Global Stock Market Highlights

Last Friday, U.S. stock markets ended the day little changed, wrapping up a strong month for equities. The upbeat monthly performance was driven by easing trade tensions, favourable inflation readings, and solid corporate earnings.

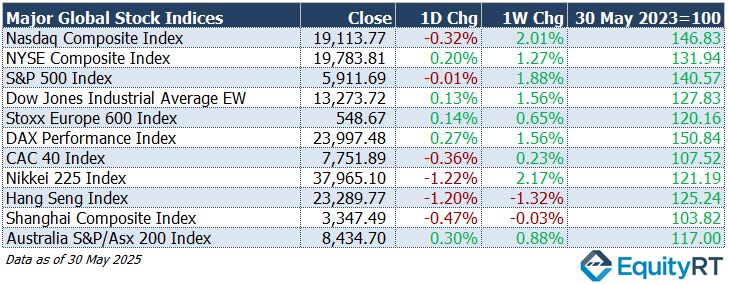

- Nasdaq Composite Index closed at 19,113.77, down 0.32% on the day and up 2.01% for the week.

- NYSE Composite Index closed at 19,783.81, up 0.20% on the day and up 1.27% for the week.

- S&P 500 Index closed at 5,911.69, down 0.01% on the day and up 1.88% for the week.

- Dow Jones Industrial Average EW closed at 13,273.72, up 0.13% on the day and up 1.56% for the week.

On Friday, European stock markets ended slightly higher, supported by easing trade tensions and hopes of continued monetary policy support. Gains were somewhat limited by brief volatility after U.S. President Donald Trump accused China of breaching a trade agreement, which momentarily dampened market sentiment.

- Stoxx Europe 600 Index closed at 548.67, up 0.14% on the day and up 0.65% for the week.

- DAX Performance Index closed at 23,997.48, up 0.27% on the day and up 1.56% for the week.

- CAC 40 Index closed at 7,751.89, down 0.36% on the day and up 0.23% for the week.

Major Asian stock markets ended the day in negative territory, weighed down by revived trade tensions after a U.S. court ruling reinstated former President Donald Trump’s tariff measures. The decision unsettled investor confidence across the region.

- Nikkei 225 Index closed at 37,965.10, down 1.22% on the day and up 2.17% for the week.

- Hang Seng Index closed at 23,289.77, down 1.20% on the day and down 1.32% for the week.

- Shanghai Composite Index closed at 3,347.49, down 0.47% on the day and down 0.03% for the week.

- Australia S&P/ASX 200 Index closed at 8,434.70, up 0.30% on the day and up 0.88% for the week.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 99.33, up 0.05% on the day and up 0.22% for the week.

- The Brent crude oil, the global oil price benchmark, settled at $62.78 per barrel, down 0.90% on the day and down 3.09% for the week.

- The Gold surged to $3,358.00 per ounce, down 0.89% on the day and down 2.07% for the week.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, closed at 3.91%, falling 3.90 bps on the day, down 9.60 bps over the week, and 34.40 bps year-to-date.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, finished at 4.41%, down 1.60 bps on the day, down 11.00 bps over the week, and 16.80 bps lower year-to-date.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

Trade tensions are once again poised to shape global market sentiment, following fresh accusations from U.S. President Trump that China breached the recent tariff truce. U.S. Trade Secretary Scott Bessent’s statement that negotiations with Beijing are currently “a bit stalled” adds to the uncertainty, casting a shadow over investor confidence.

Markets are also turning their focus toward a slate of scheduled speeches from Federal Reserve officials, which could provide insight into the central bank’s policy direction amid growing global headwinds. Economic data releases in the first week of June will further guide sentiment—most notably the U.S. jobs report and ISM PMI surveys.

Non-farm payrolls for May are projected to rise by just 130K, the slowest pace in three months and a notable drop from April’s 177K increase. The unemployment rate is expected to hold steady at 4.2%, while wage growth may soften slightly to 3.7% year-over-year. These figures would suggest a cooling labor market, possibly reinforcing expectations that the Fed will maintain a cautious stance on interest rates. Manufacturing is likely to show continued contraction, whereas the services sector may see modest expansion—pointing to a still-divergent recovery across industries.

Additional U.S. data releases will include JOLTS job openings, ADP employment change, trade balance, and factory orders, each offering further clues about labor market resilience and domestic demand.

On Thursday, US trade balance data for April will be released.

