Global Markets Recap

On Friday, stocks climbed as investors reviewed earnings reports from major tech companies and job market data, which supported the view that the Federal Reserve might continue easing interest rates.

- Nasdaq Composite Index increased to 18,239.92, gaining 0.80% for the day but down 1.50% over the week.

- NYSE Composite Index closed at 19,253.54, rising 0.08% on the day with a weekly decline of 1.04%.

- S&P 500 Index reached 5,728.80, adding 0.41% for the day, while decreasing 1.37% over the week.

- Dow Jones Industrial Average EW climbed to 12,784.59, with a daily gain of 0.89% but a slight weekly drop of 0.11%.

European markets closed on a positive note Friday, kicking off November with gains as investors analysed the latest U.S. jobs data. The pan-European Stoxx 600 rose by 1.09%, with all sectors and major indexes finishing higher.

- Stoxx Europe 600 Index closed at 510.90, up 1.09% on the day, yet down 1.52% for the week.

- DAX Performance Index rose to 19,254.97, increasing 0.93% for the day, though it slipped 1.07% over the week.

- CAC-40 Index ended at 7,409.11, with a daily increase of 0.80%, but a weekly decrease of 1.18%.

Asian stocks were largely down on Friday, with Japan’s Nikkei Index falling over 2%, influenced by a sharp drop in U.S. stock markets.

- Shanghai Composite Index dropped to 3,272.01, decreasing 0.24% for the day and down 0.84% on the week.

- Hang Seng Index closed at 20,506.43, up 0.93% for the day, while down 0.41% over the week.

- Nikkei 225 Index fell to 38,053.67, down 2.63% on the day, though it gained 0.37% over the week.

- Australia’s S&P/ASX 200 Index declined to 8,118.80, losing 0.50% for the day and 1.13% over the week.

Japan’s markets were closed today due to a public holiday.

The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 104.32, up 0.23% for the day with no change over the week.

The Brent crude oil (#LCO07) the global oil price benchmark, rose to $73.10 per barrel, gaining 0.40% for the day but dropping 3.88% over the week.

The price of gold (#XAU) fell to $2,736.21 per ounce, down 0.39% daily and 0.41% for the week.

The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, climbed 3.50 basis points to 4.22, up 10.20 bps over the week.

The 10-year U.S. Treasury yield (#USGG10YR) increased 10.70 bps to 4.40, a 15.10 bps weekly gain.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

This week, the focus will be on tomorrow’s U.S. Presidential election, followed by the Federal Reserve’s interest rate decision and Chairman Powell’s speech on Thursday.

The Federal Reserve is scheduled to announce its monetary policy decision on Thursday instead of the usual Wednesday, to avoid overlapping with Election Day.

In its September meeting, the Fed reduced the federal funds rate range by 50 basis points, lowering it from 5.25%-5.50% to 4.75%-5.00%, starting a new rate-cutting cycle.

The Fed noted growing confidence that inflation would move sustainably towards its 2% target and that risks to employment and inflation goals appeared balanced.

Markets are anticipating a 25 basis-point cut to the federal funds rate, following a more substantial 50 basis-point reduction in September. Investors will also be observing for further details regarding the Fed’s plans for the remainder of the year.

Service Sector PMI and Non-Manufacturing ISM Data

Final PMI data for the service sector in October will be released tomorrow, followed by ISM non-manufacturing data on Wednesday.

Preliminary October service sector PMI suggested slight growth, rising from 55.2 to 55.3, indicating the sector’s 21st consecutive month of expansion.

In September, the ISM non-manufacturing index rose to 54.9 from 51.5, marking its highest level since February 2023, signaling continued growth in non-manufacturing sectors.

