day but down 0.87% over the week.

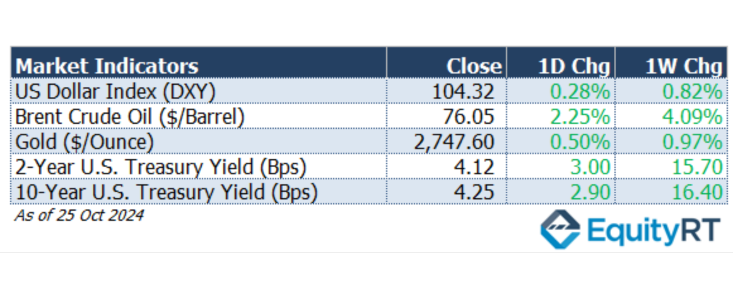

The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, increased to 104.32, rising 0.28% for the day and up 0.82% over the week.

The Brent crude oil (#LCO07) the global oil price benchmark, rose to $76.05 per barrel, gaining 2.25% for the day and 4.09% over the week.

The price of gold (#XAU) rose to $2,721.21 per ounce, up 0.50% for the day and 0.97% over the week.

The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, increased to 4.12 basis points rising 3.00 bps for the day and 15.70 bps over the week.

The 10-year U.S. Treasury yield (#USGG10YR) reached 4.25 basis points, gaining 2.90 bps for the day and 16.40 bps over the week.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

In the U.S., the Conference Board Consumer Confidence Index for October will be released on Tuesday. In September, despite expectations for a slight increase, the index fell from 105.6 to 98.7.

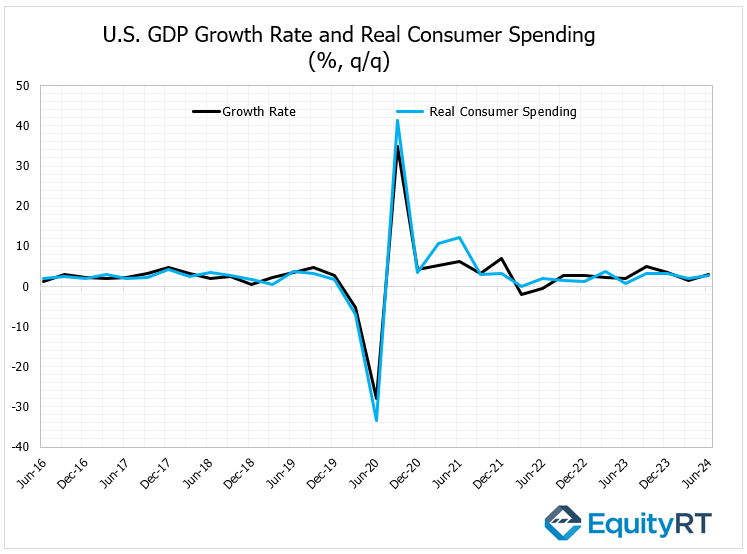

On Wednesday, preliminary quarterly GDP growth data for Q3 will be monitored. The annualized growth rate of the U.S. economy was revised slightly upward from 1.4% to 1.6% in Q1, while Q2 remained at 3%.

Consumption spending growth, a significant part of the economy, was revised down from 2.9% to 2.8%. Non-residential fixed investment, residential fixed investment, and net exports were revised downward, whereas private inventory investment and federal government spending were revised upward.

Q3 growth is expected to be around 3%, like Q2.

