Global Markets Recap

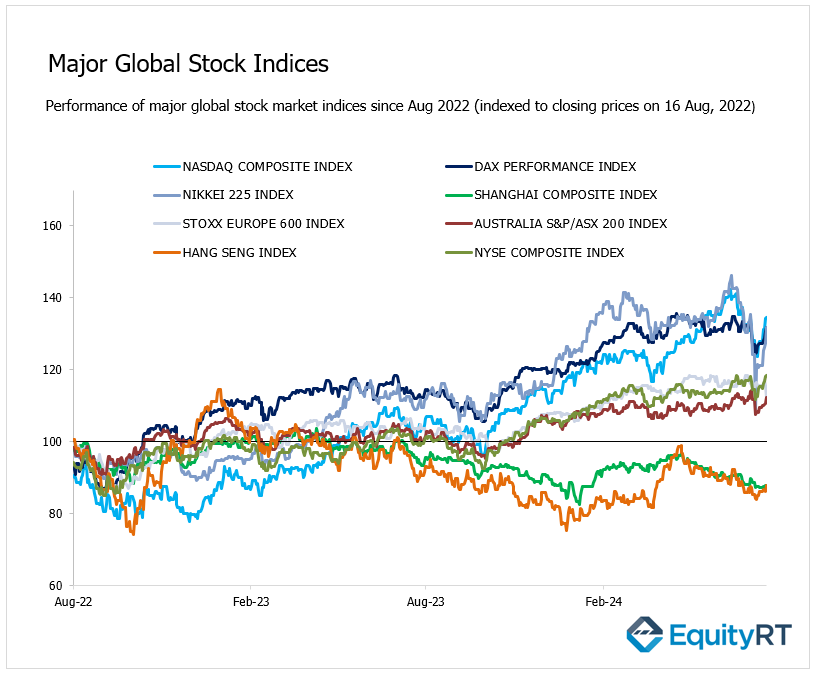

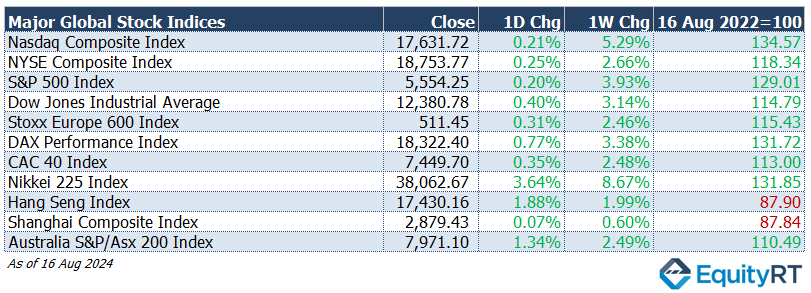

On Friday, Wall Street indices ended the day with slight gains as the preliminary University of Michigan consumer sentiment index for August exceeded expectations.

European stocks ended trading this week with strong gains. On a weekly basis, the STOXX Europe 600, encompassing approximately 90% of the market capitalization of European markets across 17 countries, closed 2.46% higher, ending at 511.45.

Germany’s DAX completed the week in the positive territory, gaining 3.38%, to close at 18,322.40. France’s CAC-40 gained 2.48% to finish at 7449.70.

Asia-Pasific Markets traded mixed on Friday. Japan’s Nikkei-225 index closed the week with a 8.67% gain. Hong Kong’s Hang Seng index rose by 1.99%, finishing at 17,430.16. Australia’s S&P/Asx 200 Index gained 2.49% to 7,971.10.

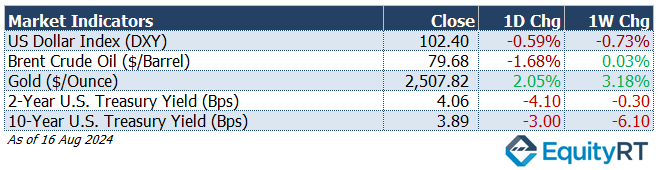

The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 102.40 marking a 0.73% weekly loss.

The Brent crude oil (#LCO07) closed the previous week at USD 79.68 per barrel, reflecting a 0.03% weekly gain.

The price of gold (#XAU) closed last week with a 3.18% weekly gain settling at USD 2,507.82 per ounce.

The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, closed at 4.06% with a 0.30 basis points weekly loss.

