Global Stock Market Highlights

Last Friday, U.S. stock markets closed the week with slight losses as investors stayed cautious ahead of key U.S.-China trade talks set for the weekend. Sentiment was weighed down by uncertainty, especially after President Trump proposed lowering tariffs on Chinese goods to 80%, down from the earlier suggestion of 145%, leaving markets waiting for more clarity.

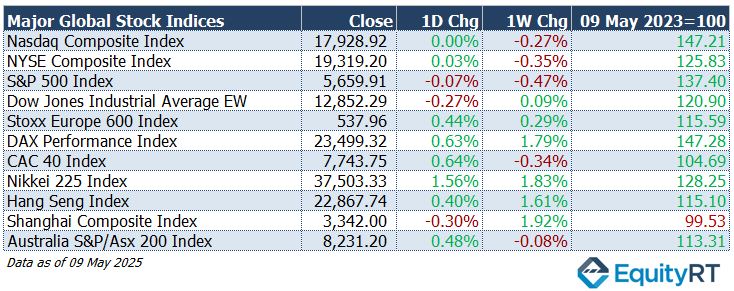

- Nasdaq Composite Index closed at 17,928.92, unchanged on the day and down 0.27% for the week.

- NYSE Composite Index closed at 19,319.20, up 0.03% on the day and down 0.35% for the week.

- S&P 500 Index closed at 5,659.91, falling 0.07% on the day and 0.47% for the week.

- Dow Jones Industrial Average EW closed at 12,852.29, declining 0.27% on the day but up 0.09% for the week.

European stock markets closed higher on Friday, supported by strong earnings from major companies and easing concerns around inflation. Optimism over the European Central Bank’s steady policy outlook also helped boost sentiment.

- Stoxx Europe 600 Index closed at 537.96, gaining 0.44% on the day and 0.29% for the week.

- DAX Performance Index closed at 23,499.32, advancing 0.63% on the day and 1.79% for the week.

- CAC 40 Index closed at 7,743.75, rising 0.64% on the day but down 0.34% for the week.

Asian markets ended the week mostly higher, driven by tech stock gains and hopes for policy support in China. Investors were also encouraged by signs of economic stabilization in the region.

- Nikkei 225 Index closed at 37,503.33, jumping 1.56% on the day and 1.83% for the week.

- Hang Seng Index closed at 22,867.74, up 0.40% on the day and 1.61% for the week.

- Shanghai Composite Index closed at 3,342.00, declining 0.30% on the day but up 1.92% for the week.

- Australia S&P/ASX 200 Index closed at 8,231.20, increasing 0.48% on the day but edging down 0.08% for the week.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 100.34, down 0.30% on the day but up 0.30% for the week; it remains down 7.48% year-to-date.

- The Brent crude oil, the global oil price benchmark, closed at $63.91 per barrel, gaining 1.70% on the day and 4.27% for the week; however, it’s down 14.38% year-to-date.

- The Gold closed at $3,324.25 per ounce, rising 0.24% on the day and 2.62% for the week; it has surged 26.67% year-to-date.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, rose to 3.91%, increasing 2.80 basis points on the day and 7.00 bps for the week, it’s down 34.20 bps year-to-date.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, closed at 4.39%, edging up 0.80 basis points on the day and 6.90 bps for the week; it has declined 18.70 bps year-to-date.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

Trade talks between the U.S. and China took center stage over the weekend, as Treasury Secretary Bessent and chief negotiator Greer met with Chinese Vice Premier He Lifeng in Switzerland. The outcome of these discussions is expected to influence market sentiment in the days ahead.

President Trump described the meetings as a “total reset” in bilateral trade relations, emphasizing their “friendly but constructive” tone. Although no concrete agreements were reached, this was the first face-to-face dialogue between the two countries since the imposition of sweeping tariffs, 145% by the U.S. and 125% by China, which have strained roughly $600 billion in trade flows.

Trump voiced optimism about gaining broader access to Chinese markets for U.S. businesses, though specifics remain unclear. With negotiations set to continue, both sides appear to be exploring avenues to ease trade tensions and stabilize economic relations.

