Global Markets Recap

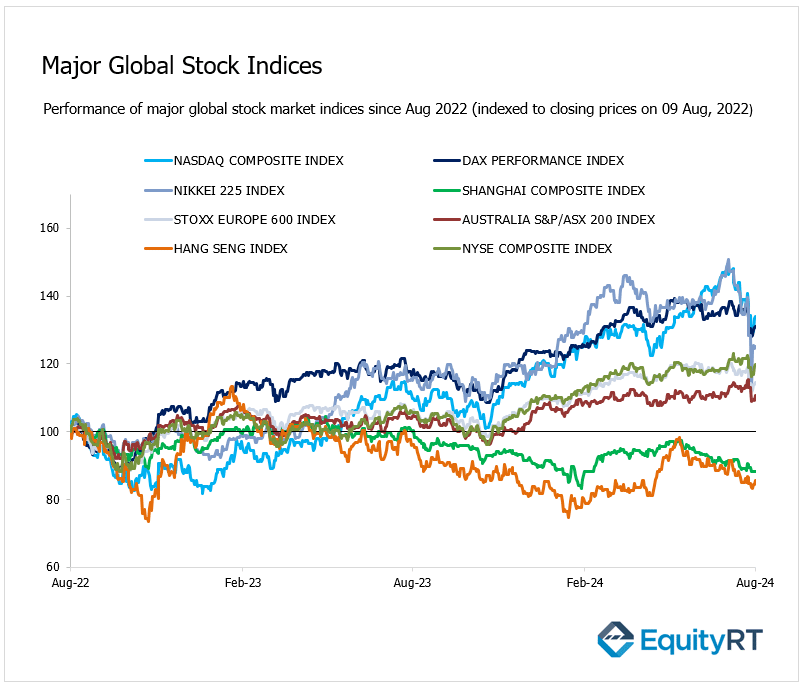

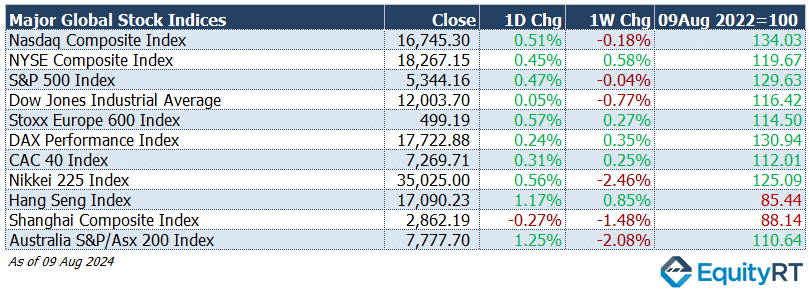

On Friday, Wall Street indices closed higher as some Fed members hinted at a potential rate cut soon.

European stocks rose on Friday as markets recovered from the recent oversold. On a weekly basis, the STOXX Europe 600, encompassing approximately 90% of the market capitalization of European markets across 17 countries, closed 0.3% higher, ending at 499.19.

Germany’s DAX completed the week in the positive territory, gaining 0.35%, to close at 17,722.88. France’s CAC-40 gained 0.25% to finish at 7,269.71.

Japan’s Nikkei-225 index closed the week with a 2.5% decline, marking its fourth consecutive weekly loss. The index plummeted 12.4% last Monday, its steepest drop since 1987. This sharp sell-off was driven by a rate hike from the Bank of Japan and the unwinding of the yen carry trade. Japanese markets were closed today due to a holiday.

Hong Kong’s Hang Seng index rose by 0.85%, finishing at 17,090.23. Australia’s S&P/Asx 200 Index lost 2.08% to 7,777.70.

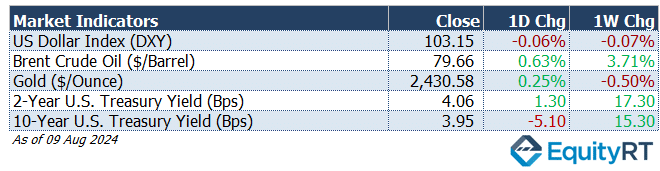

The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 103.15 marking a 0.07% weekly loss.

The Brent crude oil (#LCO07) closed the previous week at USD 79.66 per barrel, reflecting a 3.71% weekly gain.

The price of gold (#XAU) closed last week with a 0.50% weekly loss settling at USD 2,430.58 per ounce.

The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, closed at 4.06% with a 17.30 basis points weekly gain.

The 10-year U.S. Treasury yield (#USGG10YR) completed the week with a 15.30 basis points gain, settling at 3.95%.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

- Key U.S. Inflation Data to Influence Fed’s Policy Decisions

In the U.S., key data influencing Fed policy will be in focus, with July’s PPI out tomorrow and CPI on Wednesday.

