Global Markets Recap

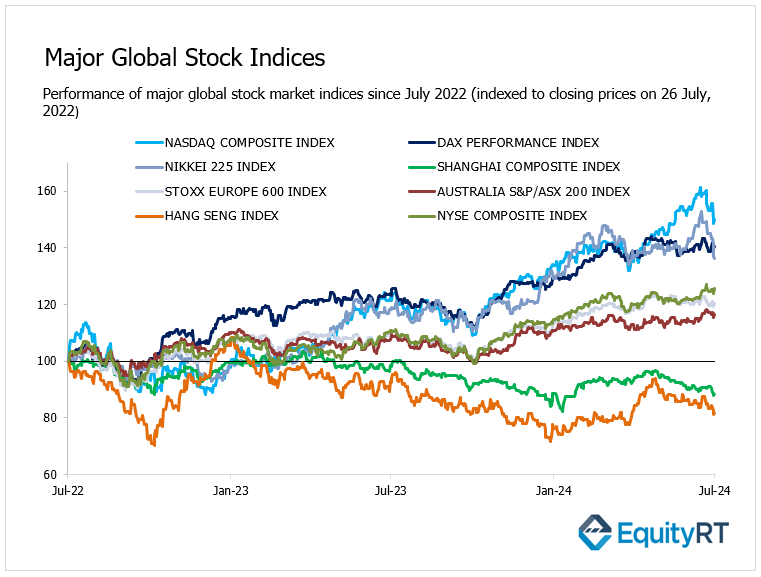

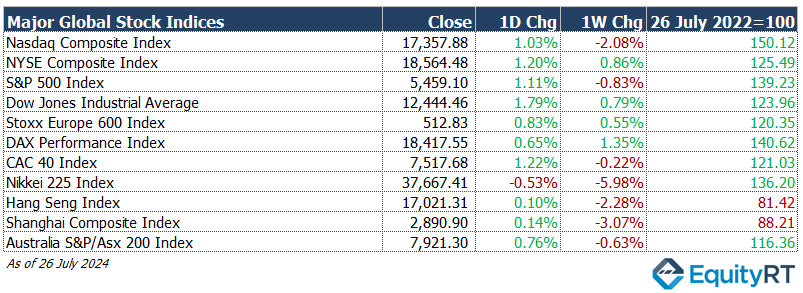

Wall Street indices closed the day with gains exceeding 1% on Friday, buoyed by the Fed’s June PCE deflator data, which aligned with expectations on a monthly basis. This data, closely watched by the Fed for monthly price trends, kept market hopes alive for a rate cut in September.

Additionally, the University of Michigan’s consumer confidence index for July saw a slight upward revision, contributing to the positive market sentiment.

European stocks closed higher on Friday.

The STOXX Europe 600, encompassing approximately 90% of the market capitalization of European markets across 17 countries, gained 0.83%, ending at 512.83.

Germany’s DAX gained 0.65%, to close at 18,417.55. France’s CAC-40 gained by 1.22% to finish at 7,517.68.

Asia-Pacific markets finished mixed.

Japan’s Nikkei-225 dropped 0.53%, or 202.10 points, finishing at 37,667.41.

Hong Kong’s Hang Seng index advanced slightly to 17,021.31. Australia’s S&P/Asx 200 Index rose by 0.76% to 7,921.30.

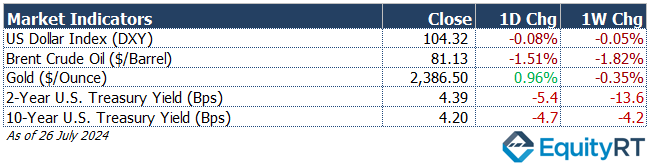

The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 104.32 marking a 0.05% weekly loss.

The Brent crude oil (#LCO07) closed the previous week at USD 81.13 per barrel, reflecting a 1.82% weekly loss.

The price of gold (#XAU) closed last week with a 0.35% loss settling at USD 2,386.50 per ounce.

The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, closed at 4.39% with a 13.6 basis points weekly loss.

The 10-year U.S. Treasury yield (#USGG10YR) completed the week with a 4.2 basis points loss, settling at 4.20%.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Recent US Economic Indicators: Highlights from Last Week

Let’s take a look at the macroeconomic indicators and developments tracked in the US last week:

In the U.S., the June PCE deflator data, along with personal income and spending figures, were released on Friday.

