Global Stock Market Highlights

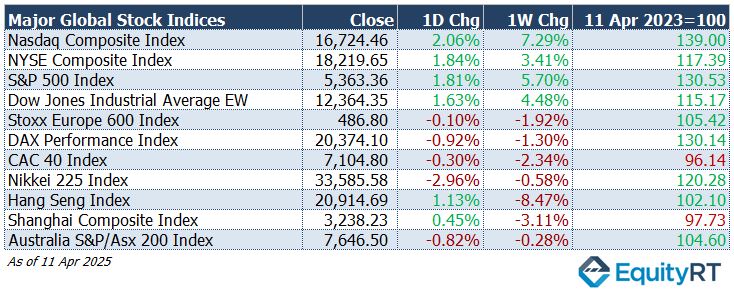

U.S. stock markets ended last Friday on a strong note, rebounding from a turbulent week dominated by trade tensions and economic uncertainty. The late-week rally was driven in part by easing pressure in the U.S. bond market, which offered a measure of reassurance to investors unsettled by President Trump’s aggressive trade stance. Still, despite Friday’s gains, major indices remained in negative territory for the year, highlighting the market’s ongoing struggle with volatility and investor apprehension.

- Nasdaq Composite Index closed at 16,724.46, rising 2.06% on the day and 7.29% for the week.

- NYSE Composite Index closed at 18,219.65, gaining 1.84% on the day and 3.41% for the week.

- S&P 500 Index closed at 5,363.36, up 1.81% on the day and 5.70% for the week.

- Dow Jones Industrial Average EW closed at 12,364.35, adding 1.63% on the day and 4.48% over the week.

European markets saw notable declines last Friday, as investor sentiment was weighed down by concerns over the U.S. administration’s sudden tariff decisions, sparking heightened market volatility. While the European Union held back from immediate retaliation, finance ministers began discussions to map out potential responses. Meanwhile, the European Central Bank voiced its worries about mounting financial stress among non-bank institutions. Attention now turns to the upcoming ECB meeting, where a quarter-point rate cut is widely anticipated.

- Stoxx Europe 600 Index closed at 486.80, slightly down 0.10% on the day and 1.92% for the week.

- DAX Performance Index closed at 20,374.10, declining 0.92% on the day and 1.30% over the week.

- CAC 40 Index closed at 7,104.80, slipping 0.30% on the day and 2.34% for the week.

Asian markets delivered mixed performances last Friday, amid escalating trade tensions between the U.S. and China. The U.S. administration’s move to hike tariffs on Chinese imports to 145% triggered swift retaliatory measures from Beijing, intensifying uncertainty across the region. While markets such as Japan and Australia posted notable losses, indices in Hong Kong and mainland China managed to stabilize, supported by government intervention and renewed investor optimism around possible economic stimulus measures.

- Nikkei 225 Index closed at 33,585.58, dropping 2.96% on the day and 0.58% for the week.

- Hang Seng Index closed at 20,914.69, rising 1.13% on the day but falling 8.47% for the week.

- Shanghai Composite Index closed at 3,238.23, up 0.45% on the day but down 3.11% over the week.

Australia S&P/ASX 200 Index closed at 7,646.50, falling 0.82% on the day and 0.28% for the week.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 99.76, falling 1.33% on the day, 3.16% over the week, and down 8.01% year-to-date.

- The Brent crude oil, the global oil price benchmark, closed at $64.76 per barrel, rising 2.26% on the day, dipping 1.25% over the week, and down 13.24% year-to-date.

- The Gold ended at $3,236.55 per ounce, gaining 1.49% on the day, up 6.57% for the week, and soaring 23.33% year-to-date.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, rose to 3.98%, up 9.40 basis points on the day, 30.70 bps over the week, but down 27.50 bps year-to-date.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, ended at 4.49%, increasing 5.80 basis points daily, 50.30 bps over the week, and slipping 8.20 bps year-to-date.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

This week, global markets are expected to remain highly sensitive, with investor sentiment shaped by ongoing trade tensions and the impact of escalating tariffs—particularly on the U.S. economy. Volatility is likely to persist across asset classes as uncertainty clouds the broader outlook.

In the U.S., all eyes will be on corporate earnings, with a wave of high-profile reports due from Goldman Sachs, Bank of America, Citigroup, Johnson & Johnson, Abbott Laboratories, UnitedHealth Group, and Netflix. These results—and more importantly, forward guidance—will be key in gauging the resilience of corporate America amid persistent economic headwinds.

Markets will also navigate a holiday-shortened week, with U.S. stock and bond markets closed on Good Friday.

Fed commentary will be closely watched, especially a scheduled speech from Chair Jerome Powell at the Economic Club of Chicago, as investors look for insights into the Fed’s policy trajectory for the rest of 2025.

