Global Markets Recap

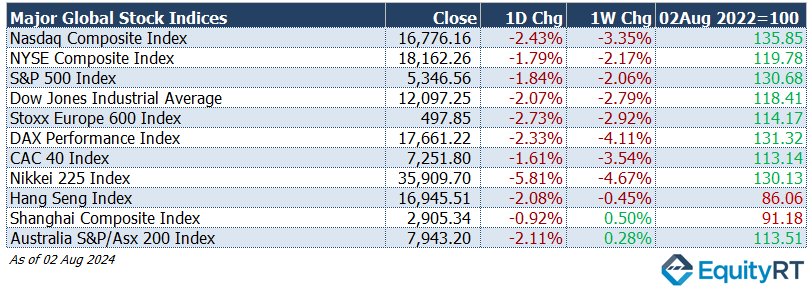

On Friday, Wall Street indices closed with sharp declines exceeding 2%, led by technology stocks. This drop was influenced by July’s US labor market data, which came in weaker than expected, indicating a more rapid deterioration in the labor market and increasing concerns about a potential recession in the US economy.

European stocks also tumbled on Friday. The STOXX Europe 600, encompassing approximately 90% of the market capitalization of European markets across 17 countries, fell close to 3%, ending at 497.85 and hitting an over 3-monthly low.

Germany’s DAX completed the week in the negative territory, losing 2.33%, to close at 17,661.22. France’s CAC-40 lost by 1.61% to finish at 7,251.80.

Most Asia-Pacific markets finished lower. Japan’s Nikkei-225 dropped 5.81% or 2,216.63 points, finishing at 35,909.70, the second-biggest points drop in history.

Hong Kong’s Hang Seng index dropped almost 1%, finishing at 16,945.51. Australia’s S&P/Asx 200 Index lost 2.11% to 7,943.20.

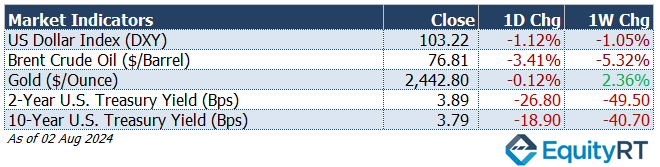

The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 103.22 marking a 1.05% weekly loss.

The Brent crude oil (#LCO07) closed the previous week at USD 76.81 per barrel, reflecting a 5.32% weekly loss.

The price of gold (#XAU) closed last week with a 2.36% weekly gain settling at USD 2,442.80 per ounce.

The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, closed at 3.89% with a 49.5 basis points weekly loss.

The 10-year U.S. Treasury yield (#USGG10YR) completed the week with a 40.70 basis points loss, settling at 3.79%.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Recent US Economic Indicators: Highlights from Last Week

Let’s take a look at the macroeconomic indicators and developments tracked in the US last week:

- Fed Decision

The Fed kept the federal funds rate range steady at 5.25%-5.50% in last week’s meeting, in line with expectations, marking the eighth consecutive meeting without a rate change. The decision was unanimous.

The Fed noted in its statement that inflation had made some further progress toward the 2% target in recent months, and that risks to employment and inflation objectives remained more balanced.

Fed Chair Powell reiterated their commitment to data dependency and indicated that no decision had been made in advance for the September meeting. However, he mentioned that if confidence in inflation continues to grow and the labor market remains strong, a rate cut could be on the table in September.

- Employment Data

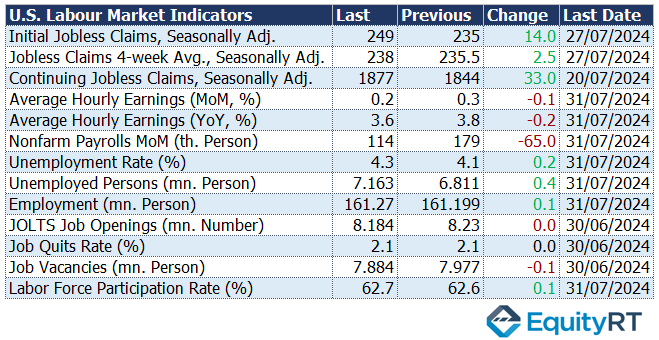

In July, the ADP private sector employment increase slowed from 155,000 to 122,000, marking the lowest level in six months. Expectations were for it to be similar to the previous month at 150,000.

The JOLTS job openings data for June fell from 8.23 million to 8.18 million, which was a smaller decline than the expected 8 million, indicating a partial slowdown in labor demand.