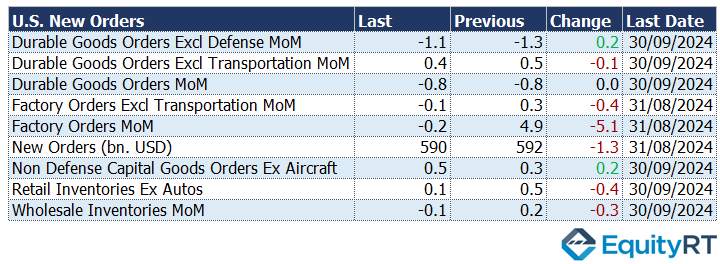

September Durable Goods and Factory Orders

Final September durable goods and factory orders data will be tracked today. Preliminary data indicated a 0.8% month-over-month decrease in durable goods orders, reflecting declines in defense and non-defense aircraft orders by 23.7% and 22.7%, respectively.

Factory orders dipped slightly by 0.2% in August, following a 4.9% increase in July, indicating a softening trend in manufacturing demand.

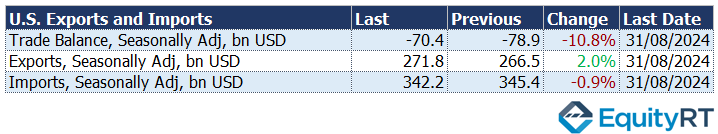

Trade Balance for September

Trade balance data, due tomorrow, previously showed that the monthly trade deficit narrowed from $78.9 billion in July to $70.4 billion in August, the lowest in five months. This was due to a 0.9% decline in imports to $342.2 billion and a 2% rise in exports to $271.8 billion, marking record export levels.

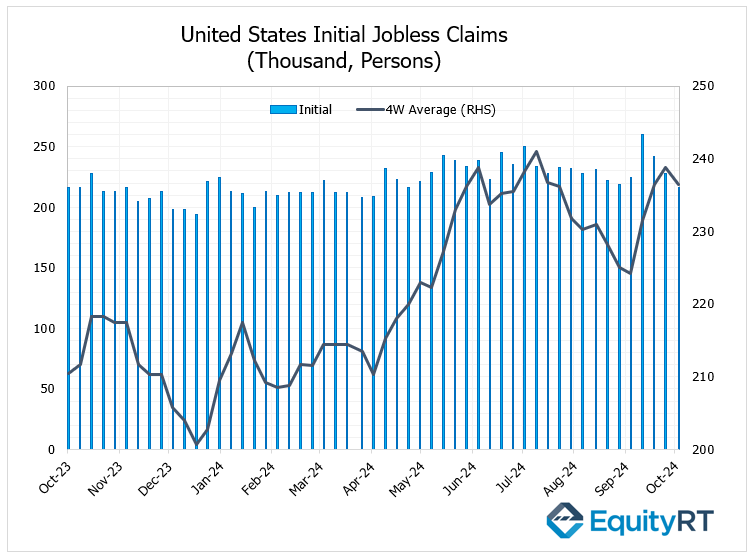

Weekly Jobless Claims and Labor Market Indicators

Weekly jobless claims, which will be released on Thursday, previously showed a decline from 228,000 to 216,000, reaching a five-month low and staying below historical averages.

The decline confirms the resilience of the U.S. labour market despite the Federal Reserve’s tight interest rates, reinforcing expectations that the Fed will refrain from aggressive rate cuts in future meetings.

Additionally, the four-week moving average for initial jobless claims, which smooths out volatility, decreased to 236,500.

Consumer Confidence Index – University of Michigan

The preliminary November University of Michigan Consumer Confidence Index will be announced on Friday. October’s index was revised upward from 68.9 to 70.5, reaching its highest since April.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

October’s PMI Data

The final PMI data for the manufacturing and services sectors in Europe for October, which provide insights into the current economic landscape, will be monitored this week.

According to preliminary data, manufacturing PMIs showed a contraction across the region, excluding the UK, due to weak demand in October.

Preliminary data also indicated that service PMIs remained in the growth zone above the 50-threshold across the region, except for France, in October.

On Wednesday, the September factory orders data will be released, and on Thursday, industrial production figures will be closely watched to gauge the production trends in Germany.