The 10-year U.S. Treasury yield (#USGG10YR) completed the week with a 6.10 basis points loss, settling at 3.89%.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

U.S. Economic Indicators Released Last Week

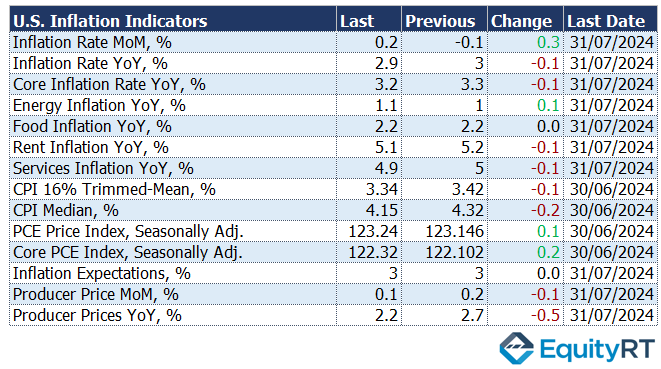

- In July, the US Consumer Price Index (CPI) rose by 0.2% month-over-month, aligning with expectations after a 0.1% decrease in June, marking the highest level in three months. On an annual basis, the inflation rate fell from 3% to 2.9%, reaching its lowest level since March 2021. The monthly CPI increase in July was driven by a rise in the pace of service group price increases, which exceeded the headline CPI. Core CPI rose by 0.2% month-over-month, up from 0.1% in June, in line with expectations. On an annual basis, core CPI slowed from 3.3% to 3.2%, maintaining its lowest levels since April 2021.

- After a 0.3% monthly increase in industrial production in June, July saw a 0.6% decline, exceeding expectations of a 0.3% drop. This decline marked the steepest fall in the past six months.

- The New York Fed’s Empire State Manufacturing Index for August rose from -6.6 to -4.7, indicating a slight slowdown in manufacturing sector contraction, though it remained in negative territory for the ninth consecutive month. Expectations were for a rise to -6.

- US retail sales in July showed a 1% increase month-over-month, recovering above expectations of 0.4% following a 0.2% decline in June. This was the strongest monthly increase since January 2023.

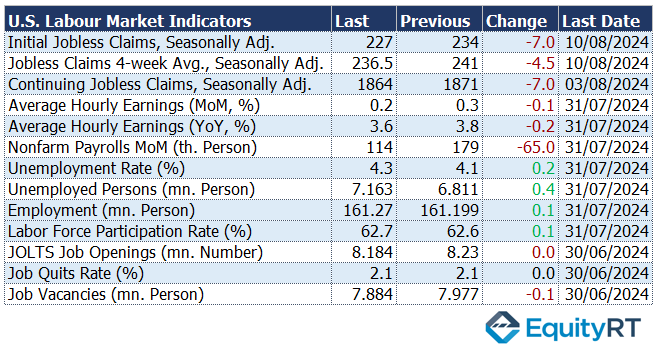

- Weekly initial jobless claims fell from 234,000 to 227,000, contrary to expectations of a slight increase, marking the lowest level in five weeks and continuing to trend below historical averages.

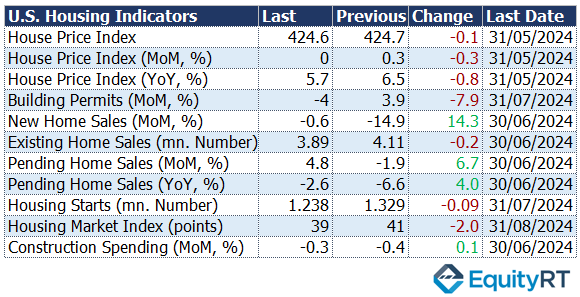

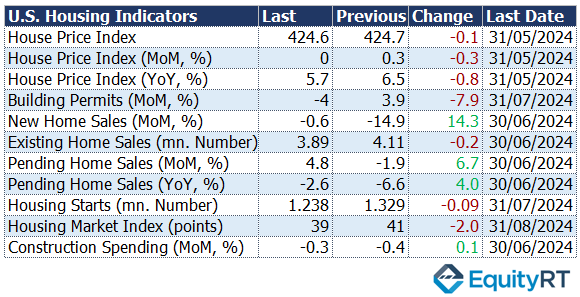

- In the US, housing starts decreased by 6.8% month-on-month in July, significantly surpassing the expected 1.5% decline, marking the lowest level since 2020. The US building permits dropped by 4% month-on-month in July, also exceeding the forecasted 1.5% decline, reaching the lowest level in four years. These figures indicate an accelerated weakening in the housing market.

