Global Markets Recap

Last Friday, Wall Street saw mixed results among its major indices as investors tracked new inflation data that could influence the Federal Reserve’s forthcoming interest rate decisions.

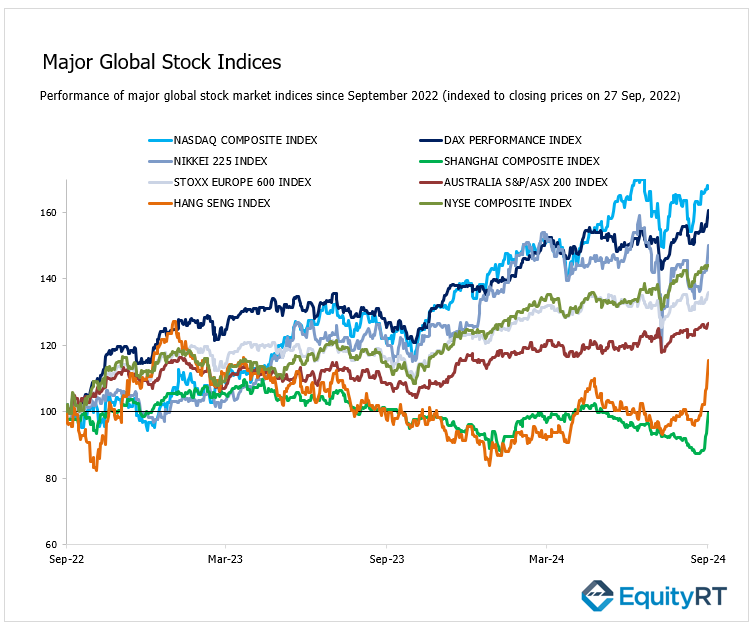

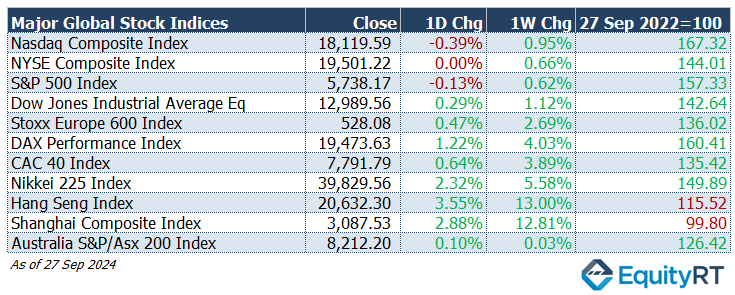

- Nasdaq Composite Index dropped by 0.39% to finish at 18,119.59, but achieved a 0.95% gain for the week.

- NYSE Composite Index remained flat for the day, closing at 19,501.22, with a 0.66% weekly increase.

- S&P 500 Index fell by 0.13%, closing at 5,738.17, but managed a 0.62% weekly gain.

- Dow Jones Industrial Average EW gained 0.29%, closing at 12,989.56, with a 1.12% weekly rise.

Europe’s major stock markets all closed higher on Friday with notable weekly gains:

- Stoxx Europe 600 Index advanced by 0.47%, closing at 528.08, with a strong 2.69% weekly rise.

- DAX Performance Index surged by 1.22%, ending at 19,473.63, and posted an impressive 4.03% weekly gain.

- CAC-40 Index climbed 0.64%, finishing at 7,791.79, and rose by 3.89% for the week.

Asian markets showed significant strength last week, with the Hang Seng and Shanghai Composite indices posting double-digit weekly gains. The Australian market had a steady performance compared to the larger gains seen in other global markets.

- Hang Seng Index surged 3.55%, ending at 20,632.30, with an outstanding 13.00% gain for the week.

- Shanghai Composite Index rose by 2.88%, finishing at 3,087.53, with a notable 12.81% weekly rise.

- Nikkei 225 Index jumped by 2.32%, closing at 39,829.56, and delivered a strong 5.58% weekly increase.

- Australia’s S&P/ASX 200 Index gained 0.10%, closing at 8,212.20, with a modest 0.03% weekly increase.

China is set for a week-long official holiday that begins on Tuesday.

