Global Stock Market Highlights

U.S. stock markets ended higher last Friday, with the S&P 500 logging its ninth straight daily gain. The rally was fueled by a stronger-than-expected U.S. jobs report for April and renewed optimism around U.S.-China trade relations. Investor sentiment was lifted after China signaled a willingness to return to the negotiating table, following the tariff hikes introduced by President Trump earlier in April.

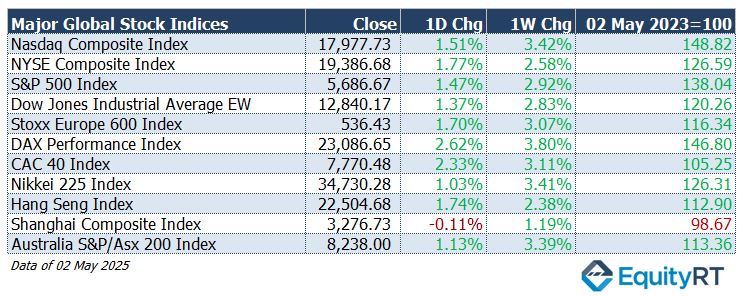

- Nasdaq Composite Index closed at 17,977.73, rising 1.51% on the day and 3.42% for the week.

- NYSE Composite Index closed at 19,386.68, rising 1.77% on the day and 2.58% for the week.

- S&P 500 Index closed at 5,686.67, rising 1.47% on the day and 2.92% for the week.

- Dow Jones Industrial Average EW closed at 12,840.17, rising 1.37% on the day and 2.83% for the week.

Last Friday, European stock markets closed higher, buoyed by easing U.S.-China trade tensions and a stronger-than-expected U.S. jobs report.

- Stoxx Europe 600 Index closed at 536.43, rising 1.70% on the day and 3.07% for the week.

- DAX Performance Index closed at 23,086.65, rising 2.62% on the day and 3.80% for the week.

- CAC 40 Index closed at 7,770.48, rising 2.33% on the day and 3.11% for the week.

Asia-Pacific markets advanced following China’s announcement that it is evaluating potential trade talks with the U.S., boosting investor sentiment.

- Nikkei 225 Index closed at 34,730.28, rising 1.03% on the day and 3.41% for the week.

- Hang Seng Index closed at 22,504.68, rising 1.74% on the day and 2.38% for the week.

- Shanghai Composite Index closed at 3,276.73, falling 0.11% on the day but up 1.19% for the week.

- Australia S&P/ASX 200 Index closed at 8,238.00, rising 1.13% on the day and 3.39% for the week.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, ended at 100.04, down 0.15% on the day, up 0.57% for the week, but down 7.75% year-to-date.

- The Brent crude oil, the global oil price benchmark, closed at $61.29 per barrel, falling 1.35% on the day, down 6.85% for the week, and down 17.89% year-to-date.

- The Gold ended at $3,239.34 per ounce, inching up 0.06% on the day, down 2.43% for the week, but up 23.43% year-to-date.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, rose to 3.83%, gaining 12.30 bps on the day, up 7.00 bps for the week, but down 42.00 bps year-to-date.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, ended at 4.31%, rising 9.30 bps on the day, up 4.80 bps for the week, and down 26.20 bps year-to-date.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

This week, investor attention will center on potential U.S.–China tariff negotiations, the Federal Reserve’s interest rate decision, and a fresh wave of Q1 corporate earnings. China has announced it is “evaluating” U.S. proposals, and President Trump has continued to signal a willingness to lower tariffs—setting the stage for renewed trade talks.

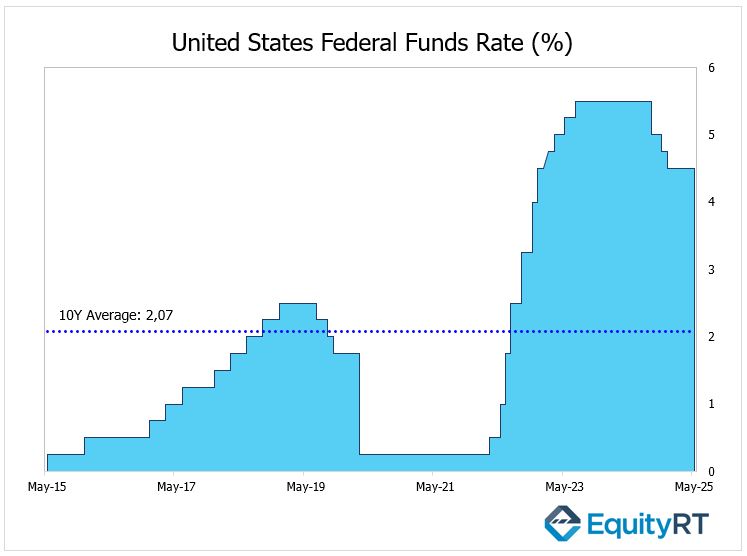

The Federal Reserve is set to meet on Wednesday, with markets widely anticipating no change to interest rates. Policymakers appear to be adopting a cautious stance as they monitor the impact of tariffs on the economy amid signs of slowing growth and a gradually softening labor market. Fed officials have indicated that short-term rates will remain on hold until there is clearer evidence that inflation is approaching the 2% target, or the labor market shows noticeable weakness. So far, neither condition has been met. Economists caution that the full effects of President Donald Trump’s aggressive tariffs are yet to be seen, and uncertainty remains over their eventual impact on prices and employment.