Weekly new jobless claims in the US rose above expectations for the week ending July 27, increasing from 235,000 to 249,000. This marks the highest level in nearly a year, indicating a partial cooling in the job market, although it remains below historical averages.

In the US, nonfarm payroll growth in July slowed to 114,000 from 179,000, falling well below expectations of 175,000 and marking the lowest level in the past three months. Additionally, the previous month’s figure was revised down from 206,000 to 179,000.

The unemployment rate rose to 4.3% in July from 4.1%, reaching its highest level since October 2021. Expectations had been for the rate to remain steady at 4.1%.

The number of unemployed persons increased by 352,000 to 7.16 million, while the number of employed persons rose by a modest 67,000 to 161.3 million.

Regarding inflation trends, average hourly earnings growth slowed to 0.2% month-on-month in July from 0.3%, falling short of expectations of 0.3%. On a year-on-year basis, the increase decelerated to 3.6% from 3.8%, surpassing expectations of a 3.7% rise and marking the lowest level since May 2021.

- Housing Market

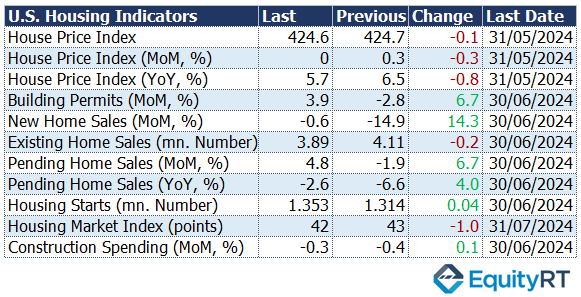

Pending home sales data, which shows the number of homes under contract but not yet closed, rebounded in June with a 4.8% increase following a 1.9% decline in May. However, the annual decline in pending home sales weakened 2.6% in June, down from 6.6% in May.

Construction spending data showed a 0.3% decrease in June, following a 0.4% decline in May. This continued drop for the second consecutive month highlights ongoing weakness in the housing market.

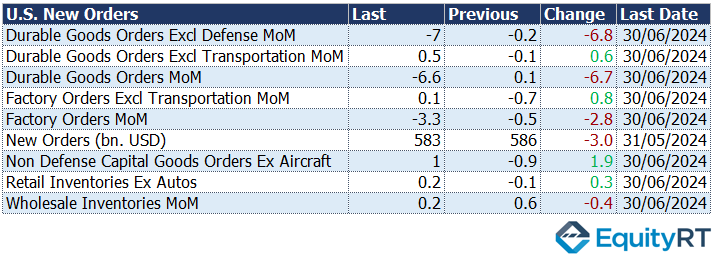

- Durable Goods and Factory Orders

Durable goods orders, which had risen by 0.1% month-on-month in May, declined 6.6% in June ending a four-month upward trend.

Factory orders, after a 0.5% decline in May, fell by 3.3% in June, exceeding expectations of a 3.2% decrease and continuing its downward trend for the second consecutive month.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Upcoming U.S. Economic Indicators to Watch This Week

- S&P Global Services PMI and ISM Non-Manufacturing Data

On Monday, attention will be on the July S&P Global Services PMI and the July ISM Non-Manufacturing Index, which will provide signals about the latest economic activity in the US.

On Tuesday, the June trade balance data will be released. In May, the trade deficit increased from $74.5 billion to $75.1 billion, continuing its high levels since October 2022, although it was below expectations. In May, imports fell by 0.4% to $336.7 billion, while exports decreased by 0.7% to $261.7 billion. For June, the trade deficit is expected to decline to $72.5 billion.

- Weekly Jobless Claims

On Thursday, the weekly initial jobless claims data will be monitored. The most recent weekly jobless claims rose from 235,000 to 249,000, exceeding expectations and reaching the highest level in nearly a year, indicating a partial cooling in the labor market. However, the level remains low compared to historical averages.

Take the guesswork out of investing: Backtest your strategies with ease!

Key Economic Indicators From Europe Last Week

- Inflation Trend in The Eurozone and Germany

In the Eurozone, the headline CPI‘s monthly increase slowed from 0.2% in June to 0% in July, marking its lowest level in six months. Expectations were for a 0.1% decrease.

On an annual basis, the headline CPI slightly rose from 2.5% to 2.6%, while the forecast was for it to remain at 2.5%. Core CPI in the region held steady at 2.9% year-on-year, above the expected 2.8%.

In Germany, the monthly increase in headline CPI rose from 0.1% to 0.3% in July, in line with expectations, marking the highest level in three months. On an annual basis, it increased slightly from 2.2% to 2.3%. Core CPI in Germany remained steady at 2.9% year-on-year, continuing its trend at the lowest level since February 2022.