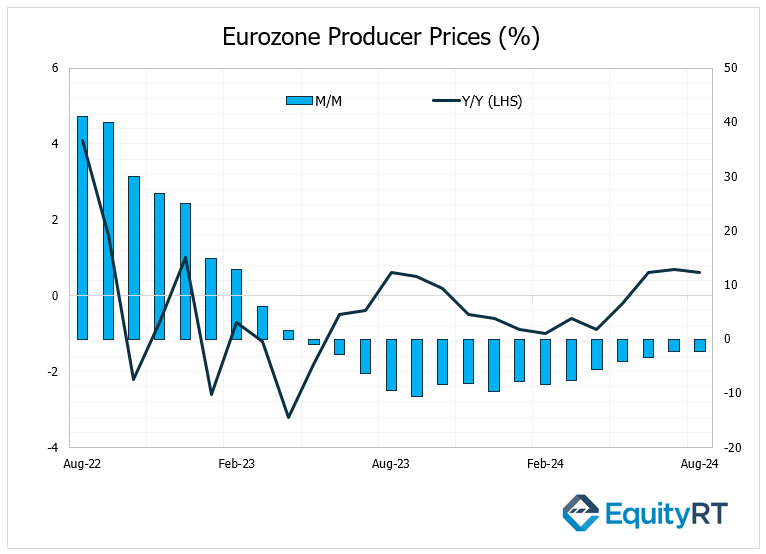

Producer Price Data in the Eurozone

On Wednesday, the Eurozone’s Producer Price Index (PPI) data for September will be released.

The PPI in the Eurozone had recorded a monthly increase of 0.7% in July and a slightly higher-than-expected increase of 0.6% in August, extending its upward trend for three consecutive months. However, the annual decline rate rose from 2.2% to 2.3%, continuing a downward trend over the past sixteen months.

The notable increase in PPI in August was primarily driven by a significant rise in energy product prices, which rose by 1.9%.

The monthly PPI is expected to show a decline of 0.7%, while the annual PPI is projected to decrease by 3.5%.

Trade Data for Germany

On Thursday, Germany’s September trade data will be published. Exports in Germany increased by 1.5% month-on-month in August, indicating a slowdown in positive foreign demand. Conversely, imports fell by 3.4% monthly in August, exceeding expectations and signaling weakening domestic demand.

As a result, the trade surplus increased from €16.9 billion in July to €22.5 billion in August due to rising exports and falling imports, marking the highest trade surplus since May.

In September, a 2.3% decline in exports and a slight 0.1% increase in imports are anticipated.

Retail Sales in the Eurozone

Also on Thursday, retail sales data for September, which will signal the trend in domestic demand in the Eurozone, will be monitored.

Retail sales in the Eurozone experienced a 0% change in July, followed by a 0.2% increase in August, consistent with expectations, indicating a recovery. Year-on-year, retail sales rose by 0.8% in August after a 0.1% decrease in July, showing a rebound following two months of decline.

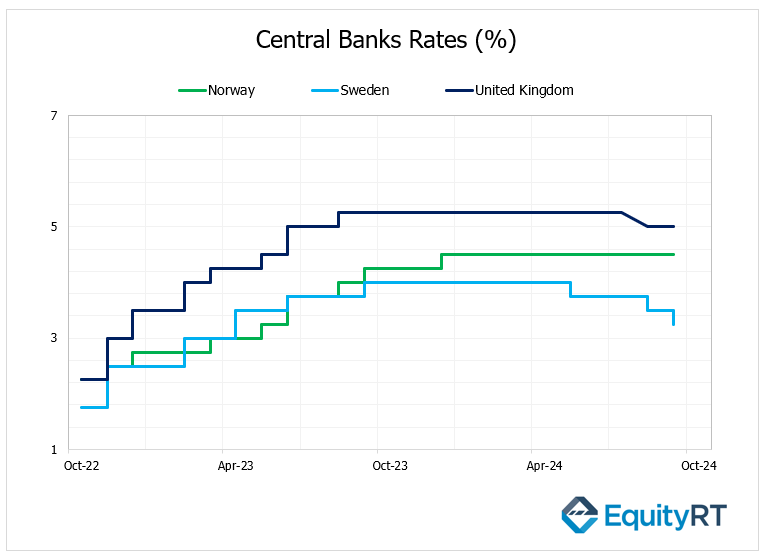

Central Bank Meetings in the UK, Sweden and Norway

On Thursday, the Bank of England (BoE) meeting will be followed closely. After cutting the policy interest rate by 25 basis points from 5.25% to 5% during its August meeting, the BoE maintained the rate at 5% during its September meeting, aligning with expectations.