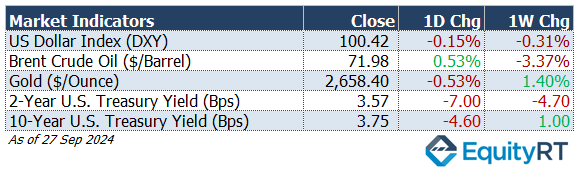

The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, decreased by 0.15%, closing at 100.42, with a 0.31% decline over the week.

The Brent crude oil (#LCO07) the global oil price benchmark, rose by 0.53%, finishing at $71.98 per barrel, but saw a weekly drop of 3.37%.

The price of gold (#XAU) ) fell by 0.53% for the day, closing at $2,658.40 per ounce, while gaining 1.40% for the week.

The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, dropped 7.00 basis points to 3.57%, down by 4.70 bps for the week.

The 10-year U.S. Treasury yield (#USGG10YR) declined by 4.60 basis points, closing at 3.75%, but recorded a weekly rise of 1.00 bps.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

U.S. Economic Indicators: Last Week’s Macro Highlights

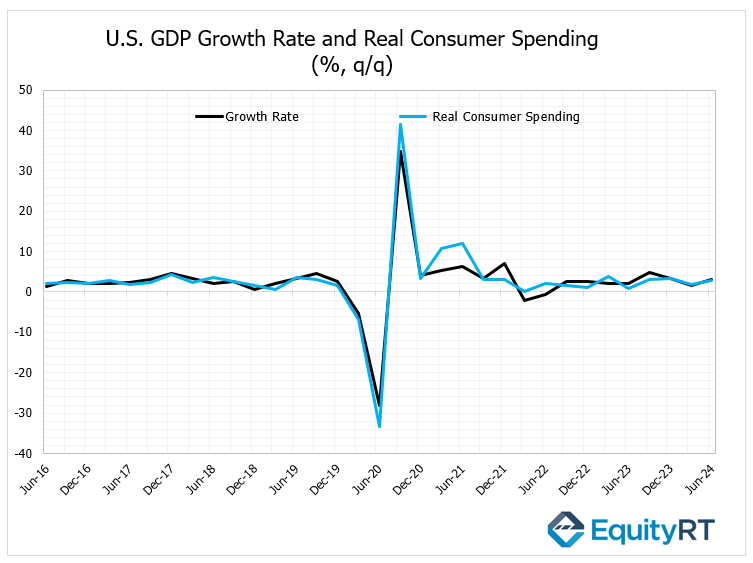

The annualized quarterly growth rate of the U.S. economy was slightly revised upward from 1.4% to 1.6% for Q1, while the growth rate for Q2 remained consistent at 3%, aligning with revised data.

The growth rate of consumption expenditures, which comprise a significant portion of the national economy, was slightly revised downward from 2.9% to 2.8%.

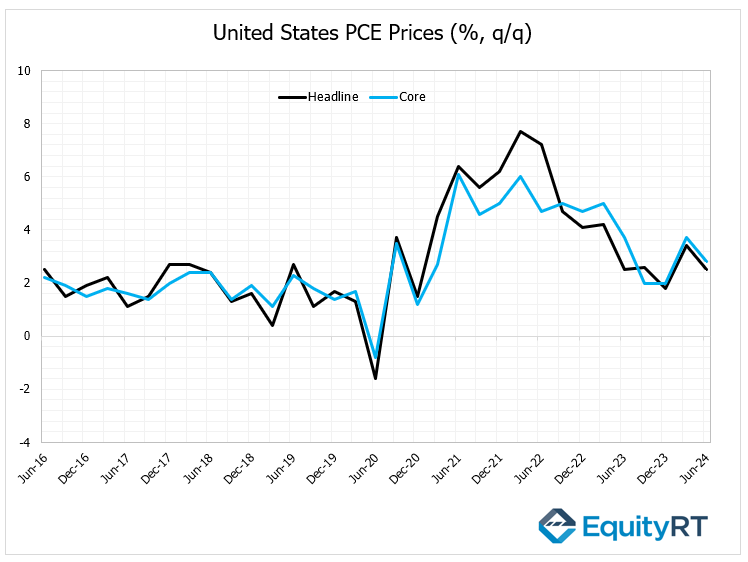

In terms of the annualized quarterly PCE price index, it recorded a level of 3.4% in Q1, followed by a decrease to 2.5% in Q2, consistent with revised data.

The core PCE price index was 3.7% in Q1 and registered at 2.8% in Q2, also in line with the revised data.