Investors will also be watching a busy earnings calendar, with major reports expected from Alibaba, Cisco, Applied Materials, Deere & Co., and Walmart.

The U.S. economic calendar is full. April inflation data covering consumer, producer, and trade prices will offer the first full read under President Trump’s new tariff policy.

Markets expect a 0.3% monthly rise in both headline and core consumer prices after March’s declines.

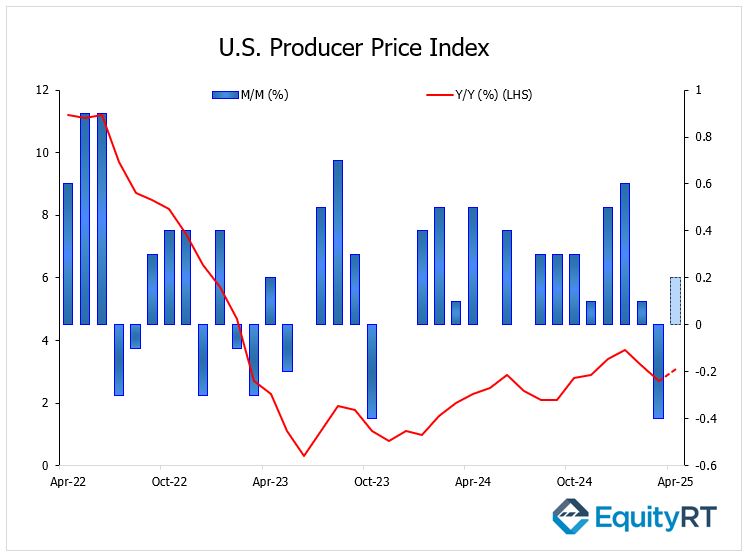

On Thursday, U.S. PPI data will be released. Overall, U.S. producer prices rose 2.7% year-on-year in March, easing from 3.2% in February and below forecasts. Monthly prices dropped 0.4%, largely due to a sharp decline in energy costs, and missed forecasts for a 0.2% gain. This marked the smallest annual increase since September.

Core producer price inflation (excluding food and energy) eased to 3.3% year-on-year, down from 3.5% in February, marking the lowest reading since September. On a monthly basis, core producer prices fell 0.1%, contrasting with expectations of a 0.3% increase.

Despite the recent decline, producer prices are projected to increase in the coming months because of new tariffs. Monthly PPI is expected to rise to 0.2%, up from -0.4%, while the year-on-year growth is forecast to accelerate to 3.1%, up from 2.7%.

Other key indicators include retail sales (seen up just 0.1% after March’s tariff-driven surge), industrial production, housing data, and regional manufacturing surveys. The preliminary University of Michigan Consumer Sentiment Index may also show a slight improvement after April’s drop.

Beyond the U.S., focus will shift to Canada’s housing starts, Mexico’s rate decision, and Brazil’s updates on retail sales and business confidence.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

In the United Kingdom, GDP growth for Q1 is projected to reach 0.6%, a notable increase from 0.1% in Q4. However, the Bank of England’s latest policy meeting suggests that underlying growth in Q1 2025 is likely to have been flat. The unemployment rate is forecast to rise to 4.5%, the highest level since August 2021.

In Germany, the ZEW Economic Sentiment Index is expected to recover in May after hitting a 21-month low.

