Global Stock Market Highlights

Last Friday, U.S. stock markets closed higher, driven by easing trade tensions and positive economic data. A significant factor was the announcement of a trade truce between the U.S. and China, which alleviated investor concerns over escalating tariffs and potential economic slowdown. Economic indicators also played a role; for instance, retail sales rose by 0.1% in April, aligning with expectations, and the producer price index (PPI) showed a sharper-than-expected decline, suggesting easing inflationary pressures.

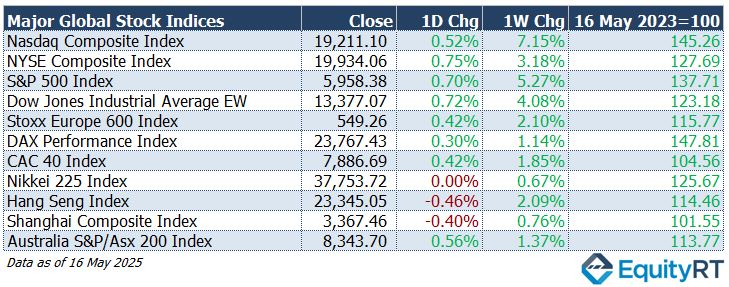

- Nasdaq Composite Index closed at 19,211.10, up 0.52% on the day and up 7.15% for the week.

- NYSE Composite Index closed at 19,934.06, up 0.75% on the day and up 3.18% for the week.

- S&P 500 Index closed at 5,958.38, up 0.70% on the day and up 5.27% for the week.

- Dow Jones Industrial Average EW closed at 13,377.07, up 0.72% on the day and up 4.08% for the week.

On Friday, European markets reflected cautious optimism, balancing positive trade developments against ongoing global economic uncertainties.

- Stoxx Europe 600 Index closed at 549.26, up 0.42% on the day and up 2.10% for the week.

- DAX Performance Index closed at 23,767.43, up 0.30% on the day and up 1.14% for the week.

- CAC 40 Index closed at 7,886.69, up 0.42% on the day and up 1.85% for the week.

Asian stock markets experienced mixed performances, reflecting investor caution amid fading optimism over U.S.-China trade negotiations. While some markets saw modest gains, the broader sentiment remained subdued as investors awaited clearer signals on global trade developments.

- Nikkei 225 Index closed at 37,753.72, unchanged on the day and up 0.67% for the week.

- Hang Seng Index closed at 23,345.05, down 0.46% on the day and up 2.09% for the week.

- Shanghai Composite Index closed at 3,367.46, down 0.40% on the day and up 0.76% for the week.

- Australia S&P/ASX 200 Index closed at 8,343.70, up 0.56% on the day and up 1.37% for the week.

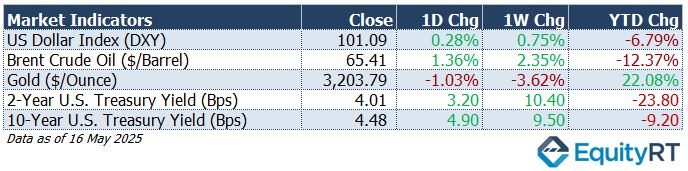

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 101.09, up 0.28% on the day and 0.75% for the week; down 6.79% year-to-date.

- The Brent crude oil, the global oil price benchmark, settled at $65.41 per barrel, gaining 1.36% on the day and 2.35% for the week; down 12.37% year-to-date.

- The Gold finished at $3,203.79 per ounce, falling 1.03% on the day and 3.62% for the week; still up 22.08% year-to-date.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, ended at 4.01%, up 3.20 bps on the day and 10.40 bps for the week, down 23.80 bps YTD.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, stood at 4.48%, rising 4.90 bps on the day and 9.50 bps for the week, down 9.20 bps YTD.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

Markets this week will keep a close eye on trade developments following President Trump’s statement that the U.S. will notify select trading partners of plans to unilaterally raise tariffs, citing overwhelming meeting demands.

Attention will also turn to a packed schedule of Federal Reserve speakers, as investors look for further signals on the Fed’s policy direction for the rest of the year.

On the data front, the calendar is light; flash S&P Global PMIs are expected to show flat manufacturing activity and a continued slowdown in services.

On Thursday, home sales data in the U.S. for April will be released. In March 2025, US existing home sales dropped 5.6% to a seasonally adjusted annual rate of 4.02 million units, missing expectations of 4.13 million and marking the sharpest decline in over two years. This occurred despite a slight dip in benchmark borrowing costs, which boosted mortgage applications. Meanwhile, new single-family home sales rose 7.4% to 724,000, hitting a six-month high and surpassing the expected 680,000, supported by the same decline in borrowing costs.

In April new home sales are likely declined, while existing home sales may show little change.

In earnings, major U.S. retailers like Home Depot, Lowe’s, and TJX Companies, as well as tech firms Palo Alto Networks and Intuit, are due to report.

In Canada, inflation is forecast to drop sharply to 1.6% from 2.3%, with retail sales and PPI data also expected.

In Latin America, markets will watch GDP figures from Mexico and Chile, alongside Mexican trade data.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

This week, markets will closely follow the ECB’s March meeting minutes, which follow last month’s 25bps rate cut and the removal of language describing policy as “restrictive.” The ECB also flagged a deteriorating economic outlook amid intensifying global trade tensions.