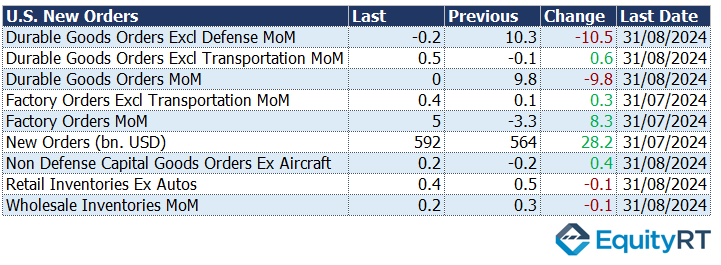

Regarding durable goods orders, after a significant monthly increase of 9.9% in July, expectations of a decrease in August did not materialize, as orders remained flat at 0%.

Additionally, non-defense capital goods orders, a key indicator of business investment in the U.S., rebounded with a 0.2% increase in August following a 0.2% decline in July.

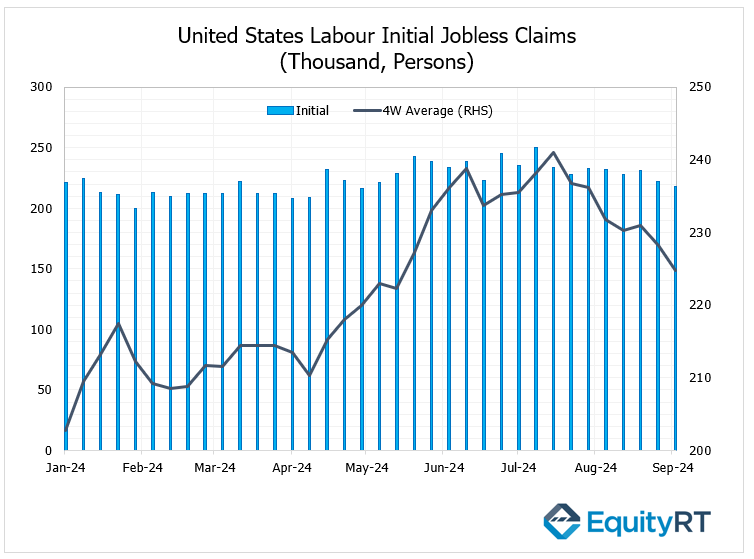

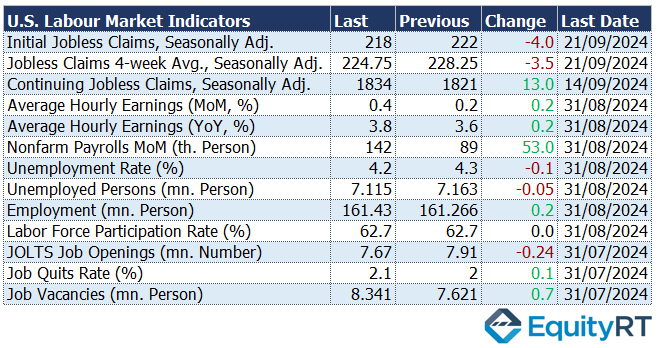

From labor market data, weekly initial jobless claims for the week ending September 21 fell from 222,000 to 218,000, despite expectations of a slight increase (225,000) reaching a new 4-month low. Despite the decline, the number of claims remained higher than the averages recorded earlier this year.

The 4-week average of jobless claims dropped to 224.75 thousand on September 21, down from a revised 228 thousand the week before and marking the lowest reading in 16 weeks.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Upcoming U.S. Economic Indicators to Watch This Week

This week in the U.S., several key economic and market indicators are on the calendar, drawing attention to manufacturing, employment, and inflation data, all of which could influence Federal Reserve decisions. Here’s what to watch:

- Manufacturing and Fed Speeches

Markets will be watching the Chicago PMI manufacturing index for September to gauge industrial activity. The index is expected to drop slightly from 46.1 to 45, indicating continued contraction in manufacturing.

On Monday, Fed Bowman and Chair Powell are set to speak, offering potential insights into future monetary policy.

- Labor Market

On Tuesday, JOLTs Job Openings for August will be tracked. The number of job openings dropped by 237,000 to 7.673 million in July 2024, down from a revised figure of 7.910 million in June. This marks the lowest level since January 2021 and came in below market expectations, which had projected 8.10 million available positions.