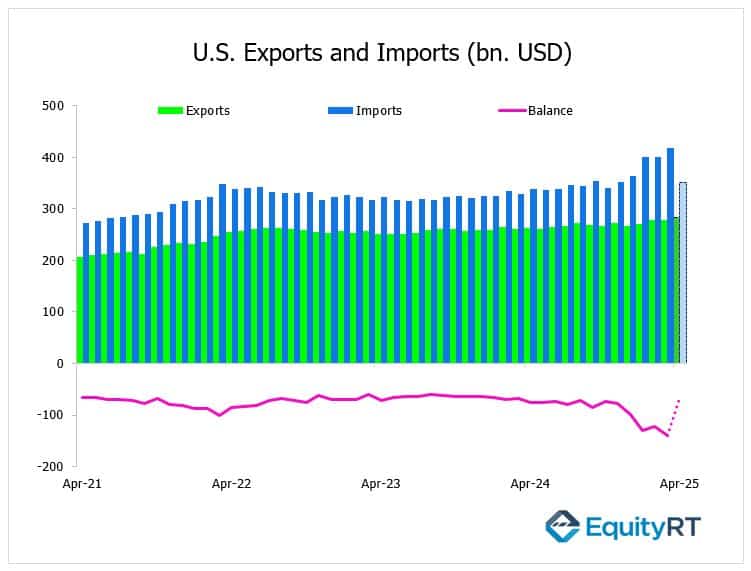

The U.S. trade deficit widened to a record $140.5 billion in March 2025, exceeding forecasts of $137 billion. The increase was largely driven by a 4.4% surge in imports to an all-time high of $419 billion, as businesses rushed to bring in goods ahead of expected tariff hikes in April. Import growth was led by pharmaceutical preparations, passenger cars, and tech-related goods.

Export growth was led by gains in passenger cars, natural gas, non-monetary gold, and computer accessories, though these were partly offset by a notable decline in civilian aircraft shipments.

The trade gap widened significantly with the EU and Vietnam, but narrowed with China, Switzerland, and Canada. The trade balance with Mexico remained largely unchanged.

The record deficit underscores how tariff uncertainty is reshaping trade flows, with importers front-loading orders. While goods exports hit a new high, weak service exports and growing imbalances with key partners highlight structural trade pressures likely to persist in the months ahead.

In Canada, the central bank is widely expected to keep rates on hold, as markets await a batch of economic indicators including employment figures, trade data, and PMI readings from both S&P Global and Ivey. Meanwhile, Mexico’s consumer and business confidence metrics will be key to assessing domestic economic momentum, and Brazil will release critical numbers on industrial production, trade, and PMIs.

This combination of escalating trade rhetoric and closely watched economic indicators is likely to heighten volatility in global markets. Investors are balancing optimism around easing inflation and resilient earnings with the risks of stalled trade talks and potentially slowing labor markets. In this environment, Fed commentary and incoming data will play a crucial role in shaping expectations for future rate decisions and overall economic momentum.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

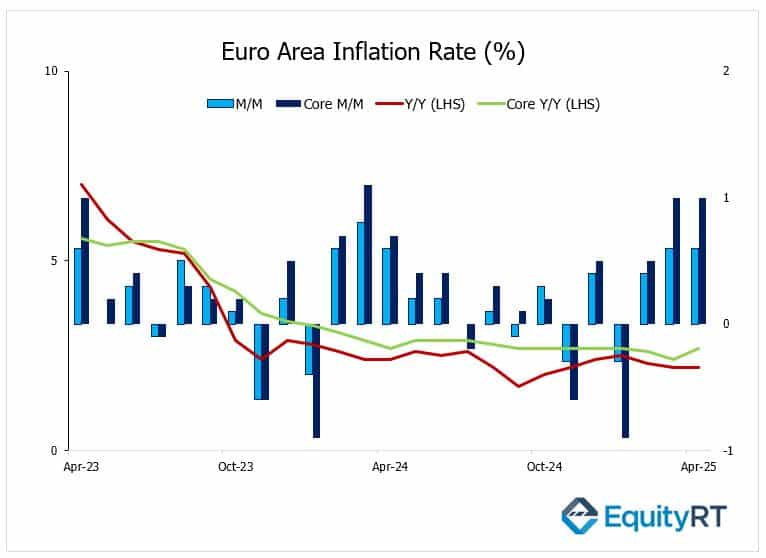

The European Central Bank (ECB) is widely anticipated to reduce its key interest rate by 25 basis points this Thursday, responding to easing inflation pressures across the Euro Area.

Headline inflation is projected to slow to 2.1% year-on-year, marking the lowest level in seven months and nearing the ECB’s inflation target of 2%. Meanwhile, core inflation, which excludes volatile food and energy prices, is expected to moderate to 2.5%, signaling that underlying price pressures are also easing.

This anticipated rate cut reflects the ECB’s cautious approach to balancing inflation control with the need to support economic growth. The inflation slowdown suggests that previous monetary tightening is beginning to take effect, giving the ECB some room to ease policy without risking a resurgence in price pressures.

On the economic data front, German trade and industrial production figures are expected to show a slight contraction, with a 0.5% decline forecast after a strong 3% increase in March. This signals potential softness in Europe’s largest economy, raising concerns about export demand and industrial momentum.