In the U.S., a series of key data releases on Wednesday will offer insight into the state of industrial activity and domestic demand. March figures for industrial production and capacity utilization will be closely watched following a stronger-than-expected 0.7% increase in output in February—marking the third consecutive monthly gain.

For March, however, industrial production is expected to dip by 0.2%, with capacity utilization seen easing slightly to 77.9%.

Also on Tuesday, the New York Fed’s Empire State Manufacturing Index for April will be released, offering a glimpse into the latest production outlook. In March, the index fell to -20, its lowest reading since May 2023. In April, the index is expected to come in at -15, remaining in contraction territory amid heightened uncertainty caused by Trump’s renewed tariff policies.

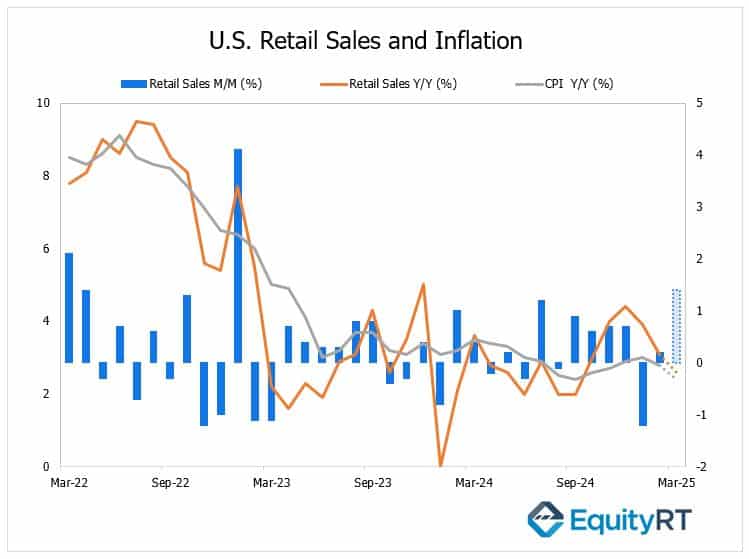

Retail sales data for March will be released on Wednesday. In February, retail sales rose by just 0.2%, falling short of expectations, after a 1.2% drop in January that was partly blamed on severe winter weather and wildfires in California. Core retail sales (excluding automobiles, gasoline, food, and building materials), which feed into GDP calculations, rebounded by 1% in February after a 1% drop in January.

For March, analysts expect headline sales to increase by 1.4% and core retail sales to rise by 0.2%.

Going forward, the outlook for retail sales will depend on consumer confidence—shaped in part by public sector job cuts, market volatility, labor market conditions, and wage growth. Additionally, Trump’s proposed tariffs could raise the cost of imported goods, potentially pressuring inflation and weighing on consumer spending.

On Thursday, attention will shift to the labor market and housing sector. Weekly initial jobless claims, a high-frequency indicator of labor market conditions, will be released. Claims recently ticked up from 219,000 to 223,000, still hovering at historically low levels, reflecting tight labor conditions. The data continues to be monitored for the impact of public employment reductions and tariff-driven uncertainties.

Also due Thursday are March housing starts and building permits—an indicator of future housing demand. Housing starts are expected to fall by 5.4% on the month, while permits are projected to dip by 0.6%, signaling continued weakness in the housing market.

Outside the U.S., attention will be on Canada, where the Bank of Canada is widely anticipated to hold rates steady following 225 basis points of cuts since June 2024. Markets will also monitor CPI data and housing starts for further economic clues

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

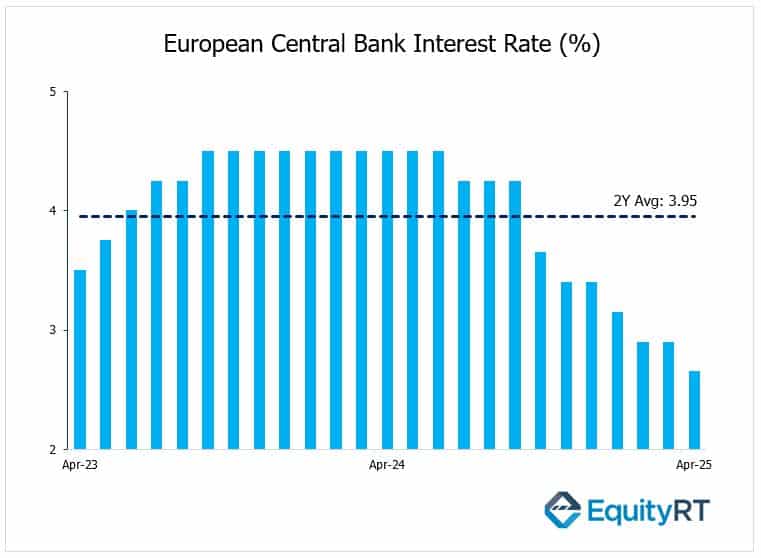

Investor attention in Europe is shifting to the European Central Bank’s policy meeting on April 17, with expectations rising for a seventh consecutive rate cut since June. This decision comes amid growing recession concerns across the Eurozone, exacerbated by President Trump’s aggressive tariff policies and their impact on global trade.