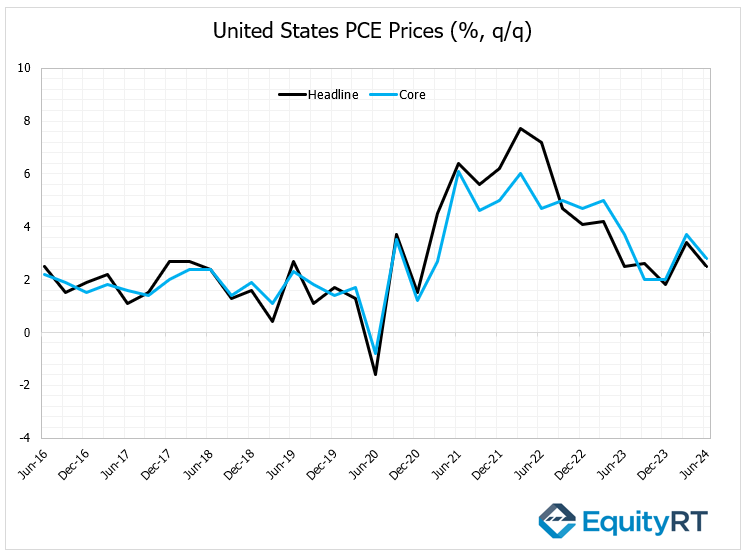

Also on Wednesday, preliminary data for the annualized quarterly Personal Consumption Expenditures (PCE) price index will be announced. The PCE price index was 3.4% in Q1 and revised down to 2.5% in Q2. The core PCE price index was 3.7% in Q1 and revised to 2.8% in Q2.

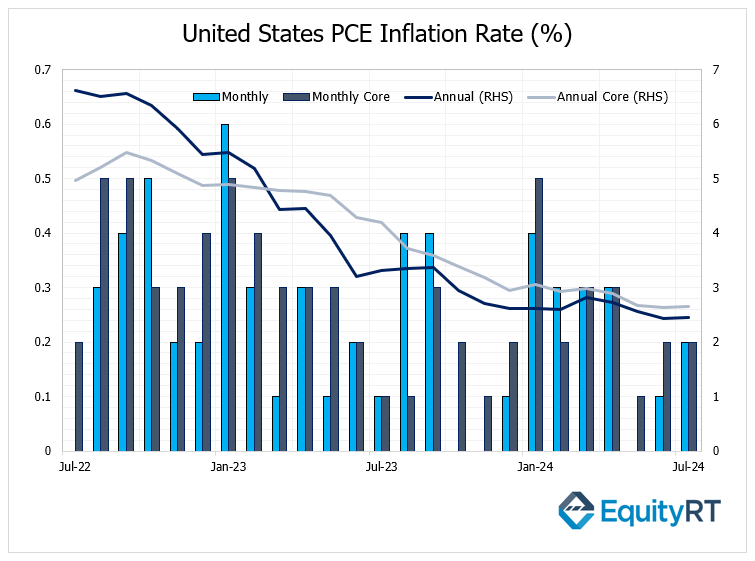

On Thursday, September PCE deflator data and personal income and spending figures will be released.

The PCE deflator is expected to rise from 0.1% to 0.2% month-over-month but decrease from 2.2% to 2.1% year-over-year. Core PCE deflator growth is expected to increase from 0.1% to 0.3% month-over-month and slightly decrease from 2.7% to 2.6% year-over-year.

Personal income and spending are both projected to rise from 0.2% to 0.4% month-over-month.

Labor market data will also be monitored closely, including tomorrow’s September JOLTS job openings data, Wednesday’s October ADP private sector employment data, Thursday’s weekly initial unemployment claims, and Friday’s October non-farm payroll, unemployment rate, and average hourly earnings data.

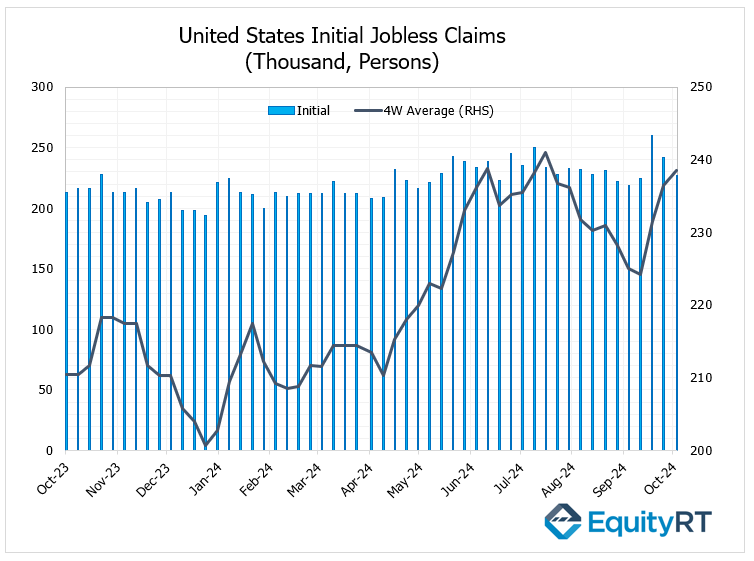

Recently reported initial jobless claims fell from 242,000 to 227,000, reaching the lowest level in three weeks and confirming the resilience of the labor market, supporting expectations that the Fed will avoid aggressive rate cuts in upcoming meetings.