The number of job openings is expected to remain stable around 7.65 million, giving a picture of labor market strength.

On Thursday, the labor market data will include weekly initial jobless claims. The most recently reported figure for initial jobless claims fell to 218,000, down from 222,000, continuing its trend at the lowest level in four months, despite expectations of a slight increase. This number remains below historical averages.

In August, non-farm payrolls rose to 142,000, up from 89,000, but still below expectations of 165,000. Additionally, the previous month’s figure was revised downward by 25,000, and June’s figure was adjusted down by 61,000.

The unemployment rate also fell to 4.2%, aligning with expectations, down from 4.3%.

Looking at inflation trends, average hourly earnings increased by 0.4% month-on-month in August, surpassing expectations of 0.3%, while the year-on-year growth rate rose slightly from 3.6% to 3.8%, against a forecast of 3.7%.

For September, a slight increase in non-farm employment growth is anticipated, rising from 142,000 to 146,000, with the unemployment rate expected to remain steady at 4.2%. However, the pace of average hourly earnings growth is projected to slow to 0.3% month-on-month while year-on-year growth is expected to hold at 3.8%.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

European Economic Trends: Last Week’s Macro Insights

The GfK consumer confidence data for October showed a slight recovery from -21.9 to -21.2, despite expectations for a decline. However, it remained in negative territory. This ongoing weakness in consumer confidence is attributed to several negative factors, including rising unemployment, an increase in company bankruptcies, and potential layoffs across many firms.

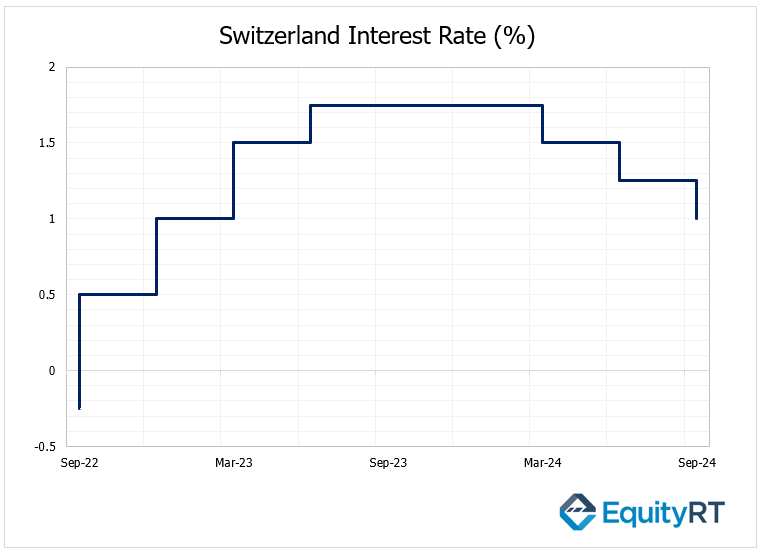

The Swiss National Bank (SNB) announced a reduction in the policy interest rate by 25 basis points to 1%, following earlier cuts of 25 basis points each in March and June. In its recent meeting, the SNB noted a significant decrease in inflationary pressures and an appreciation of the Swiss franc, aligning with market expectations.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

In Europe, all eyes are on ECB President Lagarde’s speech on Monday, particularly regarding any new assessments related to the Bank’s interest rate cut strategy.

Also today, the final GDP in the United Kingdom was monitored. The final GDP for Q2 grew by 0.5% quarter-on-quarter in Q2 2024, falling slightly short of the 0.6% reported in the initial estimate and down from 0.7% in Q1. Revisions indicated a decrease in both government spending and exports, while investment saw a more significant increase than previously anticipated.