In the minutes from the March monetary policy meeting, ECB officials warned that U.S. tariffs and possible retaliatory actions could drive inflation higher, particularly in the short term. They also highlighted that increased government spending, especially on defense and other fiscal initiatives, might contribute to rising price pressures, potentially slowing the disinflation process.

Policymakers emphasized that the updated policy statement should not be interpreted as signaling either a rate cut or a pause in April, acknowledging the increasing uncertainty about whether monetary policy remained restrictive. They pointed out that interest rates had already been significantly reduced, while leaving the option open for further cuts.

On the data front, Germany’s ZEW Economic Sentiment Index is expected to slide to a seven-month low, reflecting deepening investor pessimism. Eurozone industrial production likely contracted in February, reinforcing concerns about weakening momentum.

In the UK, a flurry of macro releases will shed light on inflation and the labor market:

Headline CPI is forecast to ease to 2.7% in March. Core inflation is projected to drop to 3.4%, both marking three-month lows. Unemployment is expected to hold steady at 4.4%, while wage growth is seen moderating.

Other notable releases include Germany’s producer and wholesale price indices, retail sales data from the British Retail Consortium and Switzerland’s trade figures.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

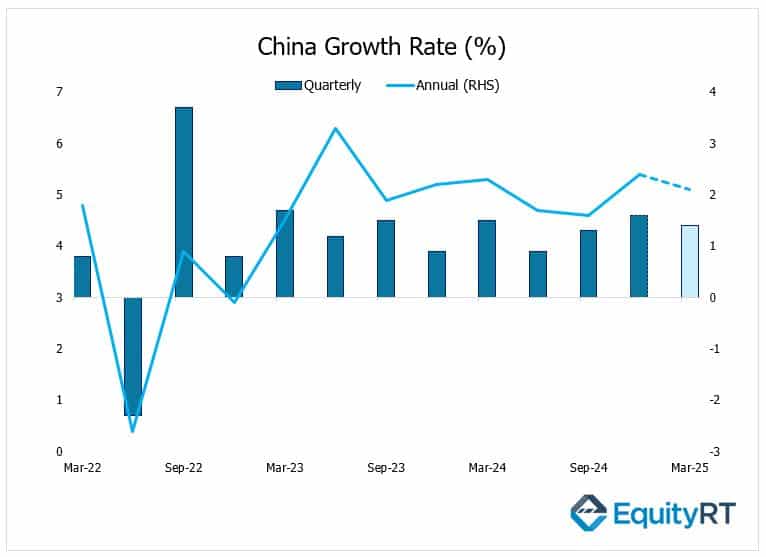

On the data front in Asia, all eyes will be on China’s first-quarter GDP figures, set to be released on Wednesday.

In the fourth quarter of last year, China’s economic growth accelerated from 1.3% to 1.6% on a quarterly basis, marking the strongest quarterly expansion since Q1 2023. This uptick reflected the impact of broad monetary and fiscal stimulus measures introduced by Chinese authorities. On an annual basis, growth also picked up from 4.6% to 5.4%, registering the highest year-on-year pace in the past 18 months. As a result, China’s economy grew by 5% in 2024 overall, in line with the government’s target of around 5%.

However, in the first quarter of this year, growth is expected to moderate amid persistent structural weaknesses in the Chinese economy and renewed headwinds from Trump’s tariff policies. Quarterly growth is forecast to ease from 1.6% to 1.4%, while annual growth is projected to slow from 5.4% to 5.1%.

Additionally, industrial production, retail sales, and fixed-asset investment are likely to have continued their growth trajectory in March, with the unemployment rate possibly dropping slightly. Markets will also be looking closely at March trade figures to gauge the extent of front-loading amid trade tensions, as well as key credit data to understand the impact of stimulus measures.

Inflation and trade data will also be key focuses in Japan and India. Meanwhile, the Bank of Korea is anticipated to implement its third rate cut of the cycle to support the economy, despite the significant decline of the won.

In Singapore, Q1 GDP is expected to show a contraction. In Australia, March job growth is expected to remain strong, while the Reserve Bank of Australia’s minutes from its most recent meeting will shed light on how the central bank is balancing growth, inflation, and trade risks.