The four-week moving average, which smooths out weekly fluctuations, increased by 2,000 to reach 238,500.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

In Europe, tomorrow the GfK Consumer Confidence Index for November, reflecting expectations for the upcoming month, will be released in Germany.

On Wednesday, preliminary GDP growth data for Q3 will be monitored in both Germany and the Eurozone.

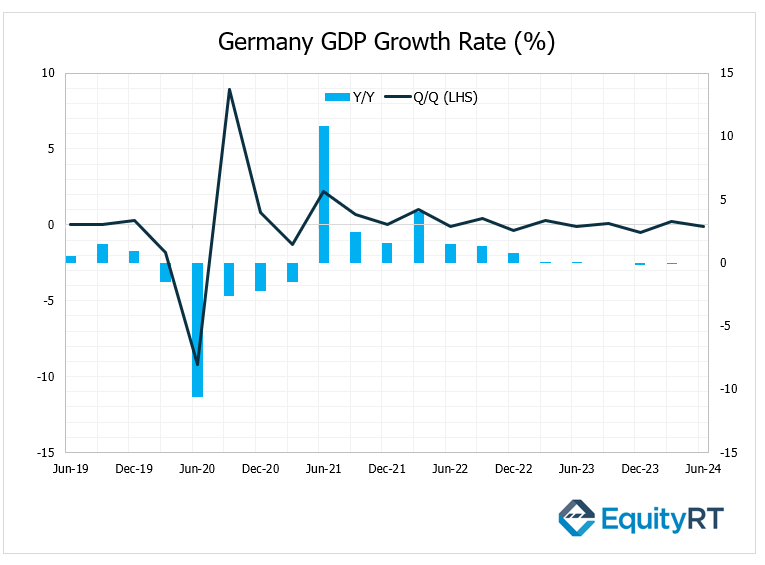

Germany’s economy contracted by 0.1% in Q2 after growing by 0.2% in Q1, mainly due to negative impacts from private consumption, fixed capital investments, and net exports.

Annually, the economy shrank by 0.1% in Q1 and stagnated (0%) in Q2.

Preliminary data suggests Germany will enter a recession with a 0.1% quarterly contraction and a 0.3% annual decline in Q3.

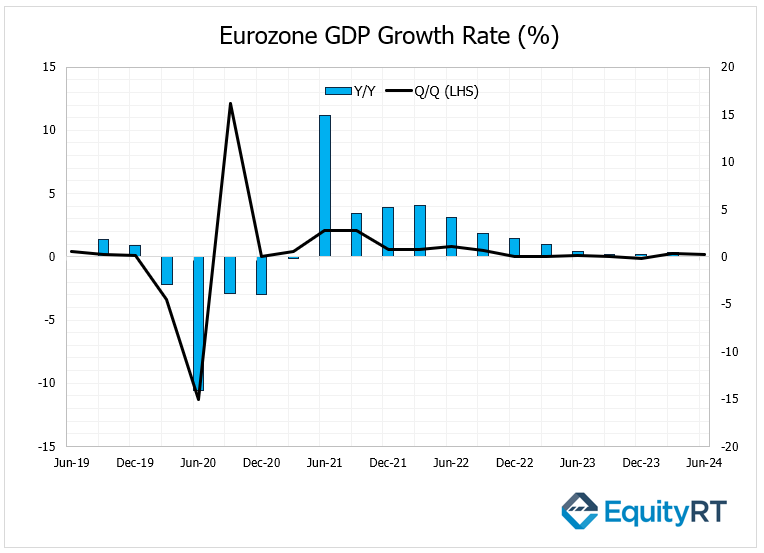

In Q2, the Eurozone’s GDP grew by 0.6% year-on-year, in line with initial estimates, marking the strongest growth in over a year. Government spending led the increase with a 2.1% rise, while household consumption grew by 0.5%, and investment declined by 3%.