- The preliminary University of Michigan consumer sentiment index for August rose to 67.8 from 66.4, beating expectations of 66.9.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Upcoming U.S. Economic Indicators to Watch This Week

- This week, global markets will be centered on the Jackson Hole Economic Policy Symposium, hosted by the Kansas City Fed, taking place in Jackson Hole, Wyoming, from August 22-24. The symposium will gather central bank governors, economists, financial market participants, academics, and government representatives from around the world to discuss long-term policy issues.

- Fed Chair Powell’s speech on Friday will be the focal point of the symposium. His speech and any new messages will be scrutinized for hints about the Fed’s potential rate cuts and interest rate

- In the U.S., the minutes from the Fed’s July meeting will be released on Wednesday.

- On Thursday, weekly initial jobless claims data will be released. The most recent data showed a decline from 234,000 to 227,000 claims, marking the lowest level in five weeks and remaining below historical averages.

- Housing market data will also be in focus, with July’s existing home sales report due on Thursday and new home sales on Friday.

-

- Existing home sales fell 0.7% month-on-month in May and 5.4% in June, continuing a four-month downward trend and marking the sharpest monthly decline since 2022, indicating a rapid weakening in housing demand.

- New home sales fell 14.9% month-on-month in May and 0.6% in June, marking the second consecutive monthly decline and reaching the lowest level in seven months, further indicating a weakening in housing demand.

-

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

European Economic Indicators Released Last Week

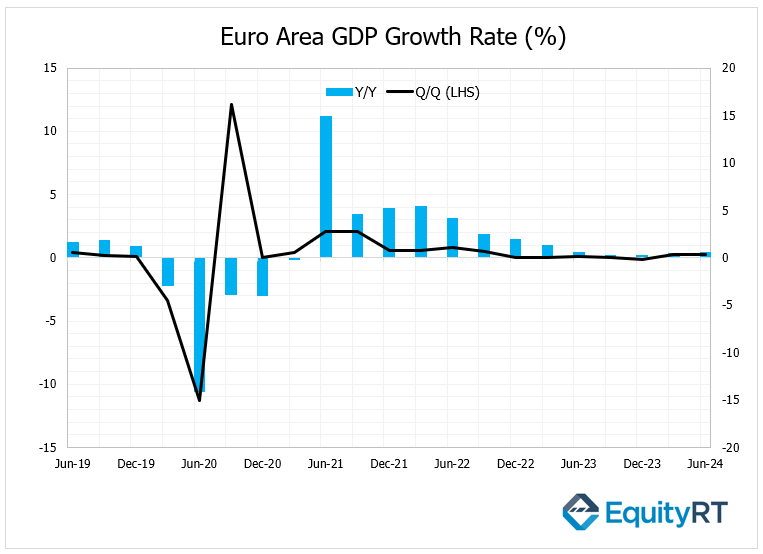

- In the Euro Area, revised GDP growth data for Q2 2024 was closely monitored. According to the data, the Euro Area economy grew by 0.3% quarter-on-quarter, in line with the preliminary figures, like the first quarter, continuing to signal the strongest growth since Q3 2022. On an annual basis, growth slightly increased from 0.5% to 0.6% in the second quarter.

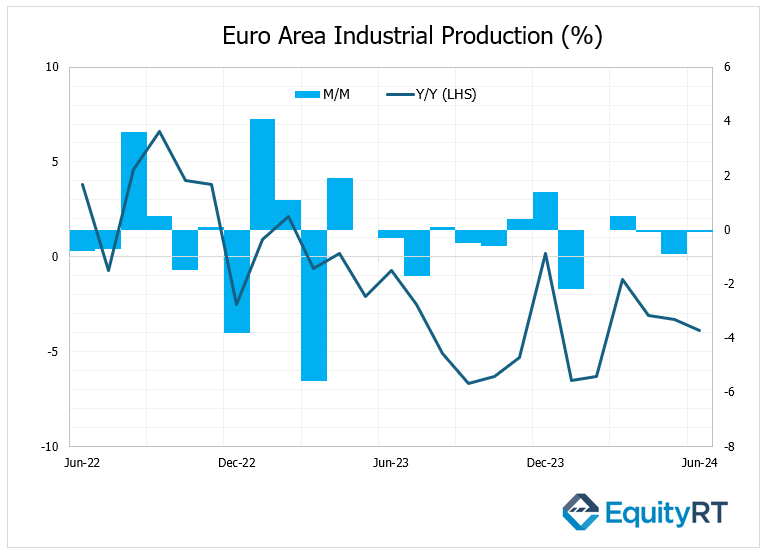

- Euro Area industrial production fell by 0.1% in June after a 0.9% decrease in May, continuing its decline for a second month. Expectations were for a 0.5% monthly increase. On an annual basis, industrial production contraction deepened from 3.3% to 3.9% in June.