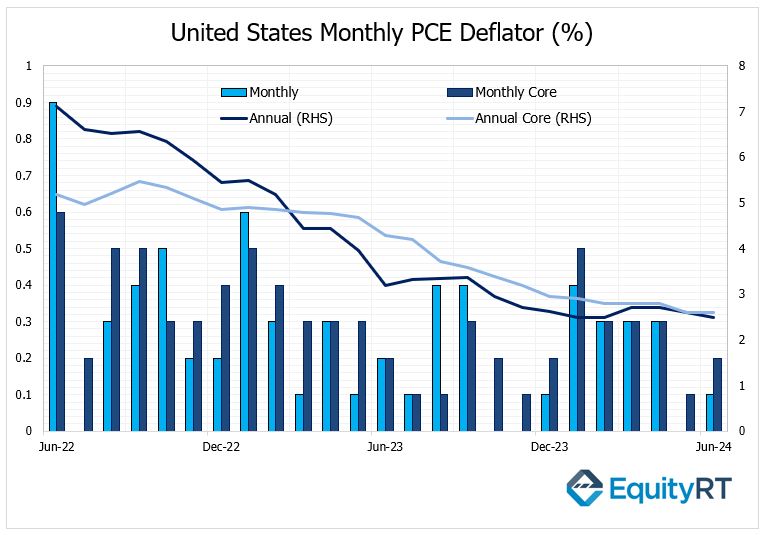

The PCE deflator rose by 0.1% month-on-month, aligning with expectations, while the year-on-year rate slightly decreased from 2.6% to 2.5%, marking the lowest level in four months.

The core PCE deflator increased by 0.2% month-on-month in June, matching expectations, while the year-on-year rate remained steady at 2.6%.

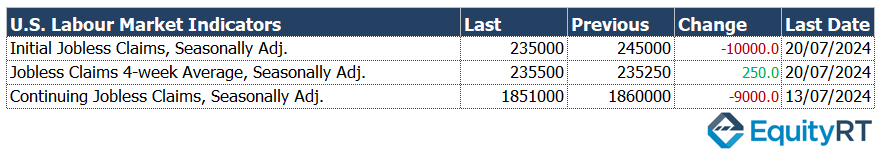

Weekly initial jobless claims for the week ending July 20 fell from 245,000 to 235,000, surpassing expectations and indicating a relatively tight labor market. The claims remained below historical averages.

Personal income growth slowed to 0.2% month-on-month in June, falling short of the expected 0.4% increase, while personal spending growth also slowed to 0.3% from 0.4%, in line with expectations.

The final reading of the University of Michigan’s consumer confidence index for July was slightly revised upwards from 66 to 66.4, although it remained at the lowest level in eight months.

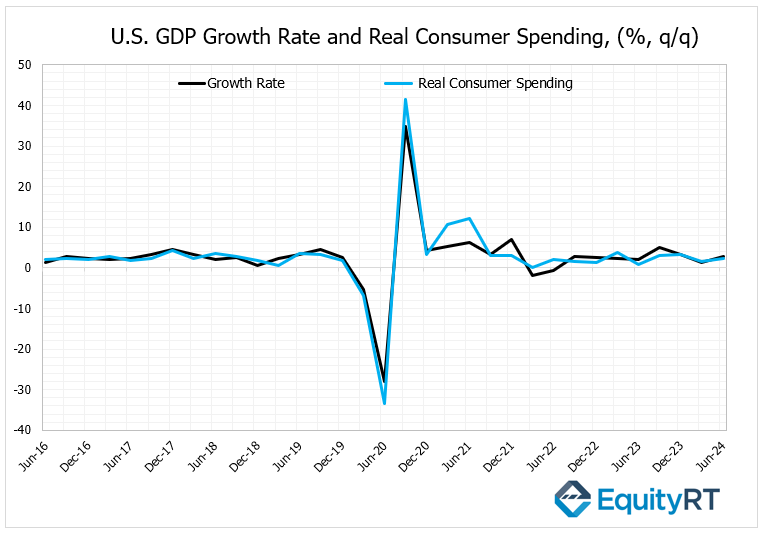

The U.S. economy grew at an annualized rate of 2.8% in the second quarter, up from 1.4% in the first quarter and exceeding market forecasts of 2%. The growth was driven by the faster-than-expected increase in consumer spending, which makes up a significant portion of the country’s economy, rising from 1.5% to 2.3%.

In the housing market, new home sales declined by 0.6% in June, following a 14.9% drop in May, marking the second consecutive month of decline and the lowest level in seven months, indicating weakening demand.

Bank of Canada Rate Decision

The Bank of Canada cut its policy rate by 25 basis points to 4.50%, following a similar cut in June. The decision was made in response to continued easing of price pressures and expectations that inflation would approach the 2% target.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Upcoming U.S. Economic Indicators to Watch This Week

This week, all eyes are on the Fed’s interest rate decision and Fed Chair Powell’s speech on Wednesday. In its June meeting, the Fed kept the federal funds rate range unchanged at 5.25%-5.50%, meeting expectations and marking the seventh consecutive meeting without a rate change.