On the data front, the ISM Services PMI for April is expected to indicate modest expansion, following stronger growth in March. Meanwhile, final U.S. trade data is likely to confirm a widening trade deficit and record-high imports in March, as buyers rushed orders ahead of tariff changes.

In Canada, labor market data, foreign trade numbers, and the Ivey PMI are on the docket.

In corporate earnings, results are expected from major names including Ford, Uber, Walt Disney, Occidental Petroleum, Palantir, AMD, Novo Nordisk, Shopify, and Pinterest, keeping the Q1 earnings season in focus.

In Latin America, Brazil’s economic calendar includes inflation, industrial production, and trade data. The country’s central bank is widely expected to raise the Selic rate as it seeks to steer inflation back toward the target.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

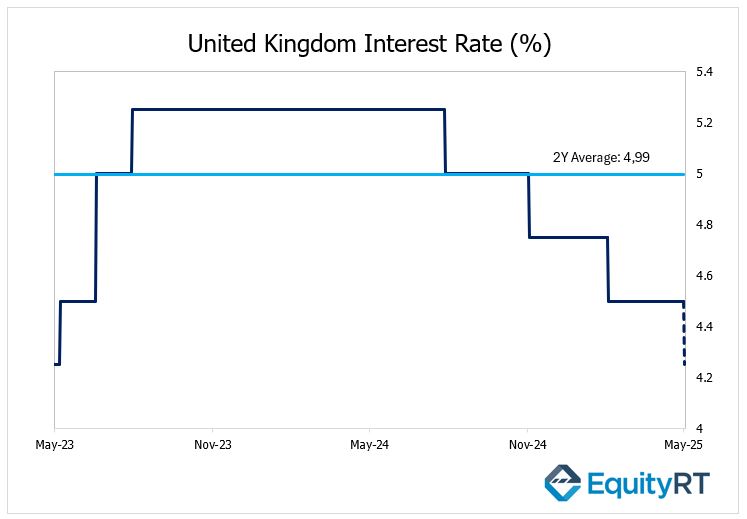

In the UK, the Bank of England is expected to cut interest rates by 25 basis points on May 8 amid concerns over global growth, particularly due to U.S. tariff impacts. The Bank of England is expected to cut interest rates by 25 basis points to 4.25% on Thursday, as it looks to support borrowers and assess the broader economic impact of U.S. tariffs. With inflation easing in recent months, policymakers appear to have room to lower rates further. The Consumer Prices Index (CPI) slowed to 2.6% in March from 2.8% in February, while services inflation — a key gauge for the Bank — also declined to 4.7% from 5%.

Poland’s central bank is also likely to lower rates by 25bps, while rate decisions from Sweden and Norway are also on the radar.

In Germany, factory orders are anticipated to show a rebound following recent stagnation. Meanwhile, services activity in Italy and Spain is projected to cool, with growth expected to slow to three- and five-month lows, respectively. France’s industrial production is forecast to rise for the second straight month.

Other notable data releases include:

- Euro Area: Retail sales

- Germany: Trade balance and construction PMI

- UK: Industrial production and house price data

- France: Foreign trade

- Italy: Retail sales and industrial output

- Russia: Manufacturing PMI

- Switzerland: Inflation, unemployment, and consumer sentiment

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

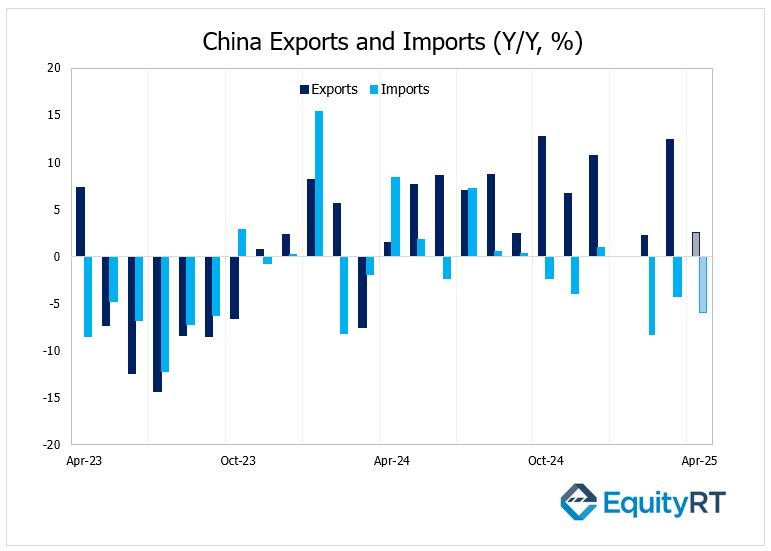

China’s trade activity is expected to slow sharply in April following record-high exports in February and March. China’s exports jumped 12.4% year-on-year in March 2025 to USD 313.9 billion, significantly outperforming market expectations of a 4.4% rise and accelerating from the 2.3% growth seen in January–February. This marked the strongest export performance since October, suggesting a wave of front-loading ahead of the latest round of U.S. tariffs.

Markets will also be watching for trade data from Vietnam and Taiwan. Other key releases from China include its Q1 current account balance and new credit figures for April.

In Japan, March household spending data will be in focus, offering insights into consumer confidence and economic recovery trends. Meanwhile, Q1 GDP reports from Indonesia and the Philippines are due, with the latter also set to release fresh inflation and unemployment data.

In Australia, attention turns to the Ai Group Industry Index and April’s building permit numbers, while in New Zealand, unemployment figures are expected to show a rise in the jobless rate.