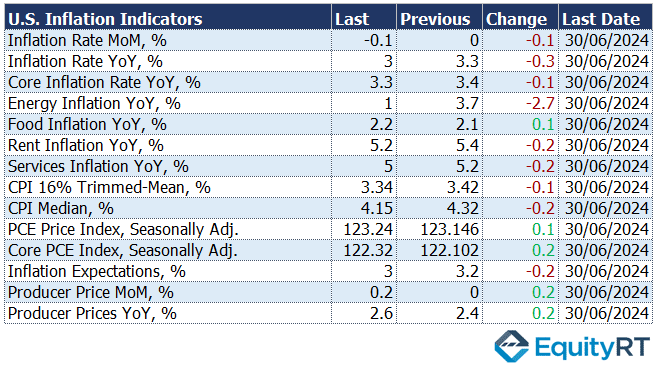

In June, headline PPI rose 0.2% month-on-month, beating expectations, and climbed from 2.4% to 2.6% year-on-year, the highest since March 2023.

Headline CPI fell unexpectedly by 0.1% in June, its first drop since May 2020, and dropped to 3% year-on-year, below expectations. Core CPI growth slowed to 0.1% month-on-month and 3.3% year-on-year, the lowest since April 2021.

For July, headline CPI is expected to rise 0.2% month-on-month, holding steady at 2.9% year-on-year, with Core CPI projected to increase by 0.2% month-on-month and slightly decrease to 3.2% year-on-year.

Headline PPI is expected to grow by 0.1% month-on-month in July, with year-on-year growth forecast to drop from 2.6% to 2.3%. Core PPI is expected to slow to 0.2% month-on-month and decrease to 2.7% year-on-year.

- Industrial Production and Capacity Utilization Trends

In addition, July’s industrial production and capacity utilization data, scheduled for release on Thursday, will be monitored for insights into production trends.

Industrial production growth slowed from 0.9% in May to 0.6% in June, though it exceeded expectations.

Capacity utilization increased from 78.3% to 78.8% in June. For July, industrial production is expected to decline by 0.1% month-on-month, while capacity utilization is forecast to decrease from 78.8% to 78.6%.

On Thursday, the New York Fed’s Empire State Manufacturing Index for August will also be released, providing the latest view on the manufacturing sector. In July, the index fell from -6 to -6.6, indicating a slight acceleration in the sector’s contraction, marking the eighth consecutive month in negative territory. The index is expected to improve slightly to -6 in August.

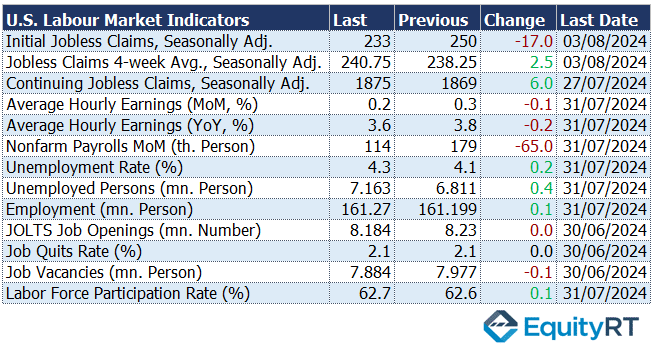

Employment market data, including weekly initial jobless claims, will be released on Thursday. The most recent data showed a larger-than-expected decrease in initial claims, from 250,000 to 233,000, the lowest level in nearly a year, remaining below historical averages. This data has eased concerns about the U.S. economy slipping into recession.

- Retail Sales and Consumer Sentiment Insights for July

Additionally, Thursday will see the release of July’s retail sales data, shedding light on domestic demand. For July, retail sales are expected to increase by 0.3% month-on-month, while core retail sales growth is forecast to slow from 0.9% to 0.1%.

On Friday, the preliminary University of Michigan Consumer Sentiment Index for August will be released. The final reading for July saw a slight upward revision from 66 to 66.4, though it remained at its lowest level in eight months.

On Friday, housing market data for July, including housing starts and building permits, will also be released.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Market Insights

- Germany’s ZEW Indices: Insights into Economic Conditions and Future Outlook

On the European side, Germany’s August ZEW Current Conditions and Expectations indices will be released tomorrow.

In July, the ZEW Current Conditions index unexpectedly improved from -73.8 to -68.9, reaching its highest level in a year, although it remained in negative territory. The ZEW Expectations index, however, fell from 47.5 to 41.8, marking a four-month low, though the decline was less severe than anticipated (41).

In August, the ZEW Expectations index is expected to decline to 38.