Meetings of the central banks of Sweden and Norway will also be tracked on Thursday.

The Swedish central bank reduced its policy rate by 25 basis points in its meetings in May and August and subsequently cut it to 3.25% from 3.50% in its September meeting, in line with expectations. In this week’s meeting, a further 50 basis point reduction to 2.75% is expected.

The Norwegian central bank kept its policy rate steady at 4.50% during its September meeting, maintaining this level over the past six meetings, and indicated that the rate is likely to remain unchanged until the end of the year. It is anticipated that the bank will keep the policy rate at 4.50% in this week’s meeting.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

In China, attention will be on the week-long Standing Committee of the National People’s Congress, with expectations that policymakers will broaden budget deficit targets to facilitate previously promised fiscal stimulus and restructuring.

Tomorrow will see the release of the October Caixin services sector PMI data, which provides signals regarding the activities of small and medium-sized enterprises in China.

The Caixin services PMI declined from 51.6 to 50.3 in September, indicating a slowdown in growth within the sector. A slight increase to 50.5 is expected for October.

Additionally, China’s trade data for October will be monitored on Thursday. Year-on-year, exports in September increased by 2.4%, while imports showed a modest rise of 0.3%.

In Japan, focus will shift to the November Tankan index for leading insights, along with minutes from the Bank of Japan’s latest meeting.

Meanwhile, South Korea is anticipated to show a softening of inflation in October. Inflation figures are also expected from the Philippines and Indonesia, the latter of which will also report its Q3 GDP.

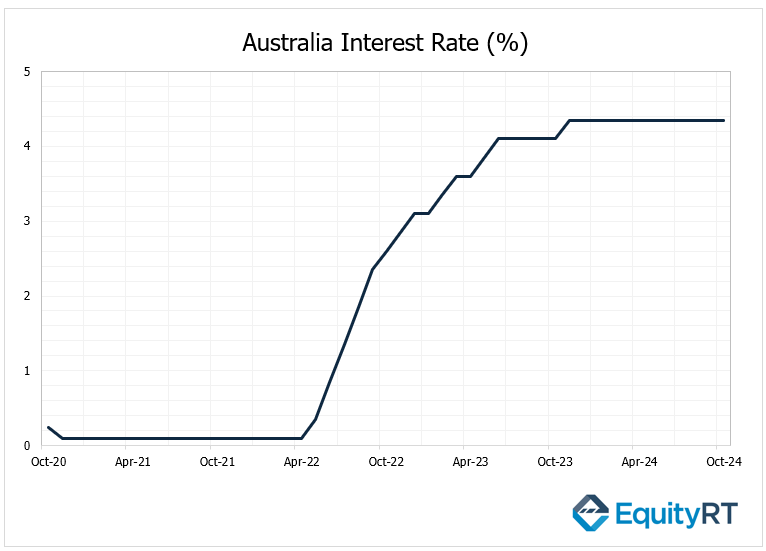

In Australia, the Reserve Bank of Australia (RBA) is expected to maintain its interest rate at 4.35%, but investors will be closely watching for indications of future policy shifts.

Other Australian release include the trade balance for September.

New Zealand will publish a range of labor data for the third quarter, with expectations for a 4.5% year-on-year increase in exports in October and a 1.5% decrease in imports.

On Tuesday, the Reserve Bank of Australia (RBA)’s meeting will be closely watched. In its September meeting, the bank kept the policy interest rate at 4.35% in line with market expectations, marking the seventh consecutive meeting without a change.

The bank’s governor emphasized that no interest rate cuts are anticipated in the near term. It is expected that the RBA will maintain the policy rate at 4.35% in this week’s meeting.