On a quarterly basis, the Euro Area’s economy expanded by 0.2%, slightly below the expected 0.3% growth and down from the 0.3% increase in Q1.

The Eurozone economy is expected to grow by 0.2% quarterly and 0.8% annually in Q3, according to preliminary data.

Also on Wednesday, the final consumer confidence data for October in the Eurozone will be released. Preliminary figures showed a slight improvement from -12.9 to -12.5, aligning with expectations, though confidence remained weak in negative territory, continuing its trend since February 2022.

Additionally, inflation data crucial for ECB’s monetary policy will be released this week, with Germany’s preliminary CPI for October on Wednesday and the Eurozone’s on Thursday.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

The People’s Bank of China (PBoC) has expanded its monetary policy toolkit to better manage liquidity in the financial system. In this context, the PBoC announced that it will conduct direct monthly reverse repo agreements with primary dealers for a period not exceeding one year. The central bank stated that this move aims to maintain adequate liquidity in the banking system and enhance its monetary policy tools.

In Asia, attention will turn to Thursday, when China releases official PMI data for October, which will give insights into both the manufacturing and non-manufacturing sectors.

On Friday, the Caixin manufacturing PMI, which focuses on the performance of small and medium-sized firms, will also be closely monitored.

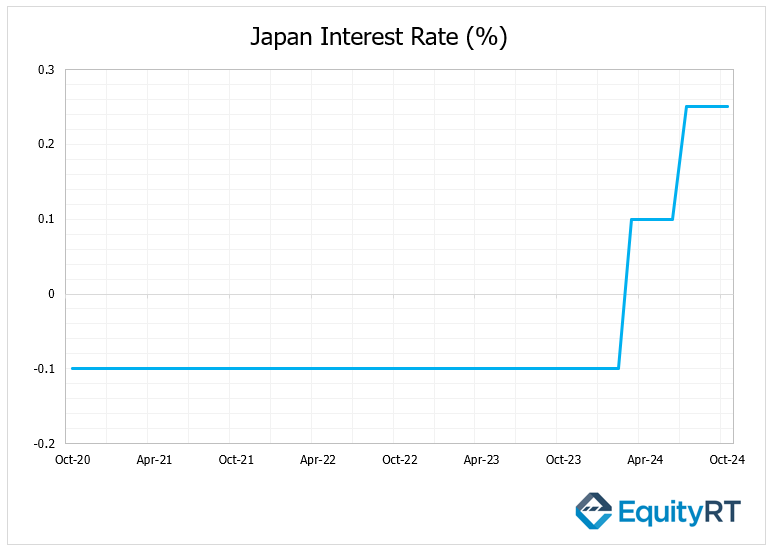

On Thursday, the Bank of Japan (BoJ) will release its interest rate.

The BoJ is largely expected to keep its key interest rate unchanged, but investors will closely monitor the quarterly outlook report for insights on when policy normalization might occur.

The BoJ kept its key interest rate at 0.25% during the September meeting, as expected, following hikes in March and July. The Bank highlighted the need for more time to assess financial markets and maintained that Japan’s economy is on track for a moderate recovery, with private consumption rising but exports and industrial production remaining flat. Inflation is between 2.5% and 3.0%, with a gradual increase expected in underlying CPI.

Additionally, Japan will release key data for October, including the consumer confidence index, along with industrial production, retail sales, the unemployment rate, and housing starts for September.

In India, the budget balance for the first half of the fiscal year will be closely watched, as it could impact one of the world’s most monitored bond markets.

South Korea will draw attention with its October PMI and trade figures. Taiwan and Hong Kong will release their GDP data for Q3, while Indonesia will publish inflation figures for October.

In Australia, market will follow CPI data for Q3, which is expected to show inflation moving closer to the RBA’s target, along with releases on producer prices and home credit aggregates.