- In June, the Euro Area’s monthly trade surplus increased from 14 billion euros to 22.3 billion euros, marking the highest level in three months. In detail, exports in the region decreased by 1.6% month-on-month in June, while imports fell by a greater 5.4%.

- The UK economy grew by 0.7% quarter-on-quarter in Q1 2024. In Q2, the growth rate slowed slightly to 0.6%, in line with expectations. On an annual basis, the growth rate increased from 0.3% to 0.9%, indicating the strongest growth since Q3 2022.

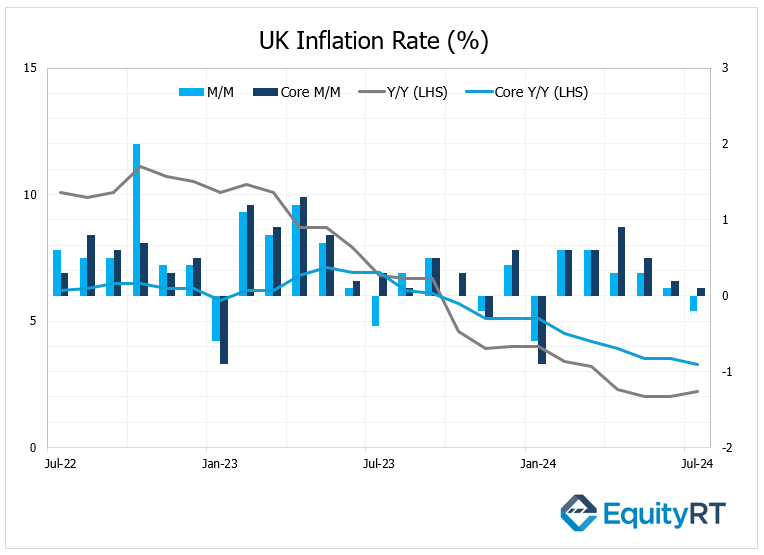

- In the UK, the monthly headline CPI fell by 0.2% in July after a 0.1% increase in June, coming in below expectations of a 0.1% decrease. This was the first decline in five months. On an annual basis, the CPI slightly increased from 2% to 2.2%, but remained below expectations of 2.3%. The monthly core CPI growth rate slowed to 0.1% in July, in line with expectations, from 0.2% in June, marking the lowest level in six months. On an annual basis, core CPI fell from 3.5% to 3.3%, reaching its lowest level since September 2021.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Market Insights

- This week, European markets will focus on the ECB’s July meeting minutes, due Thursday. In July, the ECB kept rates steady after a 25-basis-point cut in June, highlighting that rates will stay restrictive based on data, with inflation likely above target until 2025. The minutes will be key for hints on future policy moves.

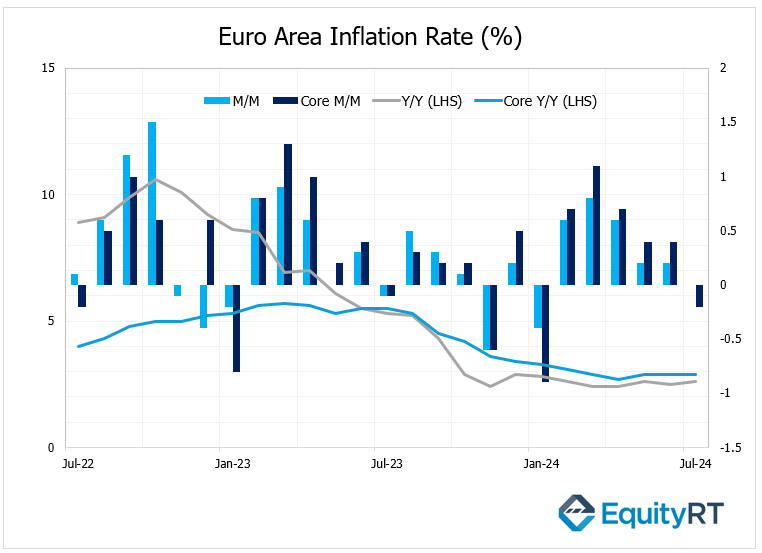

- On Tuesday, the final inflation data for July in the Euro Area will be released. Preliminary figures showed that the monthly headline CPI growth slowed to 0%, the lowest in six months, while annual headline CPI slightly increased to 2.6%, surpassing expectations. Core CPI remained steady at 2.9%, just above forecasts.