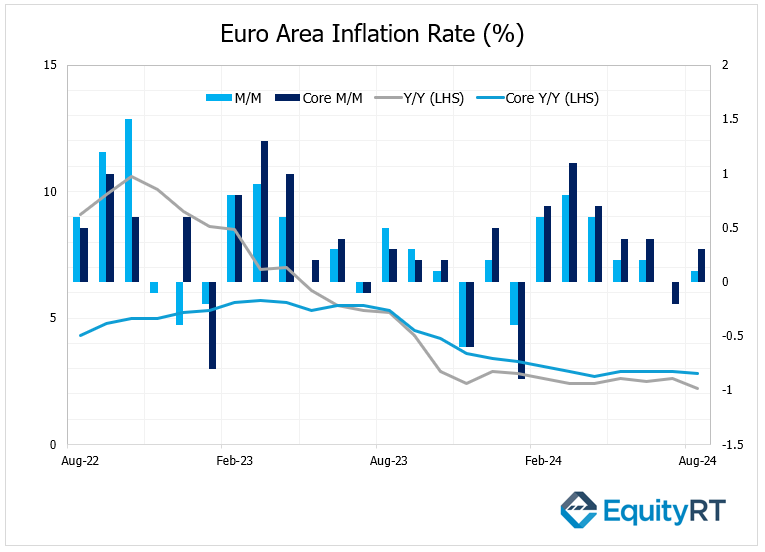

On Tuesday, the preliminary inflation rate in the Euro Area for September will be released.

In August 2024, monthly inflation recorded a modest increase of 0.1%, contrasting with expectations of a 0.2% rise. The annual inflation rate decreased to 2.2%, the lowest level since July 2021, down from 2.6% in the previous month.

Looking ahead, in the Euro Area, the inflation is anticipated to remain stable month-on-month while decreasing from 2.2% to 1.9% year-on-year.

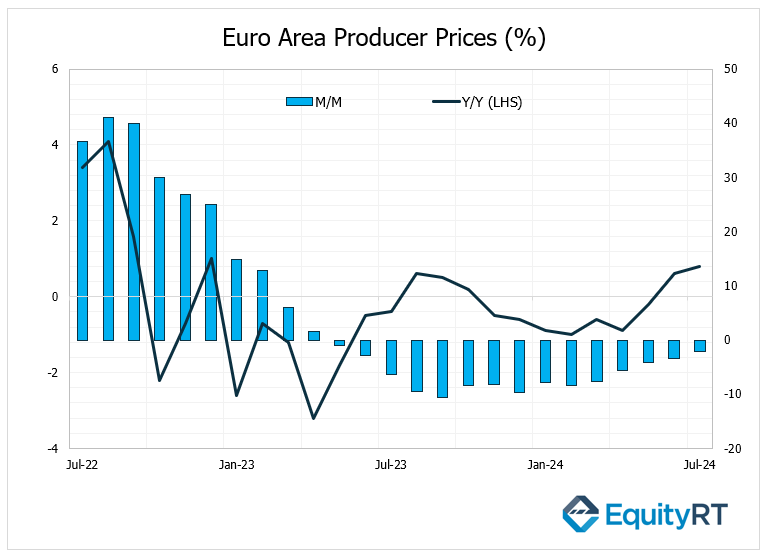

The Producer Price Index (PPI) in the Euro Area for August will be released on Thursday, providing additional insights into regional inflation trends.

The PPI in the Euro Area recorded a month-on-month increase of 0.8% in July, following a rise of 0.6% in June. However, the annual decline in the PPI slowed from 3.3% to 2.1%, continuing its downward trend for the past fifteen months. The notable increase in July was primarily driven by a significant rise in energy prices, which surged by 2.8%.

The monthly PPI is expected to ease by 0.3% while annual PPI is expected to slow by 2.4%.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

On Monday, the attention was focused on the NBS and Caixin PMIs for September.

The Caixin Manufacturing PMI dropped to 49.3 in September 2024, down from August’s 50.4. This decline missed market expectations of 50.5 and marks the lowest reading since July 2023, indicating a contraction in the manufacturing sector.

The official NBS Manufacturing PMI increased to 49.8 in September 2024, recovering from August’s six-month low of 49.1 and exceeding market expectations of 49.5. The official NBS Non-Manufacturing PMI decreased to 50.0 in September 2024, down from 50.3 in the previous month.

In Japan, a busy week of economic data will feature the Tankan Large Manufacturers Index for Q3, consumer confidence metrics for September, the Bank of Japan’s Summary of Opinions, as well as industrial production, retail sales, and the unemployment rate for August. Meanwhile, India will publish its current account data for the June quarter, while South Korea will announce its inflation rate, trade figures, and September PMI.

Additionally, Indonesia and the Philippines will report their inflation rates. In Australia, the spotlight will be on August’s trade balance, home credit, retail sales, and building permits.