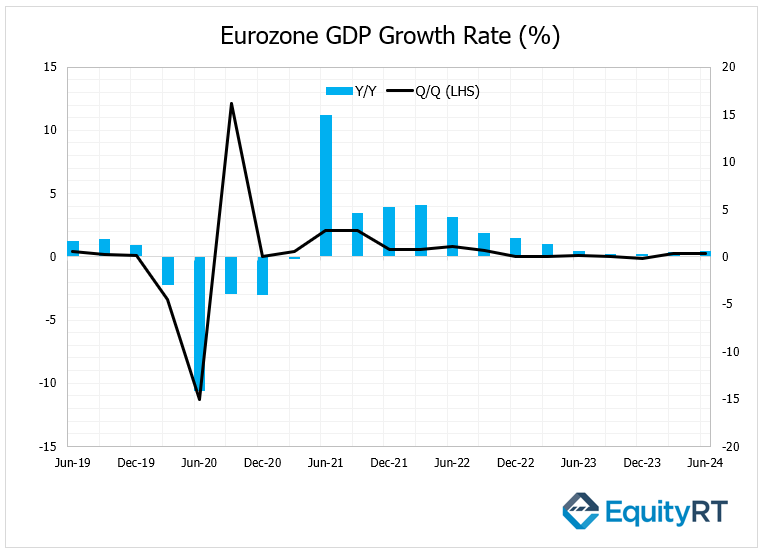

- Eurozone Economic Growth

The Eurozone economy grew by 0.3% in the second quarter, similar to the first quarter, marking the strongest growth since Q3 2022. This exceeded expectations of 0.2% growth. On an annual basis, the growth rate rose slightly from 0.5% to 0.6%, with forecasts predicting a 0.5% increase.

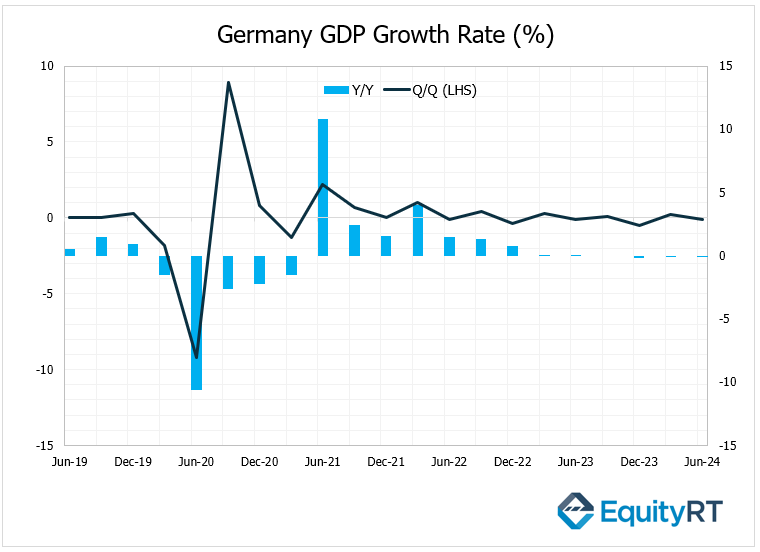

- Economic Contraction in Germany

Germany’s economy unexpectedly contracted by 0.1% in the second quarter of this year, following a 0.2% growth in the first quarter. This was contrary to expectations of a 0.1% quarterly growth. Annually, the economy shrank by 0.1%, similar to the previous quarter, while expectations were for it to remain stable.

- Consumer Confidence in the Eurozone

The final consumer confidence data for July in the Eurozone matched the preliminary reading at -13, continuing at the highest levels since February 2022. Despite this, consumer confidence remains in negative territory.

- Bank of England Interest Rate Cut

The Bank of England (BoE), after keeping the policy interest rate unchanged for seven consecutive meetings, lowered the rate by 25 basis points from 5.25% to 5% in yesterday’s meeting, in line with expectations.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Market Insights

Today, the final July HCOB Services PMI data, which provides insights into the economic situation across Europe, was released. Additionally, the August Sentix Investor Confidence Index and June’s Producer Price Index (PPI) for the Eurozone were also reported.

On Tuesday, attention will shift to the Eurozone’s June retail sales data, which will provide signals about domestic demand.

In Germany, the June factory orders data will be released on Tuesday, and the June industrial production data will be followed on Wednesday.

On Wednesday, Germany’s June trade balance data will be released.

Additionally, on Friday, the final Consumer Price Index (CPI) data for July from Germany will be published, which will influence the European Central Bank’s monetary policy decisions.