- On Tuesday, Germany’s July PPI is expected to rise by 0.2% month-on-month, with the annual decline slowing to 0.8%.

- Preliminary August PMI data for Europe, out on Thursday, will provide insights into the economic outlook, with manufacturing contraction likely continuing across most regions, except the UK.

- On Thursday, the Eurozone’s August consumer confidence preliminary data will also be monitored. Consumer confidence is expected to rise to -12.8 in August, continuing its recovery.

- On Tuesday, the Swedish Central Bank meeting will also be watched. Following a 25-basis-point cut in its May meeting, lowering the policy rate to 3.75%, the bank kept the rate unchanged at 3.75% in June. The bank is expected to cut the policy rate by 25 basis points to 3.50%.

Take the guesswork out of investing: Backtest your strategies with ease!

Last Week in Asia

- In Q2 2024, Japan’s economy grew by 0.8% quarter-on-quarter, recovering from a 0.6% contraction in Q1. This growth exceeded expectations of a 0.6% increase. On an annualized quarter-on-quarter basis, the economy expanded by 3.1% in Q2, following a 2.3% contraction in Q1, also surpassing forecasts of 2.3% growth.

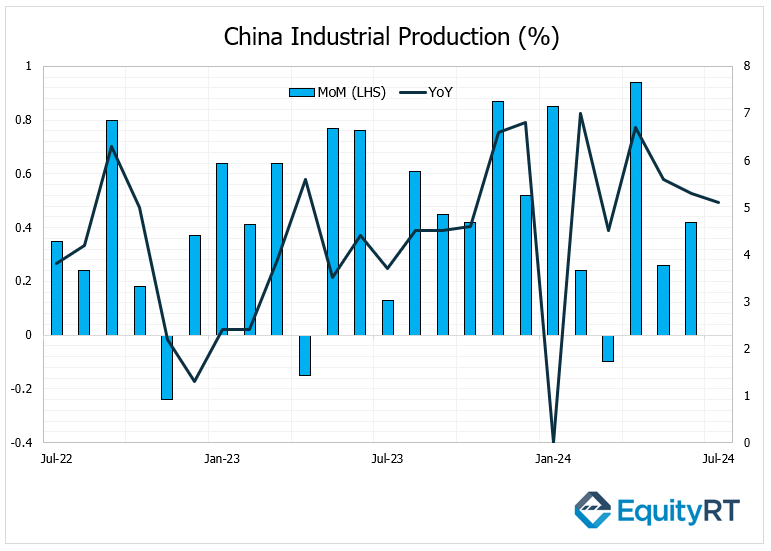

- China’s industrial production in July grew by 5.1% year-on-year, down from 5.3% in June, falling short of expectations of a 5.2% increase. This marked the slowest growth in four months.

- The year-on-year growth in retail sales accelerated to 2.7% in July from June’s 17-month low of 2%, slightly exceeding expectations of a 2.6% rise.

- The growth rate of fixed asset investments in China slowed to 3.6% year-on-year in July, down from 3.9% in June, and below expectations of 3.9%.

- Australia’s unemployment rate rose to 4.2% in July 2024, up from 4.1% in June, which matched market expectations. This marks the highest unemployment rate since January 2022.

Upcoming Asian Data

- In Asia, attention will be on tomorrow’s meeting of the People’s Bank of China (PBoC). Last month, the bank surprised markets by cutting the 1-year loan prime rate (LPR), a key short-term loan benchmark, from 3.45% to 3.35%, and the 5-year LPR, which influences long-term loans. Additionally, the PBoC lowered the 7-day reverse repo rate from 1.8% to 1.7%. In this week’s meeting, the bank is expected to keep rates steady, preferring to monitor the effects of the recent rate cuts.

- Other indicators to watch in Asia include China’s trade data for July, Indonesia’s interest rate decision, Japan’s inflation rate and retail sales for July.