- Eurozone Q2 GDP Growth Data: A Closer Look at the Economic Performance

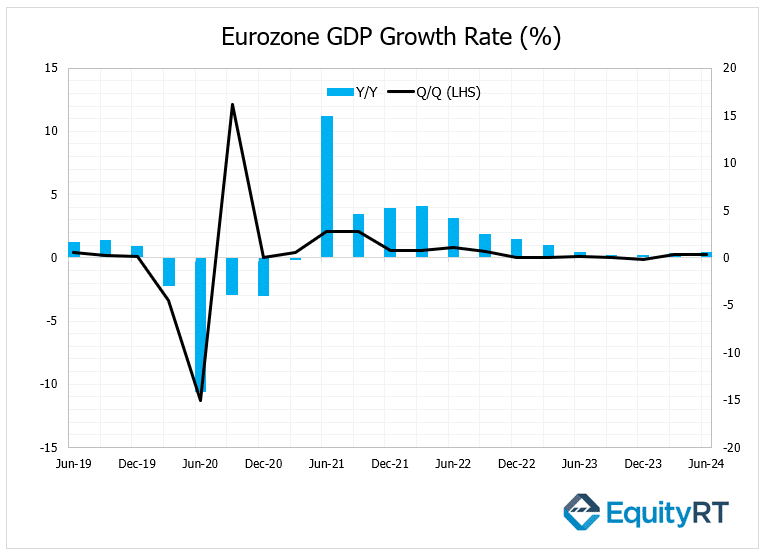

On Wednesday, revised GDP growth data for the Eurozone’s second quarter will be monitored. Preliminary data indicated that the Eurozone economy grew by 0.3% quarter-on-quarter in the second quarter, consistent with the first quarter and marking the strongest growth since Q3 2022, exceeding expectations of 0.2%. Year-on-year, growth slightly increased from 0.5% to 0.6%, also surpassing expectations of 0.5%.

- Eurozone Industrial Production: June’s Recovery Expectations

On Wednesday, the focus will also be on the Eurozone’s June industrial production data. In May, industrial production fell by 0.6% month-on-month, following a flat performance in April, and was slightly better than the expected 1% decline. Year-on-year, the contraction rate slowed from 3.1% in April to 2.9% in May.

For June, industrial production is expected to partially recover with a 0.7% month-on-month increase.

On Friday, June’s trade balance data for the Eurozone will be released.

- UK’s July CPI and GDP Data: Key Indicators for BoE’s Policy Direction

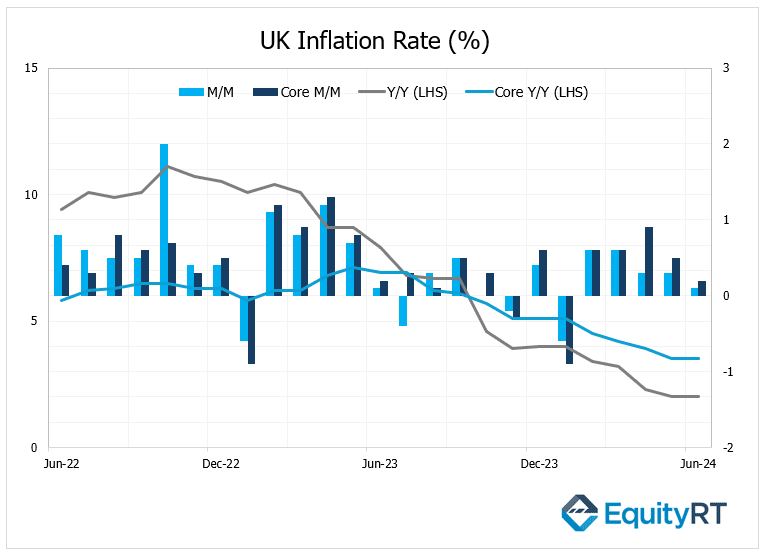

On Wednesday, the UK’s July CPI data, a key indicator for the Bank of England’s monetary policy, will be published.

In June, headline CPI‘s monthly growth rate slowed to 0.1% from 0.3%, in line with expectations, marking the lowest level in five months. Annually, it remained steady at 2%, the lowest since July 2021, and within the BoE’s target for the second consecutive month.

In July, headline CPI is expected to decrease by 0.1% month-on-month and rise slightly to 2.3% year-on-year. Core CPI is expected to slow to 0.1% month-on-month and dip to 3.4% year-on-year.

On Thursday, the UK’s preliminary GDP growth data for the second quarter will be released. The economy is expected to have slowed slightly from 0.7% to 0.6% quarter-on-quarter, while annual growth is expected to accelerate from 0.3% to 1%.

- Norwegian Central Bank Meeting

The Norwegian Central Bank’s meeting will be closely watched this week. The policy rate is expected to remain unchanged in this week’s meeting as well.

Take the guesswork out of investing: Backtest your strategies with ease!

Upcoming Asian Data

On the Asian front, key data releases from China regarding economic activity, including July’s industrial production, house price index, retail sales, and fixed asset investment will be closely monitored on Thursday.

For July, industrial production growth is expected to slow slightly to 5.2%, with fixed asset investment maintaining a similar pace of 3.9%, and retail sales growth rising to 2.6%.

Additionally, Japan’s preliminary GDP growth data for Q2 will be released on Thursday.

On Wednesday, the Reserve Bank of New Zealand’s meeting will be in focus. The policy rate is expected to remain unchanged in this week’s meeting as well.