In Southern Europe, manufacturing activity in Italy and Spain is anticipated to contract but at a slower pace, indicating tentative stabilization. Spain’s services sector may see modest growth, suggesting resilience in domestic demand despite broader economic challenges. However, the labor market shows mixed signals: Eurozone unemployment is expected to remain steady at 6.2%, while Italy’s unemployment rate may tick up slightly to 6.1%, underscoring regional disparities.

Additional data releases to watch include retail sales figures from the Euro Area and Italy, which will provide insight into consumer spending trends—a critical driver of economic growth. France’s trade data will shed light on export performance, while Switzerland’s comprehensive Q1 data—covering GDP, retail sales, manufacturing PMI, and unemployment—will offer a broader picture of economic health in the region.

In the monetary policy side, Poland’s central bank is expected to keep interest rates unchanged, signaling a wait-and-see approach amid global uncertainties. The UK will release key indicators including Bank of England credit data, Nationwide house prices, and final purchasing manager indices (PMIs), offering further clues on the trajectory of the British economy as it navigates post-Brexit adjustments and inflationary pressures.

The ECB’s likely rate cut marks a pivotal moment, highlighting the shift from aggressive tightening to a more accommodative stance amid signs of easing inflation and fragile growth signals. However, the divergence within the Euro Area economies—from Germany’s industrial softness to France’s growth and Italy’s rising unemployment—suggests that the ECB’s policy decisions must carefully balance competing economic dynamics.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

In China, the official National Bureau of Statistics (NBS) Purchasing Managers’ Index (PMI) for May is anticipated to show another contraction, reflecting ongoing challenges in the manufacturing sector. However, the broader Caixin PMI, which often better captures smaller private firms, carries more optimistic projections. Notably, both PMI surveys agree on continued expansion in the services sector, signaling that domestic demand in services remains a bright spot despite manufacturing softness.

Japan’s data calendar is relatively quiet this week, with attention focused on first-quarter capital expenditure and April’s household spending figures. These indicators will help gauge the strength of corporate investment and consumer confidence amid a backdrop of moderate inflation and a gradually recovering economy.

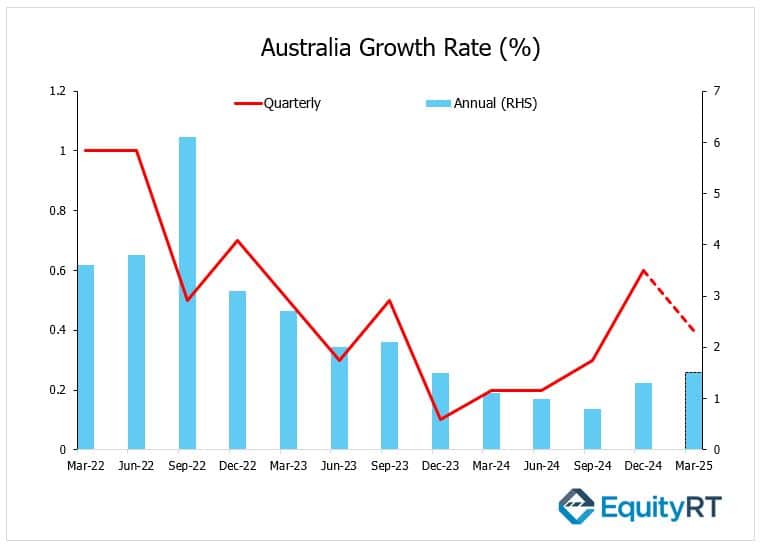

Australia’s GDP for Q1 2025 will be released on Wednesday. Australia’s economy is projected to have maintained a robust growth trajectory in the first quarter, with GDP expected to expand solidly for a second straight quarter. Despite concerns over tariff disruptions and subdued commodity prices, Australia’s trade surplus is forecasted to have widened in April, reflecting resilient export performance.

Australia’s economy grew 0.6% quarter-on-quarter in Q4 2024, beating expectations and marking the fastest growth since late 2022. The expansion was driven by a rebound in household spending, higher private investment, and strong exports. Government spending slowed, while inventory changes turned positive for the first time in three quarters.

The annual GDP growth accelerated to 1.3%, surpassing forecasts and hitting the strongest yearly gain since Q4 2023.

In India, the Reserve Bank of India (RBI) is expected to reduce its key repo rate for the third consecutive time, responding to persistently low inflation. This easing cycle highlights the RBI’s confidence in the economy’s resilience and its willingness to support growth amid softer price pressures.

Inflation updates are also awaited from several key Asian economies, including South Korea, Indonesia, the Philippines, Taiwan, and Pakistan. South Korea will additionally release its balance of trade data, which is critical for understanding the ongoing impact of tariffs and global trade tensions on its export-driven economy.