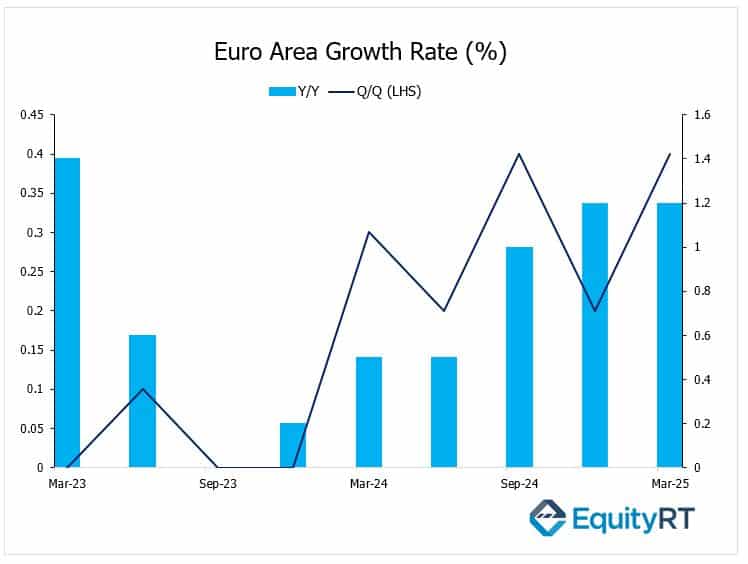

The second estimate for Euro Area GDP is anticipated to confirm a growth rate of 0.4% in Q1, up from 0.2% in Q4.

Flash GDP figures are also set to be released for Poland and Norway.

Industrial production in the Euro Area is projected to maintain strong growth, with a 1.5% increase for the third consecutive month. Additional data will include trade balances for the Euro Area and Italy, Germany’s wholesale prices, France’s unemployment rate, Switzerland’s industrial output, and both GDP and inflation figures from Russia. Final inflation data for April is also expected from major European economies.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

In China, attention will be focused on the key April credit aggregates. New yuan loans are expected to remain relatively stable, while total social financing is likely to rebound, aligning with Beijing’s plans to issue new bonds aimed at stimulating the country’s struggling consumer sector.

China released its CPI data on Saturday. China’s consumer prices fell by 0.1% year-on-year in April 2025, marking the third consecutive month of deflation. This was due to weak domestic demand, ongoing US trade tensions, and employment uncertainty. On a monthly basis, the CPI increased 0.1%, reversing a 0.4% drop in March. Core inflation, excluding food and fuel, rose 0.5%.

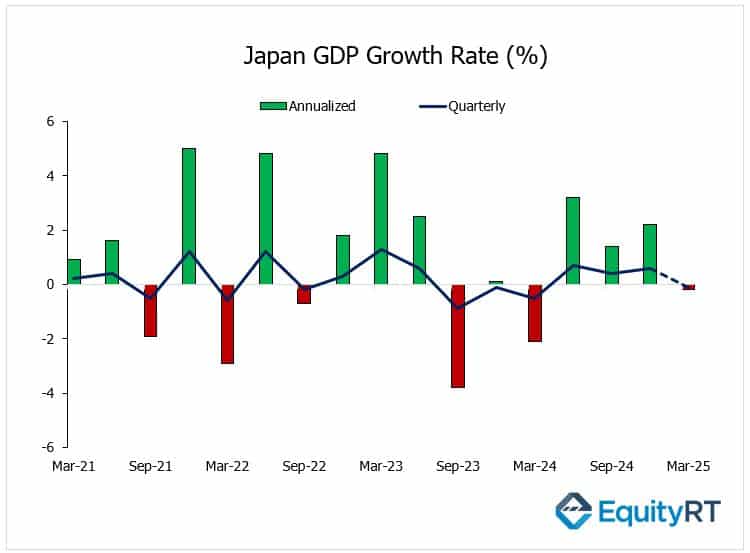

Japan’s Q1 GDP data, due Friday, is expected to reveal the economy’s first contraction in a year, following a solid 2.2% annualized expansion in Q4 2024. The previous quarter’s growth was driven by a rebound in business investment, steady government spending, and a positive trade balance, as exports rose and imports fell. However, private consumption stalled amid persistent inflation and higher borrowing costs. On a quarterly basis, GDP rose 0.6%, slightly below the initial 0.7% estimate but up from 0.4% in Q3. The Q1 downturn is likely to reflect weaker domestic demand and global trade headwinds.

In Japan, investors will also be closely monitoring the March current account figures and the latest BoJ Summary of Opinions.

In India, the inflation rate is anticipated to fall further below the RBI’s 4% target, with the trade balance expected to remain more stable compared to other trade-dependent Asian economies.

In other parts of Asia, South Korea will report its unemployment rate, and Indonesia will update its trade balance.

Australia will see a busy week of economic releases, highlighted by the Westpac consumer confidence survey for May and the NAB business confidence survey for April, followed by data on home credit aggregates and the latest labor statistics.