It is widely anticipated that the Fed will hold rates steady in July.

On Tuesday, the Conference Board Consumer Confidence Index for July will be published, shedding light on consumer sentiment.

On Wednesday, July’s ADP private sector employment data will be released, followed by data on June’s job openings.

On Thursday, the final S&P Global Manufacturing PMI for July, the ISM Manufacturing Index for July, and the latest weekly jobless claims figures will be reported, providing insights into the latest manufacturing activity and labor market conditions.

On Friday, comprehensive labor market data for July, including non-farm payrolls, the unemployment rate, and average hourly earnings, will be released.

Additionally, the final data for June’s durable goods orders and factory orders will be watched closely to gauge the production outlook.

Take the guesswork out of investing: Backtest your strategies with ease!

Key Economic Indicators From Europe Last Week

Germany’s GfK consumer confidence index for August, reflecting assessments for the coming month, rose from -21.6 to -18.4. This increase is attributed to easing inflationary pressures and rising wages, pushing the index to its highest level since April 2022. Despite this improvement, the index remains in negative territory, indicating ongoing weak sentiment.

European Economic Trends: This Week’s Market Insights

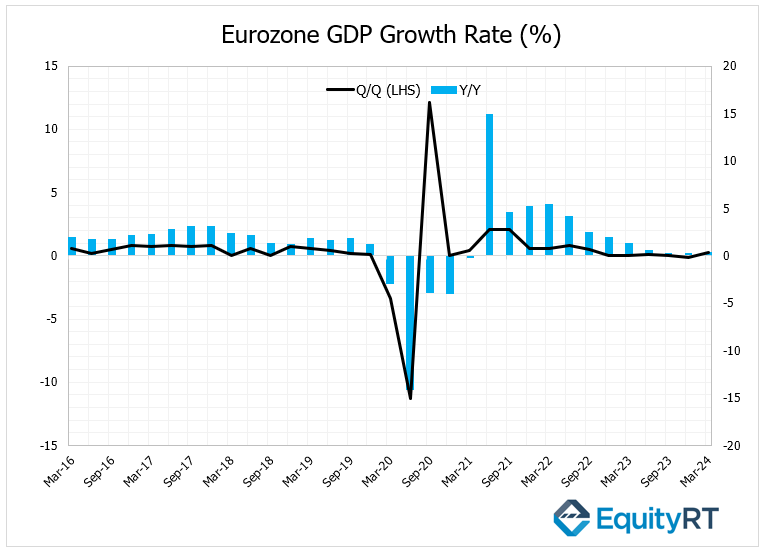

On Tuesday, the preliminary GDP growth figures for Q2 will be released for Germany and the Eurozone. Germany’s economy grew by 0.2% in Q1 2023, after contracting by 0.5% in the last quarter of 2022. Year-on-year, it contracted by 0.2%, similar to the previous quarter. For Q2, Germany is expected to show a modest quarterly growth of 0.1% and remain flat (0%) year-on-year.

The Eurozone’s economy expanded by 0.3% in Q1 2023, the strongest growth since Q3 2022, and up from a 0.1% contraction in the previous quarter. The annual growth rate increased from 0.1% to 0.4%. For Q2, the Eurozone is expected to grow by 0.2% quarterly and 0.5% annually.

The preliminary CPI data for July in Germany will be released on Tuesday, followed by Eurozone CPI data on Wednesday. In June, Germany’s headline CPI rose by 0.1% month-on-month, the lowest in six months, and decreased from 2.4% to 2.2% annually. Core CPI fell from 3% to 2.9%, the lowest since February 2022. For July, Germany’s headline CPI is expected to increase by 0.3% month-on-month and remain at 2.2% annually.