Flash PMI data, due Thursday, will offer crucial insight into how core European economies are adapting. Expectations suggest a slightly smaller contraction in manufacturing across the Euro Area, Germany, France, and the UK, alongside a modest improvement in services activity—with the Euro Area forecast to expand and contractions easing in Germany, France, and the UK.

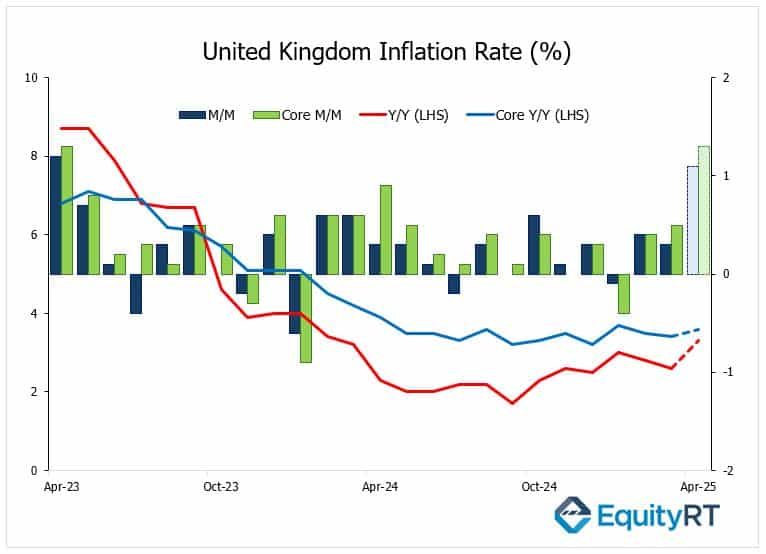

In the UK, focus will also turn to April inflation data on Wednesday.

Markets expect UK inflation to have risen sharply with April’s headline CPI expected to rise to 3.3%, the highest in 14 months, while core inflation may edge up to 3.6%.

In March, inflation had cooled to 2.6% from 2.8%, driven by falling prices in recreation, transport, and accommodation. Core inflation dipped to 3.4%, the lowest since December, though monthly core prices rose 0.5%, the sharpest increase in ten months.

The anticipated rise in April is likely tied to energy bill hikes and seasonal spending as warmer weather boosts demand.

Retail sales are projected to grow 0.4%, marking a four-month streak of gains despite persistently weak consumer sentiment.

In the Euro Area, flash consumer confidence is expected to rebound from its November 2023 lows, alongside the release of Q1 negotiated wage growth data, while in Germany, attention will focus on the Ifo Business Climate Index—which may rise for a fifth consecutive month to its strongest level since June 2024—and producer price data; meanwhile, in the UK, the CBI Industrial Trends Survey and GfK consumer confidence figures are also due.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

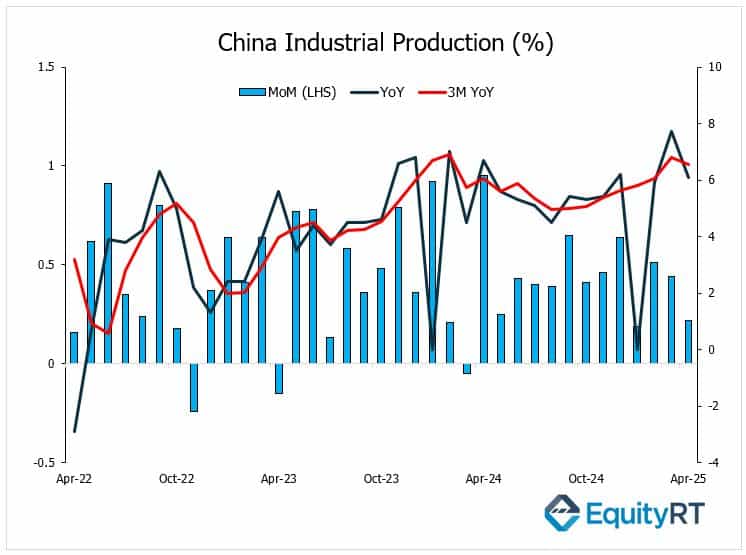

China’s April 2025 economic data signaled the first effects of rising US tariffs and Beijing’s countermeasures. Industrial production rose 6.1% year-on-year, beating forecasts but slowing from March’s 7.7% surge.

Retail sales grew 5.1%, down from March’s 5.9% and below expectations, as consumer sentiment remained cautious.

The jobless rate surveyed dipped to 5.1%, the lowest since December 2024. Fixed-asset investment rose 4% in the January–April period, missing the 4.2% forecast. Within that, infrastructure investment increased 5.8% and manufacturing investment climbed 8.8%.

Additionally, the PBoC is anticipated to cut loan prime rates, following Governor Gongsheng’s signal and a recent reverse repo rate reduction. In Japan, April’s trade balance is forecasted to return to surplus despite US tariffs, alongside updates on inflation, machinery orders, and May PMI figures—also due from India.

Elsewhere in Asia, Indonesia is expected to keep rates steady, Thailand’s GDP is set to grow for a fifth straight quarter, Australia’s RBA may resume its easing cycle with a 25bps cut and release May PMIs, while New Zealand will report its trade balance.