Take the guesswork out of investing: Backtest your strategies with ease!

Asian Economic Indicators

- China Manufacturing PMI Signals Contraction

The Caixin Manufacturing PMI for July, which indicates the activity of small and medium-sized firms in China, surprisingly fell from 51.8 to 49.8 due to weak demand conditions. This suggests the manufacturing sector has moved back into contraction territory after an 8-month expansion, marking the lowest level since October 2023.

- Bank of Japan Raises Interest Rates

The Bank of Japan (BOJ) raised its policy rate from the 0%-0.10% range to 0.25% as part of its monetary policy normalization efforts. The BOJ also announced it would reduce the pace of its monthly bond purchases.

Upcoming Asian Data

On Thursday, China’s July trade data will be released.

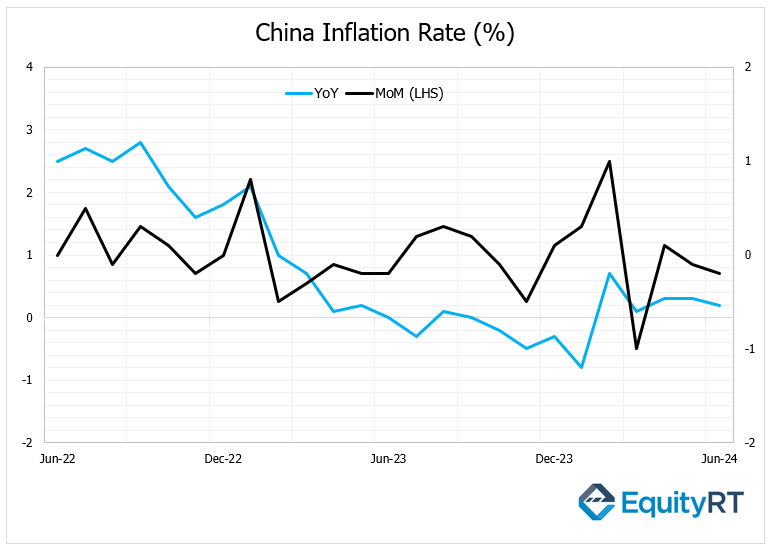

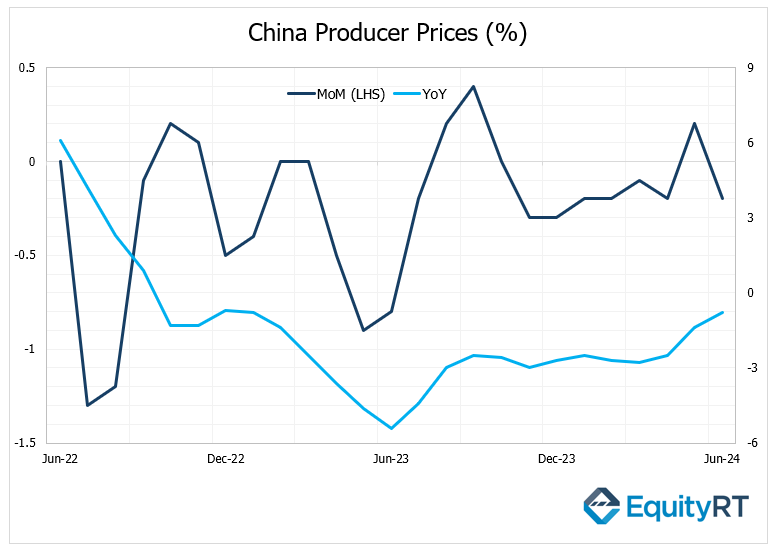

On Friday, China’s July Consumer Price Index (CPI) and Producer Price Index (PPI) data will be released.

In May, the headline CPI decreased by 0.1% month-on-month, followed by a 0.2% decline in June, marking the second consecutive monthly drop. The annual growth rate slowed from 0.3% to 0.2% in June, its lowest since March, yet continued its upward trend for the fifth month.

For July, the annual CPI growth rate is expected to rise to 0.4% from 0.2%.

The PPI, which increased by 0.2% month-on-month in May, fell by 0.2% in June. Despite this monthly drop, the annual decline rate of the PPI slowed from 1.4% to 0.8%, confirming a continued deflationary trend in producer prices for the twenty-first consecutive month. The PPI decline rate is projected to increase from 0.8% to 0.9%.

Also, the Reserve Bank of Australia’s meeting will be tracked on Tuesday. It is expected that the bank will keep the policy rate steady at 4.35% in this week’s meeting.