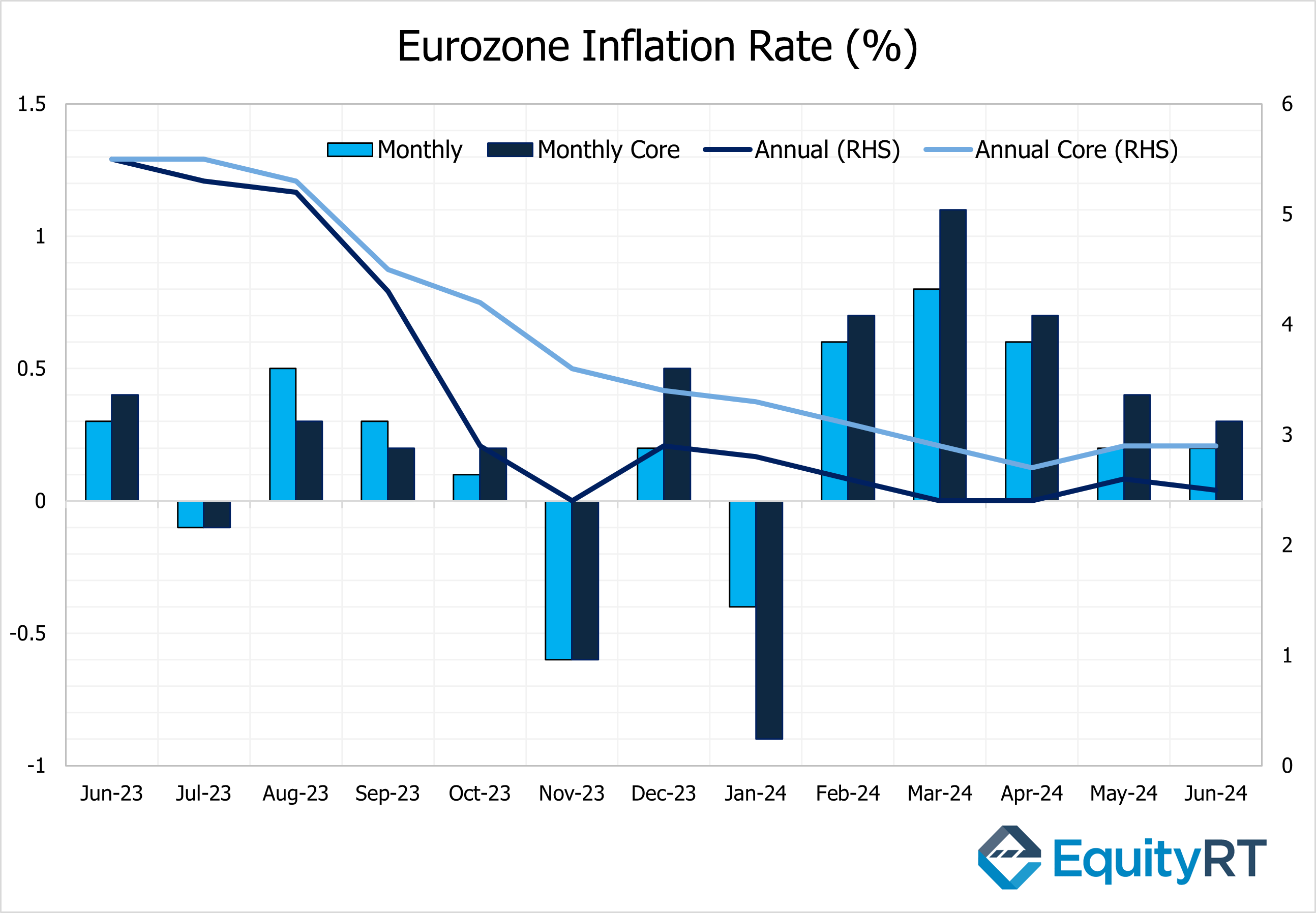

In the Eurozone, June’s headline CPI increased by 0.2% month-on-month and decreased from 2.6% to 2.5% annually, moving gradually towards the ECB’s 2% target. Core CPI remained stable at 2.9% annually. For July, the headline CPI is expected to fall by 0.1% month-on-month and remain at 2.5% annually.

Tomorrow, the final consumer confidence data for July in the Eurozone will be released. Preliminary data showed an increase from -14 to -13, the highest since February 2022, but still in negative territory.

On Thursday, the final HCOB manufacturing PMI for July will provide insights into the latest economic conditions, with preliminary data indicating contraction across the region, excluding the UK.

On Thursday, the Bank of England (BoE) will hold its meeting. In June, the BoE kept its policy rate at 5.25%, the highest in 15 years, for the seventh consecutive meeting. The upcoming meeting is expected to result in a 25-basis point rate cut, bringing the rate down to 5%.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Asian Economic Indicators

Following its fourth consecutive meeting where the central bank kept the policy rate unchanged, the Bank of Russia raised its rate by 200 basis points from 16% to 18%, aligning with expectations. The Bank indicated that further rate hikes could be considered if necessary to control inflation.

Upcoming Asian Data

On Wednesday, China’s official PMI data for July, covering both manufacturing and non-manufacturing sectors, will be released. These figures are expected to provide insights into the economic performance.

On Thursday, the Caixin PMI for July, focusing on small and medium-sized enterprises, will also be monitored for further signals about the economic conditions.

The Bank of Japan (BOJ) meeting will take place on Wednesday. In its March meeting, the BOJ ended its negative interest rate policy, which had been in place since 2016, due to emerging signs of a stable 2% inflation target driven by a robust wage cycle. The BOJ is expected to maintain current interest rates in this week’s meeting.

Other economic indicators to watch include Indonesia’s GDP growth rates for Q2 and inflation rate for June.